Nassau New York Comprehensive Special Tax Notice Regarding Plan Payments is a crucial document that provides detailed information about the various types of tax notices and payment plans applicable in Nassau County, New York. This notice helps individuals or businesses understand their tax obligations and outlines the different payment options available to them. One of the primary types of Nassau New York Comprehensive Special Tax Notice Regarding Plan Payments is the Property Tax Payment Plan. This plan helps property owners in Nassau County manage their tax payments by allowing them to spread the due amount over several installments. By utilizing this plan, property owners can avoid delinquency and potential penalties, ensuring a smoother financial management of their tax obligations. Another type is the Income Tax Payment Plan, a flexible option for individuals or businesses in Nassau County to settle their income tax liabilities. This plan allows taxpayers to divide their income tax obligations into manageable monthly payments, making it easier to meet their financial responsibilities. Nassau County provides various options within this plan, allowing taxpayers to choose the payment schedule that best suits their financial situation. The Nassau New York Comprehensive Special Tax Notice Regarding Plan Payments also covers the Sales Tax Payment Plan. This particular plan is designed for businesses that collect sales taxes on behalf of the state and county. It allows businesses to remit these taxes to the government in smaller installments, easing the burden on their cash flow while ensuring compliance with tax regulations. Additionally, the notice offers information on the Nassau County Penalty Relief Program, which provides eligible taxpayers with the opportunity to decrease or waive interest and penalties associated with late payments. This program aims to assist taxpayers who are facing financial challenges and helps them avoid excessive fees while ensuring their tax obligations are met. It's worth noting that the Nassau New York Comprehensive Special Tax Notice Regarding Plan Payments outlines the eligibility criteria, application process, and necessary documentation for each payment plan mentioned. It emphasizes the importance of timely filing, adherence to regulations, and prompt communication with the Nassau County Department of Assessment's Taxpayer Assistance Unit. In summary, the Nassau New York Comprehensive Special Tax Notice Regarding Plan Payments serves as a comprehensive guide for individuals and businesses in Nassau County, New York, seeking information about different tax payment plans. It aims to facilitate easier tax management, encourage compliance, and provide relief options for those facing financial difficulties.

Nassau New York Comprehensive Special Tax Notice Regarding Plan Payments

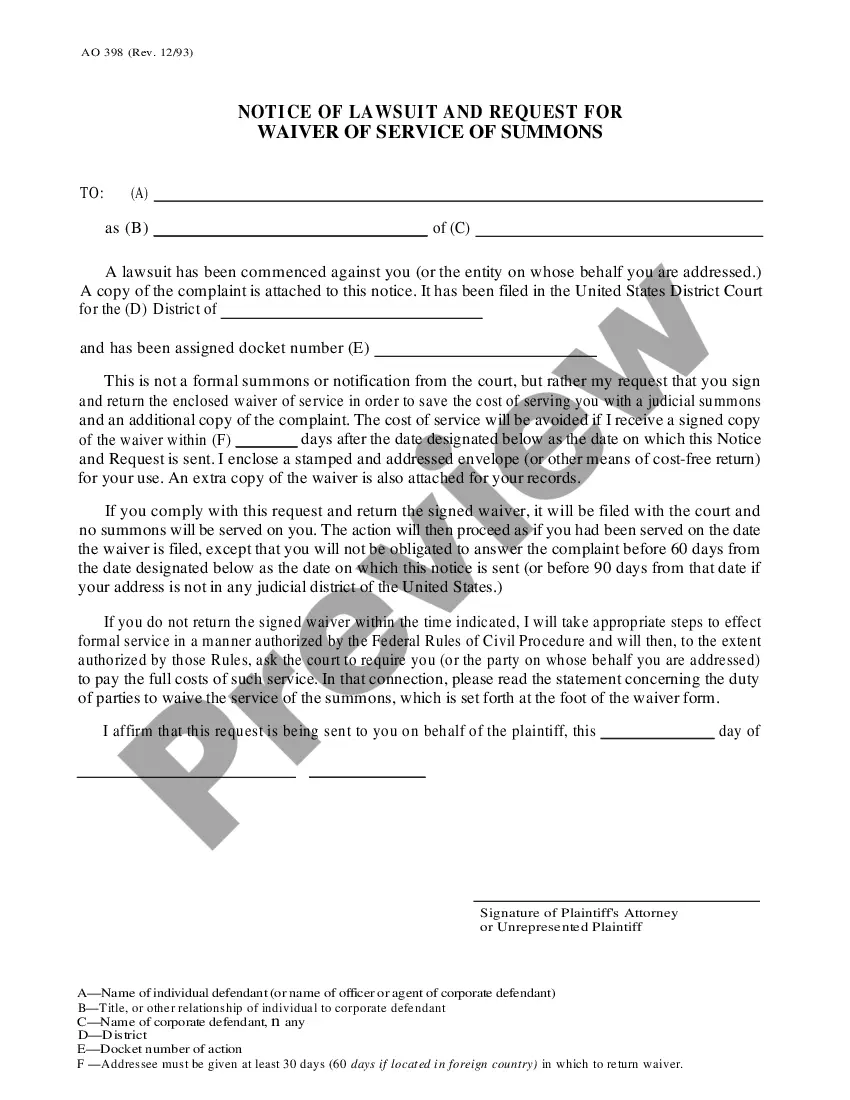

Description

How to fill out Nassau New York Comprehensive Special Tax Notice Regarding Plan Payments?

Do you need to quickly draft a legally-binding Nassau Comprehensive Special Tax Notice Regarding Plan Payments or probably any other document to handle your personal or corporate affairs? You can go with two options: contact a professional to write a valid document for you or create it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you receive professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific document templates, including Nassau Comprehensive Special Tax Notice Regarding Plan Payments and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, carefully verify if the Nassau Comprehensive Special Tax Notice Regarding Plan Payments is tailored to your state's or county's laws.

- In case the form comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the document isn’t what you were hoping to find by using the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Nassau Comprehensive Special Tax Notice Regarding Plan Payments template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Moreover, the templates we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!