Kings New York Comprehensive Special Tax Notice Regarding Plan Payments is a document that provides detailed information about the tax implications of plan payments offered by Kings New York. This notice is crucial for individuals participating in various plan payment options. The Kings New York Comprehensive Special Tax Notice Regarding Plan Payments aims to educate participants about the tax consequences that may arise from receiving payments from their plans. It helps individuals understand their reporting obligations and alerts them to potential tax liabilities associated with plan distributions. The document highlights different types of plan payments, including but not limited to: 1. Lump Sum Distributions — These are one-time payments received by participants who choose to withdraw the entirety of their account balance at once. The notice emphasizes how these distributions are taxed and provides examples to illustrate the specific tax implications. 2. Periodic Payments — Kings New York may offer participants the option to receive recurring payments over a specified period through periodic distributions. The notice delves into the tax treatment of such payments and provides examples to help participants comprehend the tax consequences involved. 3. Annuities — Participants may also choose to receive their plan payments in the form of annuities, which provide a steady income stream over a defined period. The document discusses the tax considerations associated with annuity payments, including how the tax liability is spread over the annuity's duration. Moreover, the Kings New York Comprehensive Special Tax Notice Regarding Plan Payments covers key tax rules that participants must be aware of, such as early withdrawal penalties, rollovers, and mandatory withholding requirements. It outlines the potential tax advantages and disadvantages associated with different types of plan payments, empowering participants to make informed decisions. By providing comprehensive and relevant information with appropriate keywords, the Kings New York Comprehensive Special Tax Notice Regarding Plan Payments ensures that participants have a thorough understanding of the tax implications associated with their chosen plan payments. This enables them to effectively manage their finances and make educated decisions when accessing their plan funds.

Kings New York Comprehensive Special Tax Notice Regarding Plan Payments

Description

How to fill out Kings New York Comprehensive Special Tax Notice Regarding Plan Payments?

