Fulton Georgia Information Sheet — When are Entertainment Expenses Deductible and Reimbursable: Fulton Georgia, known for its vibrant culture and bustling city life, offers residents and visitors alike numerous entertainment options. However, understanding the regulations around entertainment expense deductions and reimbursements can be crucial for businesses operating in the area. In this Fulton Georgia Information Sheet, we will delve deep into the guidelines regarding deductible and reimbursable entertainment expenses, enabling you to make informed financial decisions for your business. Key Keywords: Fulton Georgia, entertainment expenses, deductible, reimbursable, regulations, guidelines, business, financial decisions. Types of Fulton Georgia Information Sheet — When are Entertainment Expenses Deductible and Reimbursable: 1. Fulton Georgia Information Sheet — Basic Guidelines for Entertainment Expense Deductions: This type of information sheet provides a comprehensive overview of the fundamental regulations surrounding entertainment expense deductions in Fulton Georgia. It covers criteria such as the purpose of the expenditure, relationship-building activities, and business discussions necessary for deductions to be allowed. 2. Fulton Georgia Information Sheet — Reimbursement Policies for Entertainment Expenses: This information sheet focuses on the guidelines and policies for reimbursing entertainment expenses incurred by employees or associates. It outlines the documentation requirements, permissible expenses, and the necessary accounting procedures to ensure compliance with Fulton Georgia regulations. 3. Fulton Georgia Information Sheet — Navigating Complex Entertainment Expense Scenarios: This type of information sheet addresses more intricate scenarios, such as mixed-purpose entertainment events, hosting clients from out of state, and situations involving both business and personal elements. It provides detailed guidelines on how to determine whether such expenses are deductible or reimbursable based on the specific circumstances. 4. Fulton Georgia Information Sheet — Record-Keeping and Reporting Obligations: This information sheet emphasizes the importance of maintaining accurate records and documentation of entertainment expenses to support deductions or reimbursements. It highlights the required information to include, the recommended methods of record-keeping, and the timeframe for reporting expenses to taxation authorities in Fulton Georgia. In conclusion, understanding the regulations and guidelines surrounding the reducibility and reimbursement of entertainment expenses in Fulton Georgia can greatly benefit businesses operating in the area. By familiarizing yourself with the details provided in the suitable Fulton Georgia Information Sheets, you can ensure compliance, maximize deductions, and effectively manage your business finances.

Fulton Georgia Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

Description

How to fill out Fulton Georgia Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Fulton Information Sheet - When are Entertainment Expenses Deductible and Reimbursable, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Fulton Information Sheet - When are Entertainment Expenses Deductible and Reimbursable from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Fulton Information Sheet - When are Entertainment Expenses Deductible and Reimbursable:

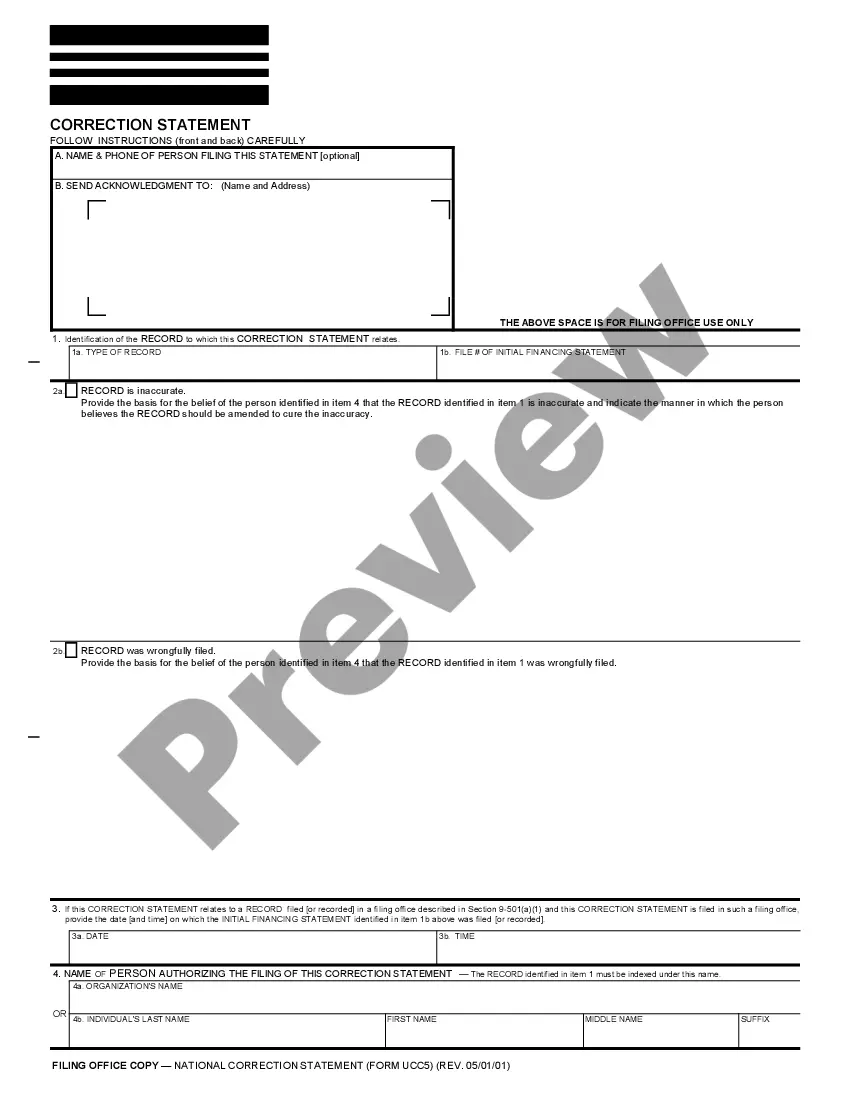

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!