San Jose California Worksheet Analyzing a Self-Employed Independent Contractor is a comprehensive tool designed to provide in-depth analysis and evaluation of a self-employed individual operating in the San Jose region. This worksheet aims to assist individuals, businesses, and organizations in better understanding the financial and legal aspects associated with hiring or working as an independent contractor in San Jose, California. The San Jose California Worksheet Analyzing a Self-Employed Independent Contractor covers various crucial areas and includes relevant keywords such as: 1. Identification and Contact Information: This section requires the contractor to provide their full legal name, contact details, and any business or DBA (Doing Business As) name if applicable. It ensures accurate record-keeping and communication. 2. Employment Classification: The worksheet explores the employment classification status of the independent contractor, determining whether the relationship is truly independent or verges on employee status. Keywords in this section include "independent contractor," "employee classification," and "IRS regulations." 3. Scope of Work: Here, the worksheet delves into a detailed description of the services or products provided by the independent contractor. Keywords to consider are "service description," "product description," and "business activities." 4. Business and Professional Licenses: This section focuses on licenses and permits necessary for the contractor's specific industry, complying with local and state regulations. Keywords include "business licenses," "professional licenses," and "permit requirements." 5. Insurance: The worksheet explores the insurance coverage held by the contractor, highlighting keywords such as "general liability insurance," "professional liability insurance," "worker's compensation insurance," and "bonding requirements." 6. Taxation and Reporting: This section analyzes the tax obligations and reporting requirements of the independent contractor, encompassing keywords such as "IRS guidelines," "self-employment taxes," "quarterly estimated tax payments," and "1099-MISC forms." 7. Financial Statements and Records: The worksheet prompts the contractor to provide financial statements, including income and expense records, profit and loss (P&L) statements, and balance sheets. Keywords to consider are "financial records," "bookkeeping," and "accounting software." Different types of San Jose California Worksheet Analyzing a Self-Employed Independent Contractor may vary in complexity or specific focus. For instance, some worksheets could concentrate on analyzing contractors operating in the gig economy or those providing professional services, while others may be more generic in nature, suitable for a wide range of independent contractors in diverse industries. Whatever the specific type of San Jose California Worksheet Analyzing a Self-Employed Independent Contractor, utilizing such a tool provides a structured and organized approach to evaluate various critical aspects, ensuring compliance with legal requirements and enhancing understanding of the financial implications associated with self-employment in San Jose, California.

San Jose California Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out San Jose California Worksheet Analyzing A Self-Employed Independent Contractor?

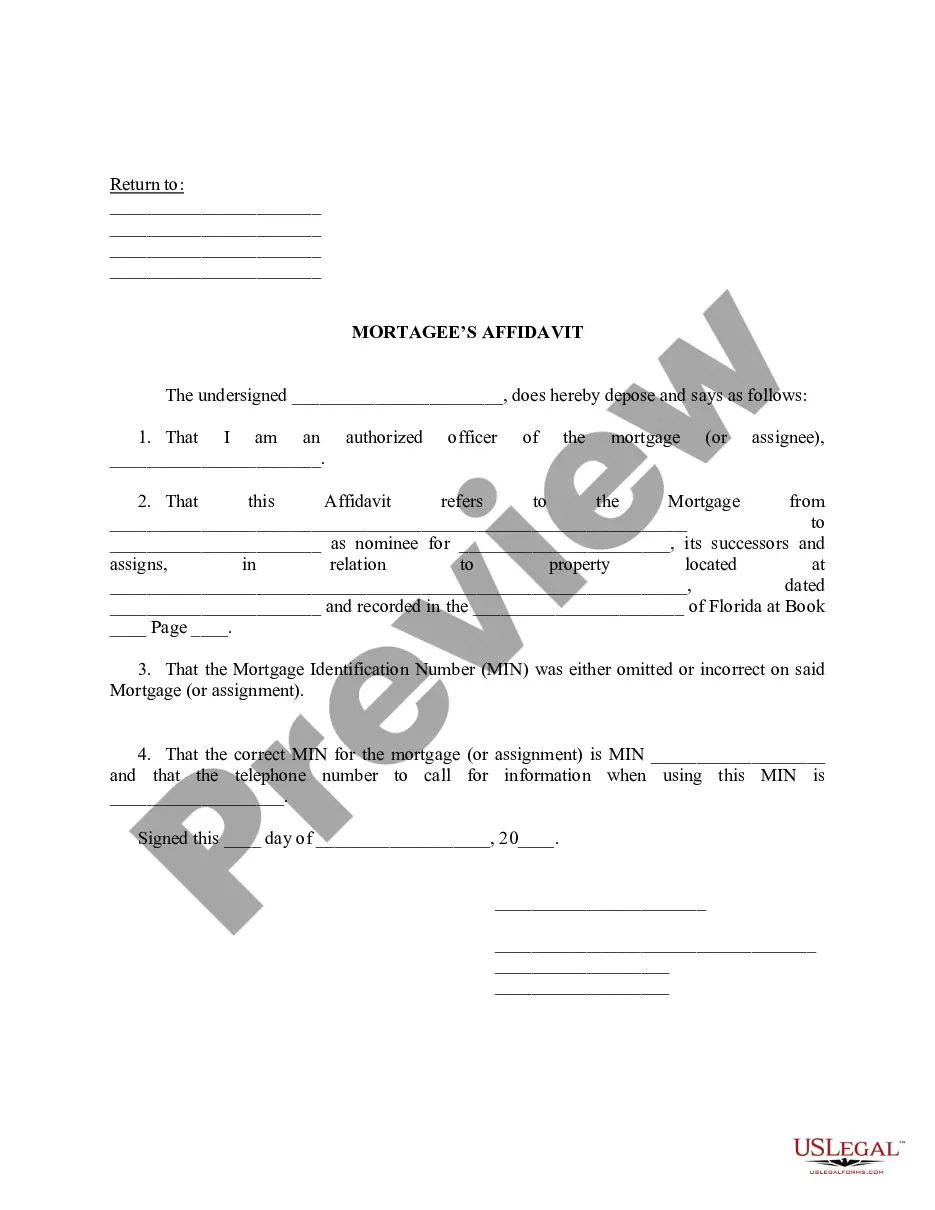

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so opting for a copy like San Jose Worksheet Analyzing a Self-Employed Independent Contractor is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to get the San Jose Worksheet Analyzing a Self-Employed Independent Contractor. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Worksheet Analyzing a Self-Employed Independent Contractor in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!