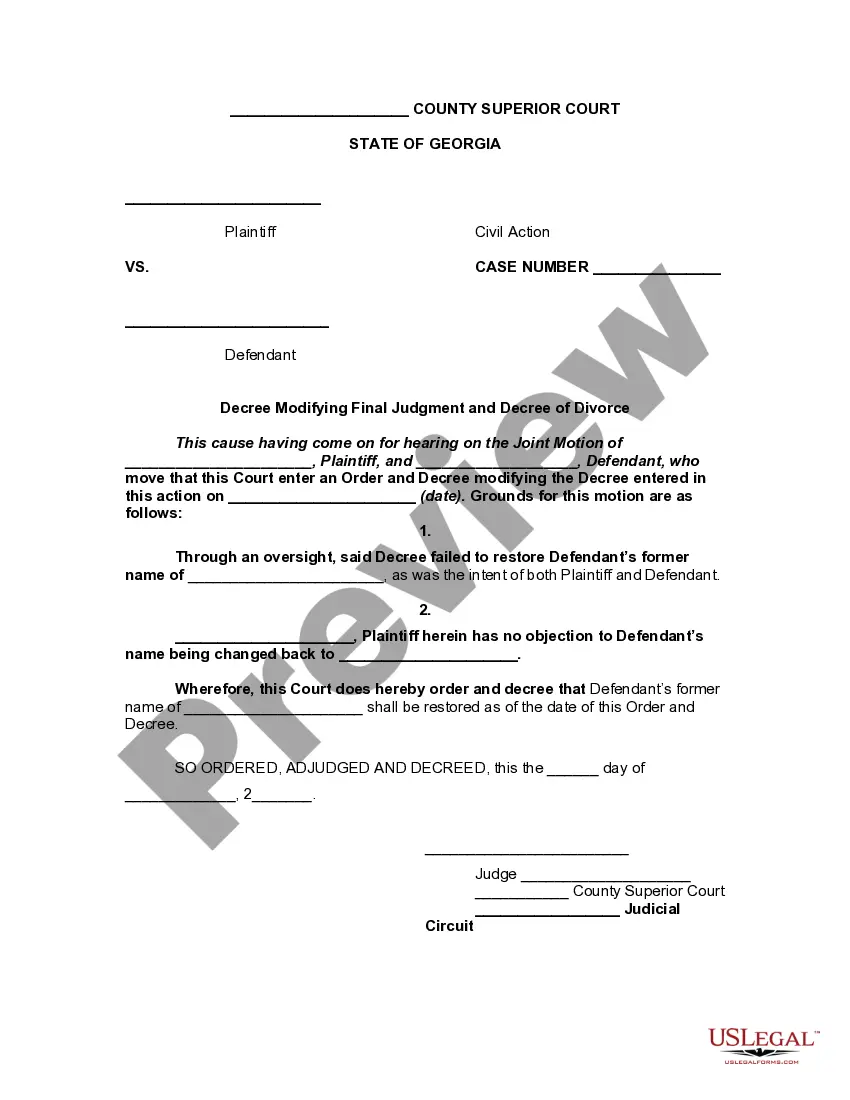

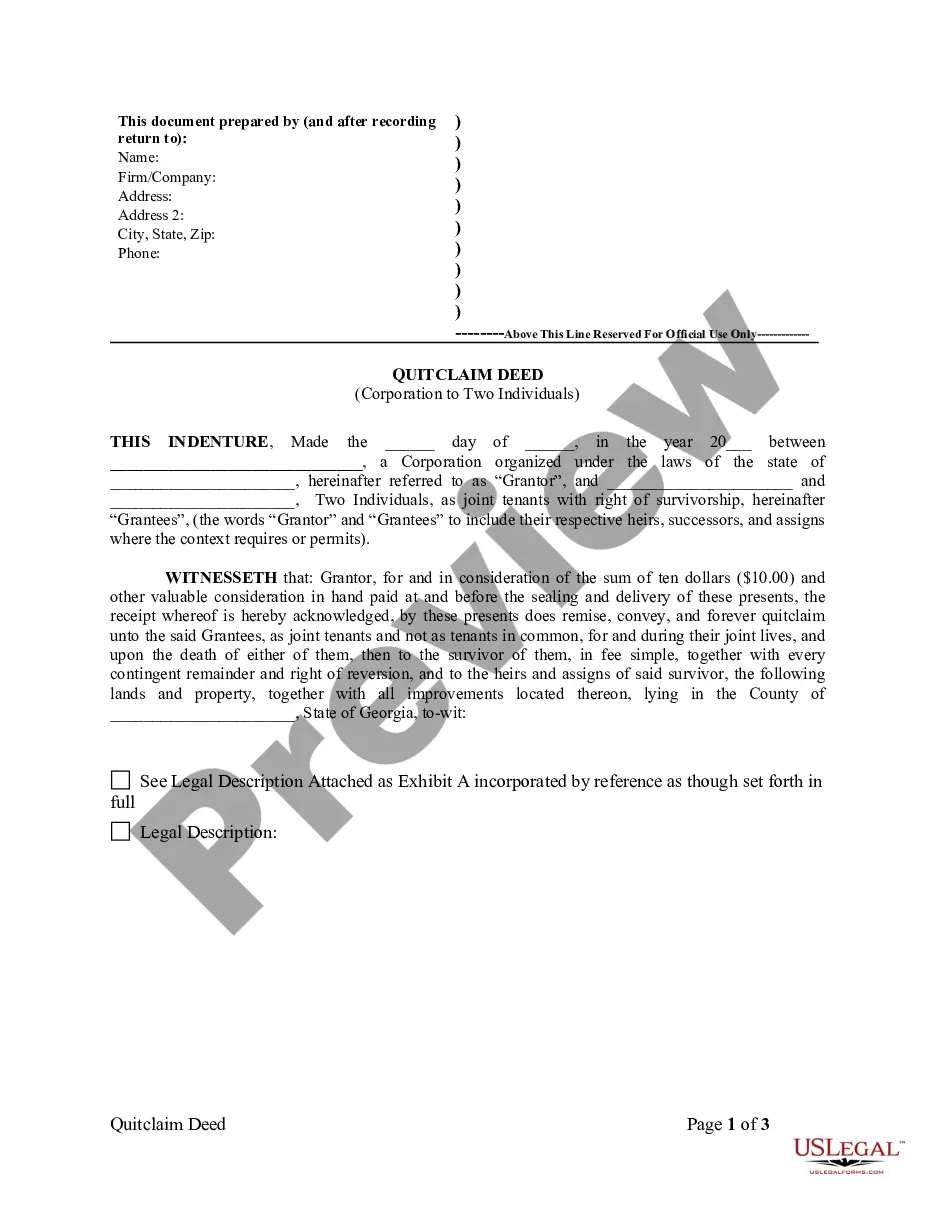

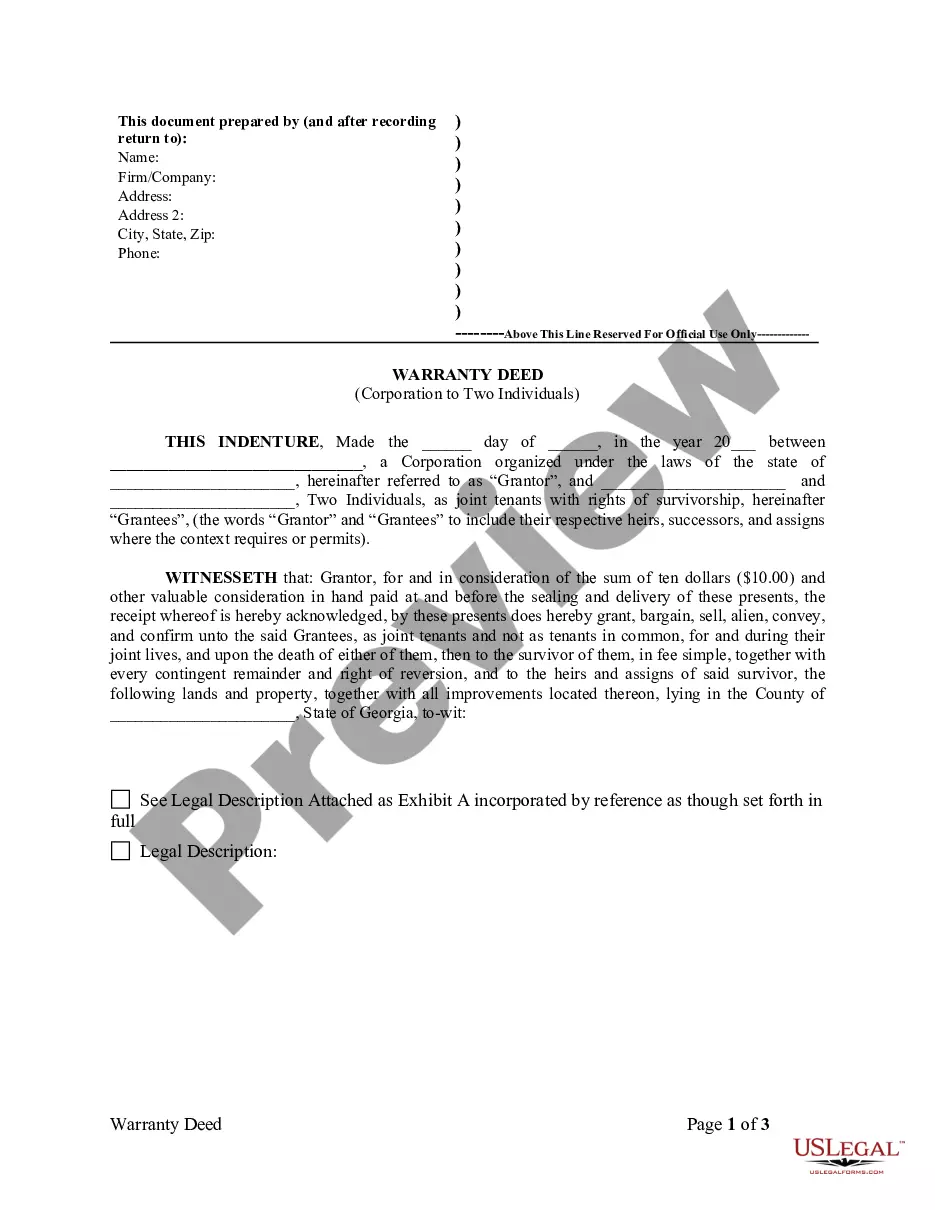

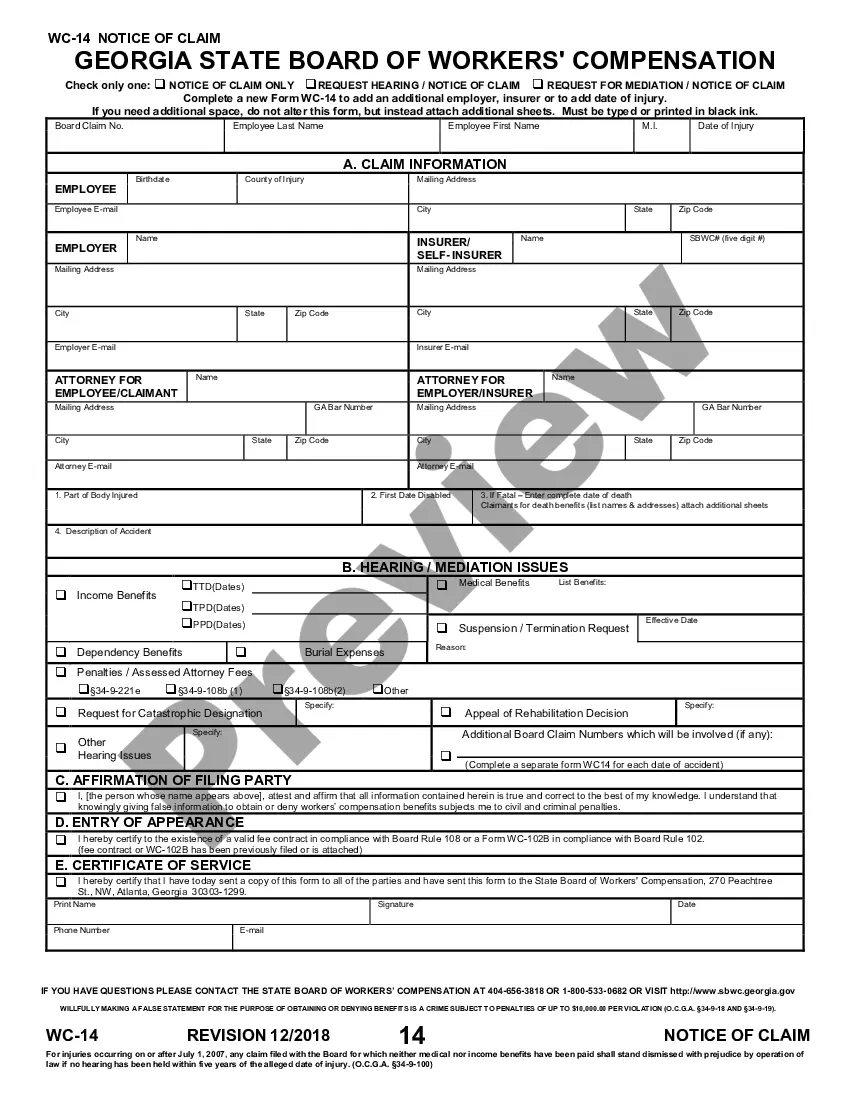

Whether you plan to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Kings Comprehensive Special Tax Notice Regarding Plan Payments is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the Kings Comprehensive Special Tax Notice Regarding Plan Payments. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Kings Comprehensive Special Tax Notice Regarding Plan Payments in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!