San Jose, California Comprehensive Special Tax Notice Regarding Plan Payments — Explained In San Jose, California, the Comprehensive Special Tax Notice Regarding Plan Payments is an essential document that provides important information regarding the payment of special taxes for property owners within various districts or areas in the city. This notice aims to inform property owners about their tax obligations and how these funds are utilized to enhance and improve the local community. The Comprehensive Special Tax Notice encompasses different types of special taxes that property owners may be subject to, such as: 1. Mello-Roos Districts: Mello-Roos is a special tax district created to fund public improvements, such as schools, libraries, roads, and other necessary infrastructure within certain developments or areas. This notice explains the specific tax rate and duration of the Mello-Roos tax, as well as how the collected funds are allocated. 2. Community Facilities Districts (CDs): CDs are established to finance public facilities and services, including parks, water supply, drainage systems, police and fire departments, and more. The notice highlights the CFD's tax rates and details about the underlying projects being financed by these taxes. 3. Improvement Area Districts: Improvement Area Districts focus on the development and maintenance of specific improvements within designated areas. This notice provides information about the taxes levied, the services provided, and the duration of the district. The Comprehensive Special Tax Notice Regarding Plan Payments typically contains: 1. Tax Obligation Details: This section outlines the specific taxes property owners are obligated to pay, including the tax rates and any special assessments or fees associated with their property. 2. Purpose of the Tax: It explains how the tax revenues will be used to support specific projects, services, or facilities that benefit the community, such as education, public safety, infrastructure, or maintenance. 3. Duration of the Tax: The notice specifies the duration of the tax assessment, including whether it is temporary or ongoing, ensuring property owners have a clear understanding of the timeframe for payment. 4. Payment Schedule: This section provides information on the payment schedule, including due dates, amounts, and acceptable methods of payment. It may also include instructions on how property owners can set up automatic payments or make partial payments if applicable. 5. Contact Information: The notice includes contact details for the appropriate department or agency responsible for administering the tax. Property owners can reach out to them to address any questions or concerns they may have. Ensuring compliance with the Comprehensive Special Tax Notice Regarding Plan Payments is crucial for property owners in San Jose, California. By understanding their tax obligations and how these funds contribute to the community's development, property owners can actively participate in shaping the growth and improvement of their area.

San Jose California Comprehensive Special Tax Notice Regarding Plan Payments

Description

How to fill out San Jose California Comprehensive Special Tax Notice Regarding Plan Payments?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the San Jose Comprehensive Special Tax Notice Regarding Plan Payments, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the San Jose Comprehensive Special Tax Notice Regarding Plan Payments from the My Forms tab.

For new users, it's necessary to make some more steps to get the San Jose Comprehensive Special Tax Notice Regarding Plan Payments:

