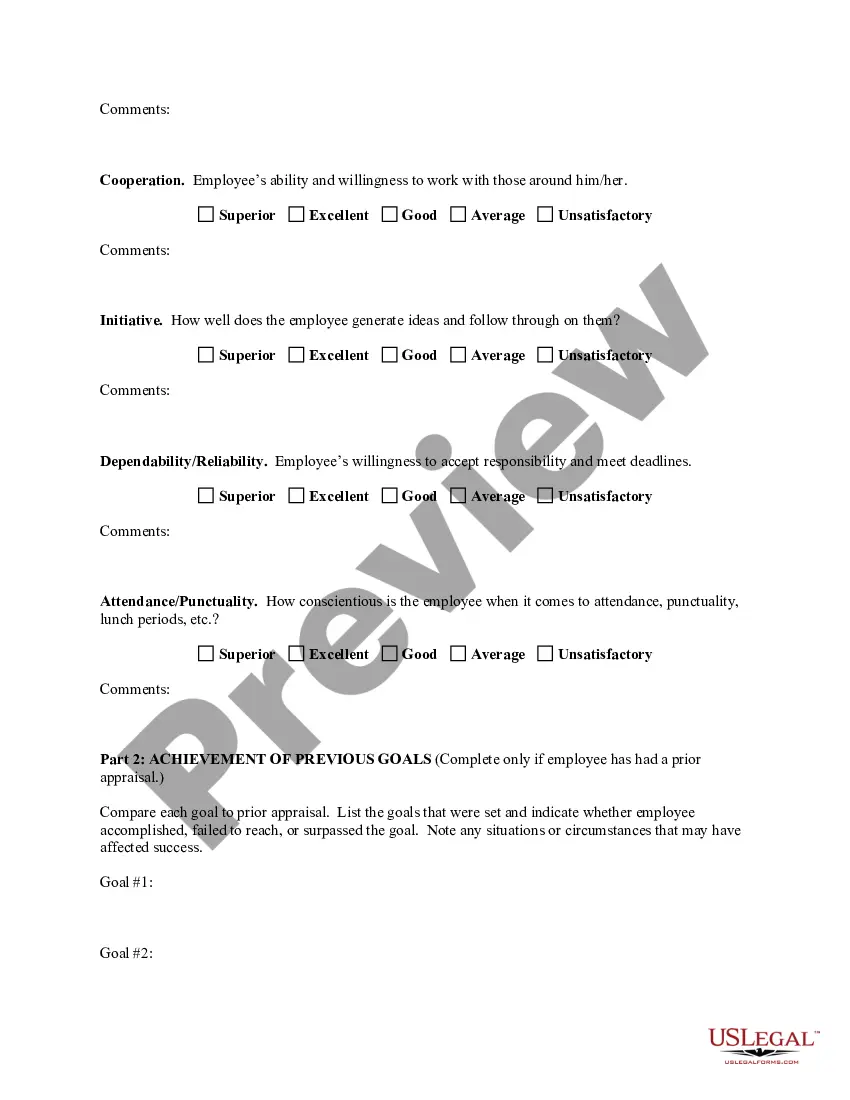

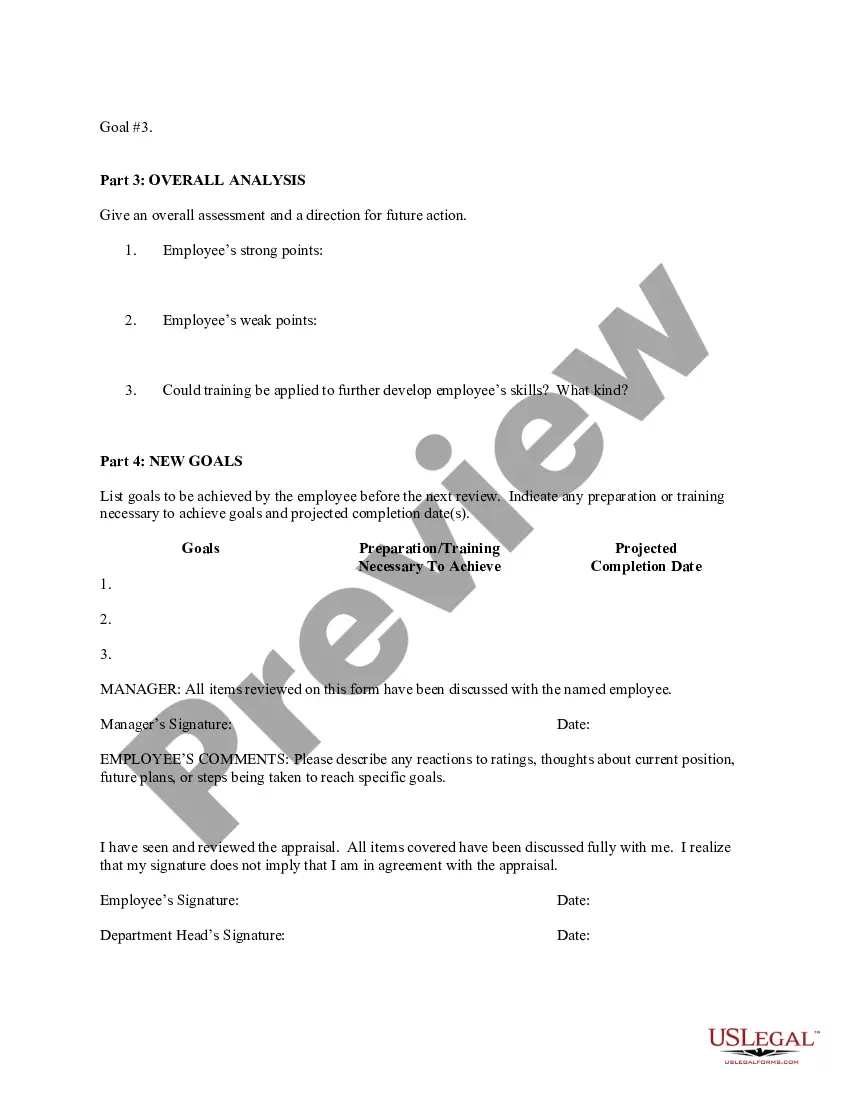

The Allegheny Pennsylvania Employee Evaluation Form for Accountant is a comprehensive tool used by organizations in Allegheny County, Pennsylvania, to assess the performance and progress of their accountants. This evaluation form provides a structured framework for analyzing an accountant's skills, competencies, and productivity in their role. It also enables employers to identify areas of improvement and opportunities for development. The Allegheny Pennsylvania Employee Evaluation Form for Accountant primarily focuses on evaluating various key aspects of an accountant's job performance, including financial management, bookkeeping, financial analysis, regulatory compliance, and software proficiency. The form typically consists of multiple sections, each designed to assess different aspects of an accountant's responsibilities. One section of the evaluation form might be dedicated to evaluating an accountant's proficiency in financial management. This section may include criteria such as budgeting, forecasting accuracy, cost control measures, and financial reporting. Accountants are assessed on their ability to efficiently manage financial resources, identify potential risks, and provide recommendations for financial improvements. Another section might concentrate on an accountant's bookkeeping skills. In this section, the evaluation form may assess the accountant's accuracy in recording financial transactions, maintaining ledgers, reconciling accounts, and preparing financial statements. Additionally, the form might evaluate the accountant's adherence to accounting principles and standards. Financial analysis is another significant component of the Allegheny Pennsylvania Employee Evaluation Form for Accountant. This section gauges an accountant's ability to analyze financial data, interpret trends, and prepare insightful reports. The evaluation may assess the accountant's proficiency in financial ratio analysis, financial forecasting, and presenting recommendations based on the analysis. Regulatory compliance is a critical aspect that is evaluated in this form. Employers assess