Maricopa Arizona Agreement to Reimburse for Insurance Premium is a legal document that outlines the terms and conditions under which an individual or entity agrees to reimburse another party for their insurance premiums. This agreement typically applies to situations where one party has paid insurance premiums on behalf of another party, and the reimbursing party agrees to repay them. The Maricopa Arizona Agreement to Reimburse for Insurance Premium is commonly used in various scenarios, including: 1. Employer-Employee Agreements: In cases where an employer provides insurance coverage for their employees, this agreement may be used to outline the terms of reimbursement if the employee is initially responsible for paying the premium. 2. Tenant-Landlord Agreements: Landlords who require tenants to have renter's insurance may use this agreement to ensure that the tenant reimburses them for the premium paid on their behalf. 3. Business Partnership Agreements: When partners in a business decide to share insurance costs, but one partner pays the premiums upfront, this agreement can be used to establish the terms of reimbursement. 4. Independent Contractor Agreements: Companies or individuals hiring independent contractors may require them to carry certain types of insurance. The agreement may be employed to ensure the contractor reimburses the company for the premium expense. 5. Personal Agreements: Individuals that have an agreement in place to provide insurance coverage for another party, such as a family member, friend, or dependent, can utilize the Maricopa Arizona Agreement to Reimburse for Insurance Premium to document the reimbursement terms. The Maricopa Arizona Agreement to Reimburse for Insurance Premium details essential information, including the parties involved, the insurance policy or policies covered, the amount of reimbursement, and the method and timeframe for reimbursement. It also outlines any additional conditions, such as penalties for late payment or breaches of the agreement. This legally binding agreement protects both parties by ensuring that the party paying the premium is reimbursed promptly and reducing the risk of disputes. It provides clarity and transparency regarding the financial responsibilities associated with insurance premiums, creating a mutually beneficial arrangement between the payer and the reimbursing party. Keywords: Maricopa Arizona, Agreement to Reimburse for Insurance Premium, insurance premium reimbursement, legal document, terms and conditions, employer-employee agreements, tenant-landlord agreements, business partnership agreements, independent contractor agreements, personal agreements, parties involved, insurance policy, reimbursement details, method of reimbursement, timeframe for reimbursement, penalties, disputes, financial responsibilities, mutually beneficial arrangement.

Maricopa Arizona Agreement to Reimburse for Insurance Premium

Description

How to fill out Maricopa Arizona Agreement To Reimburse For Insurance Premium?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life sphere, locating a Maricopa Agreement to Reimburse for Insurance Premium suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the Maricopa Agreement to Reimburse for Insurance Premium, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Maricopa Agreement to Reimburse for Insurance Premium:

