Oakland Michigan Reimbursable Travel Expenses Chart is a comprehensive document that outlines the various types of expenses eligible for reimbursement to individuals who are required to travel for official purposes within the boundaries of Oakland County, Michigan. This chart serves as a valuable resource for employees, contractors, or other personnel who are authorized to receive travel reimbursements. The Oakland Michigan Reimbursable Travel Expenses Chart is divided into different categories to ensure clarity and transparency in the reimbursement process. These categories may include but are not limited to: 1. Transportation Expenses: This section covers costs associated with various modes of transportation, such as airfare, bus fare, train tickets, rental cars, and mileage reimbursement for personal vehicles. It provides detailed guidelines on eligible expenses, travel distance limitations, and the required documentation for reimbursement. 2. Lodging Expenses: This section outlines the allowable expenses related to accommodations during official travel. It specifies the maximum daily rate for hotel rooms, along with any additional expenses such as taxes and parking fees. It also includes information on reimbursement for extended stays due to official business requirements. 3. Meals and Incidentals: This category details the per diem rates for meals and incidental expenses, which may include tips, fax/copy fees, and other small personal expenses. Guidelines regarding meal durations, eligibility for reimbursement on the first and last travel days, and receipts requirements are also mentioned. 4. Conference and Training Expenses: This section focuses on expenses related to attending conferences, seminars, or training sessions. It covers registration fees, necessary materials, and any additional costs incurred during such events while adhering to specifically outlined reimbursement limits. 5. Miscellaneous Expenses: This category encompasses various additional expenses that may arise during official travel. It could include fees for internet access, tolls, parking fees, baggage handling charges, and other reasonable and necessary miscellaneous expenses directly related to the trip. The Oakland Michigan Reimbursable Travel Expenses Chart provides a comprehensive overview of the expense types eligible for reimbursement within the county's travel policy guidelines. It ensures that personnel traveling on official business are aware of the expenses they can claim and serves as a reliable reference tool for both the travelers and the reimbursement authorities.

