Maricopa, Arizona is a vibrant city located in Pinal County, Arizona. With a population of over 50,000 residents, Maricopa offers a unique blend of small-town charm and modern amenities. Known for its picturesque landscapes, diverse community, and thriving economy, Maricopa is an ideal place for individuals looking to establish themselves as self-employed independent contractors. Determining the self-employed independent contractor status in Maricopa, Arizona is an essential step for individuals seeking to work independently and be their own boss. Being classified as a self-employed independent contractor means that an individual is not an employee but rather a separate entity providing services to clients or companies on a contractual basis. It is crucial to accurately determine one's employment status to ensure compliance with tax laws, establish legal protections, and properly manage finances. The process of determining self-employed independent contractor status in Maricopa, Arizona involves several key factors. These factors assess the degree of control, independence, and the type of work performed by the individual. It is important to consider these factors to determine the proper classification. Some significant factors include: 1. Control: The level of control that the individual has over how, when, and where the work is performed is a determining factor. If the individual has the freedom to set their schedule, choose their clients, and determine the methods to achieve the desired results, it strengthens their claim of being self-employed. 2. Financial Aspect: The extent to which an individual has control over their financial situation can also play a role. If the individual bears the expenses related to their work, such as tools, equipment, or supplies, and has the ability to realize a profit or incur a loss, it indicates self-employment. 3. Nature of the Relationship: The nature of the relationship between the individual and the client or company is vital. If there is a written agreement outlining the terms and conditions of the work, it supports the case for self-employment. Additionally, if the relationship is project-based or for a specific duration, it suggests an independent contractor status. Some common types of self-employed independent contractor classifications in Maricopa, Arizona include: 1. Freelancers: Individuals providing specialized services, such as graphic design, content writing, web development, or photography, on a project-by-project basis. 2. Construction Contractors: Skilled workers, such as carpenters, electricians, plumbers, or general contractors, who provide their services to clients in the construction industry. 3. Professional Consultants: Experts in specific fields, such as marketing, finance, law, or human resources, who offer their expertise and advice to businesses or individuals. 4. Transportation Contractors: Individuals operating their vehicles, such as taxi drivers, ride-share drivers, or truck drivers, who provide transportation services on a contract basis. By accurately determining self-employed independent contractor status in Maricopa, Arizona, individuals can ensure compliance with local laws, benefit from tax advantages, and actively manage their own business affairs. It is essential to stay updated on legal regulations and seek professional advice when necessary to maintain a successful self-employment career in Maricopa, Arizona.

Maricopa Arizona Determining Self-Employed Independent Contractor Status

Description

How to fill out Maricopa Arizona Determining Self-Employed Independent Contractor Status?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Maricopa Determining Self-Employed Independent Contractor Status, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any tasks related to document execution straightforward.

Here's how you can purchase and download Maricopa Determining Self-Employed Independent Contractor Status.

