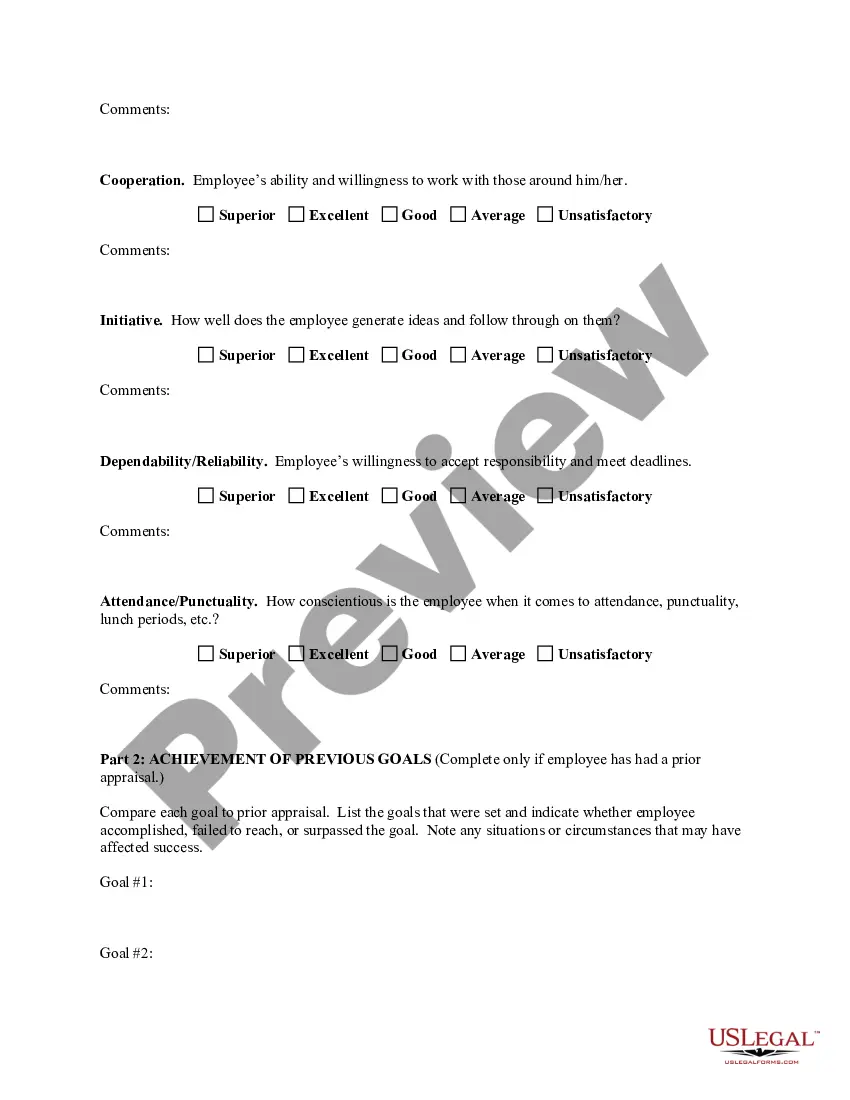

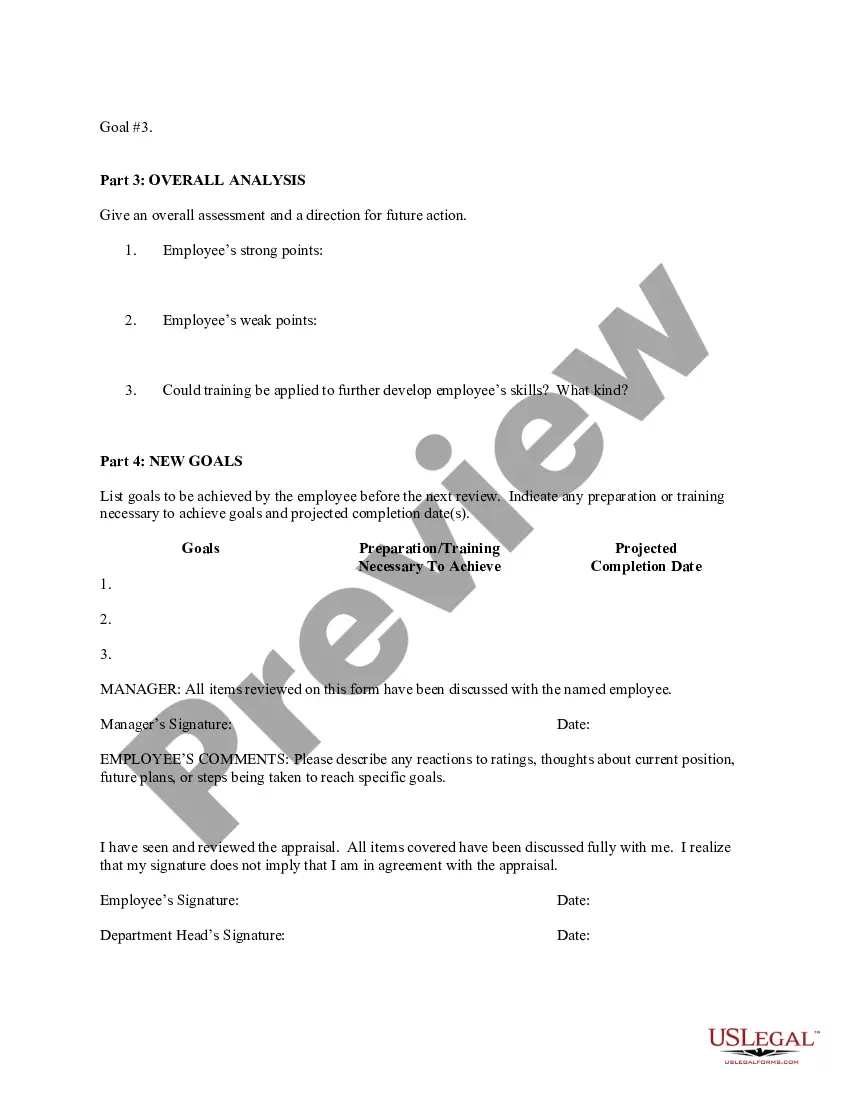

The Bronx, New York Employee Evaluation Form for Accountant is a comprehensive tool designed to assess the performance and competence of accountants working in various organizations based in the Bronx area of New York City. This evaluation form is pivotal in determining an accountant's strengths, weaknesses, and areas for improvement. The evaluation form covers various aspects of an accountant's job responsibilities, including financial analysis, bookkeeping, tax preparation, auditing, and financial reporting. It takes into account key competencies such as attention to detail, problem-solving skills, analytical abilities, communication proficiency, and adherence to deadlines and regulations. The evaluation form for accountants in the Bronx, New York may vary slightly depending on the organization's specific requirements and preferences. Therefore, it's crucial to identify different types of evaluation forms used by companies throughout the Bronx in order to cater to their unique needs. Some various types of Bronx, New York Employee Evaluation Forms for Accountants include: 1. General Accountant Evaluation Form: This form assesses an accountant's overall performance, including responsibilities related to financial reporting, cost analysis, budgeting, and adherence to accounting principles. 2. Tax Accountant Evaluation Form: This type of evaluation form focuses specifically on an accountant's proficiency in tax preparation, knowledge of tax codes and regulations, ability to identify tax-saving opportunities, and accuracy in submitting tax documents on time. 3. Audit Accountant Evaluation Form: Tailored for accountants involved in auditing, this form evaluates their understanding of auditing procedures, documentation skills, ability to identify potential risks, adherence to audit standards, and attention to detail. 4. Bookkeeping Accountant Evaluation Form: This evaluation form concentrates on an accountant's expertise in recording financial transactions, maintaining accurate and up-to-date ledgers, reconciling accounts, and providing essential financial data for analysis. 5. Financial Analyst Evaluation Form: This type of evaluation form assesses an accountant's analytical skills, forecasting abilities, financial modeling proficiency, and presentation skills while analyzing financial data to help make informed business decisions. Employers in the Bronx, New York utilize these various types of evaluation forms to effectively evaluate the performance and progress of their accountants. By objectively measuring an accountant's skills and competencies, these evaluation forms assist in identifying areas for improvement and potential training requirements, as well as in deciding compensation increases, promotions, or disciplinary actions.

Bronx New York Employee Evaluation Form for Accountant

Description

How to fill out Bronx New York Employee Evaluation Form For Accountant?

Preparing documents for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Bronx Employee Evaluation Form for Accountant without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Bronx Employee Evaluation Form for Accountant on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Bronx Employee Evaluation Form for Accountant:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!