Oakland Michigan Reimbursable Travel Expenses Chart

Description

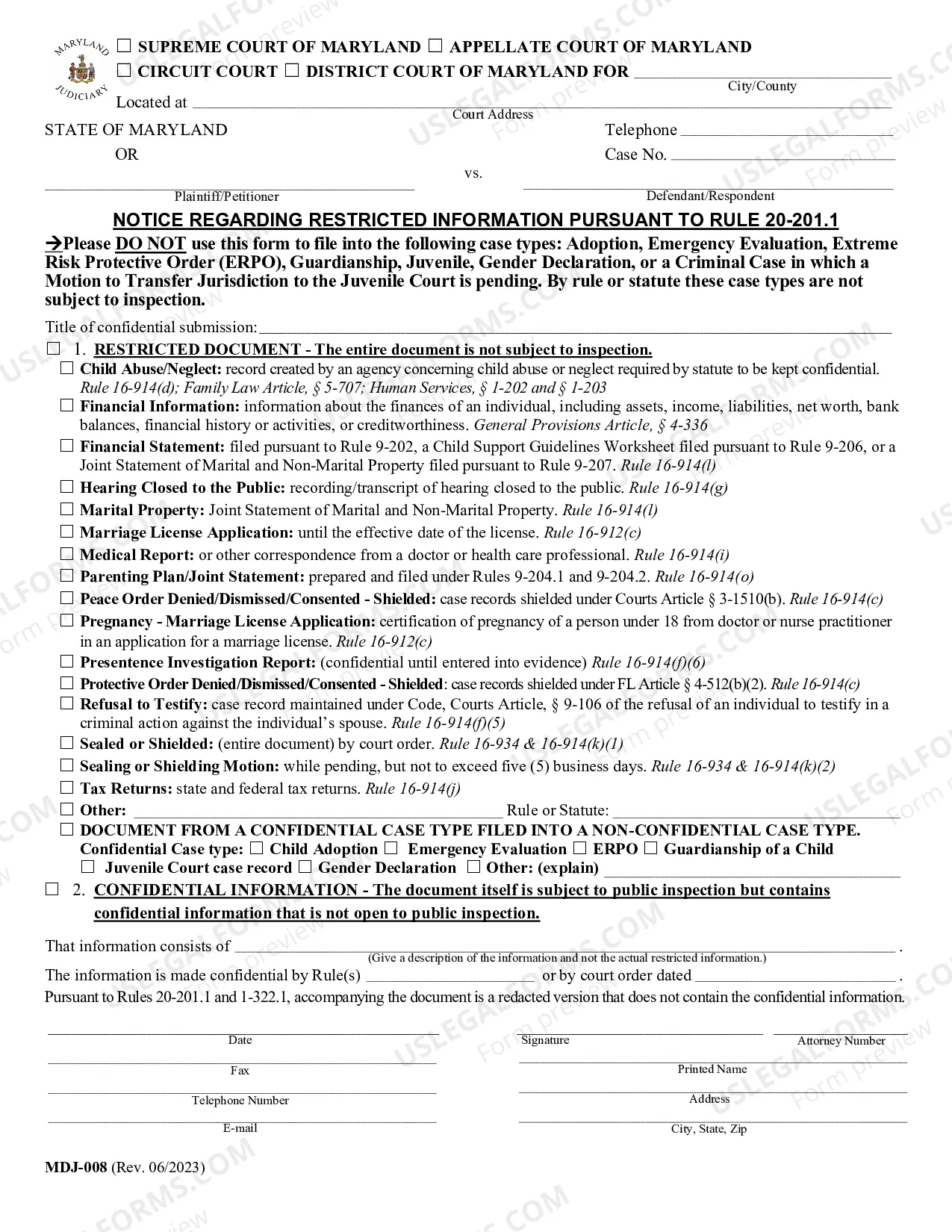

How to fill out Oakland Michigan Reimbursable Travel Expenses Chart?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life sphere, finding a Oakland Reimbursable Travel Expenses Chart meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Oakland Reimbursable Travel Expenses Chart, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Oakland Reimbursable Travel Expenses Chart:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Oakland Reimbursable Travel Expenses Chart.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Your business can deduct qualifying reimbursements, and they're excluded from the employee's taxable income. The deduction is subject to a 50% limit for meals. But, under the TCJA, entertainment expenses are no longer deductible.

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable

Reimbursable travel expenses include the ordinary expenses of public or private transportation as well as unusual costs due to special circumstances.

This deduction excludes from the employee's taxable income provided that the expenses are legitimate business expenses and the reimbursements comply with IRS rules. The best way to reimburse employees for expenses can be accomplished by using either the per diem method or an accountable plan.

QuickBooks Online Payroll Go to Payroll, then Employees. Select your employee. From Pay types, select Start or Edit. Scroll to the Additional pay types section and select Reimbursement.When you're finished, select Save.

As we mentioned, reimbursements for non-business travel, including commuting, is taxable, even if paid at or below, the Federal mileage rate and calculated on the same documentation as an accountable plan. This is considered regular wages and subject to all income and employment taxes.

While unreimbursed work-related travel expenses generally are deductible on a taxpayer's individual tax return (subject to a 50% limit for meals and entertainment) as a miscellaneous itemized deduction, many employees won't be able to benefit from the deduction.

The employer must report the total in box 1 of the W-2. The employee must complete IRS Form 2106 to itemize the deductions for travel, transportation, meals or entertainment. To be eligible, they must substantiate the time, place, business purpose and full or unreimbursed amount of the expense.

Record the amount your vendor bills you in an expense account and the amount you invoice the customer or client in an income account. record the amount your vendor bills you in an expense account and the amount you invoice the customer or client as an offset to this same expense account.

How to ask for travel reimbursement Start with a subject line.Address the recruiter.Introduce yourself.State that you have an interview.Ask about travel reimbursement.Conclude with your contact information.