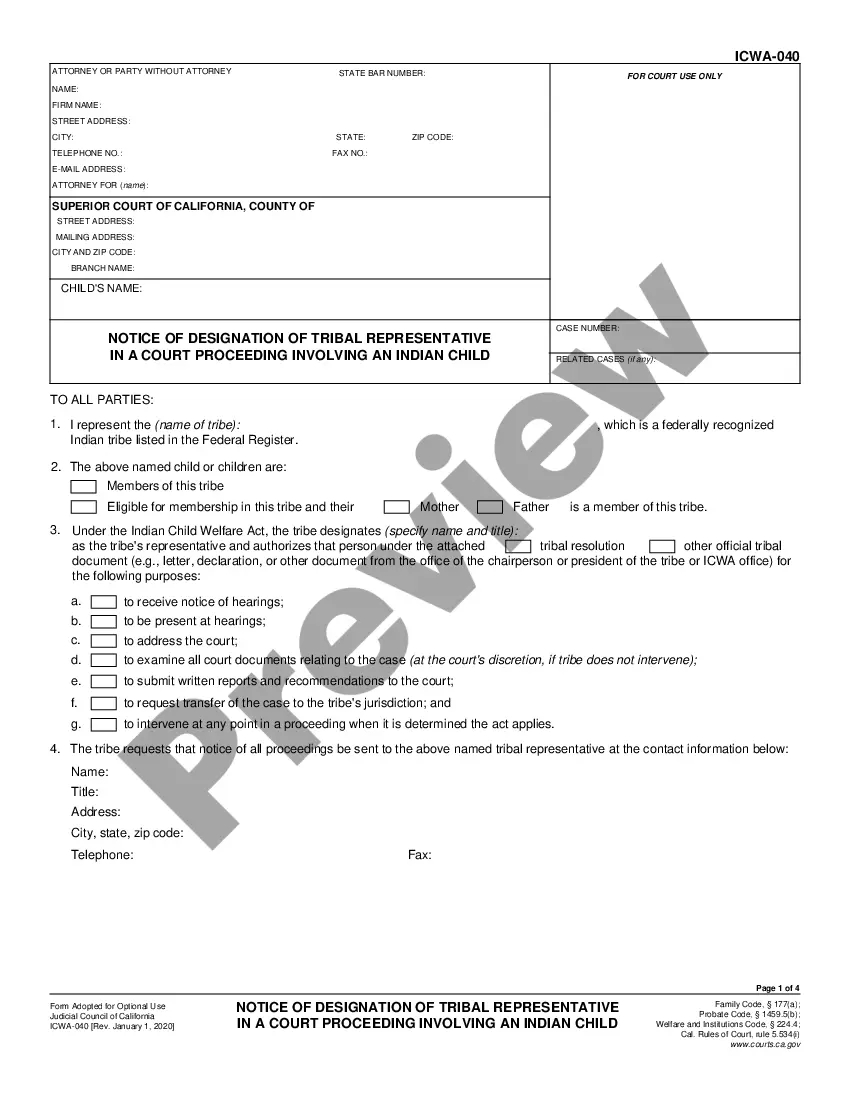

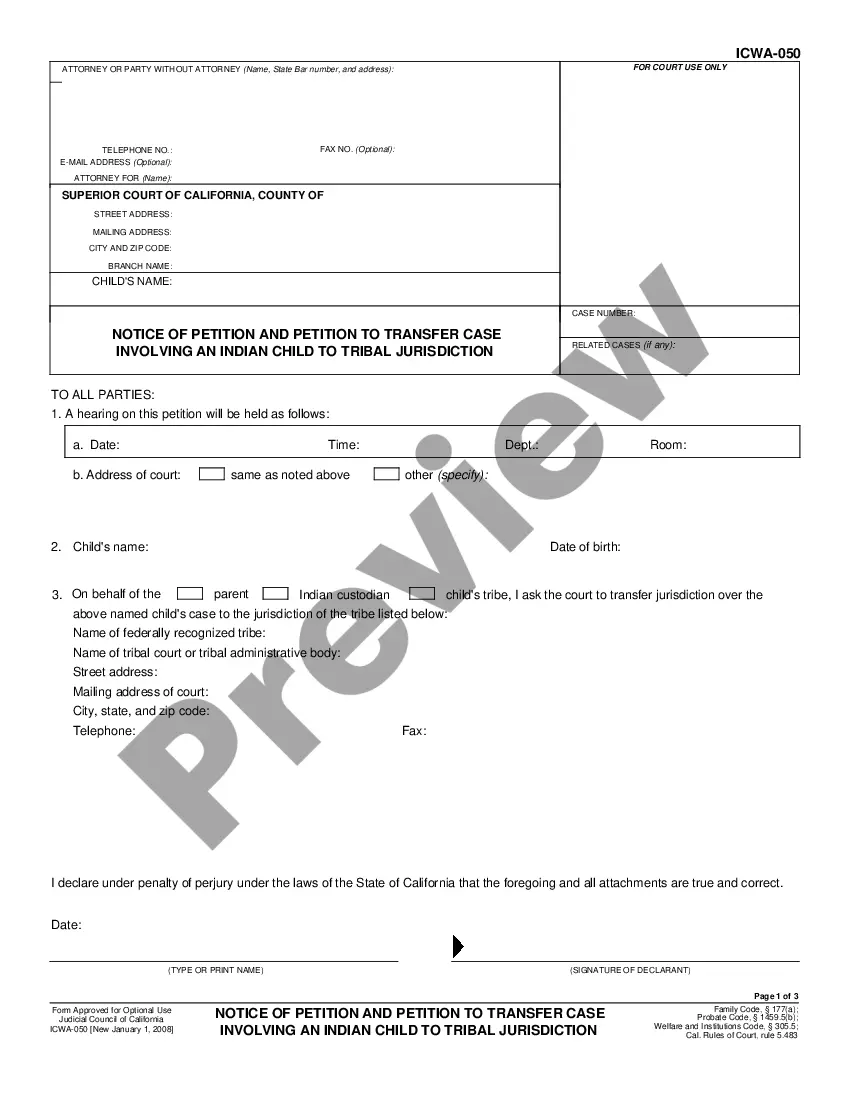

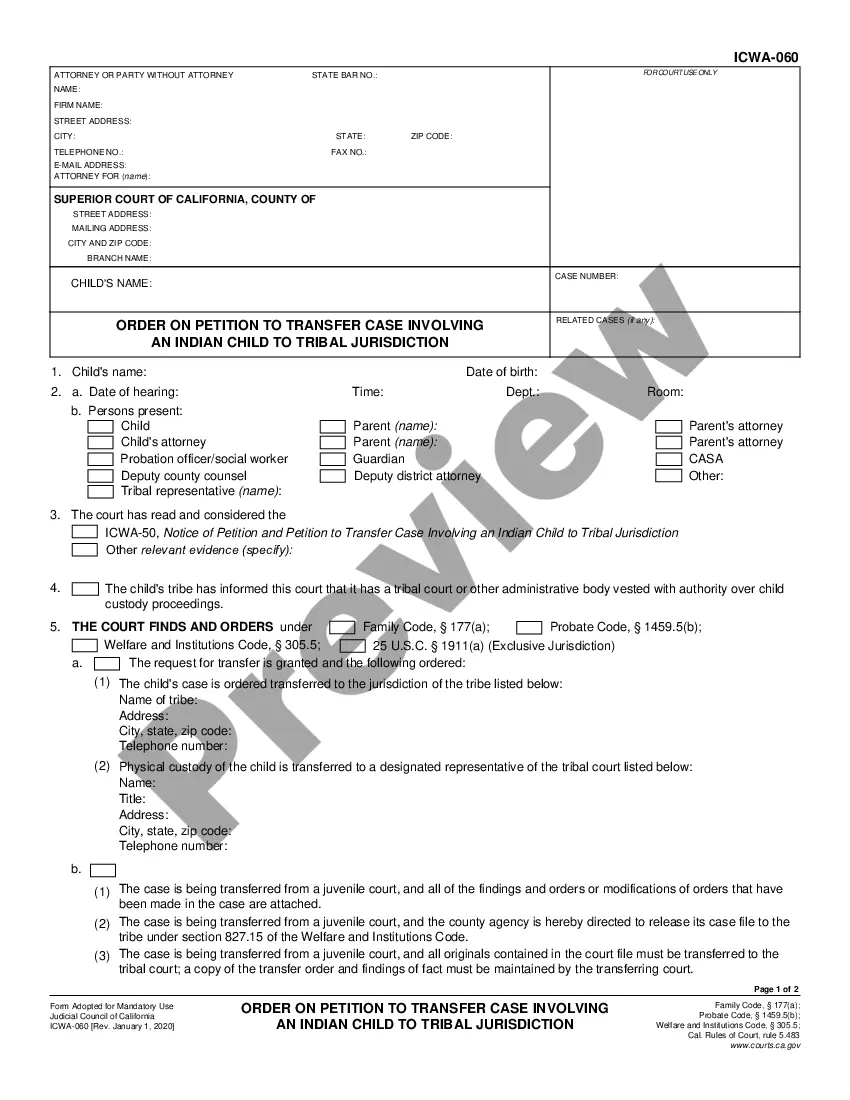

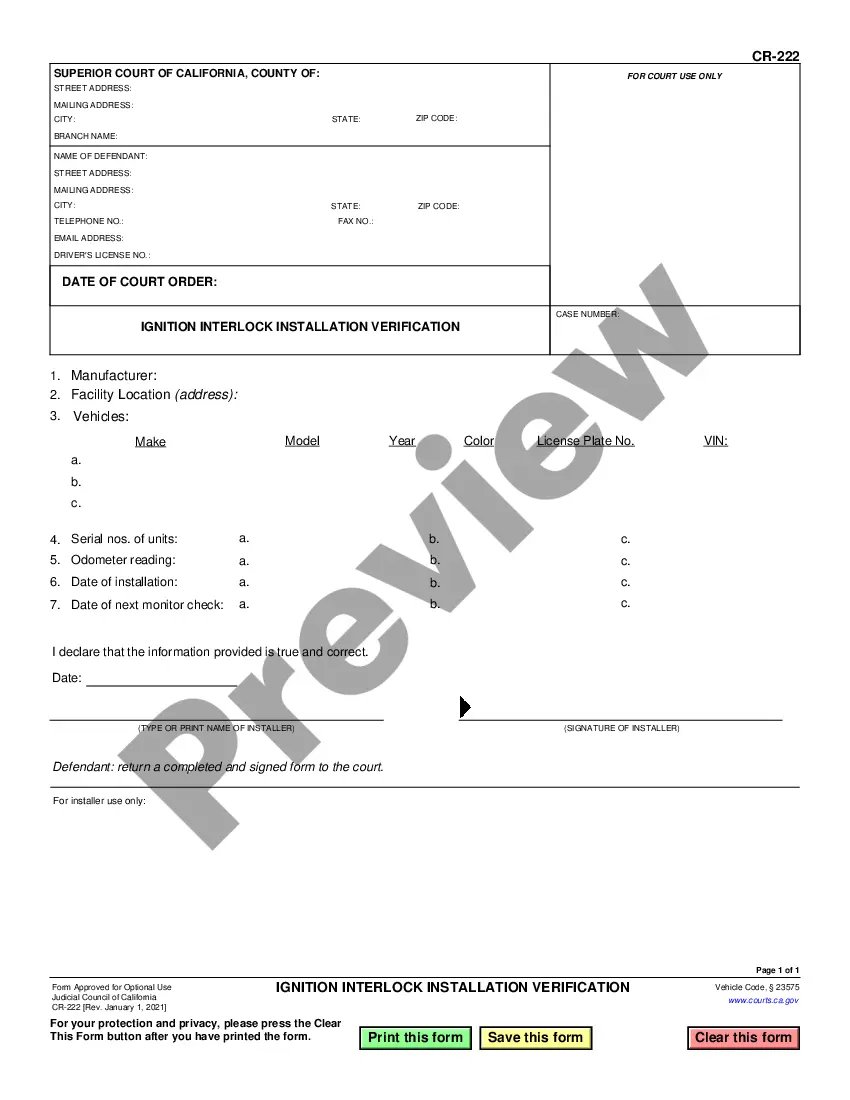

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Agreement to Reimburse for Insurance Premium.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!