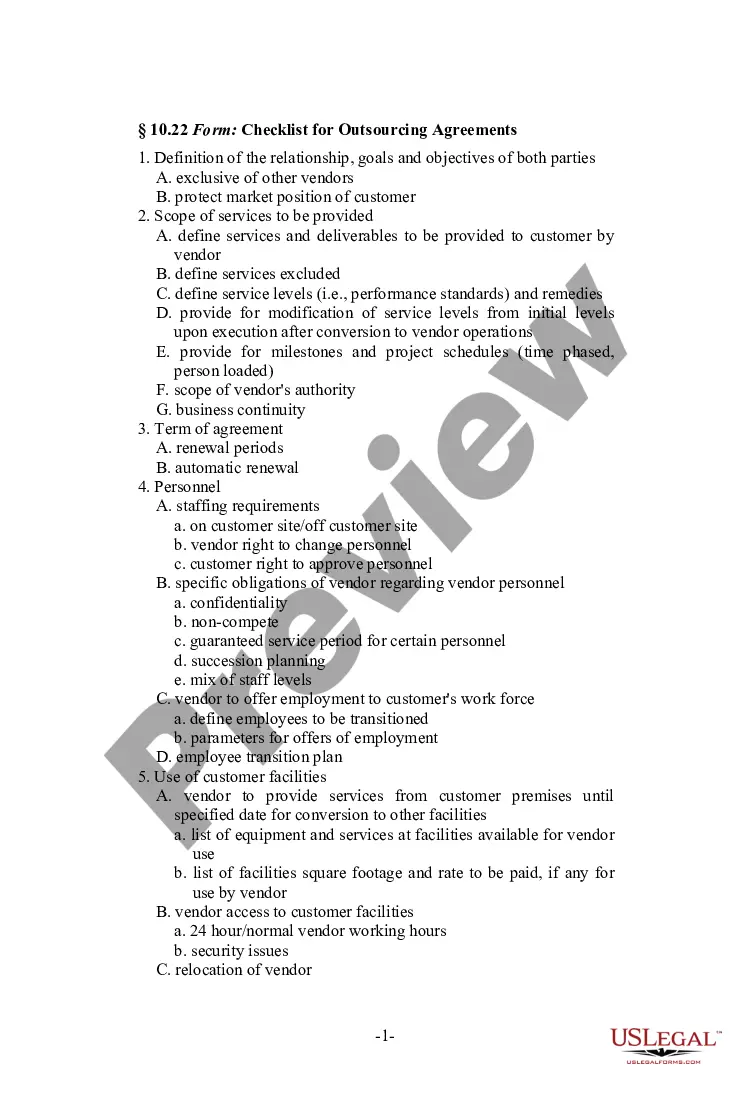

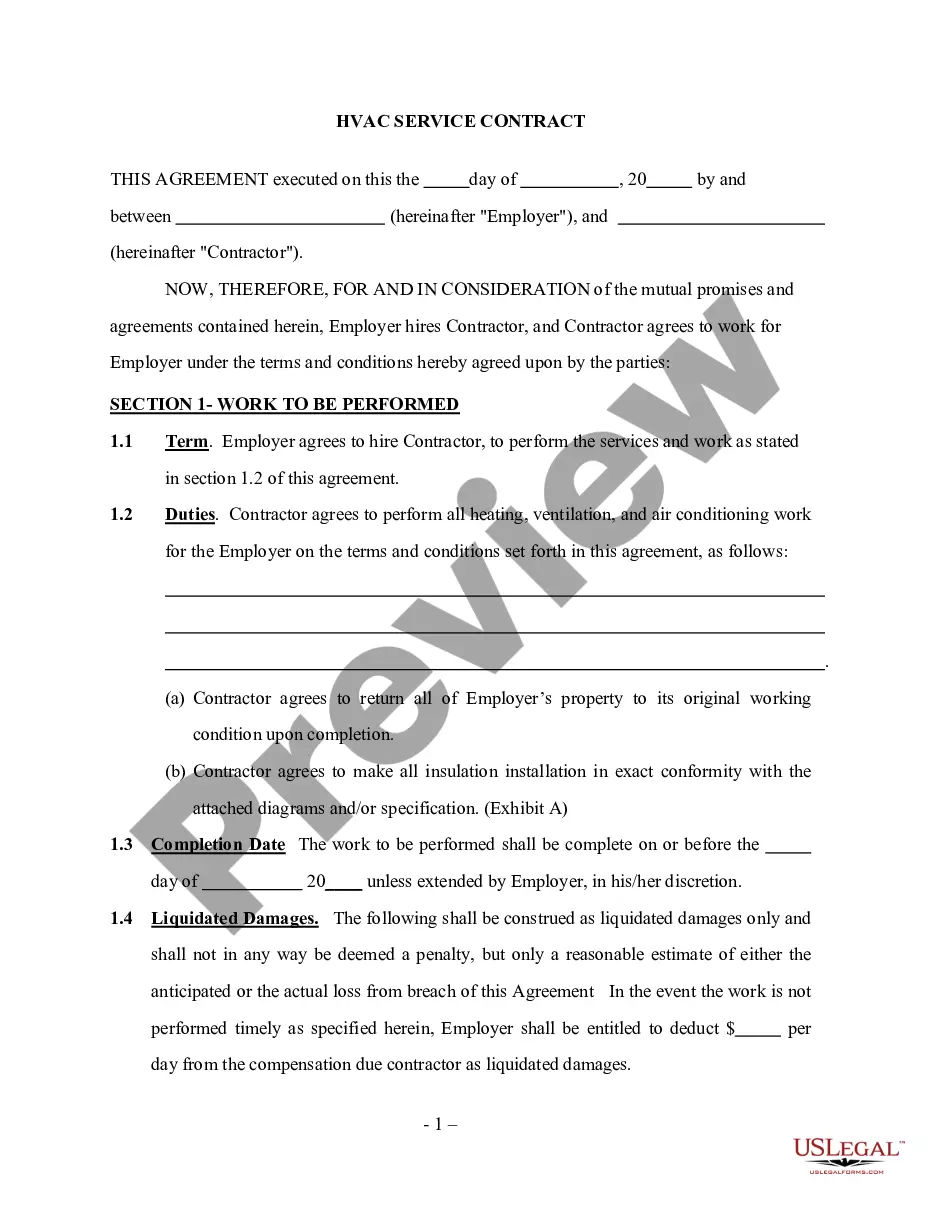

Riverside California is a city situated in Riverside County, in the southern region of the state. Known for its sunny climate, diverse population, and bustling economy, Riverside is an ideal location for self-employed independent contractors looking to establish their careers. In order to effectively analyze and manage one's self-employment as an independent contractor in Riverside California, it is essential to utilize a specialized worksheet tailored to the unique aspects of such work. The Riverside California Worksheet Analyzing a Self-Employed Independent Contractor serves as a comprehensive tool designed to assist individuals in evaluating their financial and business-related aspects. This worksheet encompasses various key elements and provides a structured approach to help ensure that the self-employed independent contractor maintains an organized and successful business venture. Keywords: Riverside California, Worksheet, Analyzing, Self-Employed, Independent Contractor, financial, business, organized, successful. Different types of Riverside California Worksheet Analyzing a Self-Employed Independent Contractor may include: 1. Finance and Income Tracking Worksheet: This type of worksheet focuses primarily on tracking income and expenses, recording financial transactions, and monitoring cash flow. It helps self-employed independent contractors in Riverside California maintain a clear understanding of their earnings, deductions, and overall financial health. 2. Tax Compliance Worksheet: As an independent contractor, it is crucial to comply with tax regulations and obligations. This worksheet assists individuals in identifying and documenting their taxable income, deductible expenses, and important tax deadlines. It helps contractors stay organized and ensure that they meet their tax obligations without any legal issues. 