The Dallas Texas Employee Time Report (Nonexempt) is a crucial document used by businesses in Dallas, Texas, to accurately track the working hours and related data of their nonexempt employees. This report plays a critical role in maintaining transparency, ensuring fair compensation, and complying with state and federal labor laws. The Dallas Texas Employee Time Report (Nonexempt) typically includes various relevant keywords such as: 1. Nonexempt employees: Nonexempt employees are those who are eligible for overtime pay under the Fair Labor Standards Act (FLEA). They are usually paid hourly and must record their working hours. 2. Working hours: The report captures the start and end times of each employee's work shift. It also records any breaks or meal periods taken during the shift. 3. Overtime hours: This section of the report documents any additional hours worked by nonexempt employees that exceed the standard 40 hours per week. Overtime hours are usually compensated at a higher rate. 4. Time-off requests: The report may include a section where employees can request time off, such as vacation days, sick leave, or personal days. These requests need to be approved by the employer or management. 5. Absences and tardiness: This section records any unscheduled absences or late arrivals. It helps in identifying patterns of attendance and addressing any excessive absenteeism or tardiness issues. 6. Pay rate: The report typically includes information about the employee's hourly pay rate, which is important for calculating their total wages. 7. Department or division: To organize and track time more efficiently, the report may require employees to specify the department or division they belong to. 8. Supervisor's approval: The report might require the signature or approval of the employee's supervisor or manager, confirming the accuracy of the recorded time and any adjustments made. Different types of Dallas Texas Employee Time Reports (Nonexempt) may vary based on the specific format or layout used by individual businesses. Some may is physical paper forms, while others may be digital templates or integrated into time tracking software. Additionally, some reports may have additional sections or fields specific to the needs and policies of a particular organization. Accurate and detailed Employee Time Reports for nonexempt employees are essential for businesses in Dallas, Texas, to ensure compliance with labor laws, avoid legal complications, and maintain transparency in their workforce management processes.

Dallas Texas Employee Time Report (Nonexempt)

Description

How to fill out Dallas Texas Employee Time Report (Nonexempt)?

