San Bernardino California Comprehensive Special Tax Notice Regarding Plan Payments is a vital document that outlines important information related to tax obligations and payment plans within San Bernardino, California. This notice is aimed at individuals and businesses who owe taxes and need to establish a payment plan to fulfill their obligations. The purpose of this comprehensive notice is to educate taxpayers about their rights and responsibilities regarding their tax liabilities and provide clear instructions on how to proceed with setting up and maintaining an appropriate payment plan. It ensures that taxpayers understand the implications of non-compliance and the consequences of failing to fulfill their tax obligations. Key points covered in the San Bernardino California Comprehensive Special Tax Notice Regarding Plan Payments include: 1. Tax Obligations: This notice clarifies the types and amounts of taxes owed by taxpayers in San Bernardino, California. It covers various tax types, including income tax, property tax, sales tax, and other local taxes. 2. Payment Options: The notice explains the available payment options for taxpayers struggling to pay their taxes in full. It outlines the different plans available, such as installment agreements, deferred payment plans, and other arrangements to make tax payments more manageable. 3. Terms and Conditions: Detailed information regarding the terms and conditions of each payment plan is provided. This includes the duration of the plan, interest rates, penalties, and any additional fees associated with the chosen plan. 4. Eligibility Criteria: The notice mentions the eligibility criteria for participating in the offered payment plans. It outlines the necessary qualifications and considerations taxpayers must meet to be eligible for these special arrangements. 5. Application Process: The notice explains the procedure for applying for a tax payment plan. It provides step-by-step instructions on how to complete the application, including required documentation, deadlines, and submission methods. 6. Consequences of Non-Compliance: The notice outlines the potential consequences if a taxpayer fails to comply with their agreed-upon payment plan. It addresses the possibility of penalties, interest, collection actions, and legal implications for non-payment or defaulting on the agreed plan. Different types of San Bernardino California Comprehensive Special Tax Notice Regarding Plan Payments may include specific notices tailored to certain tax types or unique situations faced by taxpayers. For example: — San Bernardino California Comprehensive Special Tax Notice Regarding Property Tax Plan Payments: This notice would focus exclusively on property tax obligations and the associated payment plans available. — San Bernardino California Comprehensive Special Tax Notice Regarding Sales Tax Plan Payments: This notice would specifically address sales tax obligations and the different plans offered for sales tax payment arrangements. — San Bernardino California Comprehensive Special Tax Notice Regarding Income Tax Installment Payments: This notice would provide comprehensive information about income tax obligations and the installment payment options available for individuals and businesses. Ultimately, these notices serve as a crucial resource for taxpayers, ensuring transparency, clarity, and guidance for those seeking to establish and maintain payment plans while fulfilling their tax obligations within San Bernardino, California.

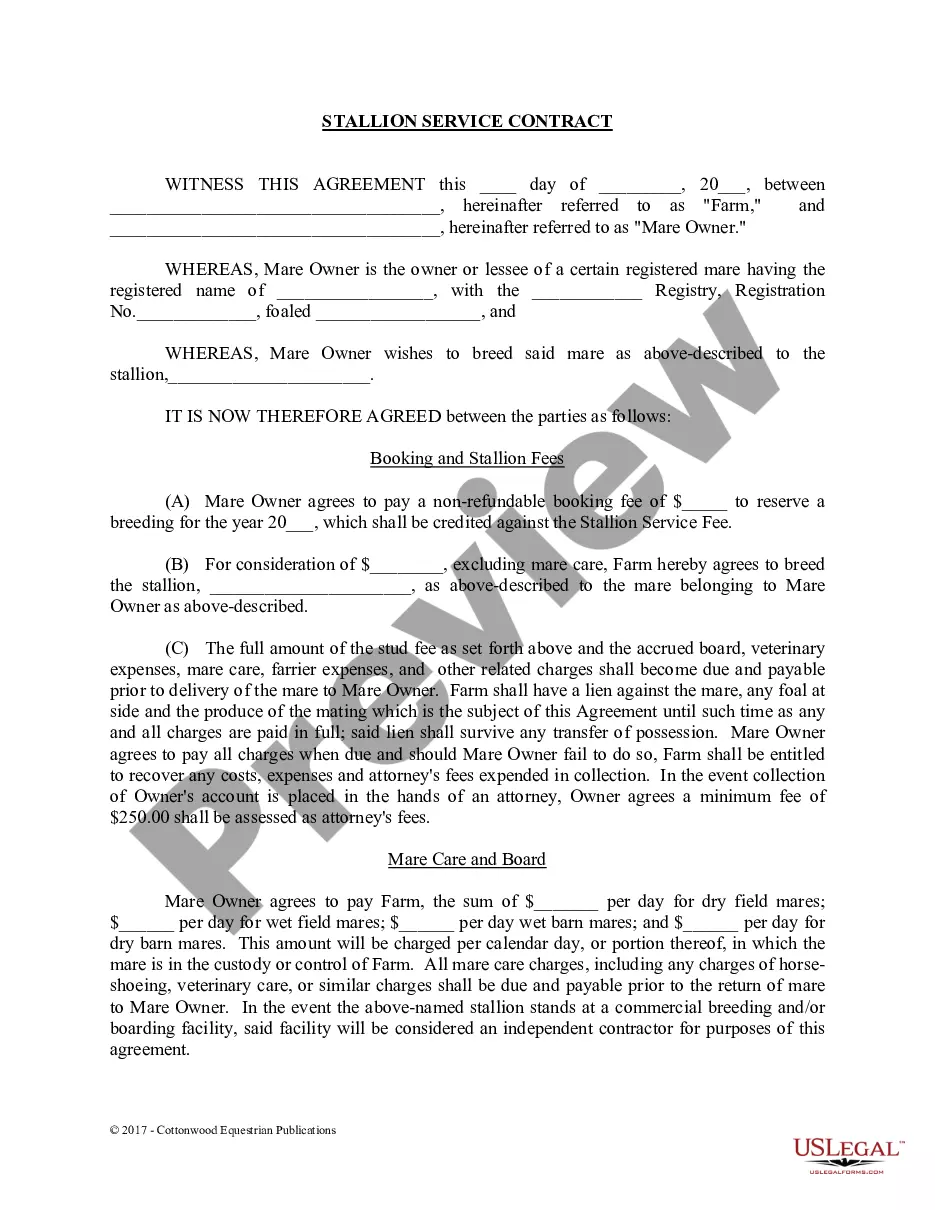

San Bernardino California Comprehensive Special Tax Notice Regarding Plan Payments

Description

How to fill out San Bernardino California Comprehensive Special Tax Notice Regarding Plan Payments?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your county, including the San Bernardino Comprehensive Special Tax Notice Regarding Plan Payments.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the San Bernardino Comprehensive Special Tax Notice Regarding Plan Payments will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the San Bernardino Comprehensive Special Tax Notice Regarding Plan Payments:

- Ensure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the San Bernardino Comprehensive Special Tax Notice Regarding Plan Payments on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!