3. Client and Project Management Worksheet: Managing clients and projects efficiently is vital for self-employed independent contractors. This type of worksheet aids in keeping track of client information, project details, deadlines, invoicing, and payment tracking. It promotes effective communication, time management, and helps contractors provide excellent customer service. 4. Retirement and Savings Planning Worksheet: Independent contractors in Riverside California need to plan for their retirement and build savings for the future. This worksheet assists contractors in evaluating their current financial situation, setting goals, and creating a personalized retirement and savings plan. It takes factors like income variability and irregular cash flow into account to ensure a stable financial future. 5. Marketing and Networking Worksheet: Successfully marketing oneself and building a strong professional network is crucial for self-employed independent contractors. This worksheet aids contractors in developing a marketing strategy, identifying target markets, tracking networking activities, and evaluating the effectiveness of marketing efforts. It helps contractors expand their client base and enhance their professional visibility within Riverside California. Keywords: Finance, Income tracking, Tax compliance, Client management, Project management, Retirement planning, Savings planning, Marketing, Networking, Professional visibility.

Riverside California Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out Riverside California Worksheet Analyzing A Self-Employed Independent Contractor?

Preparing papers for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Riverside Worksheet Analyzing a Self-Employed Independent Contractor without expert help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Riverside Worksheet Analyzing a Self-Employed Independent Contractor on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Riverside Worksheet Analyzing a Self-Employed Independent Contractor:

- Examine the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!