Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship

Description

How to fill out Sample Self-Employed Independent Contractor Agreement - For Ongoing Relationship?

Statutes and guidelines in each domain vary throughout the nation.

If you're not an attorney, it's simple to become disoriented by different standards regarding the creation of legal documents.

To prevent expensive legal guidance when drafting the Los Angeles Sample Self-Employed Independent Contractor Agreement - for ongoing relationship, you require a validated template that is applicable in your jurisdiction.

Click the Buy Now button to obtain the template once you identify the suitable one.

- That's where the US Legal Forms platform becomes extremely beneficial.

- US Legal Forms is relied upon by millions as a comprehensive online repository of over 85,000 state-specific legal documents.

- It's an excellent resource for professionals and individuals seeking DIY templates for various personal and business situations.

- All documents can be utilized multiple times: once you select a sample, it stays available in your profile for future use.

- Consequently, if you hold an account with a valid subscription, you can effortlessly Log In and re-download the Los Angeles Sample Self-Employed Independent Contractor Agreement - for ongoing relationship from the My documents section.

- For first-time users, additional steps are required to acquire the Los Angeles Sample Self-Employed Independent Contractor Agreement - for ongoing relationship.

- Review the page content to ensure you’ve located the correct sample.

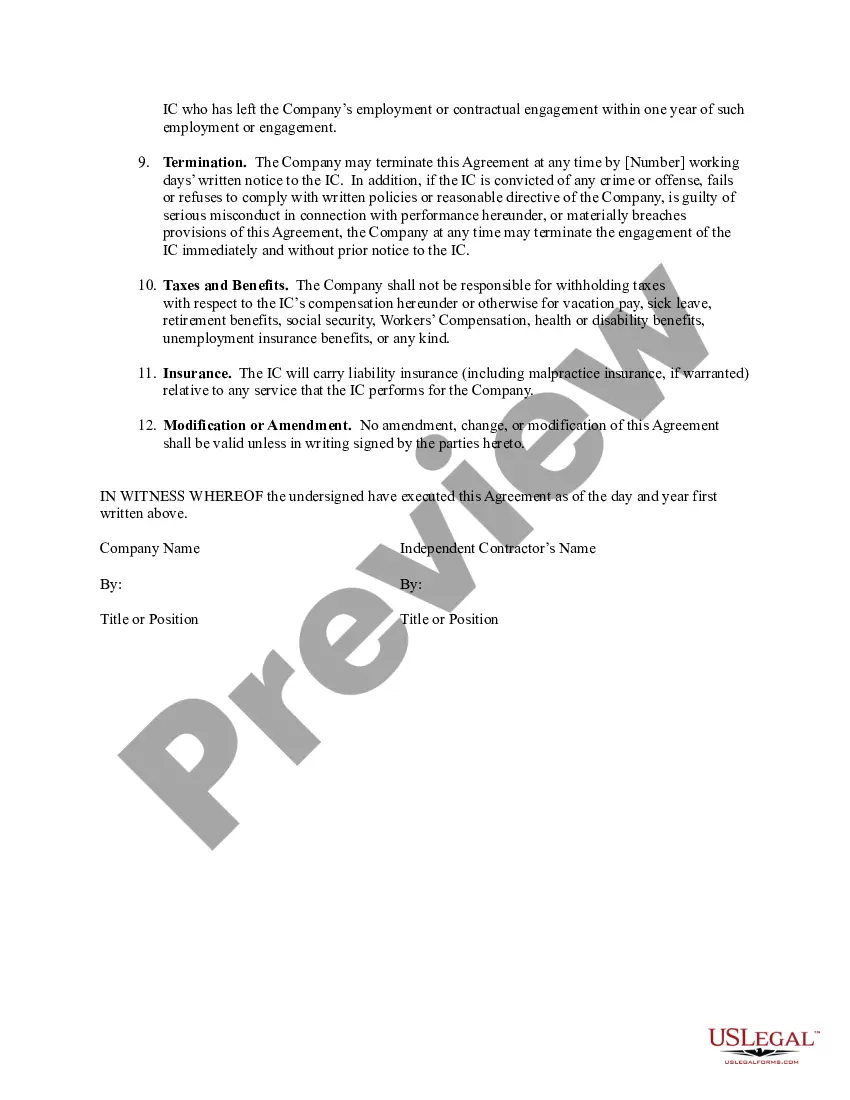

- Utilize the Preview feature or read the form description if one is available.

Form popularity

FAQ

In California, the new law regarding independent contractors, particularly Assembly Bill 5 (AB5), significantly impacts how businesses classify workers. This law requires businesses to use a strict three-part test to determine whether a worker qualifies as an independent contractor or an employee. The intent is to ensure that more workers receive benefits and protections under employment laws. For those navigating these changes, utilizing the Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship can provide clarity and help establish the terms of your employment structure.

Filling out an independent contractor agreement involves several essential steps. First, enter the contractor's details, including name and contact information. Next, outline the scope of work, payment schedule, and project milestones to ensure clear expectations. For your Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship, consider using a trusted platform like US Legal Forms to access templates and examples, ensuring all necessary clauses are included for a comprehensive agreement.

Independent contractors typically need to fill out a W-9 form, which provides their taxpayer identification information. This form is crucial for tax purposes and verifies that the contractor can receive payments. If you are seeking a Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship, the W-9 will help formalize tax reporting. This ensures compliance and keeps your business transactions transparent.

A contractor agreement should clearly outline key components that define the working relationship. Include details on services to be provided, payment terms, deadlines, and confidentiality clauses. Additionally, ensure that it specifies the nature of the relationship, especially for a Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship. By including these elements, both parties can protect their interests and expectations.

Ending a relationship with a contractor should be done with clarity and professionalism. Begin by reviewing your agreement together, discussing any issues that may have led to your decision. Following the protocols found in the Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship will help facilitate a smooth conclusion.

The 2 year contractor rule typically refers to the time after which certain contractors can claim misclassification if they have been treated as independent instead of employees. In California, this rule influences how businesses classify their workers, affecting contracts and obligations. By utilizing the Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship, you can ensure compliance and protect your business interests.

Letting go of an independent contractor requires careful communication. Initiate a discussion to inform them about your decision, providing clear reasons in a respectful manner. Referring to the guidelines in the Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship can assist in managing this delicate process.

Writing an independent contractor agreement involves outlining the scope of work, payment terms, and the duration of the relationship. Start by including both parties' names, followed by a detailed description of the duties and expectations. Incorporate standard clauses found in the Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship to ensure comprehensive coverage.

To politely terminate a contract with a contractor, begin by reviewing the terms outlined in your agreement. Schedule a conversation or send a written notice expressing your appreciation for their work, while clearly stating the reasons for termination. Utilizing the Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship can help you communicate effectively while adhering to legal obligations.

In Los Angeles, the proprietor independent contractor relationship often involves engaging freelancers for various tasks, such as graphic design, web development, or marketing services. Independent contractors provide their expertise while maintaining their own business operations. The Los Angeles California Sample Self-Employed Independent Contractor Agreement - for ongoing relationship clearly defines roles and responsibilities, ensuring both parties benefit.