Tarrant, Texas Employee Notice to Correct IRA Compliance: A Comprehensive Guide In Tarrant, Texas, employers are required to comply with immigration laws governed by the Immigration Reform and Control Act (IRA) to ensure a legal and authorized workforce. To maintain compliance with IRA regulations, employers issue an Employee Notice to Correct IRA Compliance when violations or discrepancies are found. This notice serves as an essential tool to rectify any issues and bring the employer's business operations in line with the law. The Tarrant, Texas Employee Notice to Correct IRA Compliance outlines specific actions an employee must take to rectify their non-compliance with IRA regulations. It serves as a formal written communication, allowing the employer to clearly communicate the nature of the violation, provide necessary instructions, and set a timeframe for corrective actions to be completed. Some common types of Tarrant, Texas Employee Notice to Correct IRA Compliance may include: 1. Improper Form I-9 Completion: This notice is issued when an employee's Form I-9, used to verify identity and employment authorization, contains errors, missing information, or inconsistencies. 2. Document Fraud: If an employee is suspected of using fraudulent or counterfeit documents during the hiring process, an Employee Notice to Correct IRA Compliance may be issued. It requires the employee to provide valid and genuine documents within a specified timeframe. 3. Retention of Expired Documents: Employers may issue this notice when an employee fails to re-verify their employment eligibility after their documents' expiration date. It emphasizes the importance of updating documents to ensure ongoing compliance. 4. Unauthorized Workers: When an employer learns that an employee is not legally authorized to work in the United States, they issue an Employee Notice to Correct IRA Compliance. This notice outlines the steps the employee must take to rectify their status or face potential termination. 5. Failure to Consistently Follow IRA Guidelines: This notice is issued when an employee, intentionally or unintentionally, fails to follow IRA guidelines and requirements consistently. It serves as a reminder to comply with the laws to avoid legal consequences and maintain compliance. 6. False Information: If an employer discovers that an employee provided false information during the hiring process, such as fake Social Security numbers or identities, they issue an Employee Notice to Correct IRA Compliance. This notice emphasizes the seriousness of providing accurate information and demands prompt correction. Tarrant, Texas Employee Notice to Correct IRA Compliance is a crucial document in maintaining legal workforce status. Employers use it as a tool to address non-compliance issues and ensure the integrity of their workforce. By addressing and rectifying violations through these notices, employers demonstrate their commitment to following immigration laws and fostering a lawful work environment.