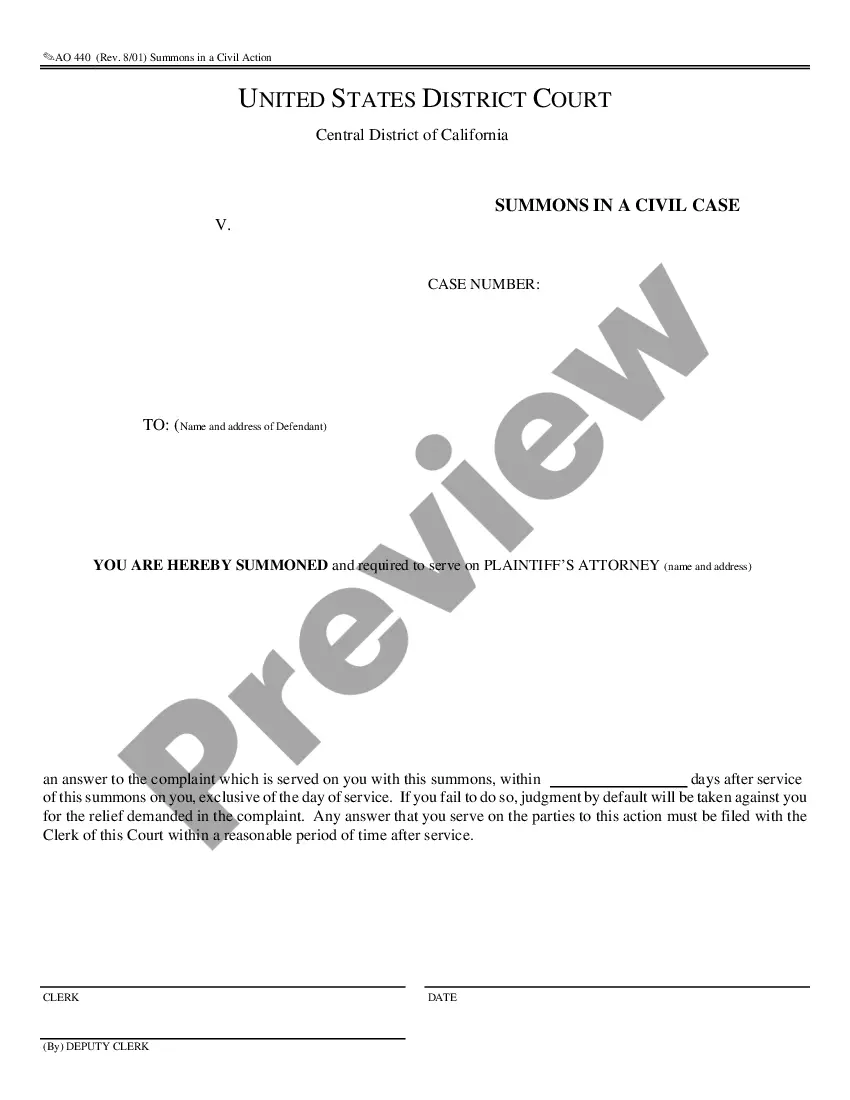

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Distribution Notice means a notice received by the Company from the Superintendent notifying the Company that it is entitled to receive the amount indicated therein from the New York paid family leave risk adjustment pool in respect of the most recently completed calendar year.

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan; or if your payment is from a Designated Roth Account to a Roth IRA or Designated Roth Account in an employer plan.

This notice is intended to help you decide whether to do such a rollover. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account (a type of account with special tax rules in some employer plans).

Regarding reporting 401K rollover into IRA, how you report it to the IRS depends on the type of rollover. If this was a direct rollover, it should be coded G. Enter the amount from your 1099-R, Box 1 on Form 1040, Line 16a. Enter the taxable amount from Box 2a on Line 16b.

Part of the rationale for the special tax treatment on long-term capital gains, is to act as an incentive and reward for risking capital. To repeal or diminish this special treatment would serve as a penalty for taking risks.

Annual fee disclosure notice Describes information about plan fees and investments. This notice consists of two parts: Participant fee disclosure - Reports certain plan administration information, including the plan and individual-level fees that might be deducted from participant accounts.

The notice is a document provided to each participant, beneficiary and alternate payee under the plan stating that the employer did not make a required funding contribution. Notice must be given before the 60th day following the due date of the quarterly or other required contribution.

IRS Publication 575 is a document published by the Internal Revenue Service (IRS) that provides information on how to treat distributions from pensions and annuities, and how to report income from these distributions on a tax return. It also outlines how to roll distributions into another retirement plan.

Specifically, whether a tax-sheltered annuity can be rolled over into an IRA. The answer to this question is yes -- but only kind of. The tax-sheltered annuity is, first and foremost, an employer-directed retirement account. As such, it carries specific rules when it comes to rollovers and withdrawals.

Reporting your rollover is relatively quick and easy all you need is your 1099-R and 1040 forms. Look for Form 1099-R in the mail from your plan administrator at the end of the year.Report your gross distribution on line 15a of IRS Form 1040.Report any taxable portion of your gross distribution.