San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its booming technology industry and entrepreneurial spirit, San Jose attracts professionals from all over the world looking to delve into the world of self-employment as independent contractors. Determining one's status as a self-employed independent contractor in San Jose, California is crucial for both individuals and businesses, as it establishes the legal relationship between parties involved and ensures compliance with labor laws. When it comes to determining self-employed independent contractor status in San Jose, several factors need to be considered. These factors include but are not limited to the degree of control over the work, the relationship between the worker and the business, the method of payment, the provision of benefits, and the level of independence. It is important to note that California has specific laws and guidelines, such as the ABC test, which sets rigorous standards for classifying workers as independent contractors. Under this test, a worker is presumed to be an employee unless they meet all three criteria: 1. The worker is free from the control and direction of the hiring entity in performing the work, both in reality and as specified in the contract. 2. The worker performs work outside the usual course of the hiring entity's business. 3. The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed. Meeting these requirements is crucial for individuals seeking self-employed independent contractor status in San Jose, California. However, it is always recommended consulting with an employment attorney or seek guidance from relevant government agencies to ensure compliance and avoid misclassification issues. In addition to the general determination, there may be various types of self-employed independent contractor status in San Jose, California, catering to different industries and professions. For instance, freelancers in creative fields such as graphic design, photography, or writing often operate as self-employed independent contractors. Similarly, consultants, IT professionals, and gig economy workers providing services through platforms like Uber or Jackrabbit also fall under this category. Understanding the nuances of self-employed independent contractor status in San Jose, California is crucial for both individuals and businesses operating in the region. Navigating the complex legal landscape, adhering to labor laws, and ensuring proper classification is essential to avoid potential legal issues and protect the rights and responsibilities of all parties involved.

San Jose California Determining Self-Employed Independent Contractor Status

Description

How to fill out San Jose California Determining Self-Employed Independent Contractor Status?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a San Jose Determining Self-Employed Independent Contractor Status meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Aside from the San Jose Determining Self-Employed Independent Contractor Status, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your San Jose Determining Self-Employed Independent Contractor Status:

- Check the content of the page you’re on.

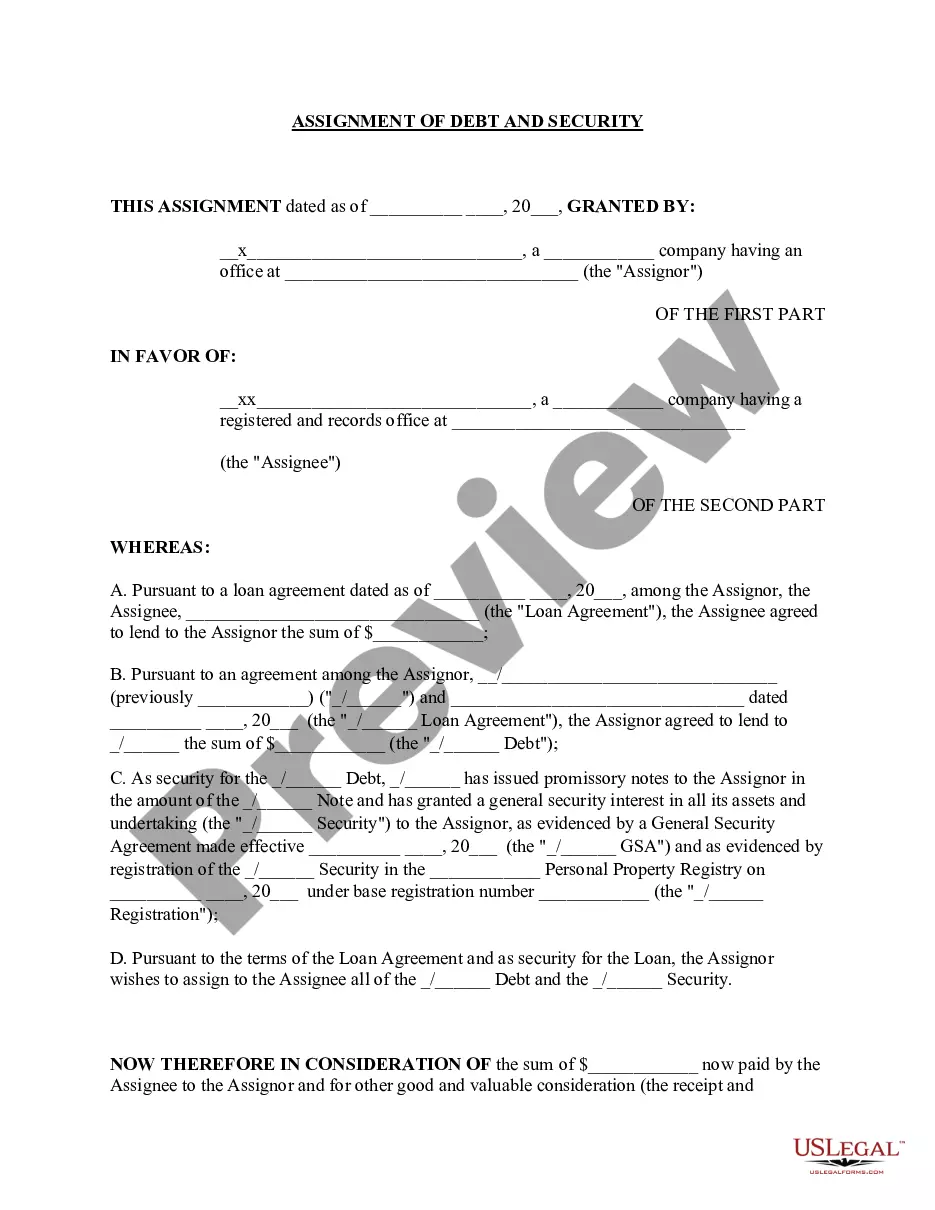

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Jose Determining Self-Employed Independent Contractor Status.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!