Hennepin County, Minnesota is a region known for its thriving entertainment scene, offering a wide range of options for both locals and visitors. When it comes to proving entertainment expenses in Hennepin County, individuals and businesses need to adhere to the Checklist for Proving Entertainment Expenses, which outlines the necessary documentation and requirements. This checklist ensures that claimed expenses are valid and eligible for tax deductions or reimbursement. The Hennepin Minnesota Checklist for Proving Entertainment Expenses can include several types, depending on the nature of the entertainment activity and the expense incurred. Some common categories may include: 1. Dining and meals: If entertainment expenses involve meals at restaurants, catering services, or food purchases during events, the checklist may require receipts or invoices that indicate the date, location, amount spent, and names of the guests or attendees. 2. Tickets for events: When attending concerts, theater shows, sporting events, or any other form of entertainment, individuals or businesses need to provide ticket stubs, receipts, or invoices as proof of the expense. These documents should specify the event's name, date, venue, seat numbers, and the amount paid. 3. Travel and transport: If the entertainment expense involves travel-related costs, such as flights, rental cars, or transportation services like taxis or ride-shares, the checklist may require receipts or invoices that show the date, destination, duration, and amount spent. 4. Lodging: For entertainment activities that require overnight stays, such as attending conferences or festivals, individuals or businesses must provide proof of lodging expenses. Receipts or invoices from hotels, hostels, or other accommodation providers must include the dates of stay and the total cost. 5. Client or customer entertainment: In situations where entertainment expenses are incurred while hosting clients or customers, additional documentation may be necessary. This can include receipts, invoices, or contracts that detail the business purpose of the entertainment, the names of the attendees, and the relationship to the business. 6. Entertainment facility rentals: If renting a facility or venue for an entertainment-related event, documentation such as contracts or agreements specifying the date, location, duration, and cost of the rental should be provided. To ensure compliance and maximize benefits, it is vital to thoroughly review the specific Hennepin Minnesota Checklist for Proving Entertainment Expenses. Adhering to these requirements will help individuals and businesses properly document and justify their entertainment-related expenses, allowing for accurate reporting, tax deductions, or reimbursement.

Hennepin Minnesota Checklist for Proving Entertainment Expenses

Description

How to fill out Hennepin Minnesota Checklist For Proving Entertainment Expenses?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Hennepin Checklist for Proving Entertainment Expenses is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Hennepin Checklist for Proving Entertainment Expenses. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

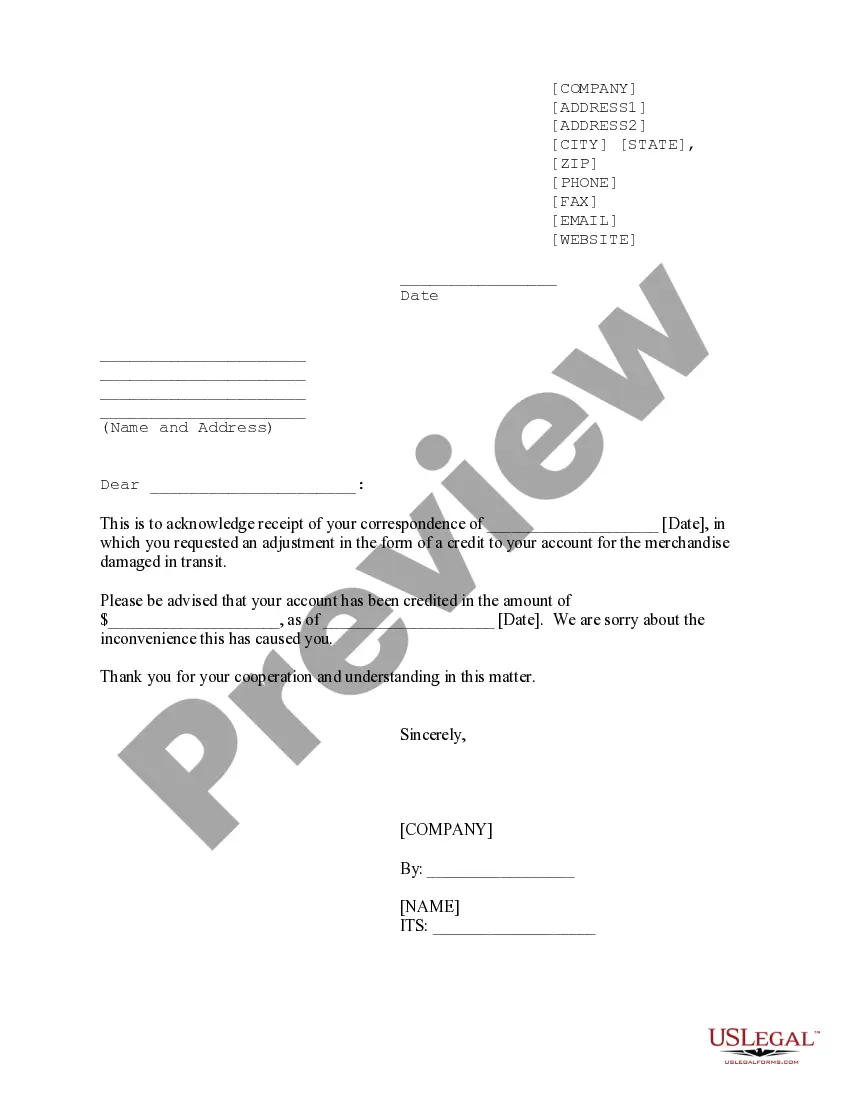

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Checklist for Proving Entertainment Expenses in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!