San Diego California Agreement to Reimburse for Insurance Premium: A Detailed Description In San Diego, California, an Agreement to Reimburse for Insurance Premium is a legally binding contract executed between two parties wherein one party agrees to reimburse the other party for insurance premiums incurred. This agreement serves as a protection mechanism for both parties involved, ensuring that insurance costs are fairly distributed and liabilities are mitigated. This agreement is commonly seen in various contexts, such as: 1. Employee Reimbursement Agreements: Many employers in San Diego, California, offer health insurance as a part of their employee benefits package. In such cases, an Agreement to Reimburse for Insurance Premium may be drafted to outline the terms and conditions under which the employer agrees to reimburse the employee for a portion or all of the insurance premiums paid. This type of agreement plays a crucial role in attracting and retaining talent, as it provides an added incentive for employees to choose a specific employer due to the reimbursement benefits offered. 2. Tenant-Landlord Agreements: In rental agreements within San Diego, California, landlords may sometimes include a clause that requires tenants to obtain rental insurance. In turn, the landlord may enter into an Agreement to Reimburse for Insurance Premium with the tenant whereby, upon providing proof of insurance and payment of premiums, the landlord agrees to reimburse the tenant for a specified amount. This arrangement safeguards both parties, with the landlord ensuring that their property is protected, and the tenant having peace of mind knowing they will be partially compensated should any unforeseen insurable risks occur. 3. Partnership or Joint Venture Agreements: In business collaborations, such as partnerships or joint ventures based in San Diego, California, there may be a need for parties involved to secure various types of insurance. To facilitate equitable distribution of insurance costs, an Agreement to Reimburse for Insurance Premium may be established, ensuring that each partner or venture member is reimbursed for their respective insurance premiums. This agreement enables transparency and the fair sharing of financial responsibilities, bolstering the trust and confidence among involved parties. Relevant keywords for this topic include: San Diego, California, Agreement, Reimburse, Insurance Premium, Employee Reimbursement, Health Insurance, Tenant-Landlord, Rental Agreement, Rental Insurance, Landlord, Tenant, Partnership, Joint Venture, Business Collaboration, Equitable Distribution, Insurance Costs, Financial Responsibilities. In conclusion, a San Diego California Agreement to Reimburse for Insurance Premium is a crucial mechanism that helps regulate the reimbursement of insurance premiums within various contexts such as employee reimbursement agreements, tenant-landlord agreements, and partnership or joint venture agreements. The agreement ensures fair distribution of insurance costs and fosters trust and transparency among the parties involved.

