Title: San Jose, California: A Comprehensive Guide to Utilizing Self-Employed Independent Contractors Introduction: In this memo, we will delve into the concept of using self-employed independent contractors in San Jose, California. We will explore the benefits, legal considerations, and various types of independent contractors available to businesses in the region. Keywords: San Jose, California, self-employed, independent contractors, benefits, legal considerations, types, businesses. 1. Understanding Self-Employed Independent Contractors: — Self-employed independent contractors are individuals who work on a contract basis for businesses or individuals, but maintain their own control over how, when, and where they work. — These contractors are not classified as employees, which means employers are not responsible for benefits, taxes, or providing a safe working environment. 2. Benefits of Hiring Self-Employed Independent Contractors: — Cost-effectiveness: Employers can save on payroll taxes, benefits, and other related expenses. — Flexibility: Contractors can be hired for short-term projects or to meet fluctuating demands, eliminating the need for long-term commitments. — Specialized Skills: Hiring self-employed contractors allows access to a diverse pool of talent with specific expertise, enabling businesses to engage professionals on an as-needed basis. 3. Legal Considerations for Hiring Self-Employed Independent Contractors: — Misclassification Risks: Employers must ensure that contractors meet the legal criteria for independent contractor status, as misclassification can result in severe penalties. — Written Agreements: Having clear and comprehensive contracts outlining the scope of work, payment terms, and project timelines is crucial. — IRS Guidelines: Familiarize yourself with the Internal Revenue Service's guidelines to avoid misclassifying employees as independent contractors. 4. Types of Self-Employed Independent Contractors in San Jose, California: — IT Specialists: San Jose, being the technological hub of Silicon Valley, is home to numerous highly skilled IT professionals who can assist with software development, cybersecurity, web design, and more. — Creative Professionals: Artists, graphic designers, photographers, and videographers offer their services as independent contractors, providing businesses with visually appealing marketing collateral, branding, and advertising. — Business Consultants: San Jose houses a wealth of experienced business consultants who offer their expertise in areas such as marketing, finance, HR, and strategy to help organizations thrive. Conclusion: Utilizing self-employed independent contractors in San Jose, California, can be a strategic move for businesses seeking flexibility, specialized skills, and cost-effectiveness. However, it is crucial to ensure compliance with legal requirements to mitigate any potential risks associated with misclassification. Keywords: San Jose, California, self-employed independent contractors, benefits, legal considerations, types, compliance, misclassification.

San Jose California Memo - Using Self-Employed Independent Contractors

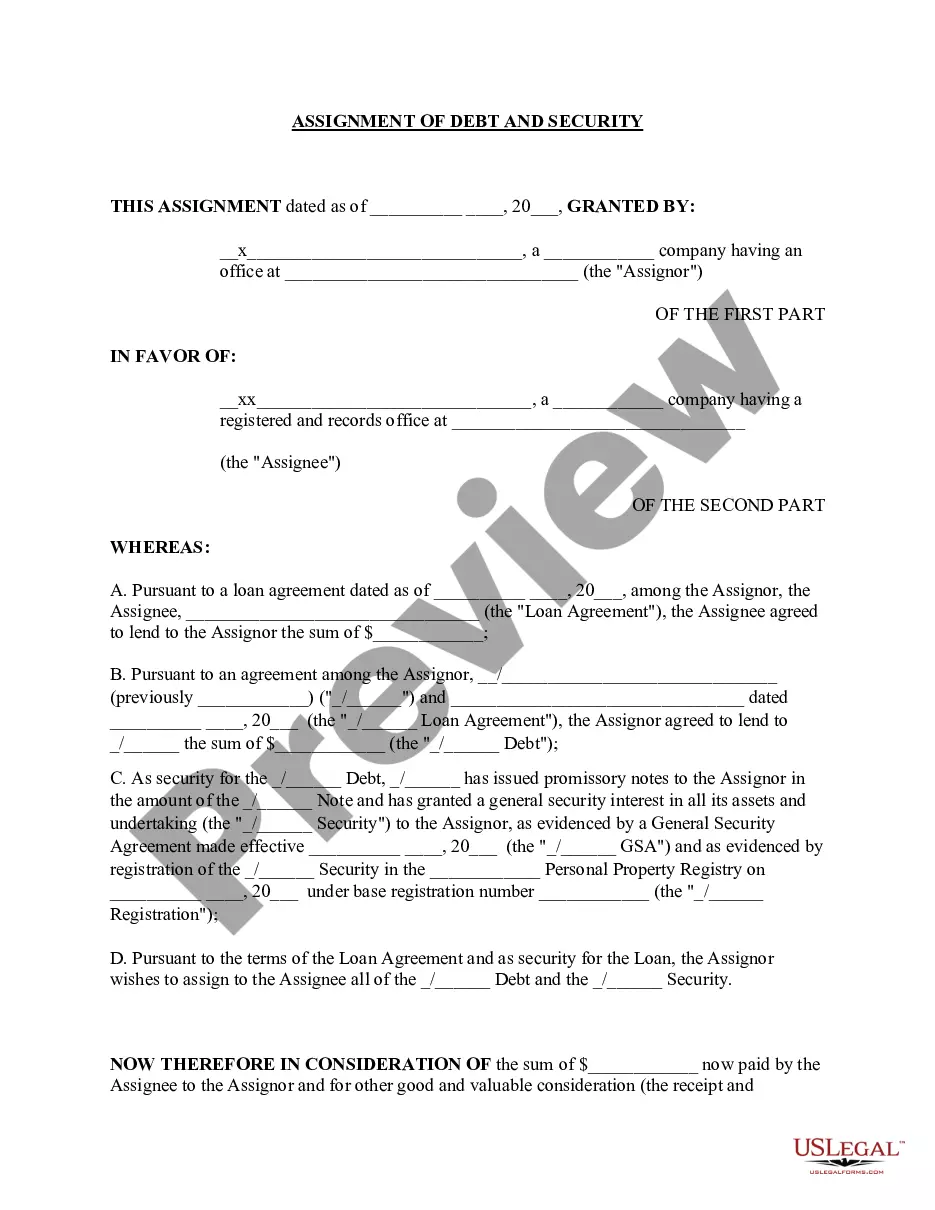

Description

How to fill out San Jose California Memo - Using Self-Employed Independent Contractors?

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the San Jose Memo - Using Self-Employed Independent Contractors, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the recent version of the San Jose Memo - Using Self-Employed Independent Contractors, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Jose Memo - Using Self-Employed Independent Contractors:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your San Jose Memo - Using Self-Employed Independent Contractors and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!