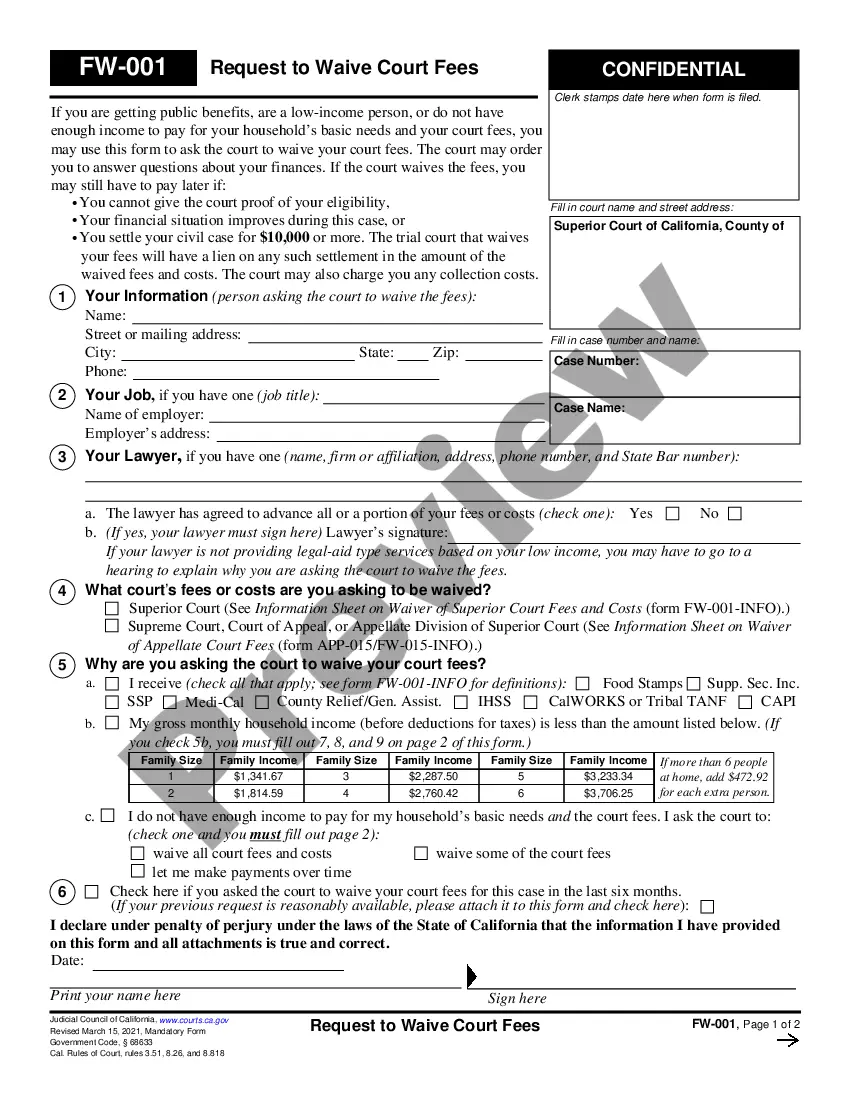

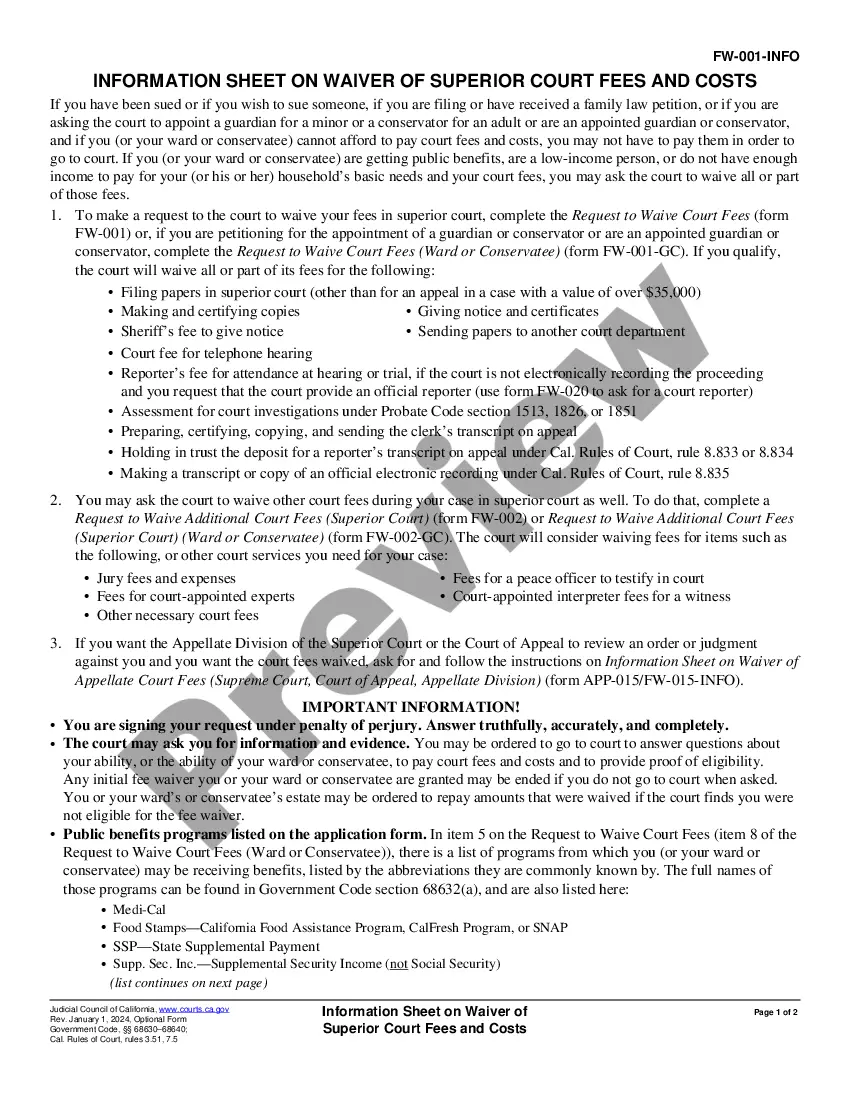

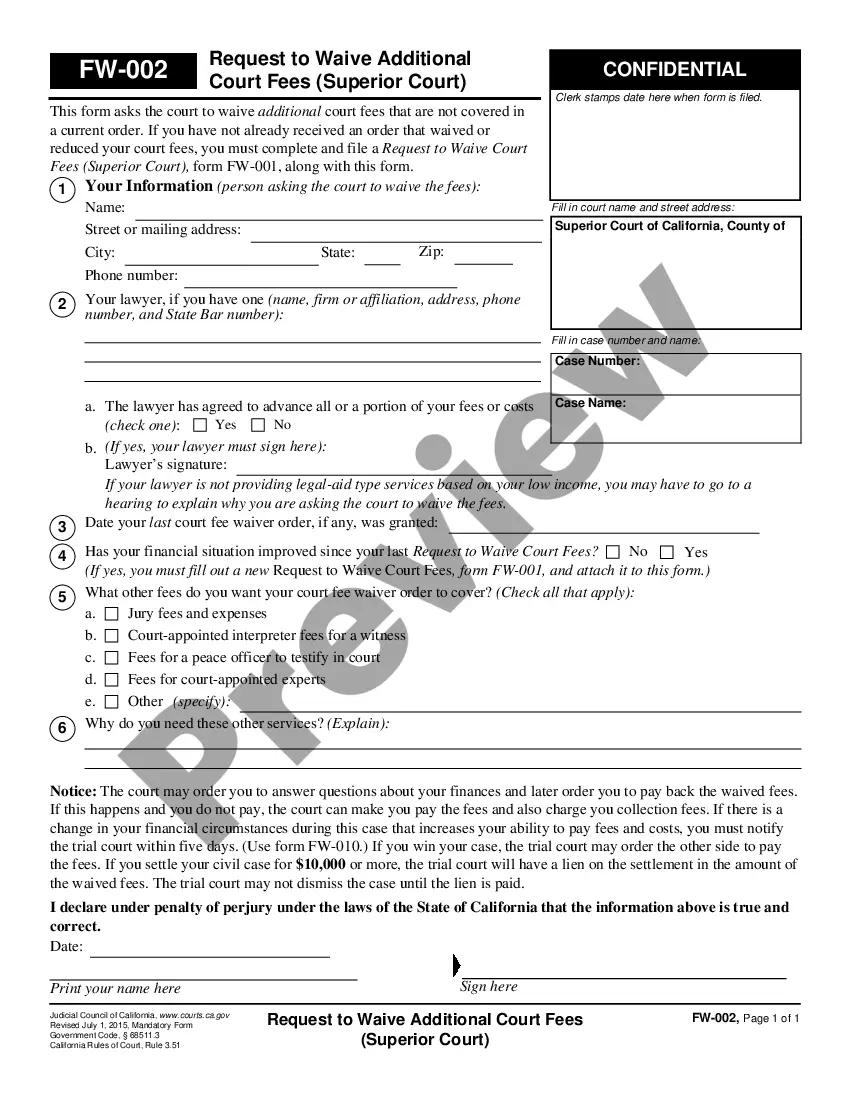

Maricopa Arizona Employee Notice to Correct IRA Compliance is a document issued by employers in Maricopa, Arizona to their employees to address any issues related to compliance with the Immigration Reform and Control Act (IRA). IRA is a federal law that requires employers to verify the identity and employment eligibility of their employees. The Maricopa Arizona Employee Notice to Correct IRA Compliance typically outlines the specific areas where the employee's compliance is deemed to be lacking and provides instructions on how to rectify those deficiencies. It serves as a formal notification to the employee that they must take immediate action to correct their noncompliance and ensure that they meet the IRA requirements. Keywords: 1. Maricopa, Arizona: Refers to the specific location where the employer is based and where the employee works. 2. Employee Notice: Indicates the purpose of the document, which serves as a notification to the employee regarding their compliance with IRA. 3. Correct: Indicates that the employee is required to make necessary changes or adjustments to ensure their compliance with IRA. 4. IRA Compliance: Focuses on the adherence to the Immigration Reform and Control Act, which requires employers to verify the eligibility of their employees to work in the United States. 