Queens, New York Comprehensive Special Tax Notice Regarding Plan Payments: The Queens, New York Comprehensive Special Tax Notice Regarding Plan Payments is a notice provided to residents of Queens, New York regarding their tax payments and specific plans related to their tax obligations. This notice is designed to inform taxpayers about various tax payment plans and options available to them within the Queens area. The Comprehensive Special Tax Notice highlights key information related to tax payment programs, providing a detailed description of each plan and its benefits. It includes relevant keywords such as: 1. Installment Payment Plan: This plan allows taxpayers to spread their tax payments over a specific period, making it more manageable for those facing financial difficulties. The notice includes details on how to enroll in this plan and the necessary steps to take. 2. Offer in Compromise (OIC): The notice provides information on the OIC program, which enables eligible taxpayers to settle their tax debt for less than the full amount owed. It outlines the criteria for eligibility and the application process. 3. Penalty Abatement: This plan focuses on reducing or eliminating penalties owed by taxpayers. The notice explains the circumstances under which penalty abatement may be granted and provides instructions to request such relief. 4. Payment Plan Adjustment: This option allows taxpayers to modify their existing payment plans based on changing financial situations. Information regarding the adjustment process, required documents, and applicable fees are all provided. 5. Special Considerations: The notice also informs taxpayers of special considerations available to individuals facing specific circumstances such as financial hardship, disability, or disaster-related challenges. It mentions the necessary criteria to qualify for these special programs. The Queens, New York Comprehensive Special Tax Notice provides an overview of each plan's requirements, benefit, and application processes. It serves as a valuable resource for Queens residents to understand their tax payment options and make informed decisions regarding their financial obligations.

Queens New York Comprehensive Special Tax Notice Regarding Plan Payments

Description

How to fill out Queens New York Comprehensive Special Tax Notice Regarding Plan Payments?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Queens Comprehensive Special Tax Notice Regarding Plan Payments, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Queens Comprehensive Special Tax Notice Regarding Plan Payments from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Queens Comprehensive Special Tax Notice Regarding Plan Payments:

