The Travis Texas Reimbursable Travel Expenses Chart is a comprehensive and detailed breakdown of allowable travel expenses for individuals or employees who are required to travel for business purposes within the Travis Texas area. This chart serves as a reference tool to track and claim eligible expenses incurred during business travel. The Travis Texas Reimbursable Travel Expenses Chart consists of various categories and subcategories, each highlighting different types of expenses that can be claimed for reimbursement. It is essential to familiarize yourself with these categories to ensure accurate and compliant expense reporting. Some commonly found categories in the Travis Texas Reimbursable Travel Expenses Chart include: 1. Transportation Expenses: This category encompasses costs associated with air travel, including airfare, baggage fees, and airport transportation. Additionally, it may cover expenses related to ground transportation, such as taxi fares, rental cars, fuel, and parking fees. Keywords: airfare, baggage fees, airport transportation, ground transportation, taxi fares, rental cars, fuel, parking fees. 2. Accommodation Expenses: Here, you will find expenses related to lodging during business travel. This may include hotel charges, room service, Wi-Fi fees, and other accommodation-related costs. Keywords: hotel charges, room service, Wi-Fi fees, lodging expenses. 3. Meal and Entertainment Expenses: This category covers food and beverage expenses incurred while traveling for business purposes. It may include breakfast, lunch, dinner, and snacks, as well as expenses associated with client meetings or entertaining business partners. Keywords: meal expenses, food expenses, beverage expenses, client meetings, entertainment expenses. 4. Incidentals Expenses: Incidentals refer to smaller, miscellaneous expenses that are necessary during business travel. This can include items like tips, laundry fees, internet charges, and personal phone calls. Keywords: incidentals, miscellaneous expenses, tips, laundry fees, internet charges, personal phone calls. 5. Miscellaneous Expenses: This category is designed to accommodate any additional expenses that do not fit into the other categories but are essential for business travel, such as conference registration fees or visa expenses. Keywords: conference registration fees, visa expenses, additional expenses. By referring to and utilizing the Travis Texas Reimbursable Travel Expenses Chart, individuals can ensure that all eligible expenses are accurately recorded and claimed for reimbursement. This promotes transparency, compliance, and fair treatment of employees who undertake business travel. Note: The specific details and subcategories within the Travis Texas Reimbursable Travel Expenses Chart may vary depending on the official guidelines and policies established by the Travis Texas administration or organization. It is crucial to review the most up-to-date and relevant chart provided by the authoritative source.

Travis Texas Reimbursable Travel Expenses Chart

Description

How to fill out Travis Texas Reimbursable Travel Expenses Chart?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Travis Reimbursable Travel Expenses Chart, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Travis Reimbursable Travel Expenses Chart from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Travis Reimbursable Travel Expenses Chart:

