Dallas, Texas Comprehensive Special Tax Notice Regarding Plan Payments is a crucial document that provides detailed information regarding the various types of plan payments and their respective tax implications in Dallas, Texas. This notice ensures that individuals and businesses understand the tax obligations associated with their plan payments. The Dallas, Texas Comprehensive Special Tax Notice Regarding Plan Payments encompasses several types of plan payments, each with its own unique considerations. Some main types include: 1. Retirement Plan Payments: This category includes distributions from 401(k), 403(b), and pension plans. The notice outlines the tax consequences of these payments, such as potential early withdrawal penalties and required minimum distributions for those of eligible age. 2. Health Savings Account (HSA) Payments: Has been tax-advantaged accounts used for medical expenses. The notice delves into the tax implications, including potential penalties for non-medical withdrawals and the tax advantages of contributing to an HSA. 3. Flexible Spending Account (FSA) Payments: FSA's allow employees to set aside pre-tax funds for qualified medical and dependent care expenses. The notice provides information on the tax rules associated with FSA distributions and the importance of using the funds within the designated timeframe. 4. Education Plan Payments: This section covers distributions from education savings accounts, such as 529 plans or Cover dell SAS. It highlights the tax benefits, including tax-free growth and qualified educational expense guidelines, while also explaining potential tax consequences of non-qualified withdrawals. 5. Employee Stock Ownership Plan (ESOP) Payments: Sops allow employees to become shareholders in their company. The notice outlines the tax considerations when receiving dividends, selling company stock, or making early withdrawals. The Dallas, Texas Comprehensive Special Tax Notice Regarding Plan Payments is designed to inform taxpayers about the tax implications of these various plan payments, ensuring compliance with federal and state tax regulations. It provides details on reporting requirements, potential penalties for non-compliance, and important deadlines associated with filing taxes related to plan payments. It is crucial for individuals and businesses in Dallas, Texas to carefully review this notice to fully understand their tax obligations and take advantage of any available tax benefits. Seeking professional advice from a tax advisor or accountant is highly recommended navigating the complexities of this comprehensive tax notice and make informed financial decisions.

Dallas Texas Comprehensive Special Tax Notice Regarding Plan Payments

Description

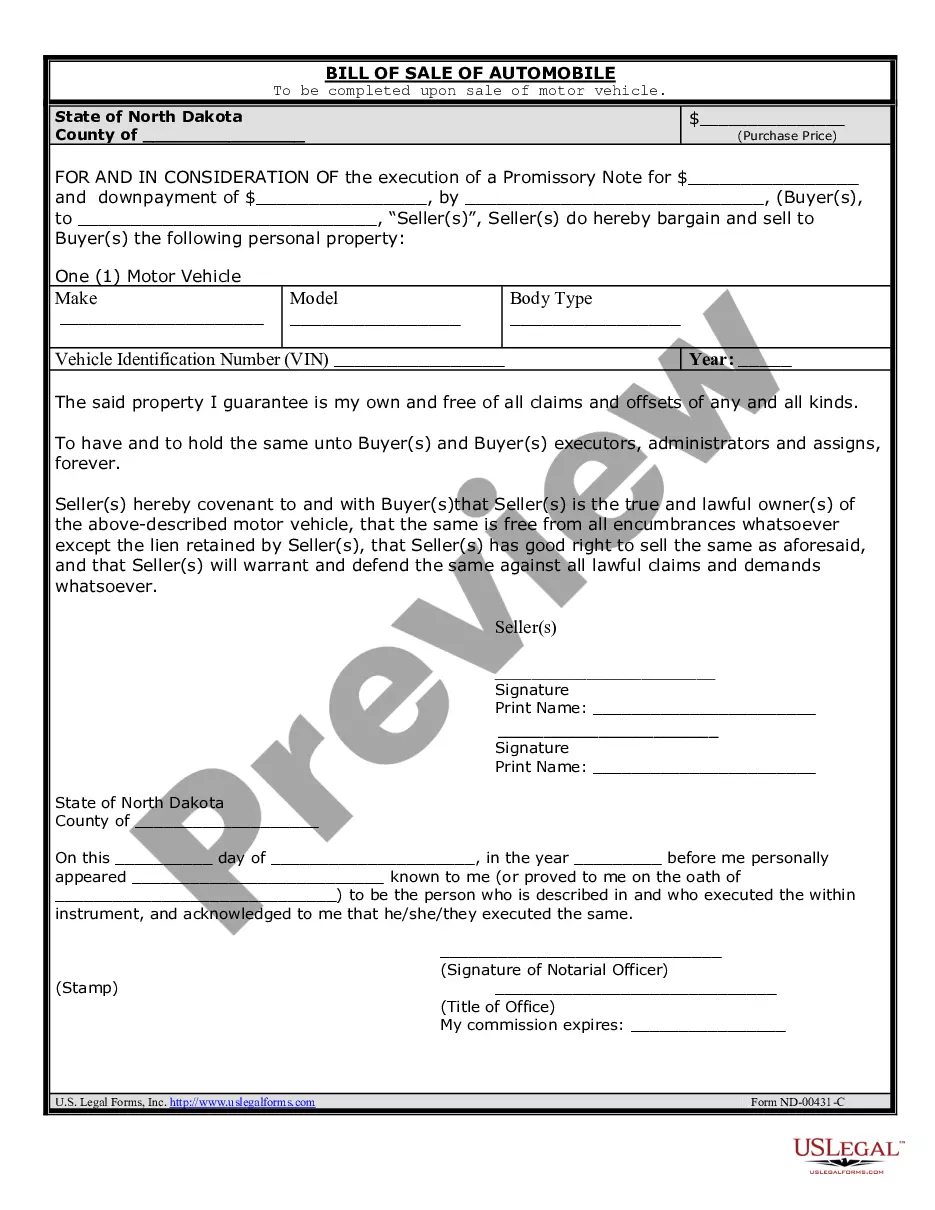

How to fill out Dallas Texas Comprehensive Special Tax Notice Regarding Plan Payments?

Creating paperwork, like Dallas Comprehensive Special Tax Notice Regarding Plan Payments, to manage your legal matters is a challenging and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for various cases and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Dallas Comprehensive Special Tax Notice Regarding Plan Payments template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Dallas Comprehensive Special Tax Notice Regarding Plan Payments:

- Ensure that your template is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Dallas Comprehensive Special Tax Notice Regarding Plan Payments isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and get the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!