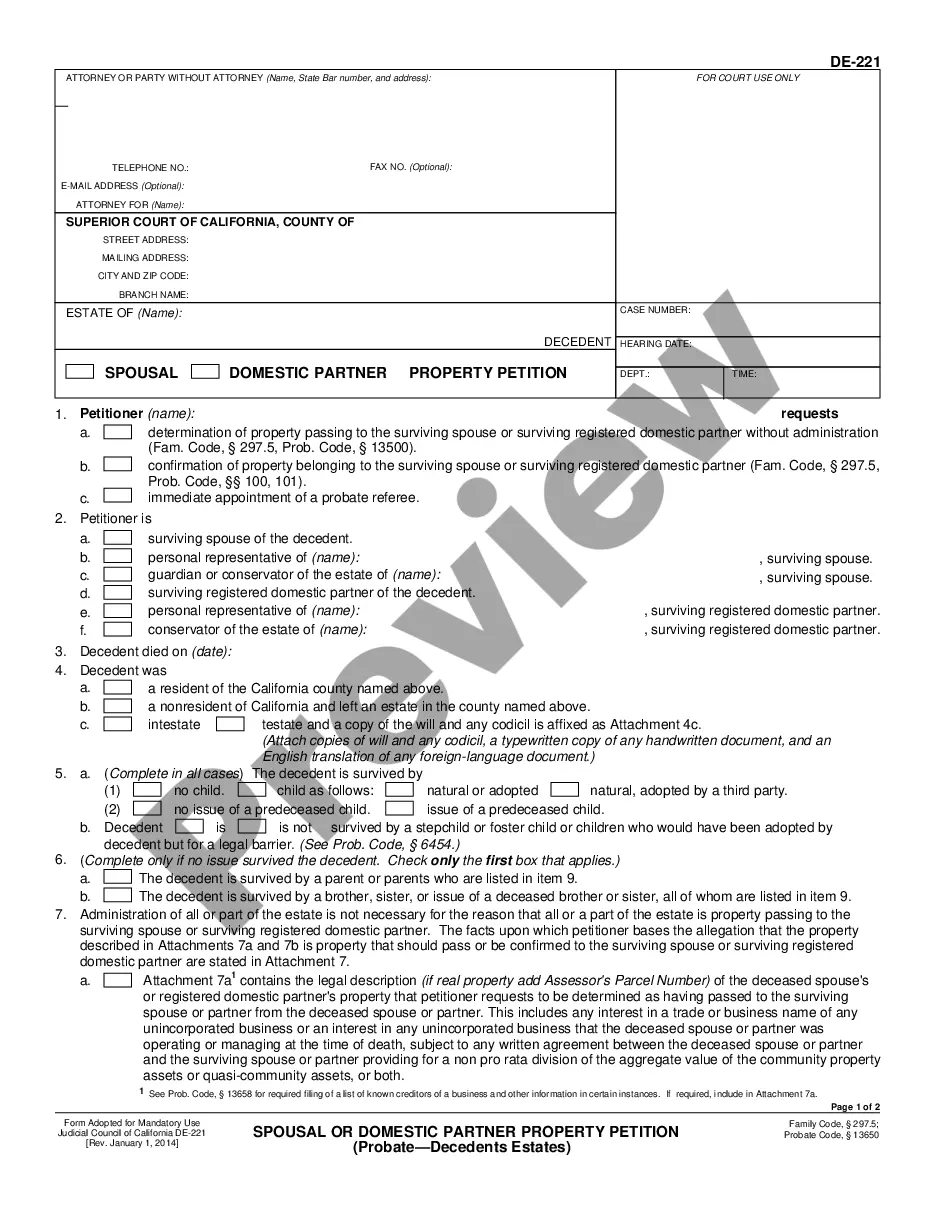

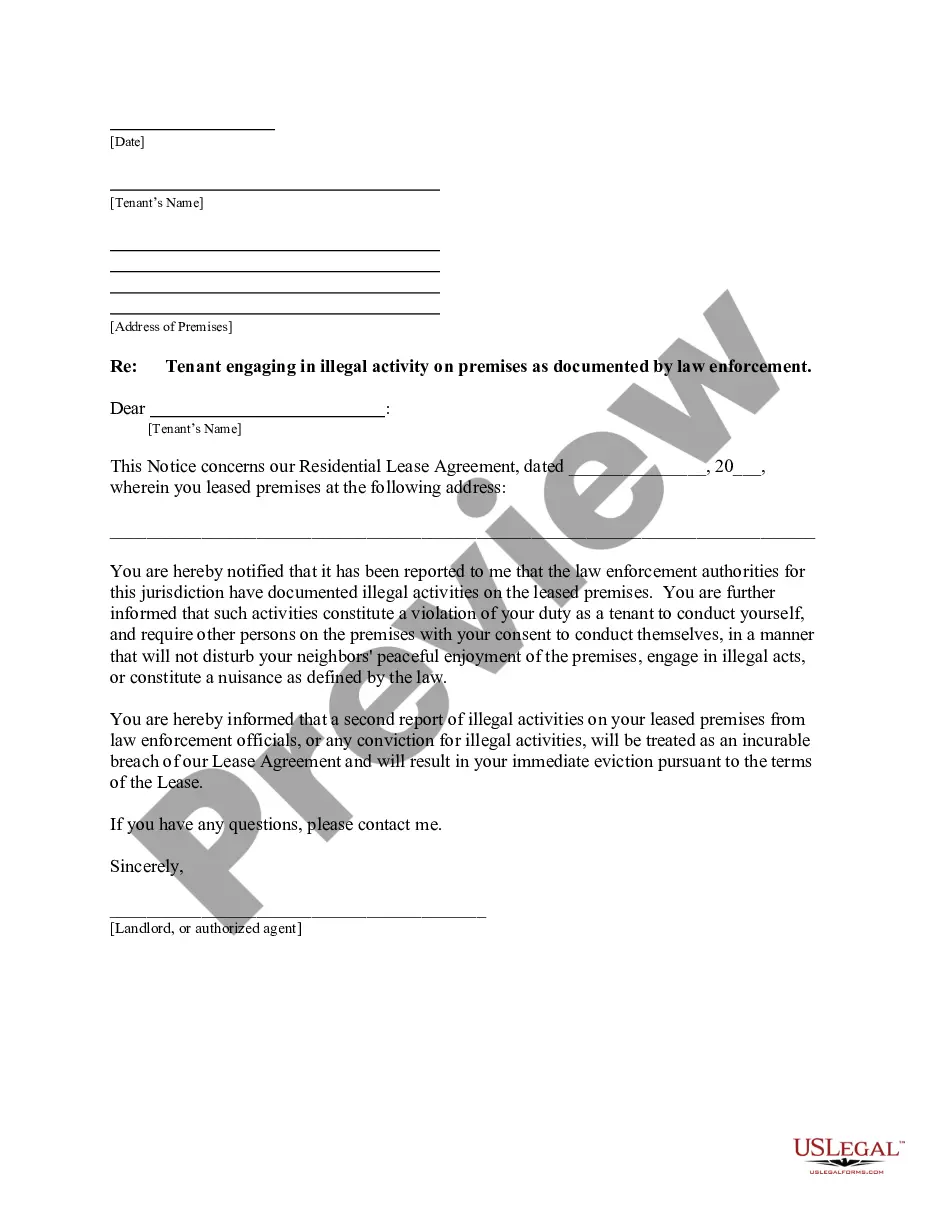

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan; or if your payment is from a Designated Roth Account to a Roth IRA or Designated Roth Account in an employer plan.

The IRA custodian that received the IRA rollover, which could be the same financial organization that distributed it to you, has to report the rollover deposit to you on IRS Form 5498. You'll get a copy of the 2013 Form 5498 at the end of May 2014 that shows you rolled over the entire IRA distribution.

IRS Publication 575 is a document published by the Internal Revenue Service (IRS) that provides information on how to treat distributions from pensions and annuities, and how to report income from these distributions on a tax return. It also outlines how to roll distributions into another retirement plan.

This notice is intended to help you decide whether to do such a rollover. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account (a type of account with special tax rules in some employer plans).

IRS regulations require Fidelity to withhold federal income tax at the rate of 10% from your total withdrawal unless your withdrawal is from a Roth IRA, or unless you elect otherwise.

The 402(f) notice provides important information about rolling over an eligible rollover distribution (i.e., generally, any lump sum payment or series of installment payments over a period of less than 10 years) to another eligible retirement plan, or individual retirement account (IRA).

This rollover transaction isn't taxable, unless the rollover is to a Roth IRA or a designated Roth account from another type of plan or account, but it is reportable on your federal tax return. You must include the taxable amount of a distribution that you don't roll over in income in the year of the distribution.

A Standard Document to be used by the borrower to request a rollover of term SOFR loans, LIBOR advances or bankers' acceptances for an additional interest period.