Title: Sample FCRA Letter to Applicant in Phoenix, Arizona: Detailed Description and Types Introduction: Phoenix, Arizona, the capital city of Arizona, is a vibrant metropolis renowned for its cultural diversity, stunning desert landscapes, and economic opportunities. In this article, we will provide a detailed description of what a Sample FCRA (Fair Credit Reporting Act) Letter to Applicant entails in the context of Phoenix, Arizona. Additionally, we will explore different types of FCRA letters commonly used in the region. Detailed Description: A Sample FCRA Letter to Applicant is an essential communication tool used by employers, landlords, and lending institutions in Phoenix, Arizona, to comply with the guidelines established by the Fair Credit Reporting Act. This federal law safeguards consumer rights, ensuring fair and accurate reporting of their credit information whenever it is collected, used, or shared. Such letters are typically utilized during the employment screening process, rental applications, credit checks, or loan applications. The purpose is to inform applicants about their rights under the FCRA, explain the reason for using credit reports, and obtain the applicant's consent for accessing their credit history or conducting background checks. A well-crafted FCRA Letter to Applicant in Phoenix, Arizona should include the following key elements: 1. Identification and Contact Information: — Headings mentioning the organization name, address, and contact details. — Clearly state whether the letter is for employment, renting, credit, or loan purposes. 2. Applicant's Rights: — Explanation of the applicant's rights as per the FCRA, such as the right to dispute inaccurate information, receive a copy of the report, or request a restore. 3. Consent for Credit Check or Background Investigation: — Request the applicant's written consent to access their credit report or conduct a background check. — Provide details regarding the specific information that will be obtained and why it is necessary for the given purpose (employment, renting, etc.). 4. Dispute and Reporting Processes: — Inform the applicant about the procedures for disputing incorrect information found on the credit report. — Explain how the organization will handle or report adverse actions (rejections, negative decisions) resulting from the credit report. Types of Phoenix Arizona Sample FCRA Letters to Applicant: 1. Sample FCRA Letter to Applicant for Employment: This type of letter is specifically designed for employers in Phoenix, Arizona, who need to carry out background checks or credit screenings as part of their hiring process. 2. Sample FCRA Letter to Applicant for Rental Application: Aimed at landlords and property management companies in Phoenix, Arizona, this letter ensures compliance with the FCRA regulations when conducting credit checks on prospective tenants. 3. Sample FCRA Letter to Applicant for Credit or Loan: Financial institutions and lending agencies in Phoenix, Arizona, employ this letter to establish their legal obligations, obtain consent, and explain the purpose of accessing an applicant's credit report during the loan or credit application process. Conclusion: In Phoenix, Arizona, the use of FCRA Letters to Applicants plays a crucial role in upholding consumer rights and ensuring fair credit reporting practices. Whether for employment, rental, credit, or loan applications, these letters are vital tools to comply with the guidelines outlined in the Fair Credit Reporting Act. By following the sample FCRA letter templates specific to each application type, businesses and organizations in Phoenix can promote transparency, accuracy, and fairness throughout their screening processes.

