Collin Texas Employee Notice to Correct IRA Compliance is a legal document used in Collin, Texas, which aims to ensure compliance with the Immigration Reform and Control Act (IRA) regulations. This notice is typically issued by employers to their employees, notifying them of their non-compliance with IRA requirements and providing an opportunity to rectify any deficiencies. The purpose of the Collin Texas Employee Notice to Correct IRA Compliance is to inform employees about their responsibilities regarding the hiring and employment of eligible workers under IRA. It outlines the specific areas of non-compliance, such as incomplete or missing I-9 forms or inadequate documentation, that need to be addressed. By issuing this notice, employers seek to educate their workforce on the importance of complying with IRA regulations and the potential consequences of non-compliance. The notice serves as a formal warning to employees, indicating that failure to correct the identified issues may result in disciplinary action, including termination or legal consequences. There may be different types of Collin Texas Employee Notice to Correct IRA Compliance, depending on the specific violations or non-compliance issues observed. Some of these variations may include: 1. Notice due to Incomplete I-9 Forms: This type of notice is issued when an employee fails to submit or complete the required I-9 form accurately. It informs the employee about the specific information missing or incomplete and provides a deadline for rectifying the situation. 2. Notice for Insufficient Documentation: This type of notice is given when an employee's documentation, such as identification or work authorization, is deemed inadequate or invalid under IRA regulations. The notice specifies the required documents or information and sets a deadline for compliance. 3. Notice for Failure to Re-verify Employment Authorization: If an employee's work authorization documents require re-verification but have not been updated within the specified timeframe, the employer may issue this notice. It informs the employee about the need for re-verification and sets a deadline for compliance. 4. Notice for Hiring Unauthorized Workers: This type of notice is applicable in cases where an employer discovers that an employee is not authorized to work in the United States. It notifies the employee of the violation and highlights the consequences, such as the need to terminate employment or potential legal penalties. Overall, Collin Texas Employee Notice to Correct IRA Compliance serves as a crucial tool for employers to promote compliance with IRA regulations and maintain a legally compliant workforce. It aims to educate employees about their responsibilities while providing an opportunity to rectify any non-compliance issues before more severe actions are taken.

Collin Texas Employee Notice to Correct IRCA Compliance

Description

How to fill out Collin Texas Employee Notice To Correct IRCA Compliance?

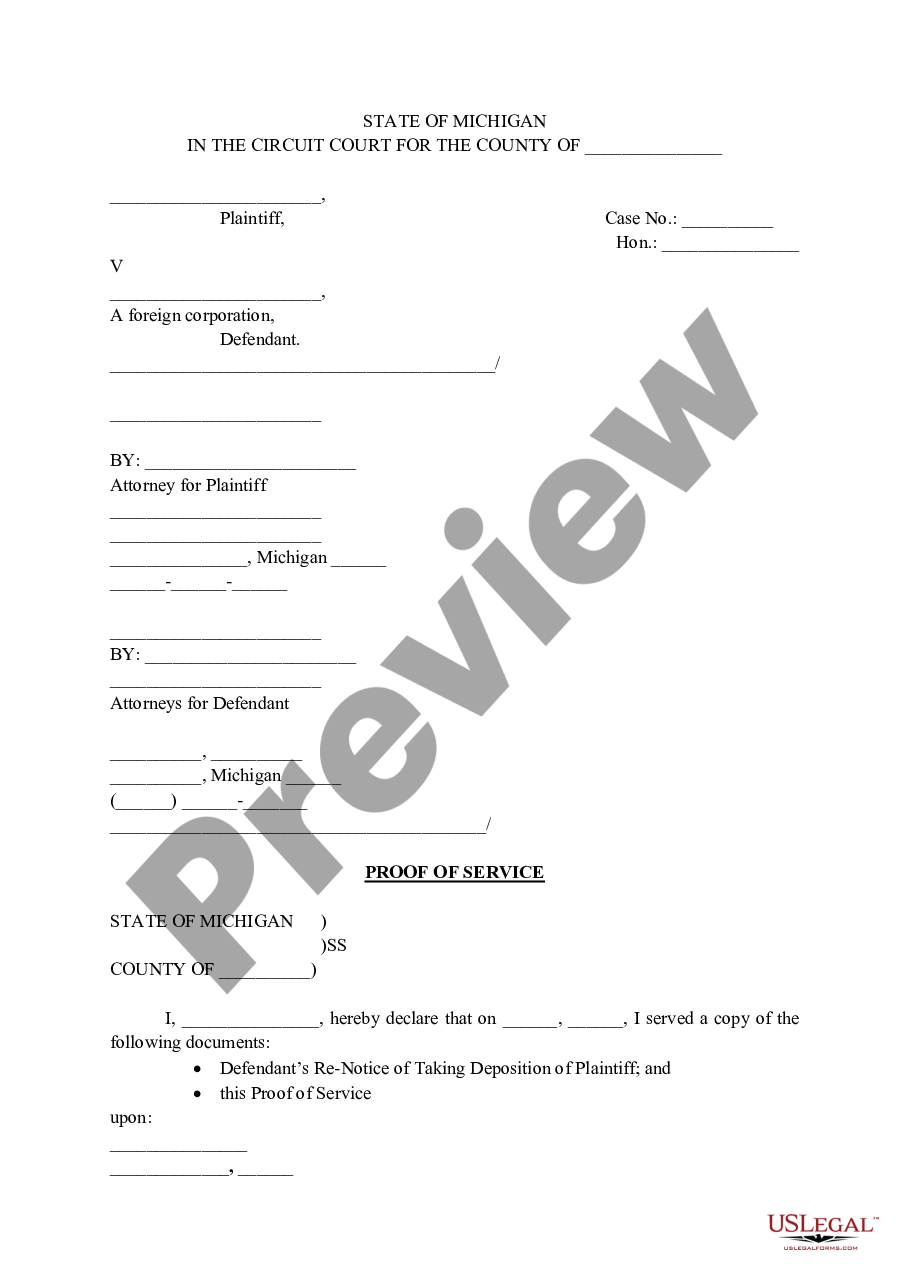

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Collin Employee Notice to Correct IRCA Compliance, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any activities related to document completion simple.

Here's how you can locate and download Collin Employee Notice to Correct IRCA Compliance.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the similar document templates or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Collin Employee Notice to Correct IRCA Compliance.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Collin Employee Notice to Correct IRCA Compliance, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you have to cope with an extremely challenging situation, we advise using the services of a lawyer to check your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-specific documents with ease!