Kings New York Checklist for Proving Entertainment Expenses is a comprehensive guide designed to help individuals and businesses effectively document and substantiate their entertainment expenses. This checklist is essential for ensuring that all relevant expenses are properly accounted for and can withstand scrutiny during an audit. By providing a detailed breakdown of necessary supporting documents, it serves as a valuable tool for meeting the stringent requirements set by the IRS. Keywords: Kings New York, Checklist, Proving, Entertainment Expenses, substantiate, documentation, audit, IRS. Types of Kings New York Checklist for Proving Entertainment Expenses: 1. General Entertainment Expenses Checklist: This checklist outlines the fundamental documentation and records individuals and businesses need to gather to prove entertainment expenses. It covers a wide range of deductibles, including meals, shows, sporting events, and recreational activities. 2. Business Entertainment Expenses Checklist: Specifically tailored to businesses, this checklist focuses on verifying and documenting expenses incurred for business-related entertainment purposes. It includes guidelines for client meetings, employee outings, and other events intended to foster business relationships. 3. Travel Entertainment Expenses Checklist: For those who incur entertainment expenses while traveling for business, this checklist highlights the additional documentation requirements needed to prove these deductions. It provides guidance on tracking expenses related to transportation, lodging, meals, and entertainment during business trips. 4. Self-employed Professional Entertainment Expenses Checklist: Targeting self-employed professionals, this checklist narrows down the necessary documentation for proving entertainment expenses. It offers insights into how to differentiate between personal and business expenses, ensuring only eligible deductions are claimed. 5. Entertainment Expenses Audit Preparation Checklist: Geared towards individuals and businesses under audit scrutiny, this checklist helps prepare for an IRS audit of entertainment expense claims. It emphasizes gathering and organizing all relevant documentation to ensure a smooth and successful audit process. By employing the appropriate Kings New York Checklist for Proving Entertainment Expenses, individuals and businesses can ensure they have met the necessary requirements for substantiating their deductions and minimizing the risk of penalties and audit issues.

Kings New York Checklist for Proving Entertainment Expenses

Description

How to fill out Kings New York Checklist For Proving Entertainment Expenses?

Preparing documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Kings Checklist for Proving Entertainment Expenses without professional assistance.

