Mecklenburg County is located in the state of North Carolina and is one of the most populous counties in the state. It encompasses the city of Charlotte, which is known for being a major financial center in the United States. Mecklenburg County is home to a rich history, diverse cultural attractions, and a thriving business community. The Mecklenburg North Carolina Information Sheet — When are Entertainment Expenses Deductible and Reimbursable provides valuable information regarding the reducibility and reimbursement of entertainment expenses. This guide is particularly helpful for individuals and businesses seeking clarification on what constitutes eligible entertainment expenses and how they can be utilized for tax purposes. Entertainment expenses refer to fees incurred while entertaining clients, customers, or potential business associates. These expenses can include meals, tickets to events, shows, and other recreational activities. However, it is crucial to understand when these expenses are considered tax-deductible and reimbursable. In the Mecklenburg North Carolina Information Sheet — When are Entertainment Expenses Deductible and Reimbursable, you will find essential details that outline the specific criteria for deducting and reimbursing entertainment costs. The document categorizes entertainment expenses into various types and clarifies the eligibility and limitations associated with each. Some different types of Mecklenburg North Carolina Information Sheets — When are Entertainment Expenses Deductible and Reimbursable may include: 1. Business Meals: This section focuses on reducibility and reimbursement of meals directly related to business activities, such as lunch or dinner meetings with clients. It provides guidelines regarding the qualifications necessary to claim these expenses. 2. Sports Event Tickets: Sports events have become a significant part of business entertainment. This section explains when tickets to sports events can be considered deductible or reimbursable and under what circumstances. 3. Theater and Performance Tickets: Entertainment related to theatrical events, concerts, or other live performances can also fall under deductible or reimbursable expenses. This section outlines the factors that determine whether these expenses qualify for tax benefits. 4. Recreational Activities: This category covers expenses associated with recreational activities like golf outings, team-building exercises, or corporate retreats. The information provided in this section helps individuals and businesses determine the reducibility and reimbursement eligibility of such events. By referencing the Mecklenburg North Carolina Information Sheet — When are Entertainment Expenses Deductible and Reimbursable, individuals and businesses can gain a better understanding of the tax implications and guidelines that govern entertainment expenses. This knowledge empowers taxpayers to make informed decisions when it comes to claiming deductions or seeking reimbursement, ensuring compliance with both local and federal tax regulations.

Mecklenburg North Carolina Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

Description

How to fill out Mecklenburg North Carolina Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