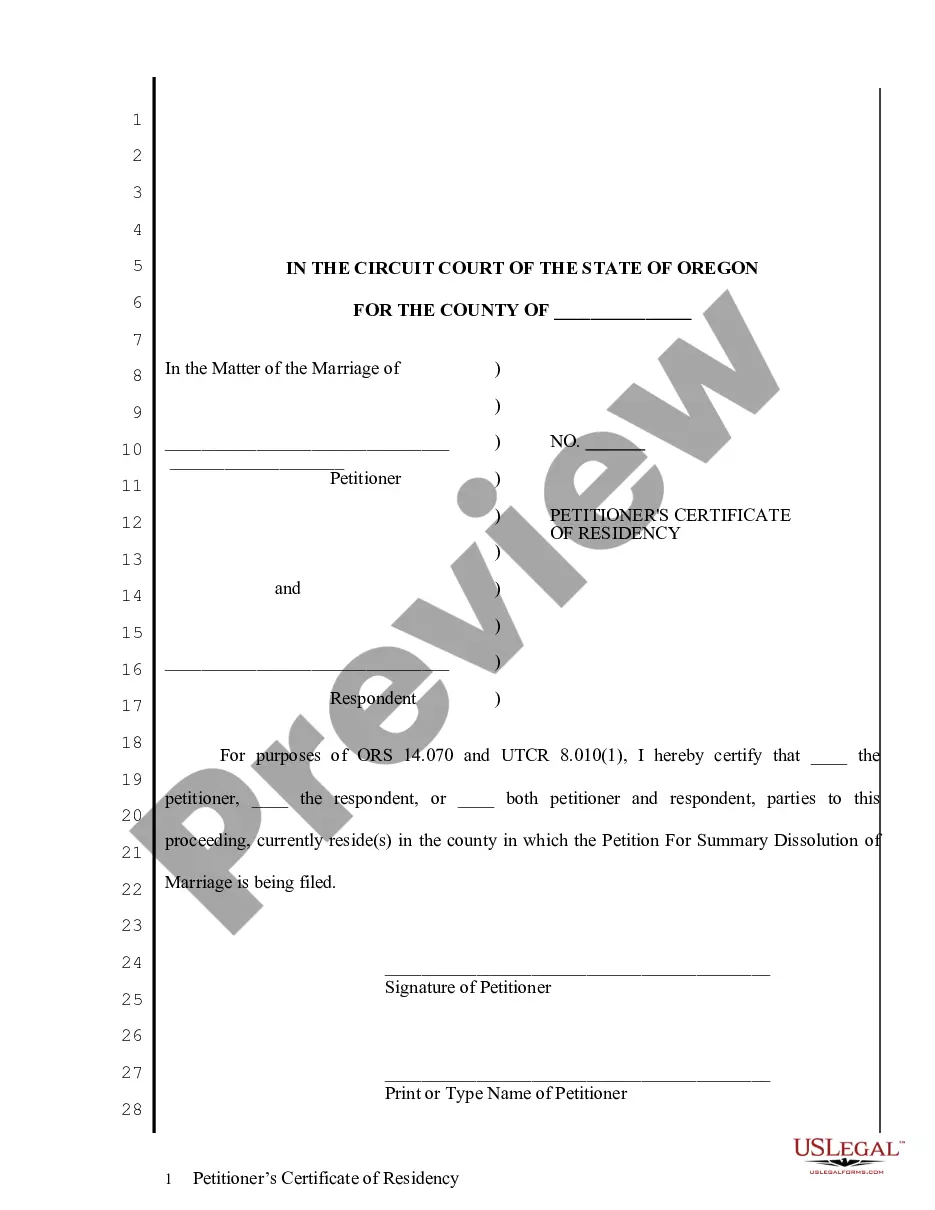

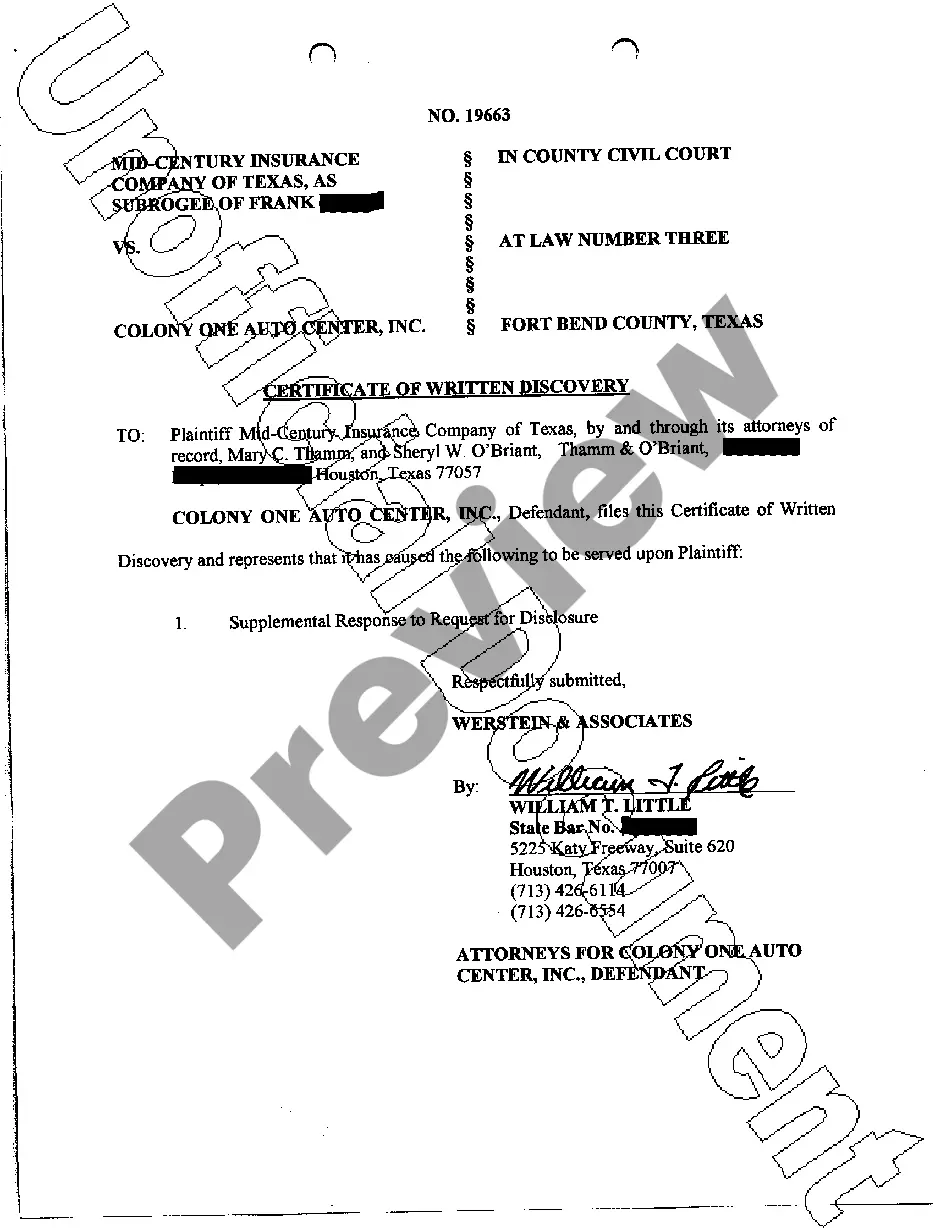

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Personal expenses such as haircut, toiletries, clothing, etc. Costs incurred due to unreasonable failures to cancel transportation or hotel reservations. Companion expenses (including travel, meals and additional driver costs on rental cars) Life, flight or baggage insurance.

Travel expenses subject to reimbursement generally include any work-related expenses incurred when the employee is away from the office....Common travel expenses may include: Mileage expense. Car rental. Gas. Hotels and motels. Parking fees. Tolls. Postage. Taxi or cab fees.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable

Lodging, meals and tips are deductible The IRS allows business travelers to deduct business-related meals and hotel costs, as long as they are reasonable considering the circumstancesnot lavish or extravagant.

A reimbursable expense is an expense that a business incurs on behalf of the customer while conducting their business. These expenses may include travel, delivery fees, currency conversion fees, office expenses, and business phone calls.

In this article, we'll take a look at four key types of employee reimbursements: Business expense reimbursement. Auto mileage and travel reimbursement. Medical expense reimbursement. Employee stipends reimbursement.

Reimbursable item means an item of expense incurred by either Party in respect of which that Party is entitled under this Agreement to be reimbursed by the other Party; Sample 1.

Business expense reimbursements include out-of-pocket expenses, such as those for travel and food. Per diem rates are daily rates paid to employees as reimbursement for business trips. Tax refunds are a form of reimbursement from the government to taxpayers.