Travis Texas Employee Evaluation Form for Veterinarian

Description

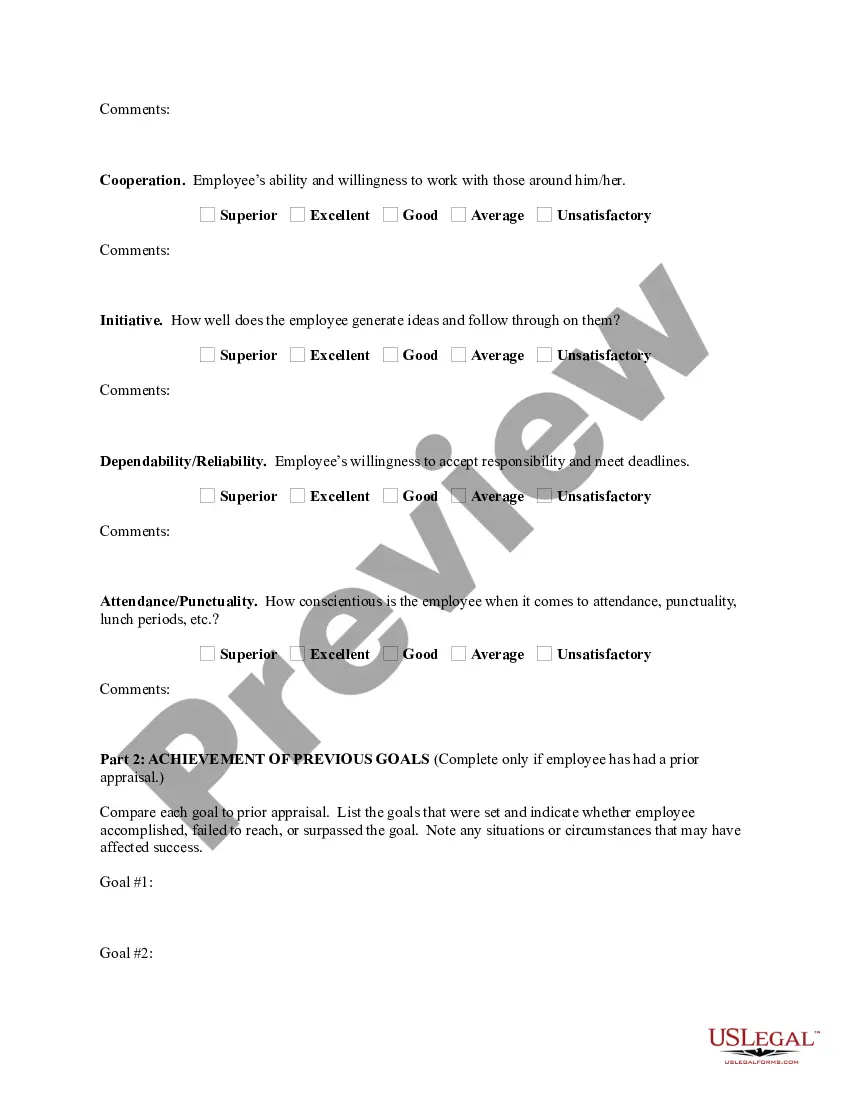

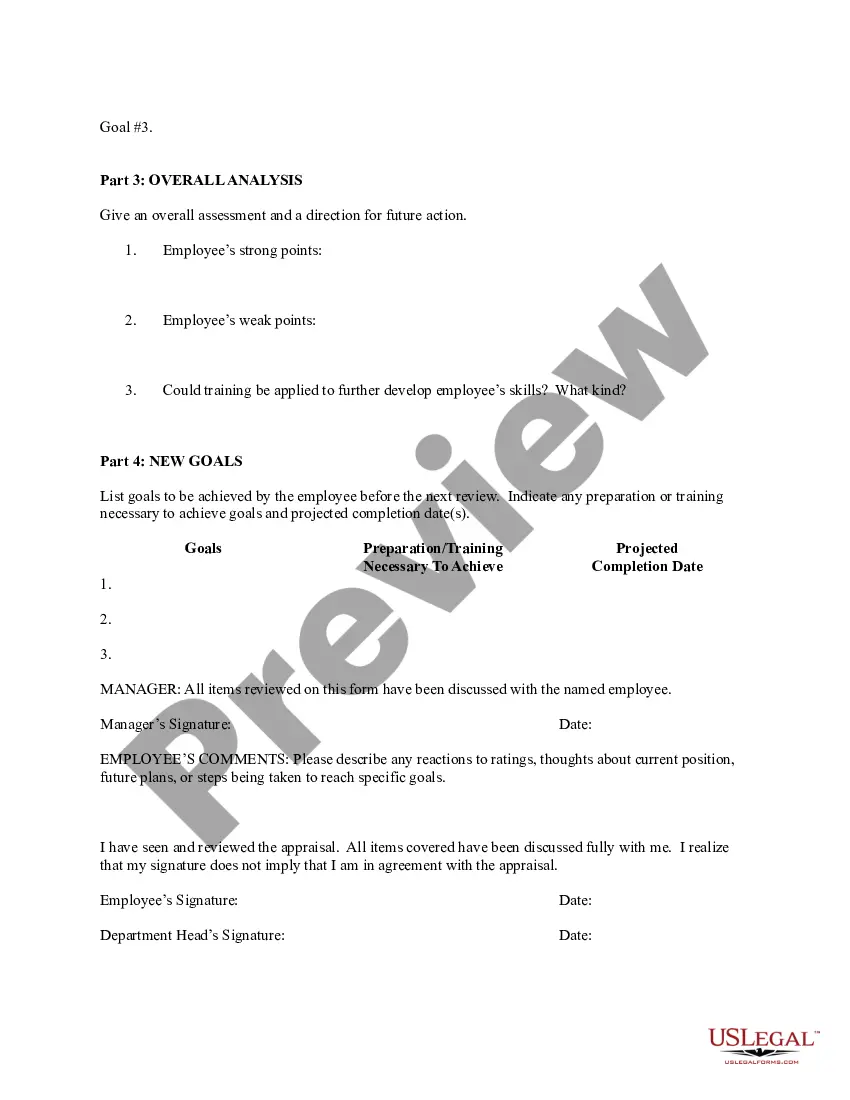

How to fill out Employee Evaluation Form For Veterinarian?

Drafting legal documents can be onerous. Moreover, if you opt to engage a lawyer to create a business agreement, documentation for property transfer, pre-nuptial contract, divorce files, or the Travis Employee Evaluation Form for Veterinarian, it might set you back significantly.

So what is the most sensible approach to conserve time and resources while producing legitimate documents that adhere to your state and local laws? US Legal Forms is an excellent option, whether you're seeking templates for personal or corporate purposes.

Don't fret if the form does not meet your specifications - search for the correct one in the header. Click Buy Now when you identify the desired template and select the most suitable subscription. Log In or register for an account to secure your subscription. Complete payment with a credit card or via PayPal. Choose the document format for your Travis Employee Evaluation Form for Veterinarian and download it. Once completed, you can either print it out and fill it in by hand or upload the template to an online editor for a quicker and more efficient completion. US Legal Forms enables you to reuse all the documents you’ve acquired multiple times - you can access your templates in the My documents section of your profile. Give it a go today!

- US Legal Forms boasts the largest online repository of state-specific legal forms, supplying users with the latest and professionally vetted documents for any scenario, all consolidated in one location.

- Consequently, if you require the most recent version of the Travis Employee Evaluation Form for Veterinarian, you can readily locate it on our website.

- Acquiring the documents takes minimal time.

- Users who have an existing account should ensure their subscription is active, Log In, and select the template utilizing the Download button.

- If you haven't yet subscribed, here's how to obtain the Travis Employee Evaluation Form for Veterinarian.

- Browse the page and confirm that there is a template for your area.

- Review the form description and employ the Preview option, if accessible, to ensure it’s the template you require.

Form popularity

FAQ

The Asset Approach estimates a value of a veterinary practice based on the value of all the assets, including goodwill. The Income Approach is based on the cash flow of the practice. Under the Income Approach, the value of a practice will depend on how profitable the practice is.