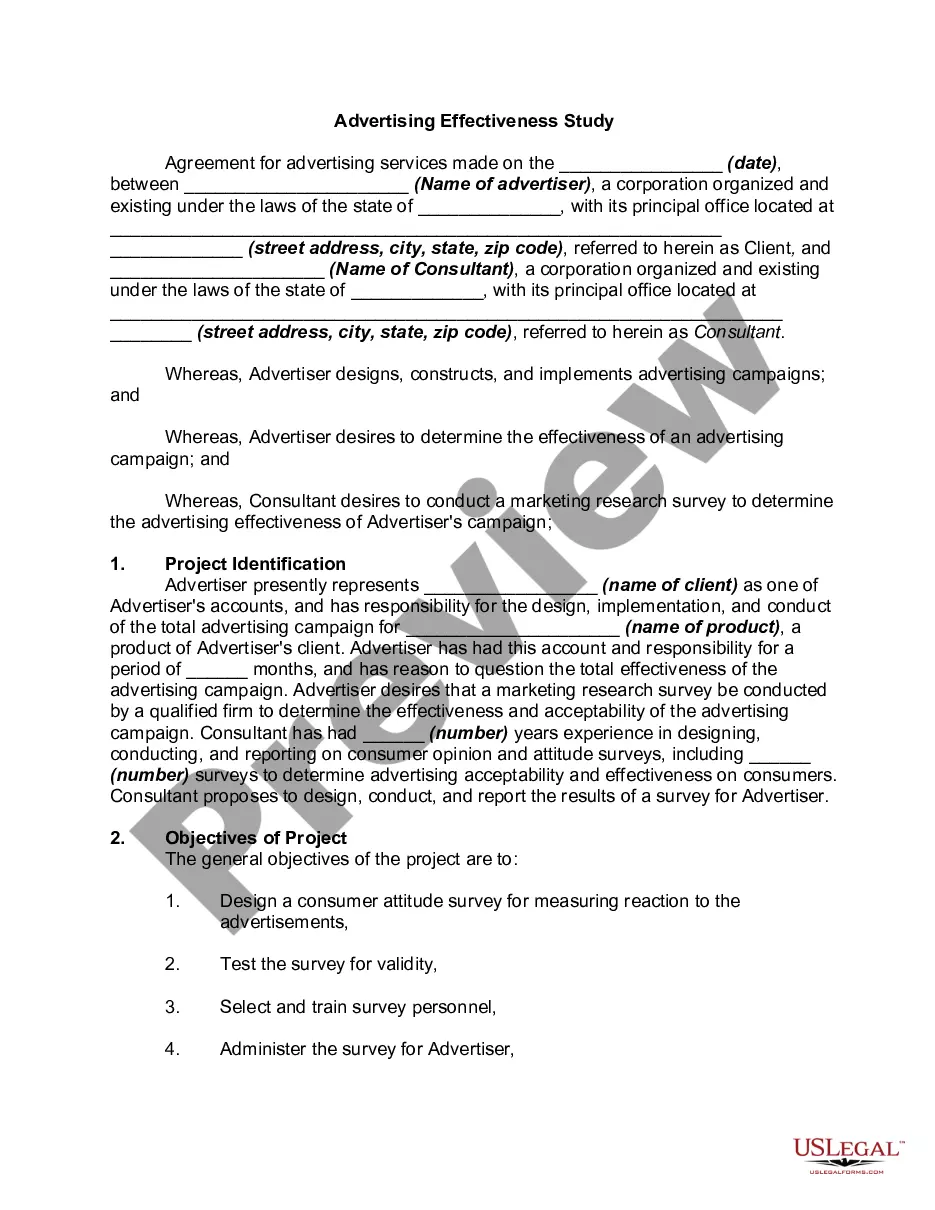

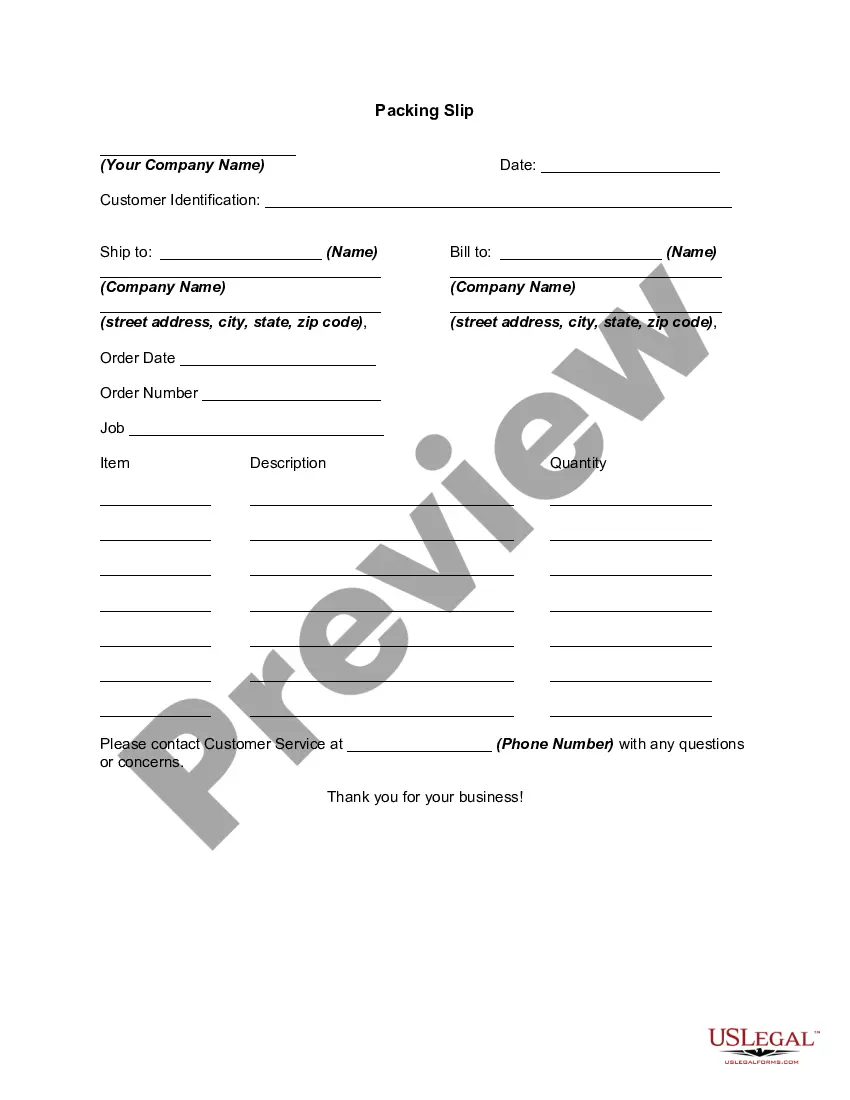

Are you looking to quickly create a legally-binding Mecklenburg Information Sheet - When are Entertainment Expenses Deductible and Reimbursable or maybe any other document to handle your personal or corporate affairs? You can go with two options: contact a legal advisor to draft a valid document for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you get neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant document templates, including Mecklenburg Information Sheet - When are Entertainment Expenses Deductible and Reimbursable and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