5. Immigration Reform and Control Act (IRA): Highlights the federal law that establishes the guidelines for employers in verifying their employees' eligibility. 6. Employment eligibility: Refers to verifying that an employee is legally authorized to work in the United States. 7. Noncompliance: Indicates the failure of the employee to meet the IRA requirements. 8. Verification: Refers to the process of confirming an individual's identity and employment eligibility, as required by IRA. Different types of Maricopa Arizona Employee Notice to Correct IRA Compliance: 1. Initial Notice: This type of notice is typically issued when an employer detects a potential compliance issue with an employee's IRCA-related documentation or identification during the verification process. It serves as a warning to the employee about the need to rectify the noncompliance within a specified timeframe. 2. Follow-up Notice: If an employee fails to address the noncompliance identified in the initial notice within the given timeframe, a follow-up notice is issued. It highlights the unresolved issues and emphasizes the consequences of continued noncompliance. 3. Warning Notice: This kind of notice is issued if an employee repeatedly fails to correct their noncompliance, despite receiving initial and follow-up notices. It emphasizes the seriousness of the situation and warns the employee about potential disciplinary actions. 4. Suspension or Termination Notice: If an employee fails to comply with IRA requirements even after receiving warning notices, they may face suspension or termination. This notice informs the employee of the employer's decision to suspend or terminate their employment due to noncompliance. It is important for both employers and employees to understand and adhere to the Maricopa Arizona Employee Notice to Correct IRA Compliance to ensure a legal and compliant workforce.

Maricopa Arizona Employee Notice to Correct IRCA Compliance

Description

How to fill out Maricopa Arizona Employee Notice To Correct IRCA Compliance?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Maricopa Employee Notice to Correct IRCA Compliance is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to get the Maricopa Employee Notice to Correct IRCA Compliance. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Employee Notice to Correct IRCA Compliance in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!