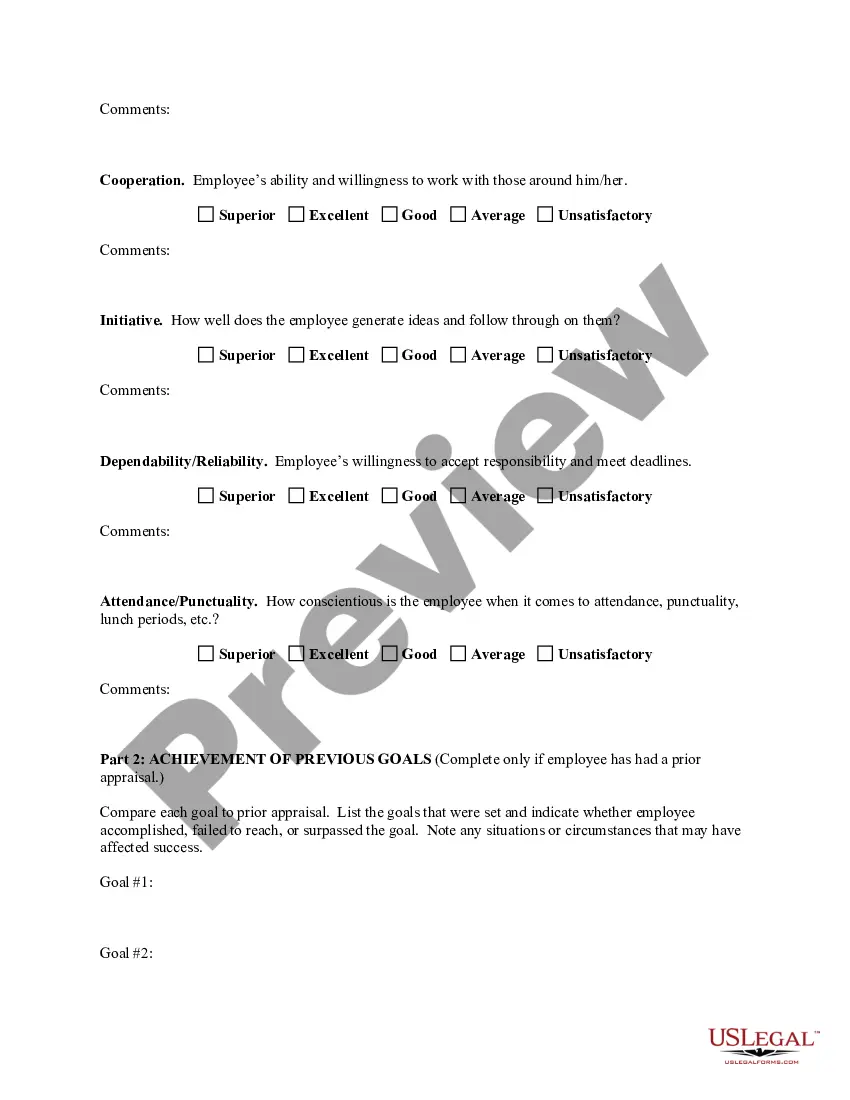

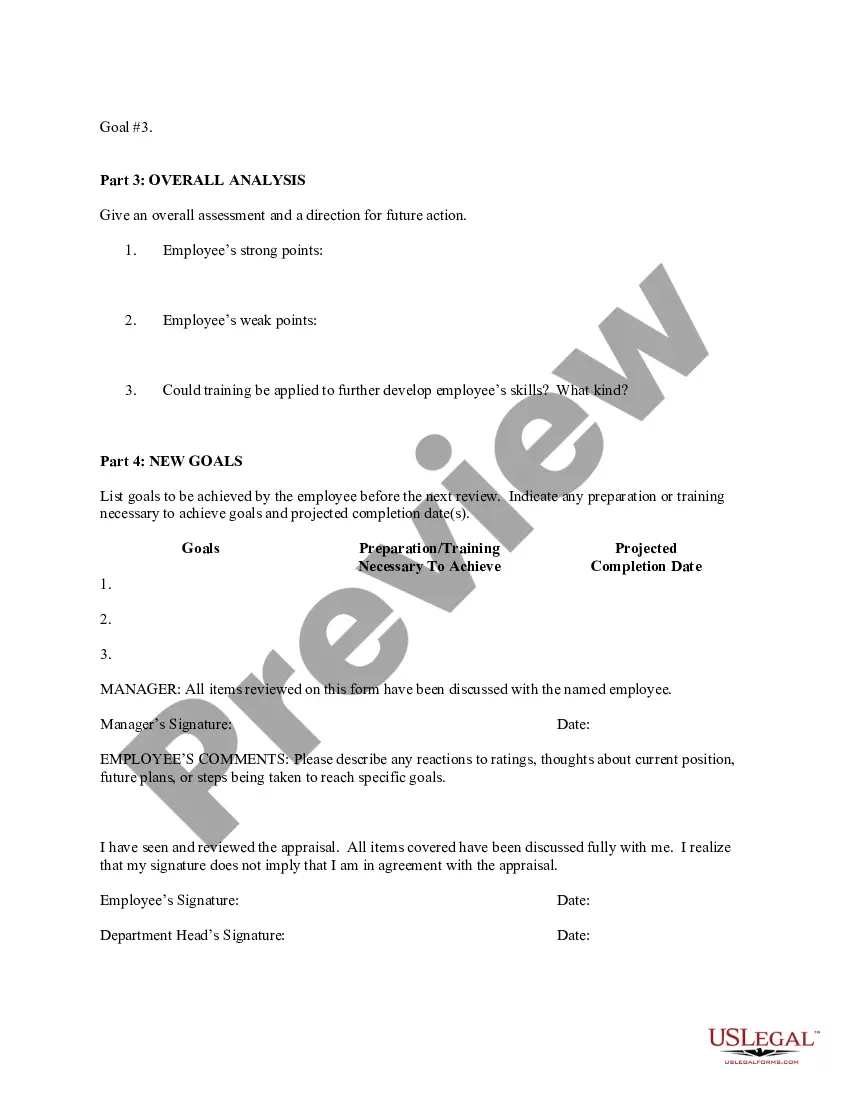

The Alameda California Employee Evaluation Form for Accountant is a comprehensive tool used by businesses and organizations located in the city of Alameda, California, to assess the performance of their accounting professionals. This evaluation form helps employers gather objective and subjective data to measure the capabilities, work ethic, and overall performance of their accountants. Designed specifically for the accounting field, this evaluation form consists of various sections and criteria that assess the accountant's skills, knowledge, and expertise in financial management, bookkeeping, tax preparation, auditing, and other accounting functions. The form also incorporates areas to evaluate the employee's ability to meet deadlines, attention to detail, problem-solving skills, and ability to work independently or as part of a team. Some important sections of the Alameda California Employee Evaluation Form for Accountant may include: 1. Technical Skills Assessment: This section assesses the accountant's proficiency in using accounting software, conducting financial analysis, interpreting financial statements, and performing reconciliations and audits. 2. Quality of Work: This section evaluates the accuracy and precision of the accountant's work, including attention to detail, error detection, and adherence to accounting standards and regulations. 3. Communication and Collaboration: This section examines the accountant's ability to communicate effectively with team members and clients, provide clear and concise explanations, and work collaboratively in cross-functional teams. 4. Organization and Time Management: This section assesses the accountant's ability to prioritize tasks, meet deadlines, manage workload efficiently, and effectively multitask. 5. Professionalism and Ethics: This section evaluates the accountant's adherence to professional ethics codes, such as confidentiality, integrity, and objectivity. It also assesses their ability to maintain professional relationships and handle sensitive financial information responsibly. 6. Professional Development and Initiative: This section examines the accountant's commitment to ongoing professional development, their willingness to learn and adapt to new technologies or regulations, and their ability to take initiative to improve processes or identify potential issues. There may be variations of the Alameda California Employee Evaluation Form for Accountant tailored to specific industries or job levels within the accounting field. For instance: 1. Alameda California Employee Evaluation Form for Senior Accountant 2. Alameda California Employee Evaluation Form for Staff Accountant 3. Alameda California Employee Evaluation Form for Public Accountant 4. Alameda California Employee Evaluation Form for Corporate Accountant These variations are designed to meet the unique expectations and responsibilities associated with different types of accounting positions within the Alameda, California, business community.

