Houston, Texas is a thriving city located in the southeastern part of the state. Known for its diverse culture, vibrant economy, and notable industries, Houston attracts individuals from various backgrounds, including those seeking self-employment opportunities as independent contractors. Determining self-employed independent contractor status in Houston, Texas is a crucial consideration for individuals and businesses alike. This process involves assessing the nature of the work relationship to ascertain whether an individual should be classified as an independent contractor or an employee. Proper classification ensures compliance with labor laws, tax regulations, and other legal obligations. In Houston, Texas, there are several types of self-employed independent contractor status. Understanding these distinctions is vital for individuals and businesses working together. Here are three common categories: 1. Traditional Independent Contractor: This type refers to individuals who provide services to a business or individual on a contractual basis. They maintain control over how the work is performed, typically set their own fees, and may have multiple clients simultaneously. Traditional independent contractors often include professions like consultants, freelancers, artists, and specialized tradespeople. 2. Gig Workers: With the rise of the gig economy, Houston, Texas experiences a surge in gig workers. These individuals engage in short-term, flexible work arrangements, often facilitated through technology platforms or apps. Common examples include ride-share drivers, food delivery drivers, and on-demand service providers. While gig workers are technically independent contractors, debates continue regarding their proper classification due to concerns about labor rights and worker protections. 3. Limited Liability Companies (LCS): Some self-employed individuals in Houston, Texas choose to operate as an LLC. An LLC is a legal structure that combines elements of a corporation and a partnership, providing personal liability protection and potential tax advantages. Operating as an LLC allows individuals to offer their services as independent contractors while having a business entity to manage finances, contracts, and legal matters. Determining self-employed independent contractor status in Houston, Texas involves considering various factors. These include the level of control the worker has over their work, the presence of a formal contract, the opportunity for profit or loss, investment in tools or equipment, integration with the business, and the permanency of the working relationship. To avoid misclassification and potential legal issues, it is crucial for businesses and individuals in Houston, Texas to understand these distinctions and consult legal professionals when necessary. Adhering to proper classification guidelines ensures fair treatment of workers, compliance with tax and labor laws, and a positive working relationship between contractors and the businesses they serve.

Houston Texas Determining Self-Employed Independent Contractor Status

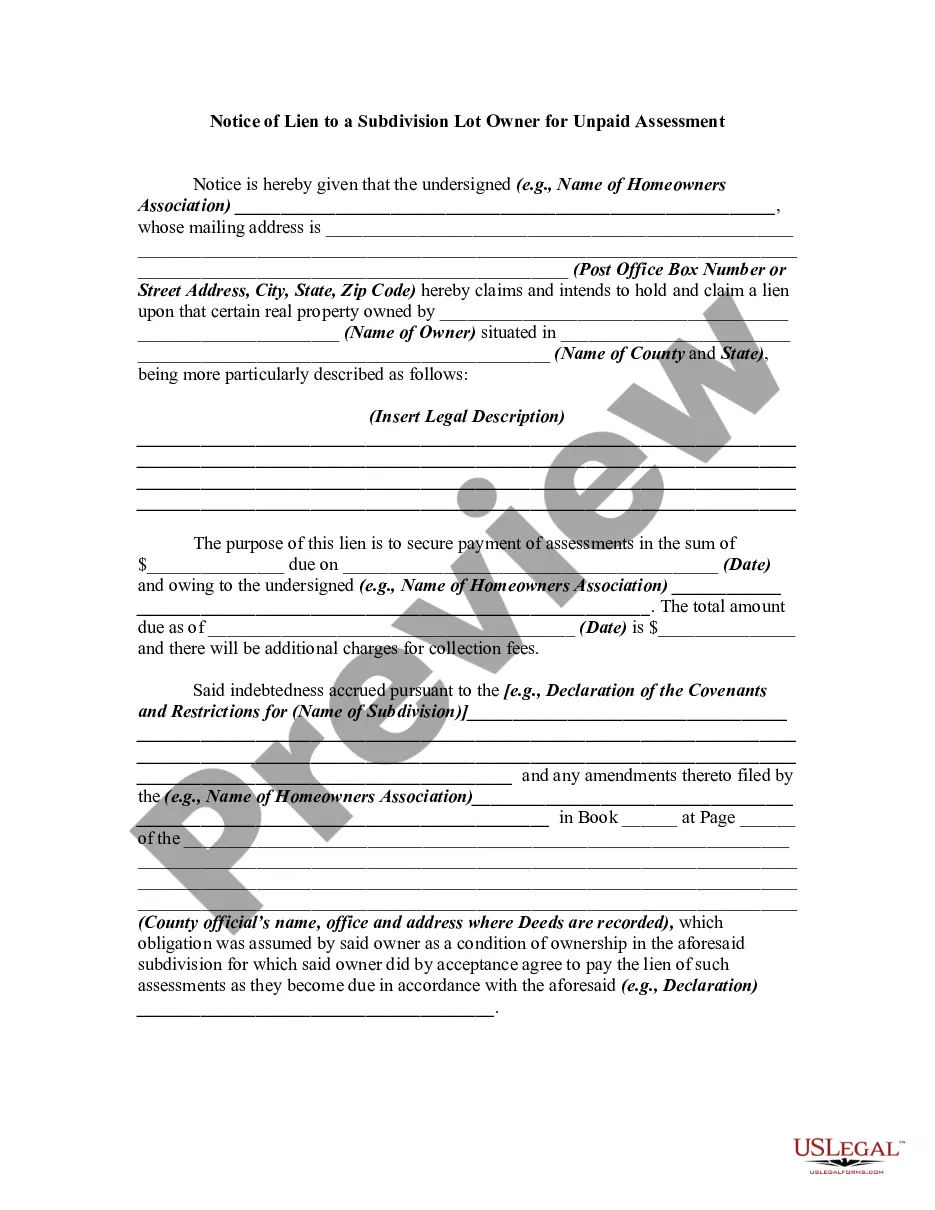

Description

How to fill out Houston Texas Determining Self-Employed Independent Contractor Status?

Draftwing paperwork, like Houston Determining Self-Employed Independent Contractor Status, to manage your legal matters is a tough and time-consumming process. Many situations require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for different cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Houston Determining Self-Employed Independent Contractor Status template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Houston Determining Self-Employed Independent Contractor Status:

- Make sure that your template is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Houston Determining Self-Employed Independent Contractor Status isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin utilizing our website and get the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can try and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!