whether the accountant is up-to-date with relevant financial regulations such as tax laws, Generally Accepted Accounting Principles (GAAP), and industry-specific regulations. The evaluation might focus on the accountant's adherence to these regulations and their ability to ensure compliance. Software proficiency is evaluated in many Allegheny Pennsylvania Employee Evaluation Forms for Accountants. This section assesses an accountant's familiarity with accounting software, spreadsheet applications, database management, and other relevant tools. It evaluates their ability to effectively use this software to streamline accounting processes, generate accurate reports, and improve overall efficiency. While the content and design of the Allegheny Pennsylvania Employee Evaluation Form for Accountant may vary across organizations, the key focus areas discussed above are commonly included. Variations might occur in the scoring mechanisms, weightage assigned to different sections, and the inclusion of additional competencies specific to an organization's needs. Overall, the Allegheny Pennsylvania Employee Evaluation Form for Accountant is a valuable tool that helps employers assess and improve the performance of their accountants by evaluating their skills, knowledge, and contributions to the financial health of the organization.

Allegheny Pennsylvania Employee Evaluation Form for Accountant

Description

How to fill out Allegheny Pennsylvania Employee Evaluation Form For Accountant?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Allegheny Employee Evaluation Form for Accountant, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any activities related to paperwork execution straightforward.

Here's how to purchase and download Allegheny Employee Evaluation Form for Accountant.

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Allegheny Employee Evaluation Form for Accountant.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Allegheny Employee Evaluation Form for Accountant, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you need to cope with an extremely challenging case, we advise getting an attorney to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!