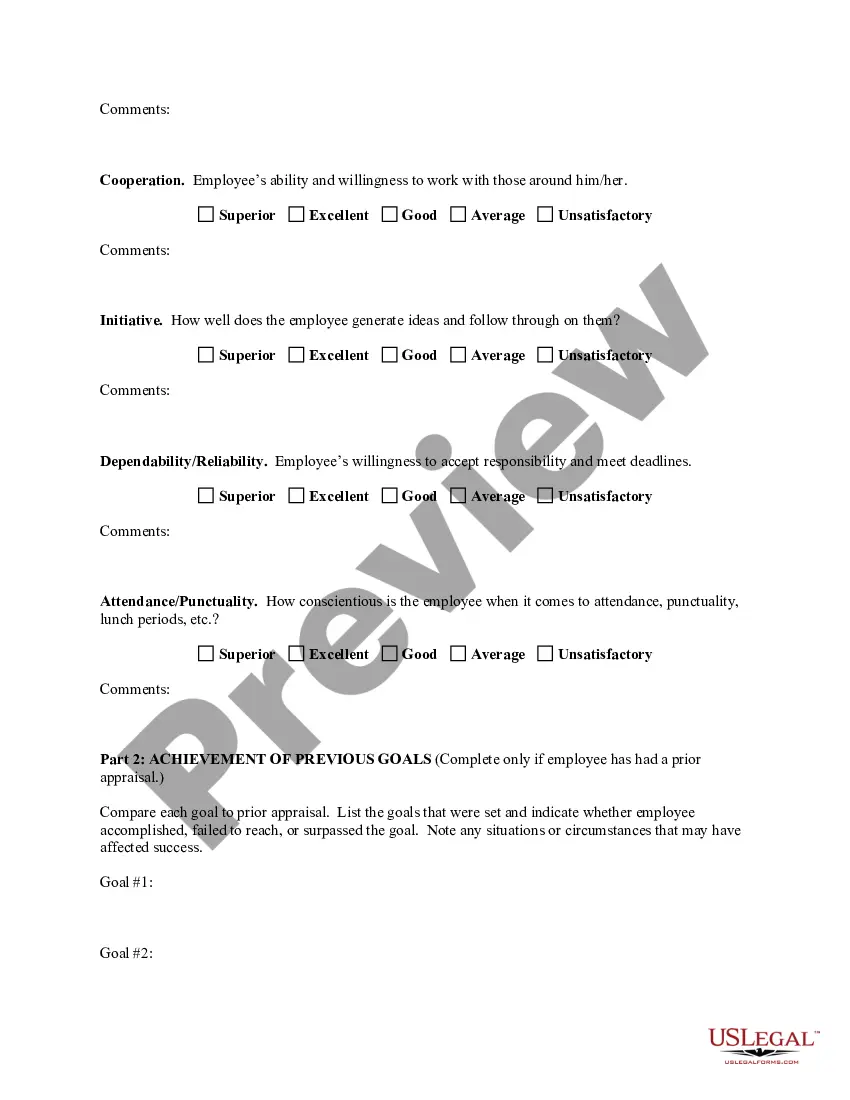

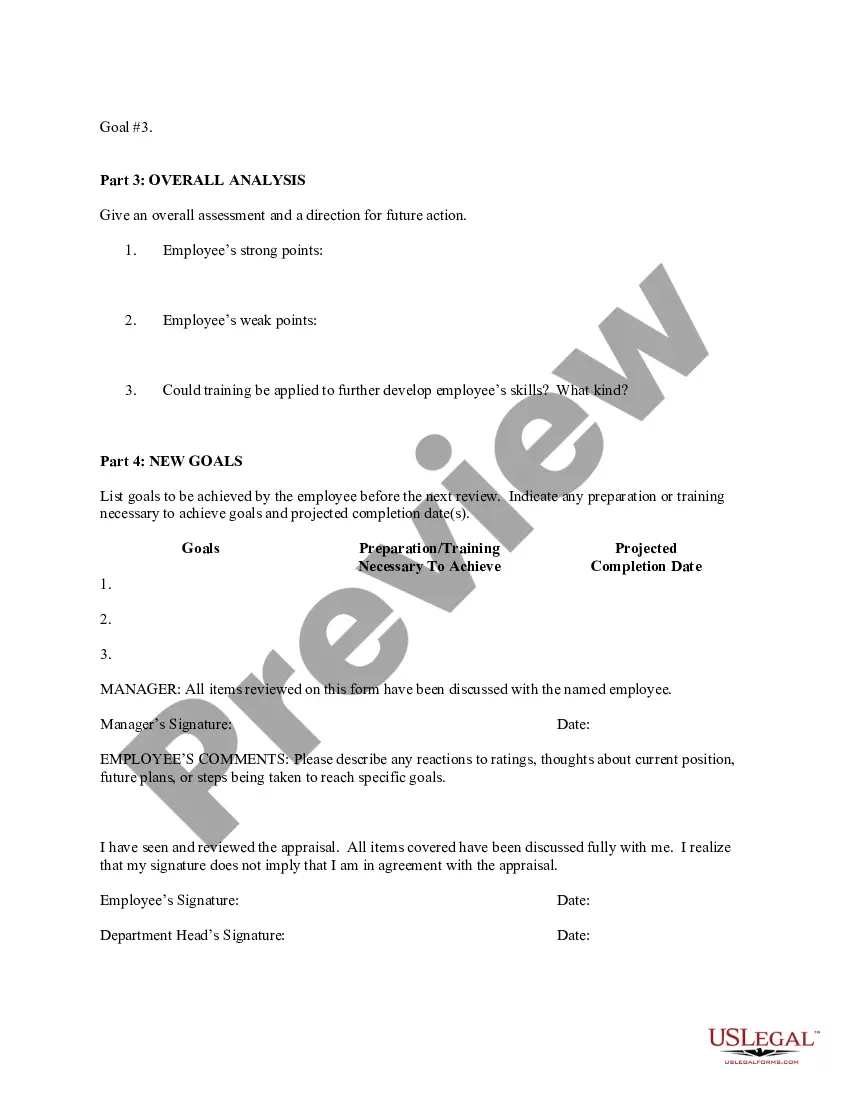

The Clark Nevada Employee Evaluation Form for Accountant is a comprehensive tool designed to assess the job performance of accountants working at Clark Nevada. This evaluation form is crucial in providing valuable feedback to accountants, identifying areas of improvement, and recognizing their contributions to the organization. By utilizing this form, Clark Nevada aims to ensure that its accountants consistently meet the company's standards of excellence in their roles. The Clark Nevada Employee Evaluation Form for Accountant covers various aspects of an accountant's job performance, including technical skills, communication abilities, problem-solving capabilities, and overall work ethic. Through a detailed rating system, supervisors can assess the accountant's proficiency in areas such as financial analysis, bookkeeping, payroll processing, tax compliance, and record-keeping. This evaluation form also takes into account the accountant's ability to meet deadlines, work well in a team, and provide accurate and reliable financial reports. Apart from performance ratings, the Clark Nevada Employee Evaluation Form for Accountant provides space for supervisors to provide specific comments and recommendations for improvement. This feature allows for constructive feedback, enabling accountants to understand their strengths and weaknesses better. It also serves as a platform for discussing career development plans and setting goals for the future. While the Clark Nevada Employee Evaluation Form for Accountant is a general form applicable to all accountants, there might be variations or additional forms developed to assess accountants in specialized roles or levels of seniority. These specific evaluation forms can include variations of the standard criteria tailored to the unique requirements of different accountant positions within Clark Nevada. For instance, there might be separate evaluation forms for staff accountants, senior accountants, and managerial-level accountants, each focusing on the specific skills and responsibilities associated with those roles. In conclusion, the Clark Nevada Employee Evaluation Form for Accountant plays a critical role in assessing the performance of accountants within the organization. By using this form, supervisors can provide detailed feedback, recognize achievements, and identify areas for improvement. With the possibility of specialized evaluation forms for different accountant positions, Clark Nevada ensures that its evaluation process is both comprehensive and tailored to the diverse roles and responsibilities of its accounting staff.

Clark Nevada Employee Evaluation Form for Accountant

Description

How to fill out Clark Nevada Employee Evaluation Form For Accountant?