San Diego California Agreement to Reimburse for Insurance Premium

Description

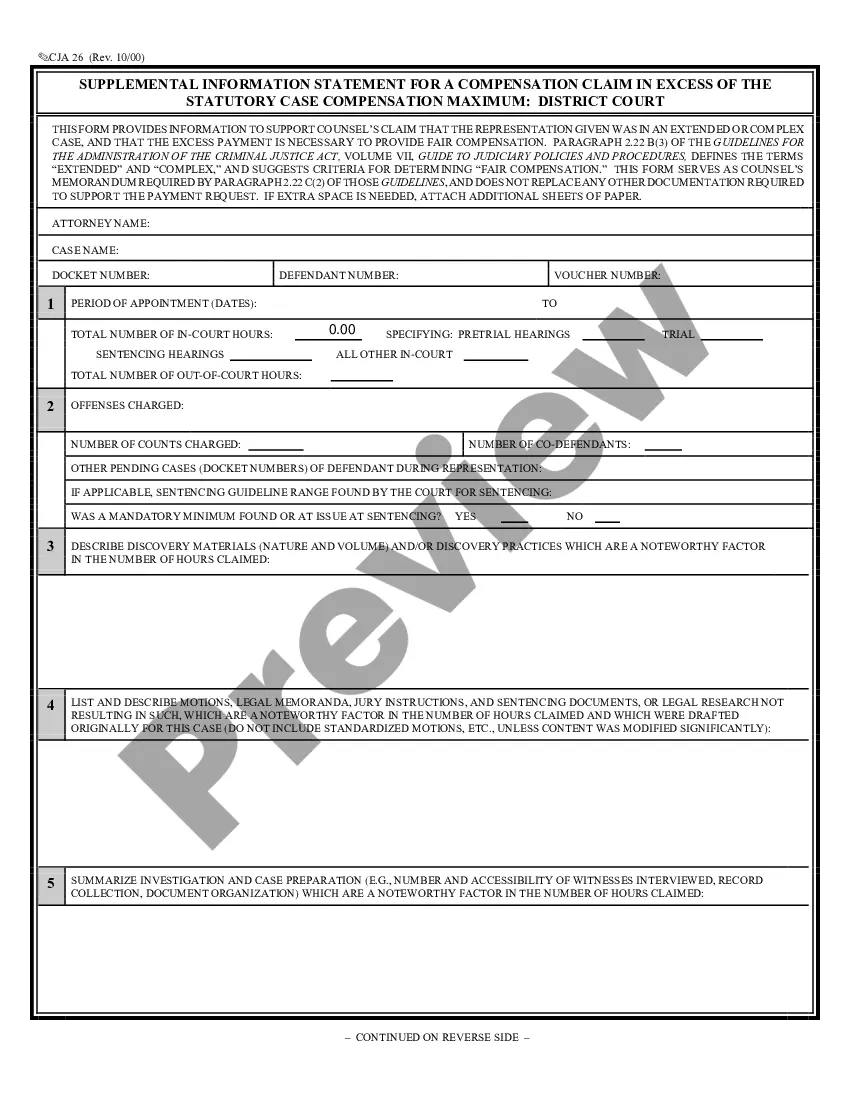

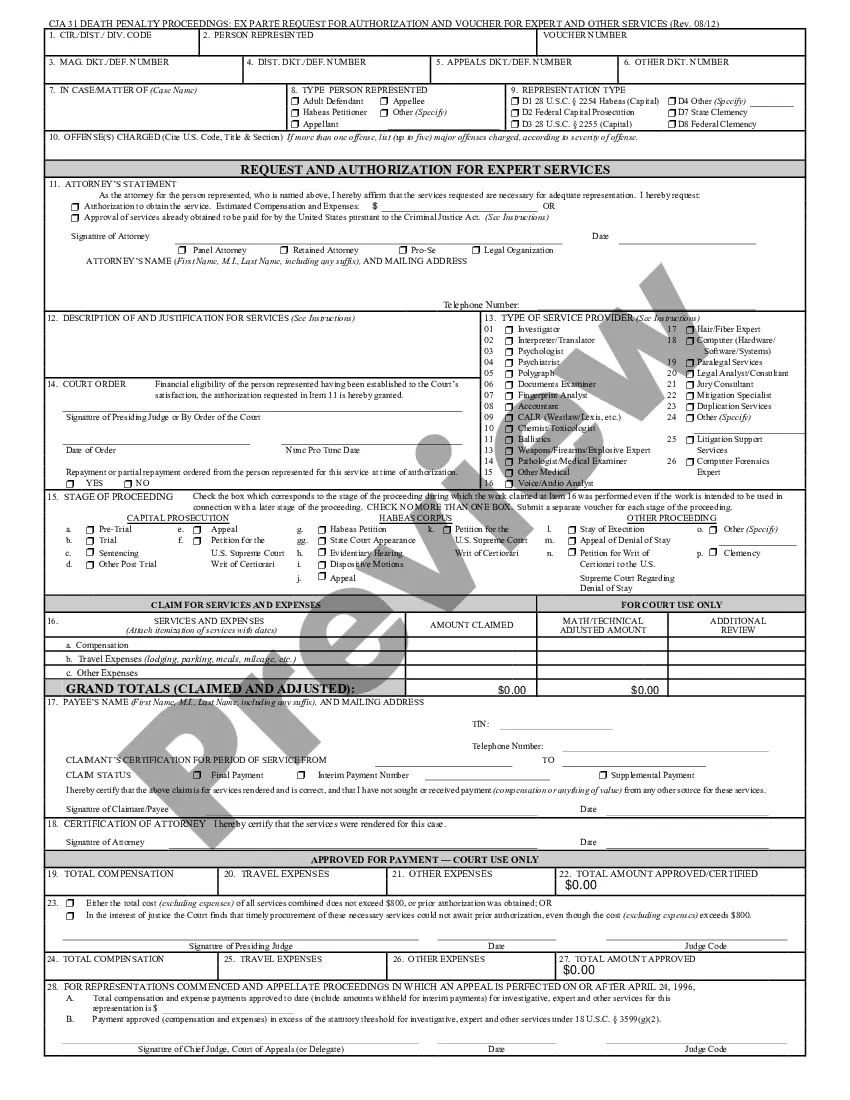

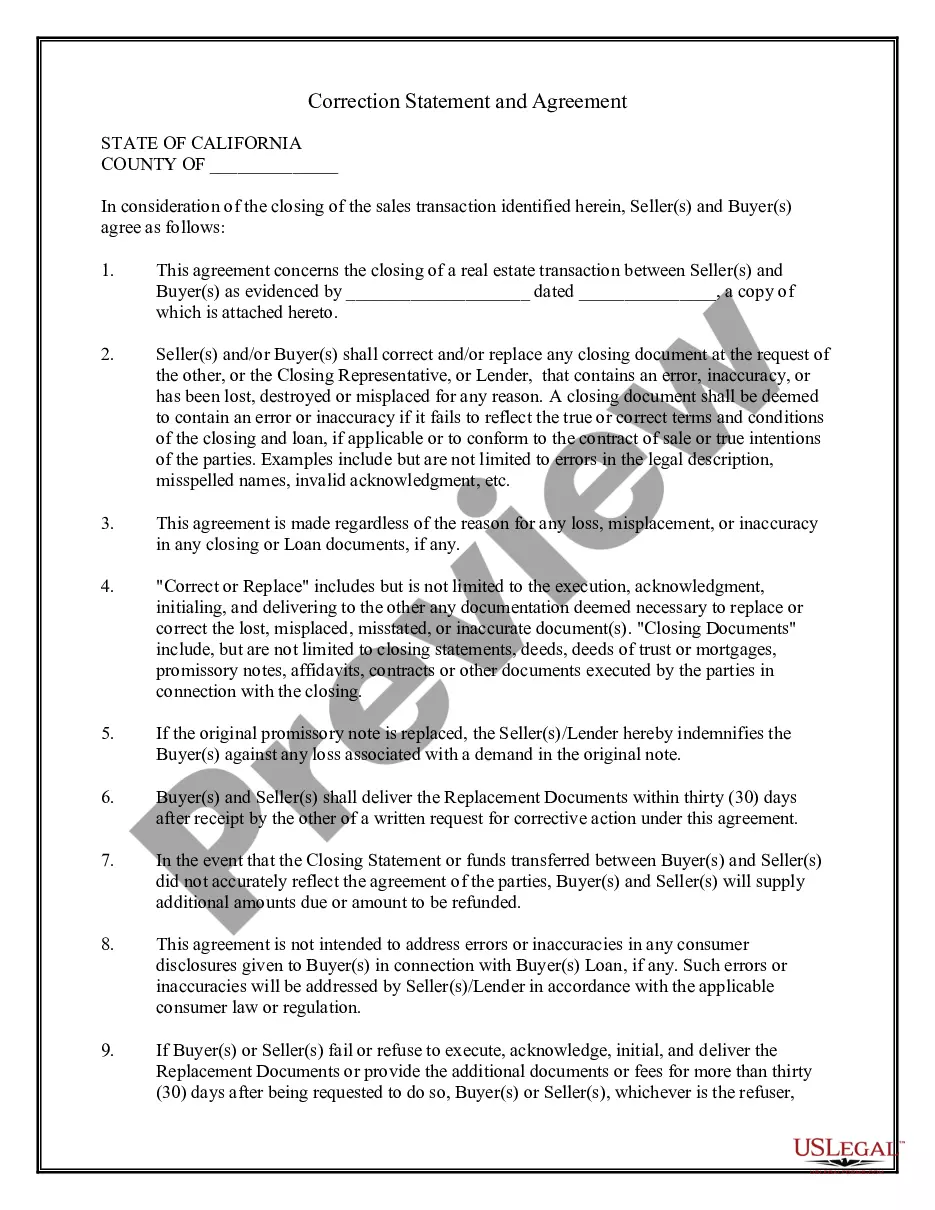

How to fill out San Diego California Agreement To Reimburse For Insurance Premium?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business objective utilized in your county, including the San Diego Agreement to Reimburse for Insurance Premium.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the San Diego Agreement to Reimburse for Insurance Premium will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the San Diego Agreement to Reimburse for Insurance Premium:

- Make sure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the San Diego Agreement to Reimburse for Insurance Premium on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!