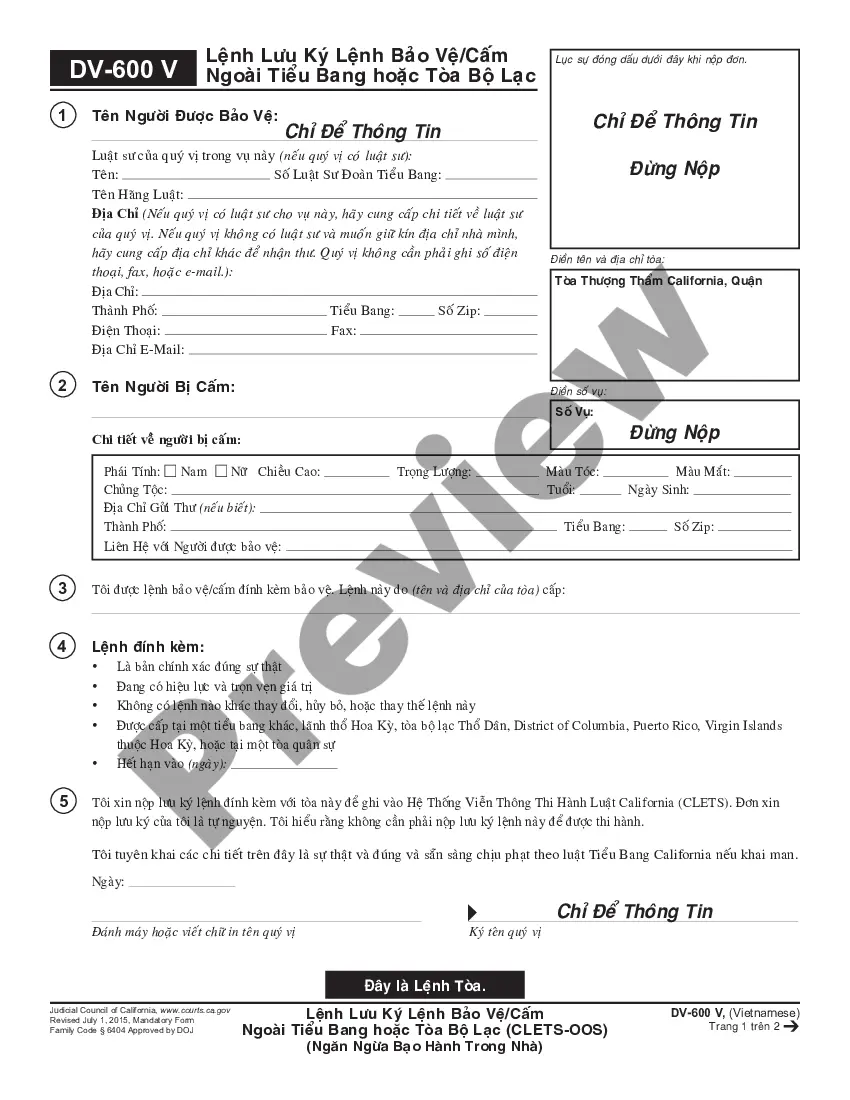

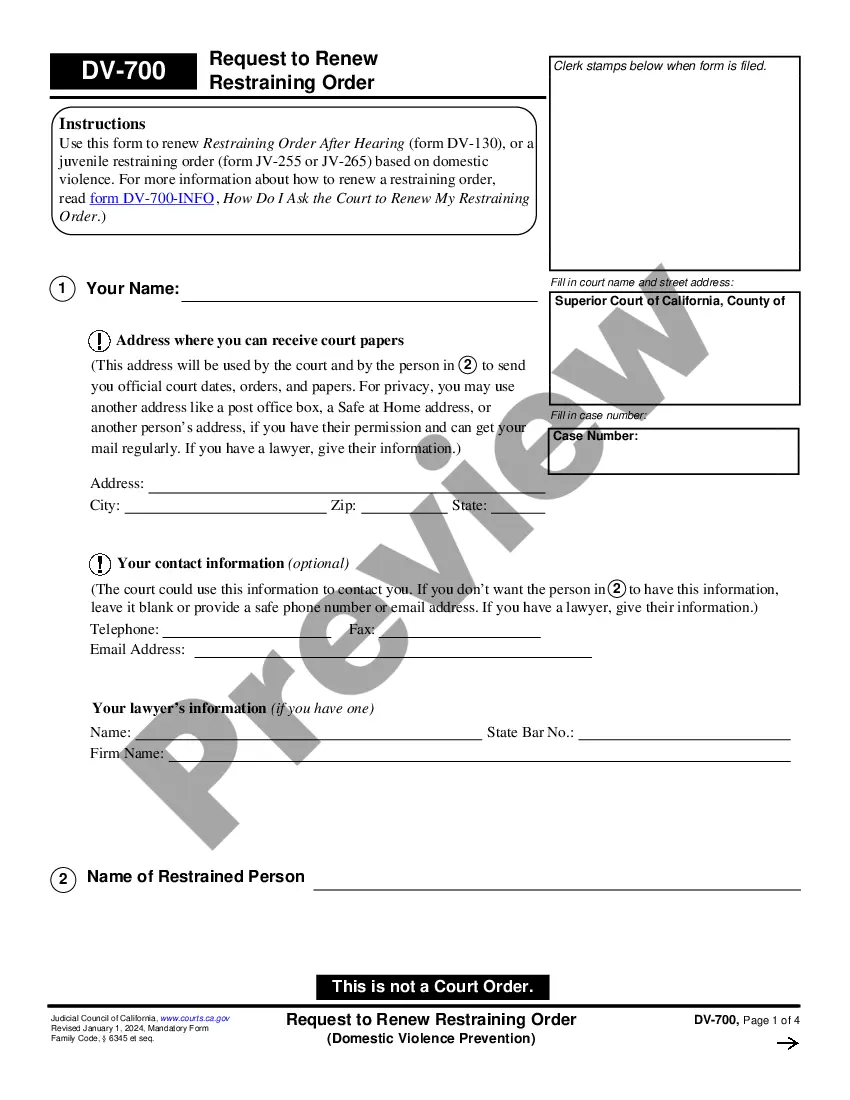

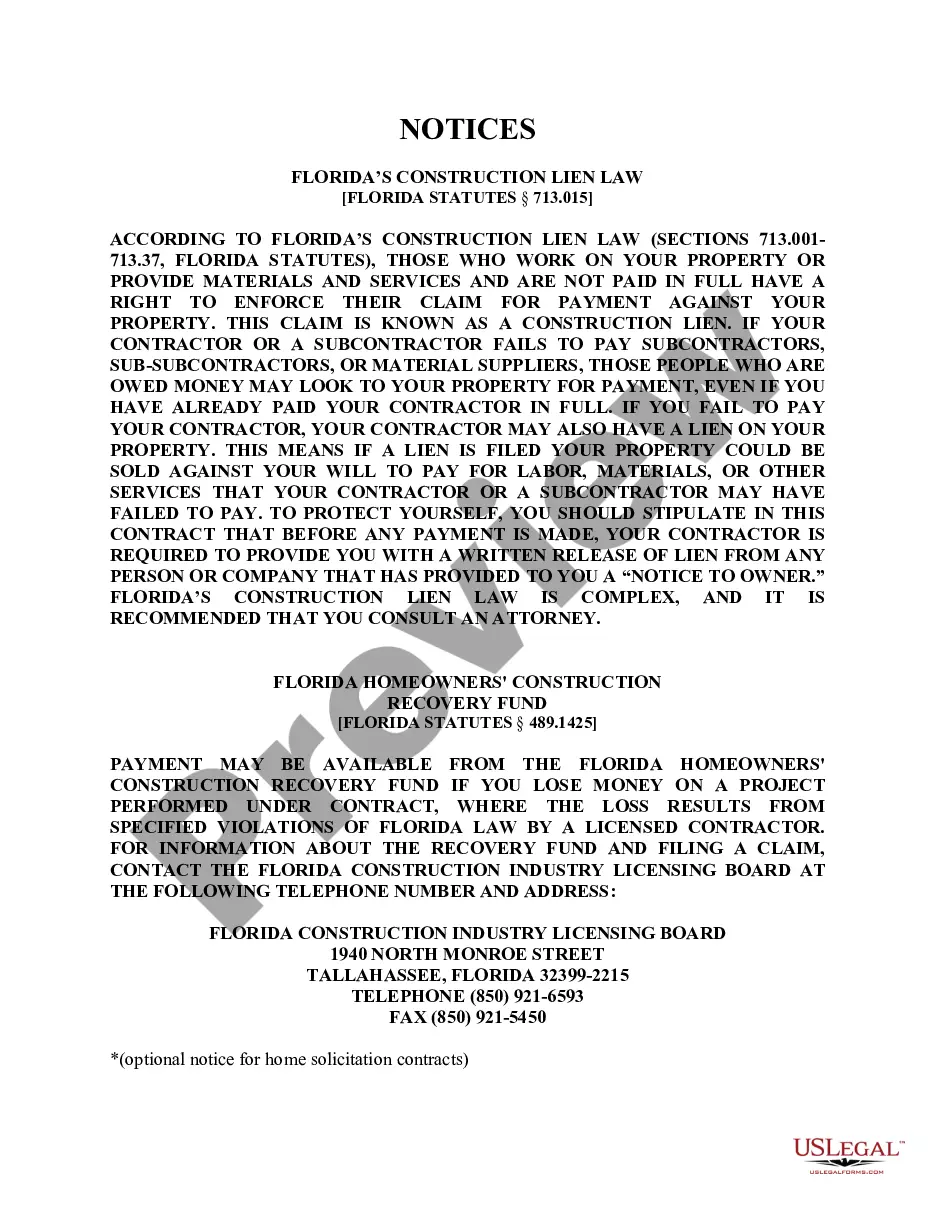

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and buy Maricopa Determining Self-Employed Independent Contractor Status.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Maricopa Determining Self-Employed Independent Contractor Status, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you need to deal with an exceptionally complicated case, we advise using the services of a lawyer to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-compliant paperwork with ease!

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Four ways to verify your income as an independent contractor Income-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Factors that show you are an independent contractor include working with multiple clients instead of just one, not receiving detailed instructions from hiring firms, paying your own business expenses such as office and equipment expenses, setting your own schedule, marketing your services to the public, having all

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Some ways to prove self-employment income include: Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Financial control If the worker is paid a salary or guaranteed a regular company wage, they're probably classified as an employee. If the worker is paid a flat fee per job or project, they're more likely to be classified as an independent contractor.