Are you looking to quickly draft a legally-binding Clark Employee Evaluation Form for Accountant or probably any other form to take control of your personal or business matters? You can select one of the two options: contact a legal advisor to write a valid paper for you or create it entirely on your own. The good news is, there's a third option - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant form templates, including Clark Employee Evaluation Form for Accountant and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, carefully verify if the Clark Employee Evaluation Form for Accountant is adapted to your state's or county's laws.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Clark Employee Evaluation Form for Accountant template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the templates we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Start with any official forms your company wants you to use, or create your own, asking each employee to craft a summary of his or her key job responsibilities, current project work, and a recap of goals and achievements. It can also be helpful to have each employee complete a written self-evaluation.

How to write an employee evaluation Review the employee's job description. Get a current copy of each person's job description and review the requirements.Highlight areas of improvement.Compare strengths and weaknesses.Recommend actionable goals.Provide constructive feedback.Welcome employee input.

When you fill the form: Be honest and critical. Analyze your failures and mention the reasons for it.Keep the words minimal.Identify weaknesses.Mention your achievements.Link achievements to the job description and the organization's goals.Set the goals for the next review period.Resolve conflicts and grievances.

Here are a few examples: I always go out of my way to help co-workers. I make sure everyone on my team feels comfortable when exchanging ideas. I look for ways to keep my team on track and make sure important milestones are met. I brainstorm ways to motivate others and freely give praise when performance goals are met.

An effective process will address these three interlinked components: Planning do employees know what you're evaluating? Cultivation creating the space for employees to bloom. Accountability making performance a proactive process.

What Should Be Included In An Employee Evaluation Form? Name of the employee. Employee ID. Employee position or designation. Name of reviewer. Review date. Reviewer title. A proper, clear rating system. A separate section for written comments.

Here are the three steps of managing employee performance in a way that inspires and motivates workers to contribute their best efforts to your company. Focus on the overall business objectives by aligning goals.Regularly talk to your staff about work performance.Measure and adapt.

Best Practices When Creating an Evaluation Form Make it easy to use. Ensure that the information your evaluation form seeks is clear and concise.Determine the focus of the form. There needs to be a clear purpose.Establish a clearly defined rating scale.

What to include in an employee performance review Communication. Collaboration and teamwork. Problem-solving. Quality and accuracy of work. Attendance, punctuality and reliability. The ability to accomplish goals and meet deadlines.

What are three stages of performance management? While comprehensive as a process, performance management can be broken down into three distinct stages: coaching, corrective action, and termination. Coaching: The coaching stage of performance management sets the tone for your company and the success of your employees.