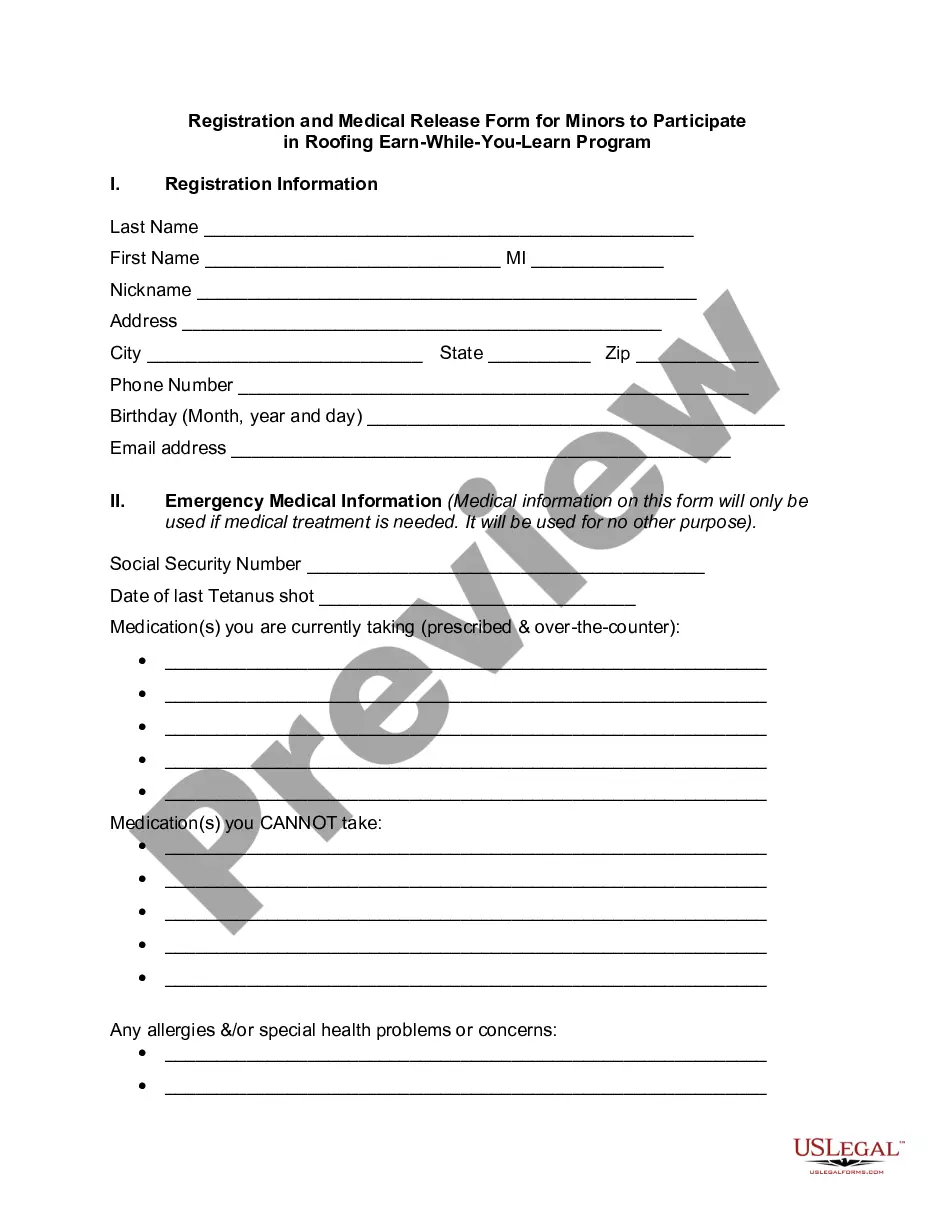

- To start with, carefully verify if the Mecklenburg Information Sheet - When are Entertainment Expenses Deductible and Reimbursable is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the form isn’t what you were looking for by using the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Mecklenburg Information Sheet - When are Entertainment Expenses Deductible and Reimbursable template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the templates we offer are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!