Houston Texas Worksheet Analyzing a Self-Employed Independent Contractor The Houston Texas Worksheet Analyzing a Self-Employed Independent Contractor is a comprehensive tool used by businesses and organizations in the state of Texas to evaluate the employment status and tax obligations of individuals who provide services as independent contractors. This worksheet is specifically designed to assess whether a worker should be classified as an employee or as an independent contractor, based on the guidelines set by the Internal Revenue Service (IRS) and the Texas Workforce Commission. Keywords: Houston Texas, Worksheet, Analyzing, Self-Employed, Independent Contractor, employment status, tax obligations, businesses, organizations, Texas, IRS, Texas Workforce Commission. The Houston Texas Worksheet Analyzing a Self-Employed Independent Contractor consists of several sections, each focusing on different aspects of the worker's relationship with the contracting entity. By analyzing these factors, businesses and organizations can determine whether the individual should be treated as an employee or as an independent contractor, which impacts various tax and legal obligations. Sections of the Houston Texas Worksheet Analyzing a Self-Employed Independent Contractor include: 1. Control and Independence: This section examines the level of control exercised by the contracting entity over the worker. Factors such as the ability to set work hours, choose work locations, and determine the methods used to complete the assigned tasks are considered. This helps evaluate the worker's independence and the extent of the employer's control, which is crucial in determining their classification. 2. Financial Aspects: This section focuses on the financial arrangement between the worker and the contracting entity. Factors such as whether the worker is reimbursed for business expenses, has the opportunity for profit or loss, and bears the risk of financial investment are analyzed. This helps determine the worker's financial independence and if they are operating as a separate business entity. 3. Relationship: This section evaluates the nature of the relationship between the worker and the contracting entity. Factors such as the presence of a written contract, the permanency of the relationship, and the provision of employee benefits are considered. This helps assess the level of commitment and exclusivity between the parties involved. By completing the Houston Texas Worksheet Analyzing a Self-Employed Independent Contractor, businesses and organizations can accurately determine the proper classification of their workers. This is crucial to comply with state and federal labor laws, taxation requirements, and eligibility for certain benefits and protections. Different types of Houston Texas Worksheet Analyzing a Self-Employed Independent Contractor may include variations based on specific industry types or updates to reflect changes in tax laws or employment regulations. Each version of the worksheet will be tailored to address the unique considerations of the particular sector or any recent legislative amendments. In conclusion, the Houston Texas Worksheet Analyzing a Self-Employed Independent Contractor is a valuable tool for businesses and organizations operating in Texas, enabling them to assess the employment status of individuals providing services as independent contractors. By applying this comprehensive worksheet, employers can ensure compliance with relevant regulations and maintain proper classifications, avoiding potential legal and financial liabilities.

Houston Texas Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out Houston Texas Worksheet Analyzing A Self-Employed Independent Contractor?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life sphere, finding a Houston Worksheet Analyzing a Self-Employed Independent Contractor suiting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Aside from the Houston Worksheet Analyzing a Self-Employed Independent Contractor, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Houston Worksheet Analyzing a Self-Employed Independent Contractor:

- Check the content of the page you’re on.

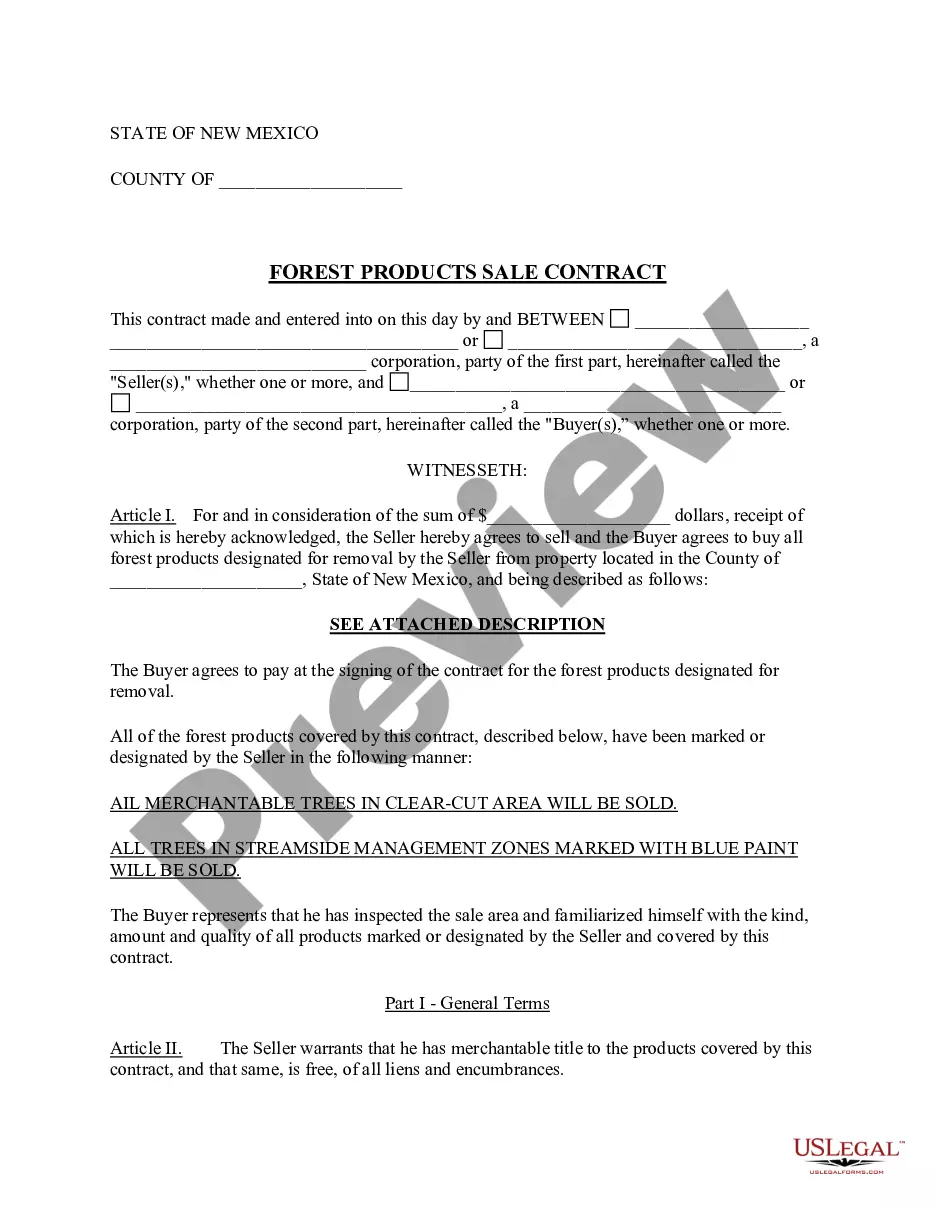

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Houston Worksheet Analyzing a Self-Employed Independent Contractor.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!