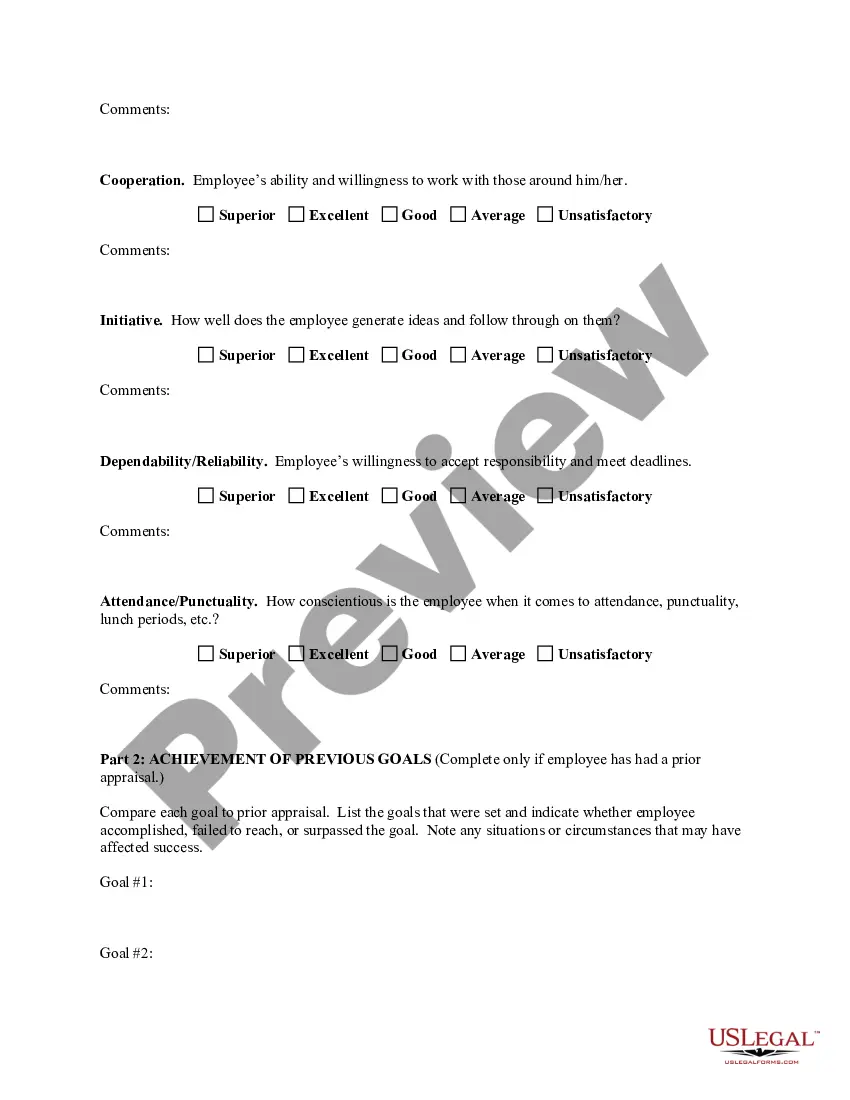

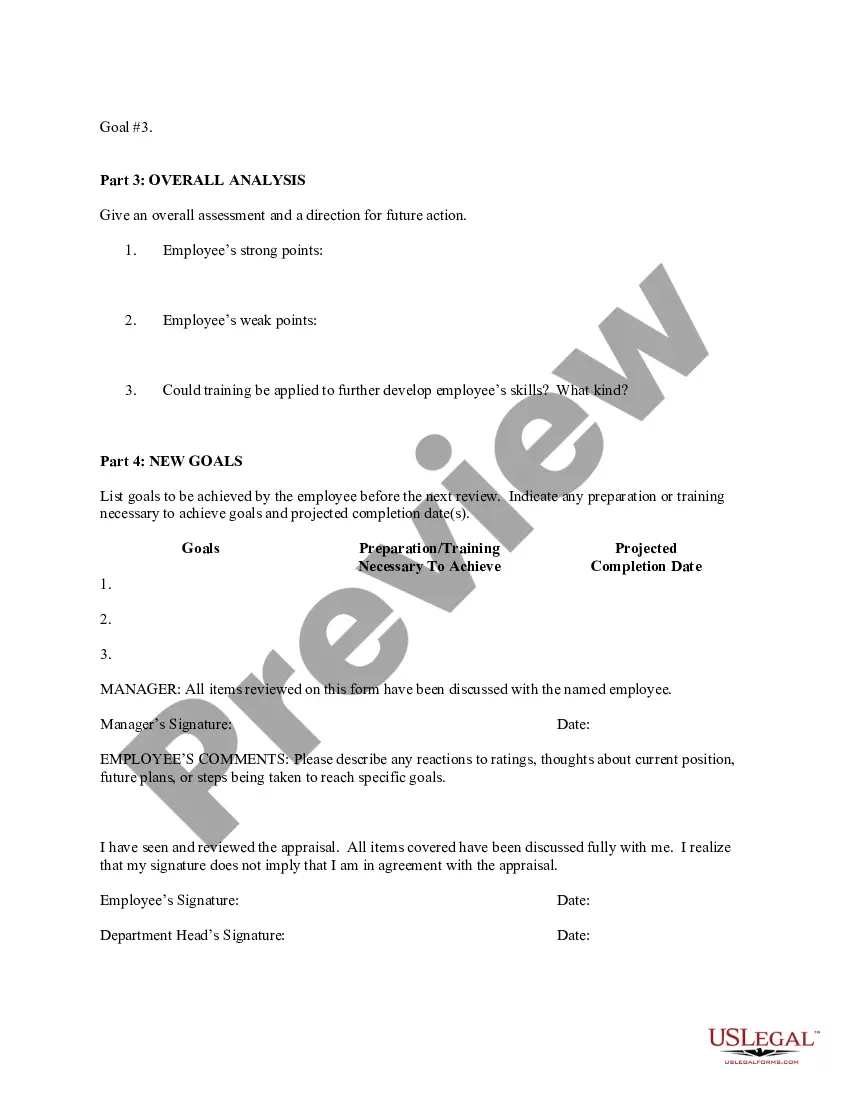

Dallas Texas Employee Evaluation Form for Accountant is a comprehensive tool used by organizations in the accounting industry to assess the performance and competency of their accountants. This form aims to provide valuable feedback to accountants while enabling employers to make informed decisions regarding promotions, raises, or training opportunities. The Dallas Texas Employee Evaluation Form for Accountant covers various aspects of an accountant's job performance, including technical skills, knowledge of accounting principles, attention to detail, communication skills, problem-solving abilities, and ability to meet deadlines. The form also evaluates an accountant's ability to work independently or as part of a team, adaptability to changing work environments, and adherence to company policies and procedures. The different types of Dallas Texas Employee Evaluation Forms for Accountant may include: 1. Performance Evaluation Form: This type of evaluation form assesses an accountant's overall performance throughout the year, highlighting their strengths, areas for improvement, and accomplishments within the organization. It focuses on skills directly related to accounting tasks and provides a comprehensive overview of an individual's contribution to the company. 2. Competency Assessment Form: This form concentrates on specific competencies required for effective accounting practices, such as financial analysis, budgeting, tax knowledge, auditing, and software proficiency. It allows employers to assess an accountant's competency level in each area, identify strengths, and suggest development opportunities. 3. Leadership Evaluation Form: In case an accountant holds a supervisory or managerial role, this form evaluates their leadership skills, ability to manage teams, communication style, decision-making prowess, and delegation skills. The form helps employers recognize accountants with aptitude for leadership positions and identify areas where additional training or mentoring might be beneficial. 4. 360-Degree Feedback Evaluation Form: Unlike traditional evaluations conducted solely by supervisors, a 360-degree feedback evaluation form incorporates feedback from multiple sources. It includes feedback from superiors, subordinates, colleagues, and clients to provide a comprehensive view of an accountant's performance. This type of evaluation form fosters a more holistic understanding of an accountant's strengths and weaknesses. Using these evaluation forms, employers in Dallas, Texas can gain insights into an accountant's skillet, professional growth, and areas of improvement. These forms play a crucial role in enhancing productivity, career development, and ultimately the success of both the accountant and the organization.

Dallas Texas Employee Evaluation Form for Accountant

Description

How to fill out Dallas Texas Employee Evaluation Form For Accountant?

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Dallas Employee Evaluation Form for Accountant suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. In addition to the Dallas Employee Evaluation Form for Accountant, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Dallas Employee Evaluation Form for Accountant:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Dallas Employee Evaluation Form for Accountant.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!