Tarrant Texas Employee Notice to Correct IRCA Compliance

Description

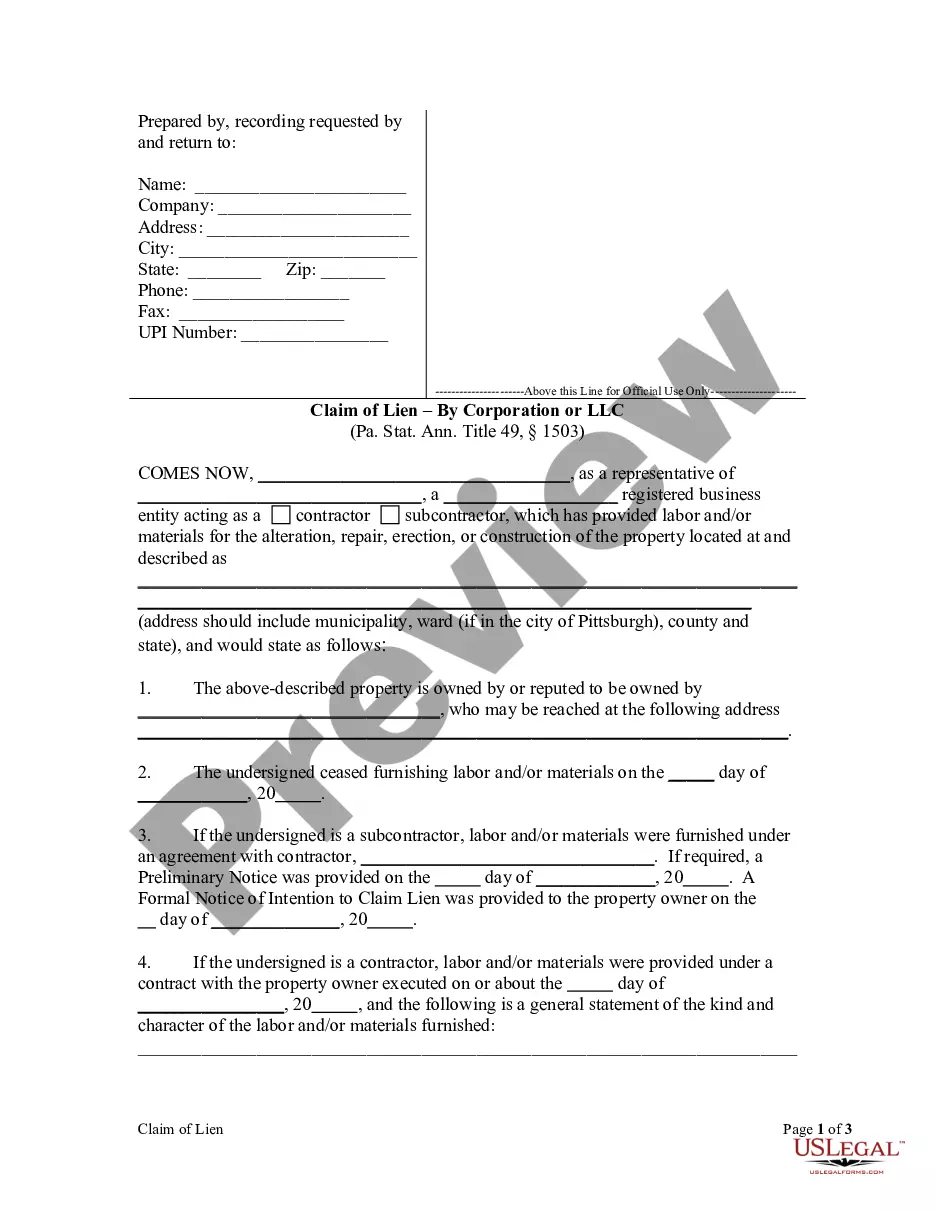

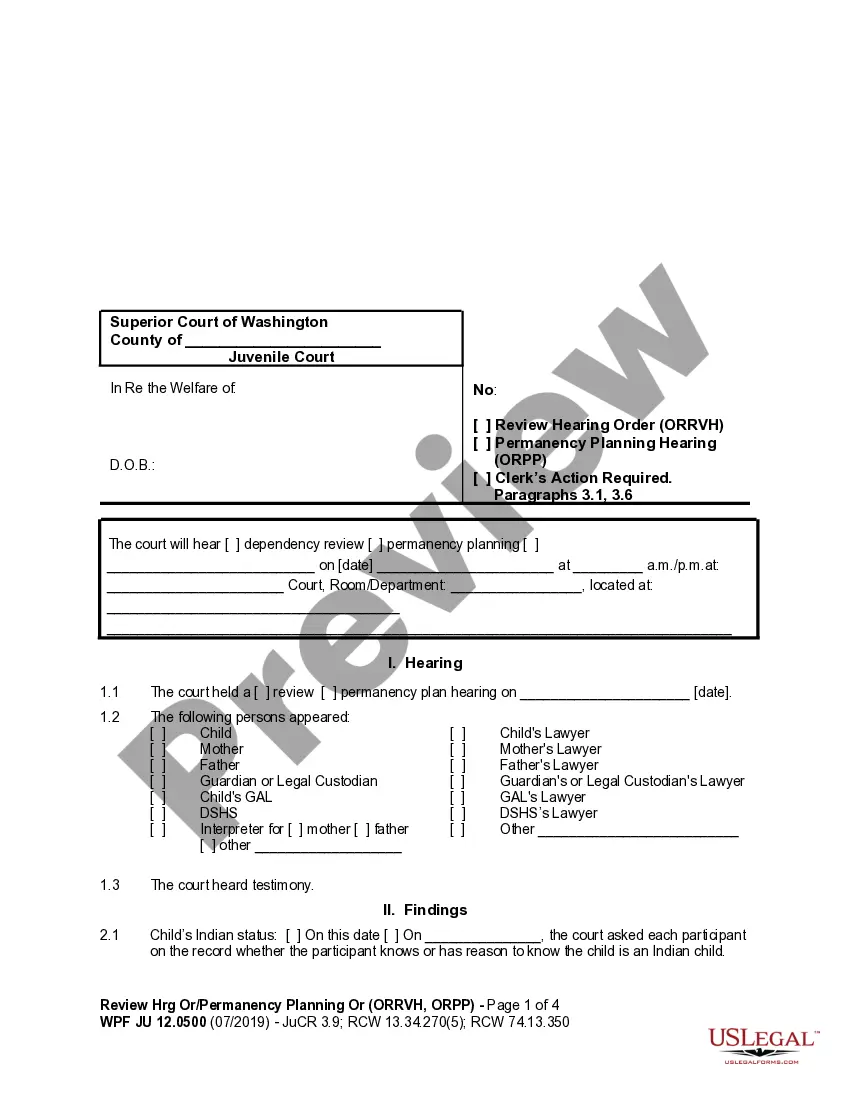

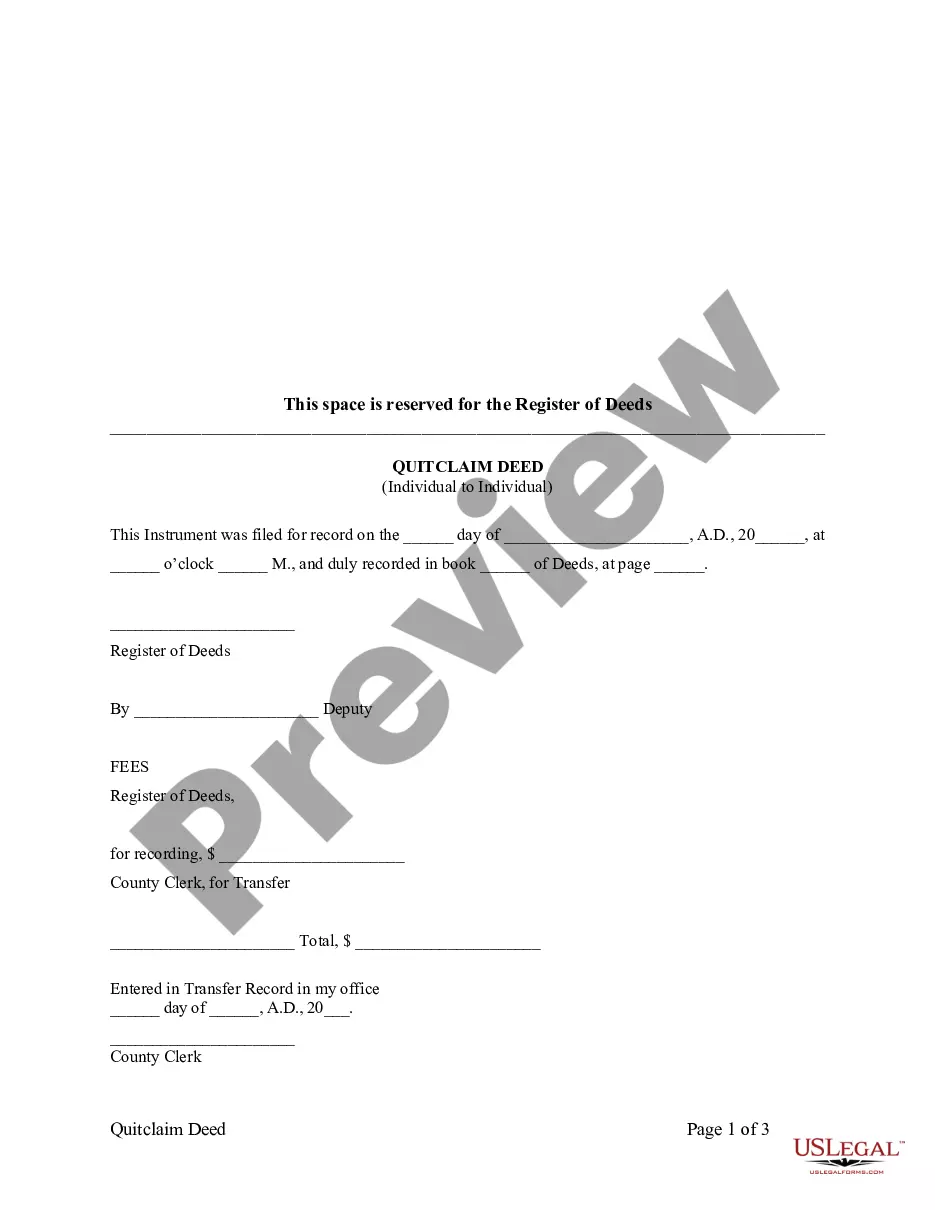

How to fill out Tarrant Texas Employee Notice To Correct IRCA Compliance?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business purpose utilized in your county, including the Tarrant Employee Notice to Correct IRCA Compliance.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Tarrant Employee Notice to Correct IRCA Compliance will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to get the Tarrant Employee Notice to Correct IRCA Compliance:

- Make sure you have opened the proper page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Tarrant Employee Notice to Correct IRCA Compliance on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Immigration and Customs Enforcement (ICE) is one of the main agencies that enforces this federal law, often by conducting I-9 audits, and with increasing regularity through work site raids (even during the COVID-19 pandemic).