Alameda California Employee Evaluation Form for Accountant

Description

How to fill out Alameda California Employee Evaluation Form For Accountant?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Alameda Employee Evaluation Form for Accountant without professional help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Alameda Employee Evaluation Form for Accountant by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Alameda Employee Evaluation Form for Accountant:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

Here are a few examples: I always go out of my way to help co-workers. I make sure everyone on my team feels comfortable when exchanging ideas. I look for ways to keep my team on track and make sure important milestones are met. I brainstorm ways to motivate others and freely give praise when performance goals are met.

Best Practices When Creating an Evaluation Form Make it easy to use. Ensure that the information your evaluation form seeks is clear and concise.Determine the focus of the form. There needs to be a clear purpose.Establish a clearly defined rating scale.

For most staff positions, the job performance areas that should be included on a performance evaluation form are job knowledge and skills, quality of work, quantity of work, work habits and attitude.

Dependability Has remained one of our most trustworthy team members Always very dependable in every situation Always ready to do whatever it takes to get the work done Well known for dependability and readiness to work hard Has been a faithful and trustworthy employee

When you fill the form: Be honest and critical. Analyze your failures and mention the reasons for it.Keep the words minimal.Identify weaknesses.Mention your achievements.Link achievements to the job description and the organization's goals.Set the goals for the next review period.Resolve conflicts and grievances.

What to Include in an Employee Evaluation Form? Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.

An employee evaluation form is a performance review tool used to track employee progress by collecting information about employees' skills, goals, and accomplishments.

How to write an employee evaluation Review the employee's job description. Get a current copy of each person's job description and review the requirements.Highlight areas of improvement.Compare strengths and weaknesses.Recommend actionable goals.Provide constructive feedback.Welcome employee input.

What to include in an employee performance review Communication. Collaboration and teamwork. Problem-solving. Quality and accuracy of work. Attendance, punctuality and reliability. The ability to accomplish goals and meet deadlines.

Tips for writing a performance review paragraph Include specific examples to support your observations.Provide guidance for career growth and professional development opportunities.Make sure your default tone is a positive one.SMART goals.Always follow up.