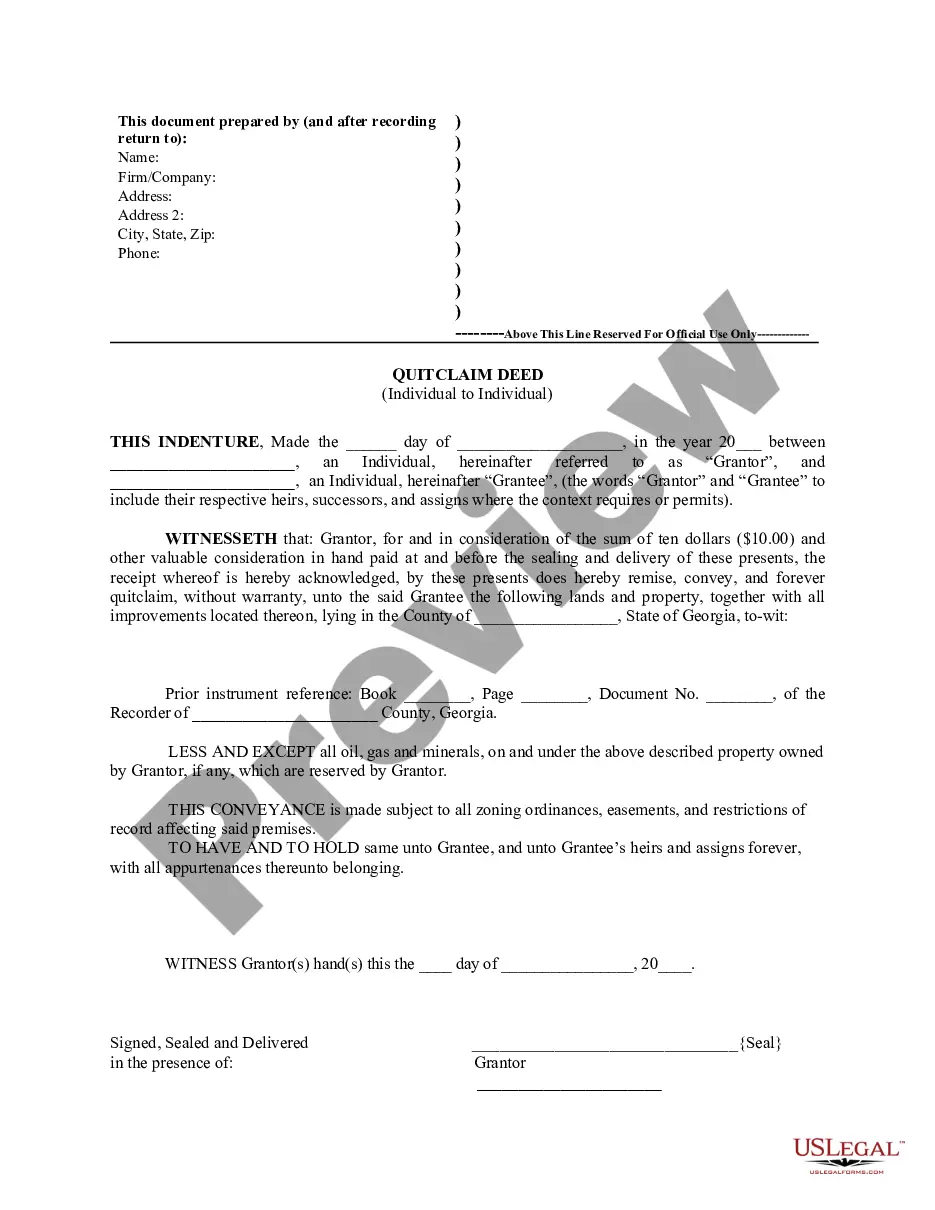

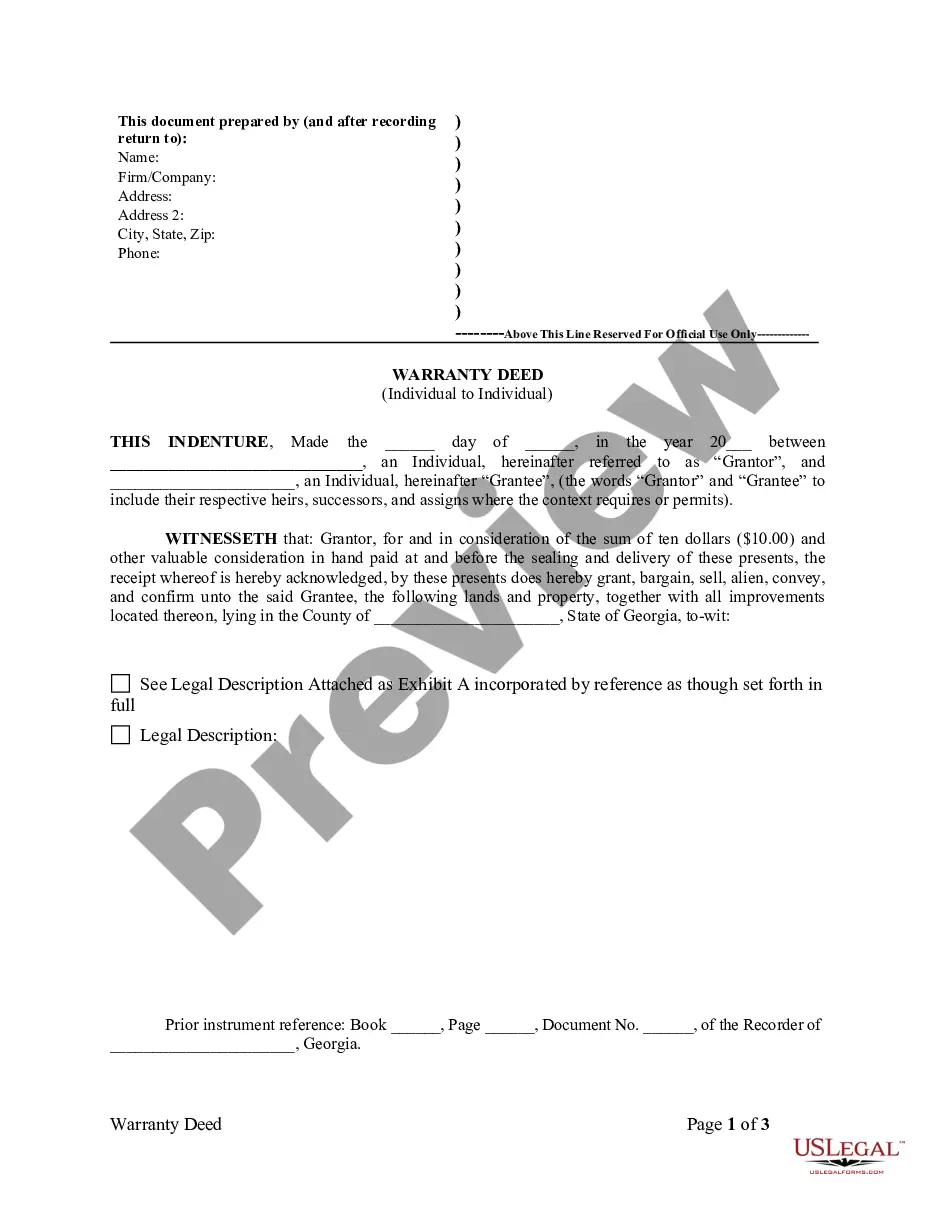

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Kings Checklist for Proving Entertainment Expenses on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Kings Checklist for Proving Entertainment Expenses:

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!