Employers verify each worker's identity and employment eligibility by completing the Form I-9, Employment Eligibility Verification at the time of hire. U.S. Citizenship and Immigration Services (USCIS), in the Department of Homeland Security (DHS), publishes the Form I-9 and accompanying instructions.

Does the IRCA apply to all employers? IRCA applies to all employers with four or more employees. Who does this law protect? This law protects all those authorized to work in the US: US citizens, non-citizen nationals, lawful permanent residents, and non-citizens who are authorized to work.

IRCA prohibits employers from knowingly hiring, recruiting, or referring for a fee any alien who is unauthorized to work. The public policy behind this law reflects the concern that the problem of illegal immigration and employment requires greater control and stronger enforcement mechanisms by the federal government.

To comply with the law, employers must: Verify the identity and employment authorization of each person they hire; Complete and retain a Form I-9, Employment Eligibility Verification, for each employee; and. Refrain from discriminating against individuals on the basis of national origin or citizenship.

Form I-9, Employment Eligibility Verification, requirements come out of the Immigration Reform and Control Act of 1986 (IRCA). IRCA prohibits employers from hiring and employing an individual for employment in the U.S. knowing that the individual is not authorized with respect to such employment.

The Immigration Reform and Compliance Act of 1986 (IRCA) prohibits the employment of unauthorized aliens and requires all employers to: (1) not knowingly hire or continue to employ any person not authorized to work in the United States, (2) verify the employment eligibility of every new employee (whether the employee

The IRCA applies to employers with 4 or more employees, to employees who are citizens or nationals of the United States, and aliens who are lawfully admitted for permanent residence, granted temporary residence status, admitted as refugees, or granted asylum.

The employer is responsible for completing Section 2 of Form I-9 by examining the documents presented by the employee and recording the document numbers and expiration dates in the appropriate columns.