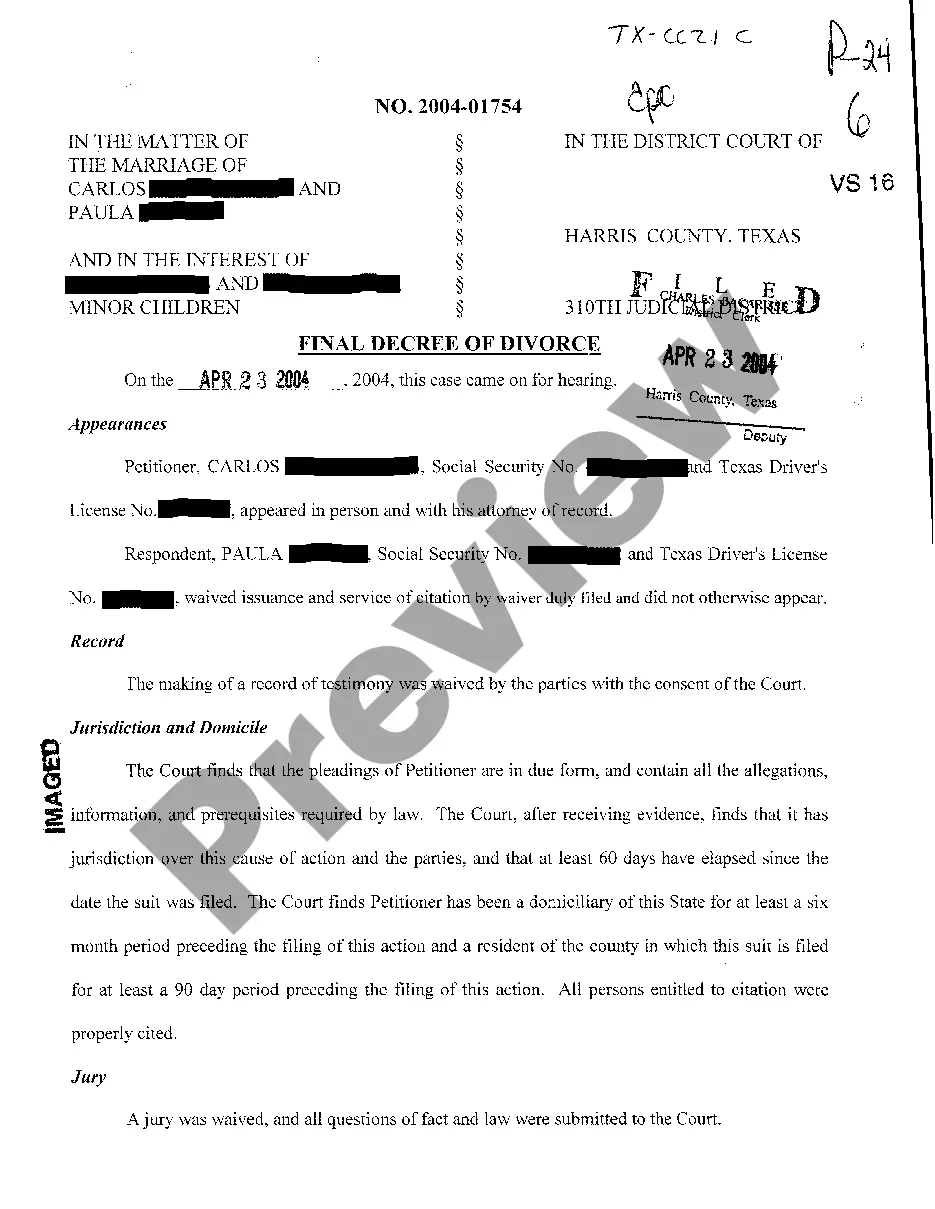

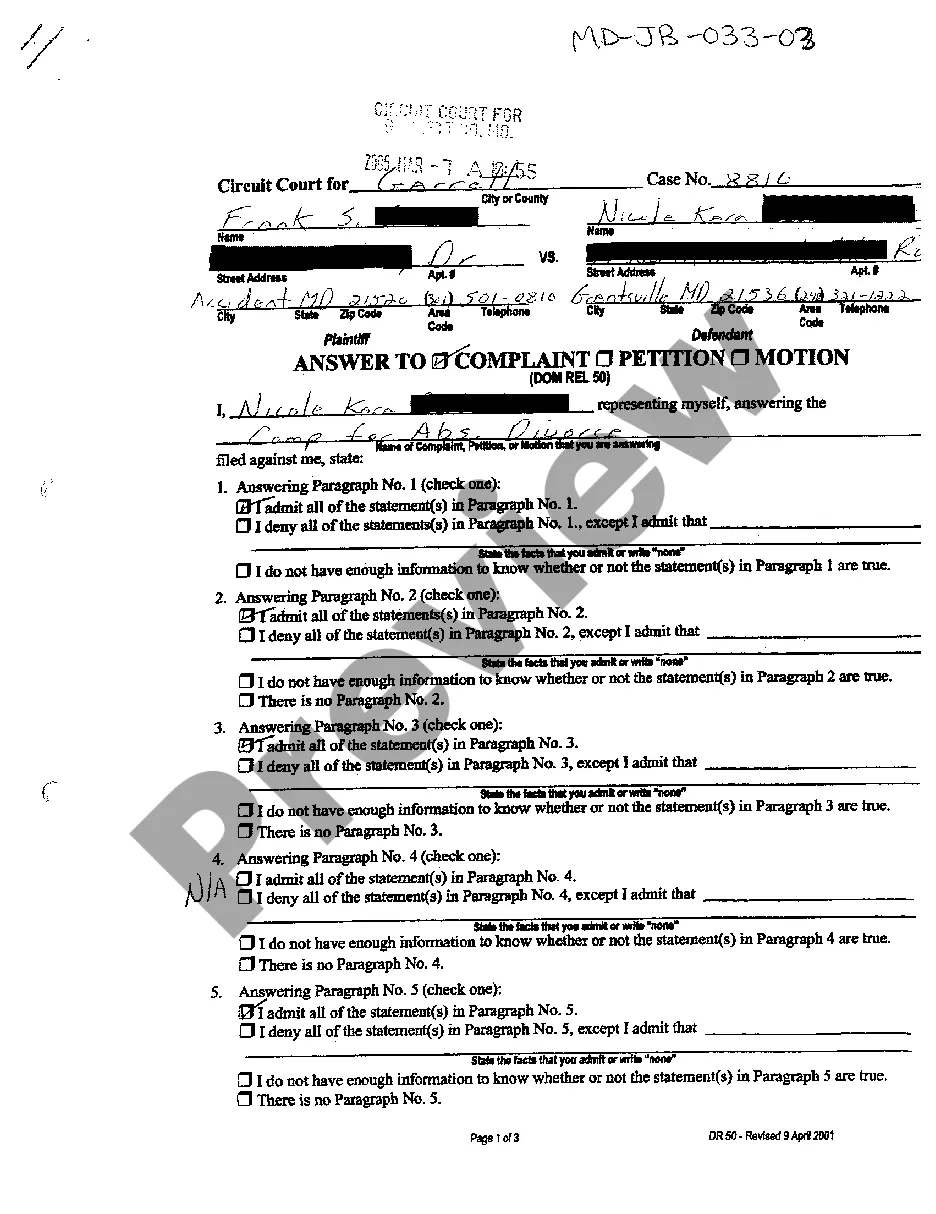

Phoenix Arizona Sample FCRA Letter to Applicant

Description

How to fill out Phoenix Arizona Sample FCRA Letter To Applicant?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Phoenix Sample FCRA Letter to Applicant suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Phoenix Sample FCRA Letter to Applicant, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Phoenix Sample FCRA Letter to Applicant:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Phoenix Sample FCRA Letter to Applicant.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!