The Nassau New York Narrative Appraisal Form is a comprehensive and detailed documentation platform used in the real estate industry for evaluating properties located in Nassau County, New York. This specific appraisal form serves as a standardized tool to assess various types of properties, including residential, commercial, and industrial properties. The Nassau New York Narrative Appraisal Form is designed to provide a systematic approach in gathering critical property information and conducting a thorough evaluation. It consists of several sections focusing on property details, market analysis, sales comparison approach, income approach, cost approach, and overall property valuation. The property details section of the appraisal form requires the appraiser to record pertinent information such as property address, legal description, zoning classification, and physical description. This section also covers property characteristics such as lot size, building size, number of units, and overall condition. The market analysis section involves analyzing the local real estate market and determining trends, supply and demand factors, economic conditions, and any influences that may affect the property's value. The appraiser performs extensive research to gather data on recent sales, active listings, and market indicators to support their analysis. The sales comparison approach introduces a comparative analysis of the subject property with recently sold properties in the immediate vicinity. This approach helps determine the property's value based on similarities and differences in terms of size, location, age, condition, and features. The income approach focuses on properties generating income, such as rental apartments or commercial spaces. This approach involves analyzing the property's income potential, rental rates in the area, and applying various capitalization methods to estimate its value. The cost approach examines the cost involved in constructing a similar property from scratch, considering factors such as land value, construction materials, labor, and depreciation. This approach is commonly used for new or unique properties where comparable sales data may be limited. Overall property valuation is the final step of the Nassau New York Narrative Appraisal Form, where the appraiser consolidates all the data, analysis, and approaches to provide an opinion of value for the subject property. This value is supported by the appraiser's expertise, research, and adherence to professional appraisal standards. While the Nassau New York Narrative Appraisal Form is a standard form used for various property types, there may be specific versions tailored for different purposes. For example, there may be separate forms for residential properties, commercial properties, vacant land, or specialized properties such as agricultural or industrial properties. The intent is to ensure a thorough and accurate appraisal process specific to the property type being assessed. In conclusion, the Nassau New York Narrative Appraisal Form serves as a comprehensive and standardized tool used by real estate appraisers to evaluate properties in Nassau County, New York. It encompasses various sections that cover property details, market analysis, sales comparison, income approach, cost approach, and overall property valuation. Different versions of the appraisal form cater to specific property types, ensuring a tailored and accurate assessment.