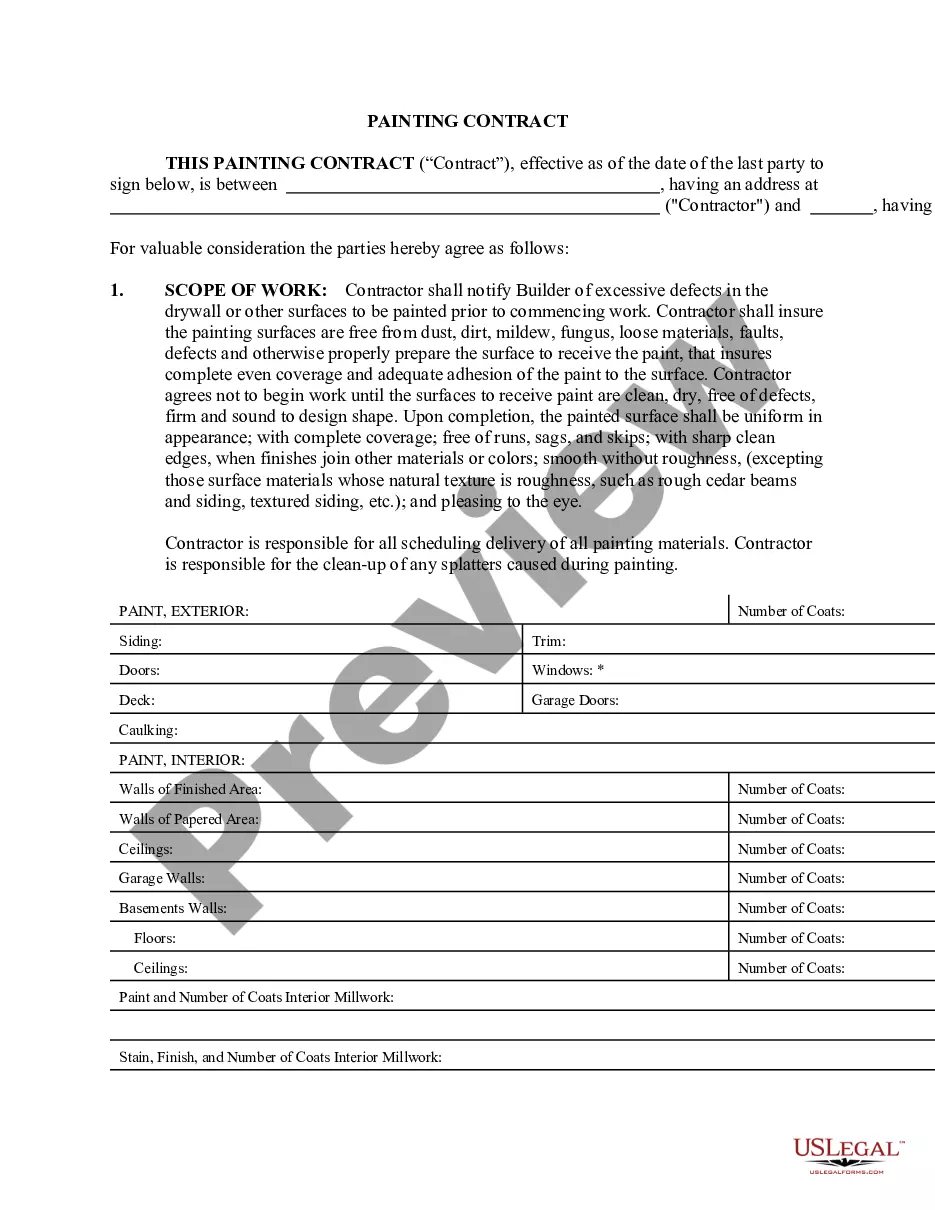

Do you need to quickly draft a legally-binding Dallas Employee Time Report (Nonexempt) or probably any other form to manage your own or business affairs? You can select one of the two options: hire a professional to write a valid paper for you or create it entirely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific form templates, including Dallas Employee Time Report (Nonexempt) and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, carefully verify if the Dallas Employee Time Report (Nonexempt) is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to check what it's suitable for.

- Start the search again if the document isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Dallas Employee Time Report (Nonexempt) template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

A. Yes, you are entitled to one hour of reporting time pay. Under the law, if an employee is required to report to work a second time in any one workday and is furnished less than two hours of work on the second reporting, he or she must be paid for two hours at his or her regular rate of pay.

Yes, you can sue your employer for failing to pay overtime by filing a complaint with the U.S. Department of Labor's Wage and Hour Division. An experienced employment law attorney can help you get the maximum amount of compensation in your wage claim.

If your employer has not paid you wages you are owed, you can file a wage claim with the Texas Employment Commission. There is an elaborate procedure of investigations and hearings described here. The form for filing a wage claim can be found here.

The statute limits the administrative penalty to $1000, or the amount in dispute, whichever is less. Failing to pay wages according to the law would include late payment of wages.

In a nutshell, the Texas Payday Law (TPL) requires an employer to pay its employees in full and on time on regularly-scheduled paydays. The law deals with the timing and manner of wage payments and how to avoid illegal deductions from wages.

Under section 13(a)(1) of the FLSA, individuals who are employed as bona fide executive, administrative, professional, or outside sales employees qualify for overtime exemptions.

You can file a wage claim using TWC's online system or by using a paper form that you print and mail or fax to the Labor Law Department. TWC encourages you to file online. Filing online is faster, safer, and the most accurate way to file your claim.

If an employee is not paid on payday, then the employer must pay the employee on another business chosen by the employee. Thus, an employer who fails to pay its employee on payday and fails to fulfill its employee's request to get paid the next business day violates the Texas Payday Law.

Employees can seek unpaid wages through the Texas Workforce Commission, The Department of Labor's Wage and Hour Division, or a lawsuit. Additionally, both employees and independent contractors can seek payment under Texas's mechanic's lien statute.

If your employer has not paid you wages you are owed, you can file a wage claim with the Texas Employment Commission.