Cuyahoga Ohio Employee Payroll Records Checklist: A Comprehensive Guide to Ensuring Compliance and Accuracy Keywords: Cuyahoga Ohio, Employee Payroll Records, Checklist, Compliance, Accuracy Description: The Cuyahoga Ohio Employee Payroll Records Checklist serves as a critical tool for businesses operating in Cuyahoga County, Ohio, to maintain accurate and compliant payroll records. With its detailed guidelines and requirements, this checklist provides a comprehensive overview of the essential documents and information that employers need to keep track of to meet legal obligations and ensure smooth payroll operations. The checklist covers various key aspects, including employee data, wages, deductions, taxes, benefits, and compliance documentation. By carefully following this checklist, employers can create a streamlined and organized system for managing employee payroll records, facilitating easier audits, ensuring legal compliance, and maintaining accurate financial reporting. Different Types of Cuyahoga Ohio Employee Payroll Records Checklists: 1. Employee Data Checklist: This aspect of the checklist focuses on capturing essential employee information, such as full name, address, Social Security number, employment start date, job title, and contact details. Maintaining accurate and up-to-date employee data is crucial for various payroll processes, including tax reporting and issuance of W-2 forms. 2. Wage and Hour Checklist: This checklist section highlights the importance of accurately recording employee work hours, hourly rates, salary information, overtime, and other compensation details. Adhering to wage and hour regulations is essential for avoiding legal issues related to minimum wage, overtime pay, and the Fair Labor Standards Act (FLEA). 3. Deductions and Benefits Checklist: This portion of the checklist focuses on tracking employee deductions, such as healthcare premiums, retirement plan contributions, and other benefit-related deductions authorized by the employee. Employers must ensure that they maintain accurate records of these deductions and benefits provided to employees when needed for payroll calculations or employee inquiries. 4. Tax Compliance Checklist: In this section, the checklist outlines the necessary steps for ensuring tax compliance. Employers must maintain records related to federal, state, and local taxes, including income tax withholding, Social Security and Medicare taxes, and unemployment tax payments. This checklist stresses the importance of accurate record-keeping for tax purposes and timely submission of tax forms. 5. Record Retention Checklist: To comply with legal requirements, employers must maintain payroll records for specific periods. This checklist segment provides guidance on how long various payroll documents, such as payroll summaries, tax forms, and benefit records, should be retained. Adhering to proper record retention practices ensures availability of records when needed and avoids potential penalties during audits. By diligently following the Cuyahoga Ohio Employee Payroll Records Checklist, businesses operating in Cuyahoga County can confidently manage their payroll processes, maintain compliance with relevant laws and regulations, and keep accurate records for financial reporting and audits.

Cuyahoga Ohio Employee Payroll Records Checklist

Description

How to fill out Cuyahoga Ohio Employee Payroll Records Checklist?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Cuyahoga Employee Payroll Records Checklist, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Cuyahoga Employee Payroll Records Checklist from the My Forms tab.

For new users, it's necessary to make some more steps to get the Cuyahoga Employee Payroll Records Checklist:

