Riverside California is a vibrant city located in Southern California, known for its rich history, diverse population, and exciting entertainment options. Whether you are a resident or a visitor, Riverside offers a wide array of entertainment expenses to enjoy. To ensure proper record-keeping and potential tax deductions, it is important to familiarize yourself with the Riverside California Checklist for Proving Entertainment Expenses. Here is a detailed description of what it entails, including relevant keywords: 1. Receipts: Save all receipts related to entertainment expenses incurred in Riverside California, such as tickets to concerts, shows, or sporting events. This includes receipts for meals, beverages, and any other eligible expenses. 2. Date and Time: Note the date and time of each entertainment expense for precise tracking and proof. 3. Description of Entertainment: Provide detailed descriptions of the entertainment activities. For example, if attending a live concert, include the name of the artist, venue, and type of music. 4. Attendees: List the names of individuals present during the entertainment activities. This applies particularly if the expenses are incurred for business entertainment purposes. 5. Purpose of Entertainment: Specify the purpose of the entertainment. For business-related entertainment, include details explaining how the activity directly relates to your trade or business. For personal entertainment, no specific purpose is required. 6. Business Relationship: If the entertainment is business-related, detail the nature and business relationship between you and the individuals present. For example, mention if they are clients, potential investors, or employees. 7. Entertainment Location: Specify the location where the entertainment took place in Riverside California. This could be a restaurant, theater, stadium, or any other entertainment venue. 8. Transportation: Keep records of transportation expenses incurred while travelling to and from the entertainment venue in Riverside. This includes the cost of gas, parking fees, and public transportation tickets. 9. Entertainment Type: There are various types of entertainment that can be claimed as expenses. These may include live performances, movies, sporting events, museum visits, or any cultural activities available in Riverside California. 10. IRS Guidelines: Familiarize yourself with the IRS guidelines for deducting entertainment expenses. Understanding the rules and limitations will help ensure compliance and maximize potential deductions. By following the Riverside California Checklist for Proving Entertainment Expenses, you can maintain accurate records and fulfill the necessary requirements for tax deductions. Remember to consult with a qualified tax professional or refer to official IRS guidelines for specific details and variations, depending on your personal or business circumstances.

Riverside California Checklist for Proving Entertainment Expenses

Description

How to fill out Riverside California Checklist For Proving Entertainment Expenses?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Riverside Checklist for Proving Entertainment Expenses, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the latest version of the Riverside Checklist for Proving Entertainment Expenses, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Riverside Checklist for Proving Entertainment Expenses:

- Look through the page and verify there is a sample for your region.

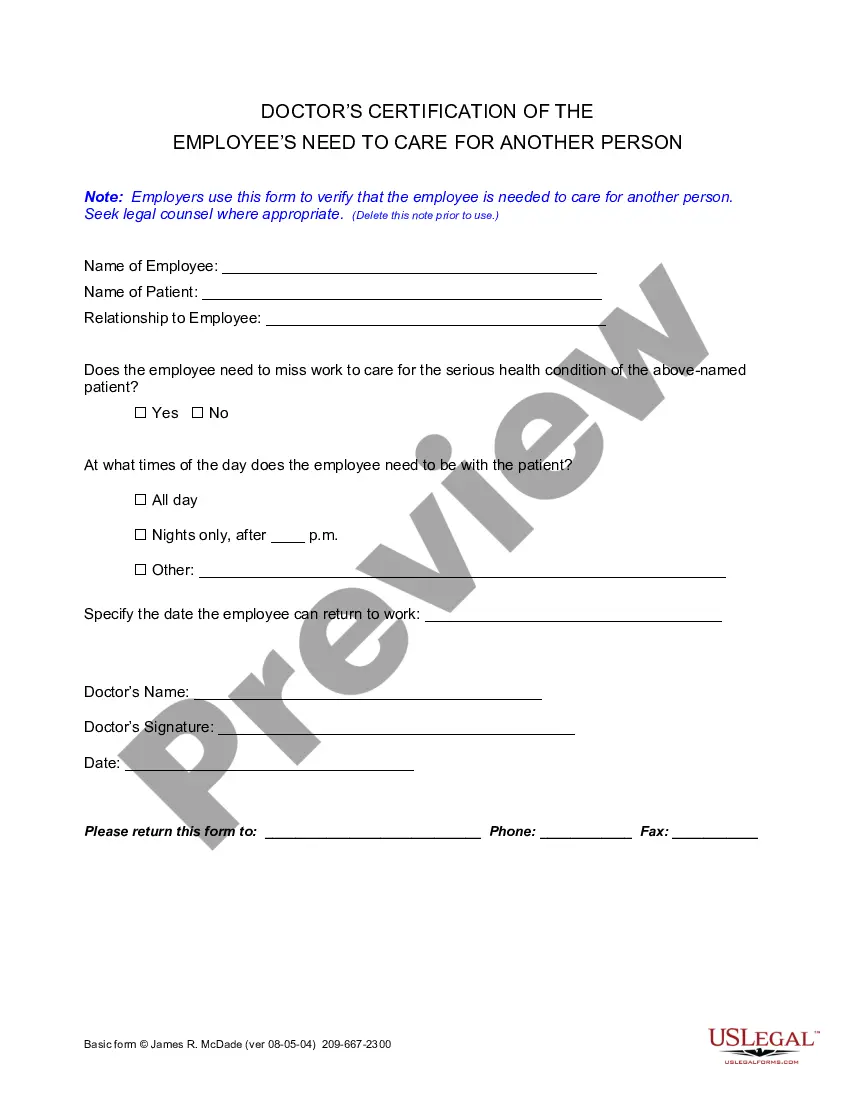

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Riverside Checklist for Proving Entertainment Expenses and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!