Nassau New York Narrative Appraisal Form

Description

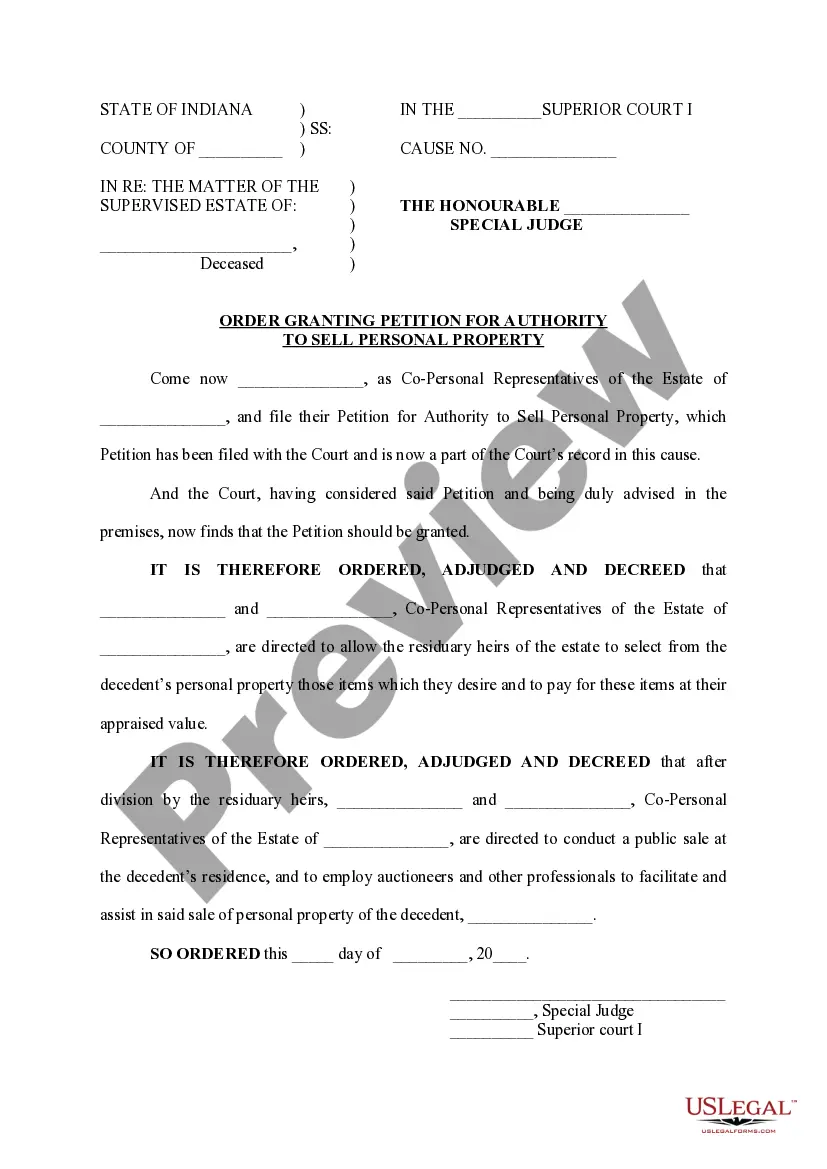

How to fill out Nassau New York Narrative Appraisal Form?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Nassau Narrative Appraisal Form is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Nassau Narrative Appraisal Form. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Narrative Appraisal Form in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

You can challenge your Assessed Value by appealing with the NYC Tax Commission, an independent agency....If you disagree with your Assessed Value reduce your property's assessment; change its tax class; adjust exemptions.

Property Values Are Higher In comparison, the median price of homes across the USA is about $250,000. This means that property values in Long Island are more than twice the national average. For this reason, those who live here will naturally have higher property assessment rates.

Properties outside New York City and Nassau County Use Form RP-524, Complaint on Real Property Assessment to grieve your assessment. The form can be completed by yourself or your representative or attorney. File the grievance form with the assessor or the board of assessment review (BAR) in your city or town.

There are two basic ways you can reduce your Property Taxes: File A Property Tax Grievance. A Property Tax Grievance is a formal complaint that is filed contesting a town's assessed value of a specific property.Lower Your Assessment through Exemptions.

Use Form RP-524, Complaint on Real Property Assessment to grieve your assessment. The form can be completed by yourself or your representative or attorney. File the grievance form with the assessor or the board of assessment review (BAR) in your city or town.

Nassau County - the Assessment Review Commission meets throughout the year, but complaints must be filed by March 1.

Who has the burden of proof for an assessment change when a homeowner appeals an assessment? Property owners can object to an assessed value of their property, within a certain period, by presenting evidence that the assessor made an error to a review board or appeal board.

The easiest way to lower your assessment is to apply for a STAR exemption. STAR is New York State's School Tax Relief Program that includes a school property tax rebate program and a partial property tax exemption from school taxes.

The tax grievance process is a lengthy and complicated one; Heller notes that it can take anywhere from 12 to 18 months, from beginning to end, so if you make a habit of grieving your taxes every single year, you'll often find it becomes a cumulative process, with each year's grievance overlapping with the next one.

If you believe the assessment is inaccurate, you may appeal by filing an application for correction with the Assessment Review Commission by March 1, 2022. You can appeal online from this site from January 3, 2022 to March 1, 2022. File online.