Veterinary practices are normally valued based on Earnings Before Interest, Taxation, Depreciation and Amortisation (EBITDA) and a multiplier. The EBITDA multiplier creates practice value, including goodwill and certain tangible assets for example property, included in the deal may increase the selling price further.

The most important consideration when building a successful veterinary practice is hiring a team of professional employees who care about animals and people. The connection that pet owners feel to your staff members may be what keeps them coming back and recommending it to pet-loving friends.

Target earnings before interest, tax, depreciation and amortization (EBITDA) is typically 14% to 17%, but the average is 11% to 12% for small-animal practices. Farquer and McCormick consider a practice of any type to be financially healthy if it is 14% to 18% EBITDA.

If you aren't quite sure what makes a good vet, here's what to look for. Good: They Care About Comfort.Good: They're Willing To Explain.Good: They Run Thorough Tests.Good: They Listen To You.Bad: They Rush You.Bad: They Try To Sell You Unnecessary Things.Bad: You Feel Uncomfortable.

Unfortunately, one of the trends we are seeing is that the average practice profitability is 10-12%, with many practices in the 7-10% range. This is a double whammy for average profitability and below practice owners: You have less cash in your pocket from smaller profits each year.

Anecdotally, practice value has been expected to be between 2/3rd's of gross revenue and 100% of 1 year's gross revenue. Often, practice owners will blindly offer that their practice is worth anywhere between 2/3rd's and 1 year's gross revenue.

(sterile triamcinolone acetonide suspension USP) Provides fast relief from pain, inflammation, and allergic signs in dogs and cats. Important Safety Information.

The money available in a veterinary practice to pay owners and others for management duties is typically 3 to 4 percent of the practice's gross income. So, if the gross income of your practice last year was $1.5 million, you can budget $45,000 to $60,000 for management.

Target earnings before interest, tax, depreciation and amortization (EBITDA) is typically 14% to 17%, but the average is 11% to 12% for small-animal practices. Farquer and McCormick consider a practice of any type to be financially healthy if it is 14% to 18% EBITDA.