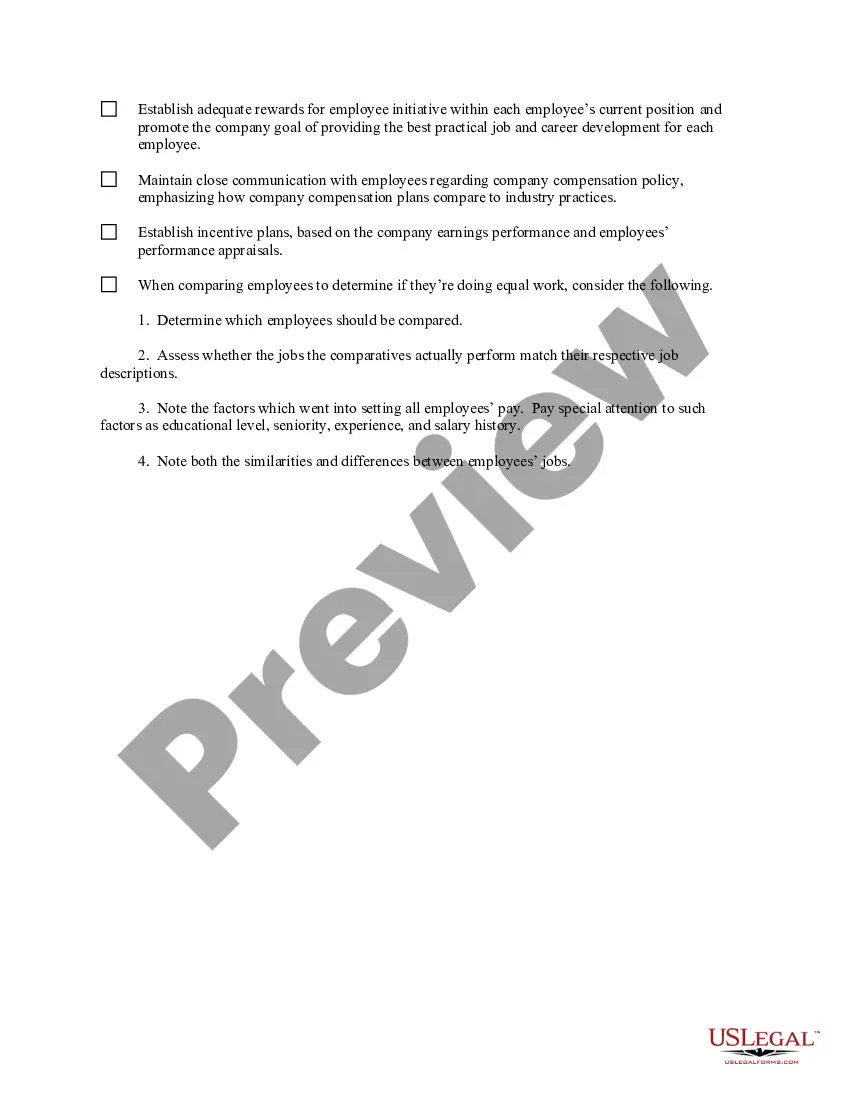

The Bexar Texas Equal Pay Checklist is a comprehensive tool designed to ensure fair compensation practices in the Bexar County region of Texas. This checklist serves as a guideline for employers to evaluate and rectify any potential gender-based pay disparities within their organizations. By following this checklist, employers can foster equal pay opportunities, promote workplace equality, and eliminate wage gaps between male and female employees. The Bexar Texas Equal Pay Checklist includes a series of steps and recommendations aimed at promoting pay equity. This invaluable resource begins with a thorough analysis of an organization's pay structure, including job classifications, salary scales, and compensation policies. Employers are encouraged to assess the gender breakdown of their workforce and identify any pay discrepancies that may exist between male and female employees holding similar positions. In addition, the checklist emphasizes the importance of transparency and communication between employers and employees regarding compensation practices. It prompts employers to establish clear policies on how pay decisions are made, ensuring that factors such as education, experience, and performance are prioritized, rather than gender. Furthermore, the checklist encourages employers to regularly review and update their pay practices. This involves conducting periodic pay audits, analyzing salary data, and addressing any identified pay disparities promptly. Employers are also advised to provide opportunities for training and career development to ensure that employees have equal access to promotions and advancement. Bexar Texas Equal Pay Checklist also highlights the legal obligations that employers must meet under state and federal laws. It reminds employers of the Equal Pay Act, which prohibits wage discrimination based on gender, and stresses the significance of complying with these regulations to avoid legal risks and penalties. Although there may not be different types of Bexar Texas Equal Pay Checklists, organizations of various sizes and industries can adapt and implement this checklist to fit their specific needs. The checklist can be utilized by both private and public sector employers, including small businesses, corporations, government agencies, and nonprofit organizations. By utilizing the Bexar Texas Equal Pay Checklist, employers can proactively address pay equity issues, create a fair and inclusive work environment, and position themselves as champions of equality. This checklist serves as a powerful tool to ensure that all employees receive equal compensation for equal work, promoting economic empowerment and social justice in the Bexar County region.

Bexar Texas Equal Pay Checklist

Description

How to fill out Bexar Texas Equal Pay Checklist?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life sphere, finding a Bexar Equal Pay Checklist meeting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the Bexar Equal Pay Checklist, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Bexar Equal Pay Checklist:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Bexar Equal Pay Checklist.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

There are generally two ways that Texas homeowners can reduce their property taxes, through tax exemptions or protesting their property's assessed value. Tax Code Section 25.18 states that all appraisal districts must complete appraisals on every property in their district at least every three years.

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

Texas Over 65 Exemption A homeowner may receive the Over 65 exemption immediately upon qualification of the exemption by filing an application with the county appraisal district office. The homeowner must apply before the first anniversary of their qualification date to receive the exemption in that year.

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

You may apply to the appraisal district the year you become age 65 or qualify for disability. If your application is approved, you will receive the exemption for the entire year in which you become age 65 or disabled and for subsequent years as long as you own a qualified residence homestead.

The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

In Texas, a property owner over the age of 65 can't freeze all property taxes. However, they do have the option of applying for a tax ceiling exemption which will freeze the amount of property taxes paid to the school district.

Seniors qualify for an added $10,000 in reduced property value. Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the home's value or at least $5,000. Optional percentage exemptions for seniors may also be available from taxing districts. These exemptions start at $3,000.