The San Diego California Comprehensive Special Tax Notice Regarding Plan Payments is an important document that outlines the details and requirements of special tax payments in the city of San Diego, California. This notice provides comprehensive information regarding the various types of special taxes, their purpose, and how they are assessed and used within the community. One type of San Diego California Comprehensive Special Tax Notice Regarding Plan Payments is related to infrastructure improvements. These special taxes are typically used to fund the construction, maintenance, and repair of public facilities such as roads, bridges, parks, and schools. The notice specifies the exact projects for which the taxes are levied and outlines the payment terms and schedule. Another type of San Diego California Comprehensive Special Tax Notice Regarding Plan Payments is for community services. These special taxes are dedicated to funding essential services like public safety, transportation, waste management, and environmental programs within the city. The notice provides a detailed breakdown of the specific services covered and the associated costs. The San Diego California Comprehensive Special Tax Notice Regarding Plan Payments also includes information on the assessment methodology. It explains how the taxes are calculated based on factors such as property value, square footage, or the number of occupants. The notice also outlines any exemptions, discounts, or special considerations that may apply. Additionally, the San Diego California Comprehensive Special Tax Notice Regarding Plan Payments highlights the legal obligations of property owners in relation to special taxes. It clarifies the responsibilities for timely tax payments, penalties for non-compliance, and the potential consequences for delinquency. Overall, the San Diego California Comprehensive Special Tax Notice Regarding Plan Payments is a crucial document for property owners in San Diego. It provides transparent and detailed information regarding special tax obligations, enabling residents to understand how their tax contributions are utilized to improve the community and enhance essential services.

San Diego California Comprehensive Special Tax Notice Regarding Plan Payments

Description

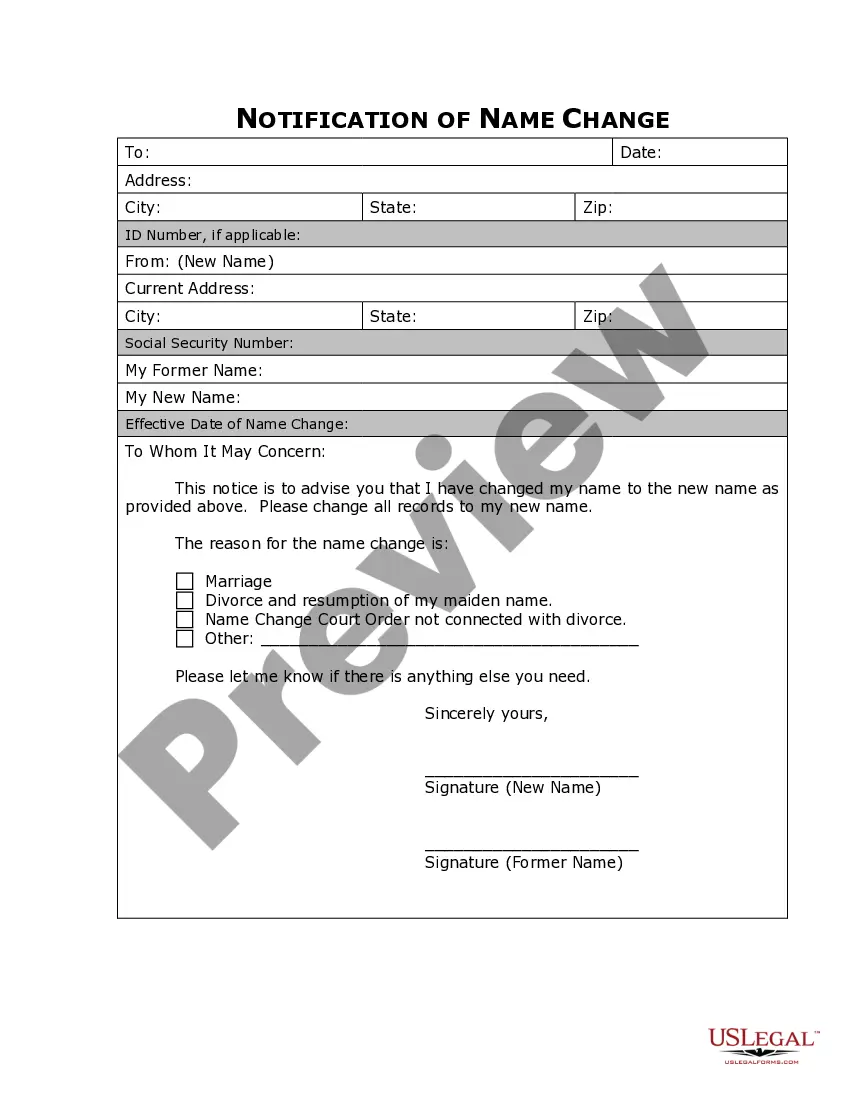

How to fill out San Diego California Comprehensive Special Tax Notice Regarding Plan Payments?

If you need to get a reliable legal paperwork supplier to find the San Diego Comprehensive Special Tax Notice Regarding Plan Payments, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it simple to get and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to search or browse San Diego Comprehensive Special Tax Notice Regarding Plan Payments, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the San Diego Comprehensive Special Tax Notice Regarding Plan Payments template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or execute the San Diego Comprehensive Special Tax Notice Regarding Plan Payments - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

The notice is a document provided to each participant, beneficiary and alternate payee under the plan stating that the employer did not make a required funding contribution. Notice must be given before the 60th day following the due date of the quarterly or other required contribution.

IRS Publication 575 is a document published by the Internal Revenue Service (IRS) that provides information on how to treat distributions from pensions and annuities, and how to report income from these distributions on a tax return. It also outlines how to roll distributions into another retirement plan.

The 402(f) notice provides important information about rolling over an eligible rollover distribution (i.e., generally, any lump sum payment or series of installment payments over a period of less than 10 years) to another eligible retirement plan, or individual retirement account (IRA).

Part of the rationale for the special tax treatment on long-term capital gains, is to act as an incentive and reward for risking capital. To repeal or diminish this special treatment would serve as a penalty for taking risks.

This notice is intended to help you decide whether to do such a rollover. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account (a type of account with special tax rules in some employer plans).

Once you start withdrawing from your 401(k) or traditional IRA, your withdrawals are taxed as ordinary income. You'll report the taxable part of your distribution directly on your Form 1040.

Gains from the sale of securities are generally taxable in the year of the sale, unless your investment is in a tax-advantaged account, such as an IRA, 401(k), or 529 plan. Generally, for those accounts, you only incur taxes when you start taking withdrawals.

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan; or if your payment is from a Designated Roth Account to a Roth IRA or Designated Roth Account in an employer plan.

What is my withholding percentage? IRS regulations require Fidelity to withhold federal income tax at the rate of 10% from your total withdrawal unless your withdrawal is from a Roth IRA, or unless you elect otherwise.