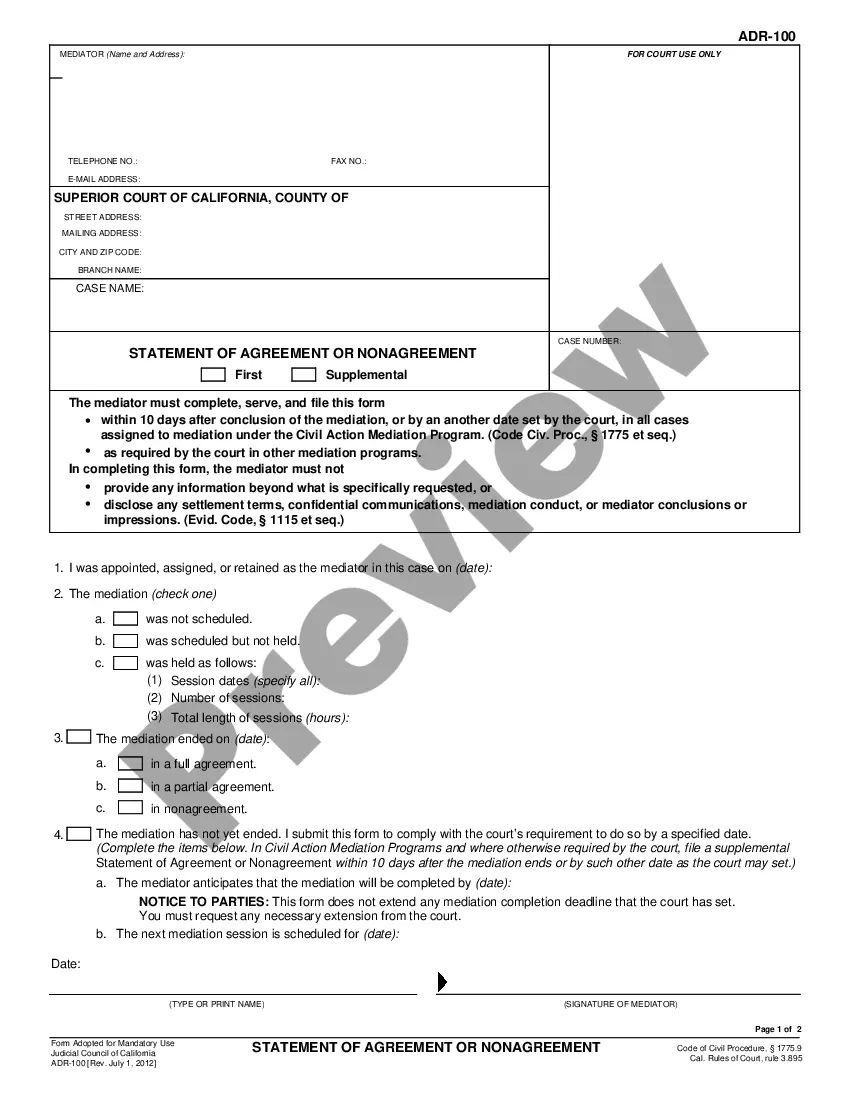

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Types of Employee Records Basic Information. This category includes personal information such as the employee's full name, social security number, address, and birth date.Hiring Documents.Job Performance and Development.Employment-Related Agreements.Compensation.Termination and Post-Employment Information.

Rule 4141-23-02 Records to be kept five years. Records established as required by rule 4141-23-01 of the Administrative Code shall be preserved and maintained for a period of not less than five years after the calendar year in which the remuneration with respect to such worker was paid.

Employment law suits, increased scrutiny and audits by the Department of Labor, Employment Security Commission and other state agencies require a business maintain great employment records. Key is having a system in place to track records and stay organized.

Payroll records are the combined documents pertaining to payroll that businesses must maintain for each individual that they employ. This includes pay rates, total compensation, tax deductions, hours worked, benefit contributions and more.

Payroll records is a blanket term that applies to all documentation associated with paying employees, from hiring documents and direct deposit authorization forms to paystubs. This includes anything that documents total hours worked, their pay rate, tax deductions, employee benefits, etc.

In addition, employers must keep for at least two years all records (including wage rates, job evaluations, seniority and merit systems, and collective bargaining agreements) that explain the basis for paying different wages to employees of opposite sexes in the same establishment.

Maintaining employee records and personal information is one of the many administrative tasks performed by the HR department within businesses of all sizes....3. Employment details Employee identification number. Employment type. Employment status. Date of joining. Bank account number. Bank name. IFSC. Last working day.

What should be in an employee file? Main file. Pre-hire information. Personal information. Business-specific forms. Job performance records. Separation / termination information, if applicable. Confidential information. Payroll records. Benefit information. Medical records. Form I-9. Direct deposit information.

Employers have to keep time and wages records for 7 years. Time and wages records have to be: readily accessible to a Fair Work Inspector (FWI)...Best practice tip Weekly time and wage records. Employment records - general employer and employee details. Rosters or Rosters. Timesheets.

How Long Should Records Be Retained: Each employer shall preserve for at least three years payroll records, collective bargaining agreements, sales and purchase records.