The Houston Texas FLEA Exempt / Nonexempt Compliance Form is a crucial document designed to ensure proper classification and adherence to the Fair Labor Standards Act (FLEA) regulations in Houston, Texas. This form aids businesses and organizations in determining whether their employees are exempt or nonexempt from FLEA provisions, particularly regarding minimum wage and overtime pay. Keywords: Houston Texas, FLEA, exempt, nonexempt, compliance form, Fair Labor Standards Act, minimum wage, overtime pay. There are two main types of Houston Texas FLEA Exempt / Nonexempt Compliance Forms, namely: 1. FLEA Exempt Compliance Form: This form assesses whether an employee qualifies for an exempt status under the FLEA. Such employees are exempt from receiving overtime pay and must meet specific criteria under one of the FLEA exemptions, including executive, administrative, professional, or certain computer-related roles. The FLEA Exempt Compliance Form evaluates an employee's job duties, responsibilities, salary, and other factors to determine if they meet the exemption requirements. 2. FLEA Nonexempt Compliance Form: This form analyzes whether an employee falls into the nonexempt category, meaning they are entitled to receive minimum wage for all hours worked and overtime pay for hours beyond the standard 40-hour workweek. Nonexempt employees are typically engaged in manual labor, non-managerial roles, or positions that do not meet the FLEA exemption criteria. The FLEA Nonexempt Compliance Form ensures accurate classification, proper payment, and compliance with FLEA provisions for these employees. In Houston, Texas, businesses and organizations must carefully complete and maintain these forms to ensure FLEA compliance, protect employees' rights, avoid legal penalties, and maintain transparent employment practices. It is essential to understand the distinction between exempt and nonexempt employees by assessing their duties, responsibilities, and salary to prevent misclassification, labor disputes, or potential legal issues. Using the Houston Texas FLEA Exempt / Nonexempt Compliance Form properly allows businesses to uphold the FLEA's requirements accurately, treat employees fairly, maintain accurate records, and create a positive and compliant work environment.

Houston Texas FLSA Exempt / Nonexempt Compliance Form

Description

How to fill out Houston Texas FLSA Exempt / Nonexempt Compliance Form?

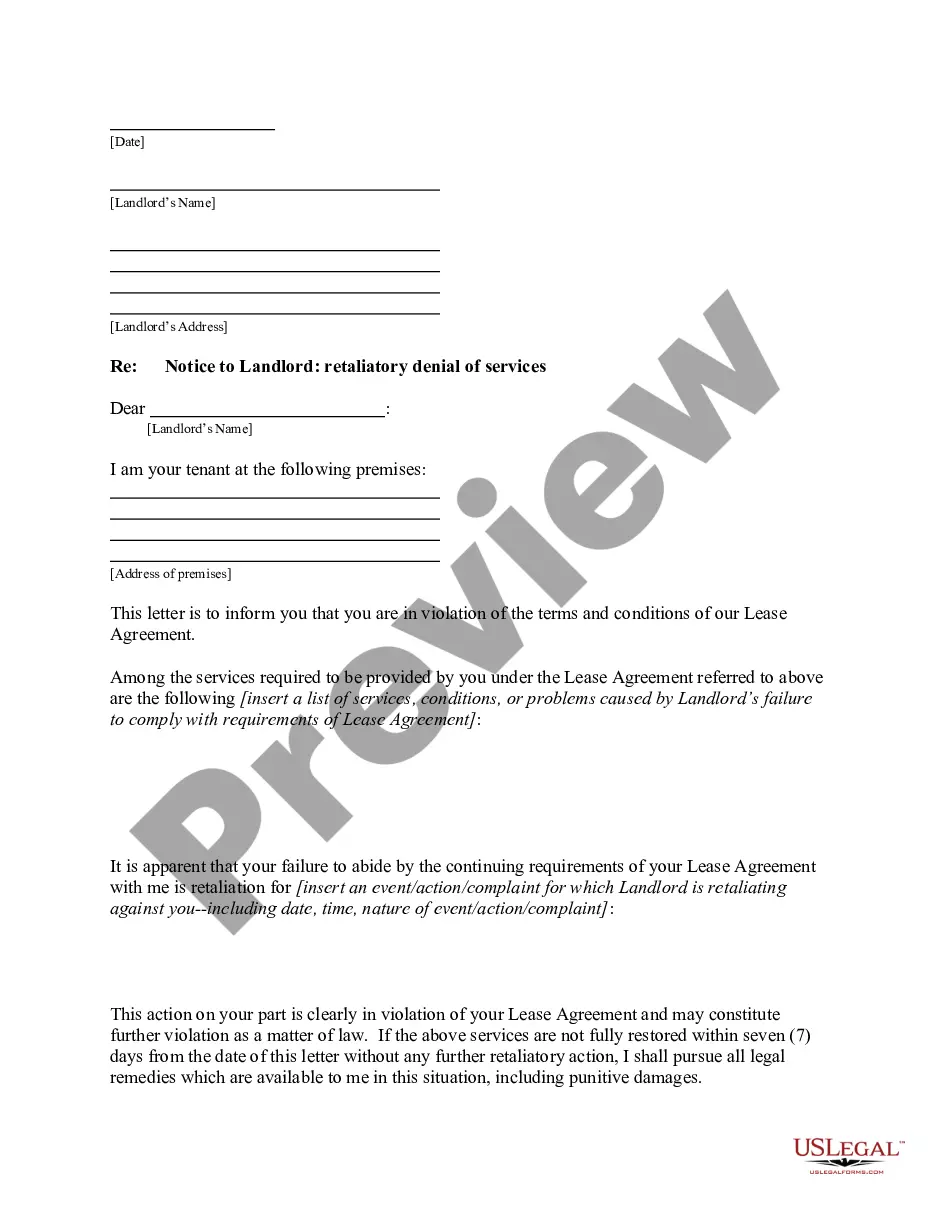

Are you looking to quickly draft a legally-binding Houston FLSA Exempt / Nonexempt Compliance Form or probably any other document to manage your personal or business affairs? You can go with two options: contact a professional to write a valid document for you or draft it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get neatly written legal papers without having to pay sky-high fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including Houston FLSA Exempt / Nonexempt Compliance Form and form packages. We offer templates for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, double-check if the Houston FLSA Exempt / Nonexempt Compliance Form is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were seeking by utilizing the search box in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Houston FLSA Exempt / Nonexempt Compliance Form template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Moreover, the templates we provide are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!