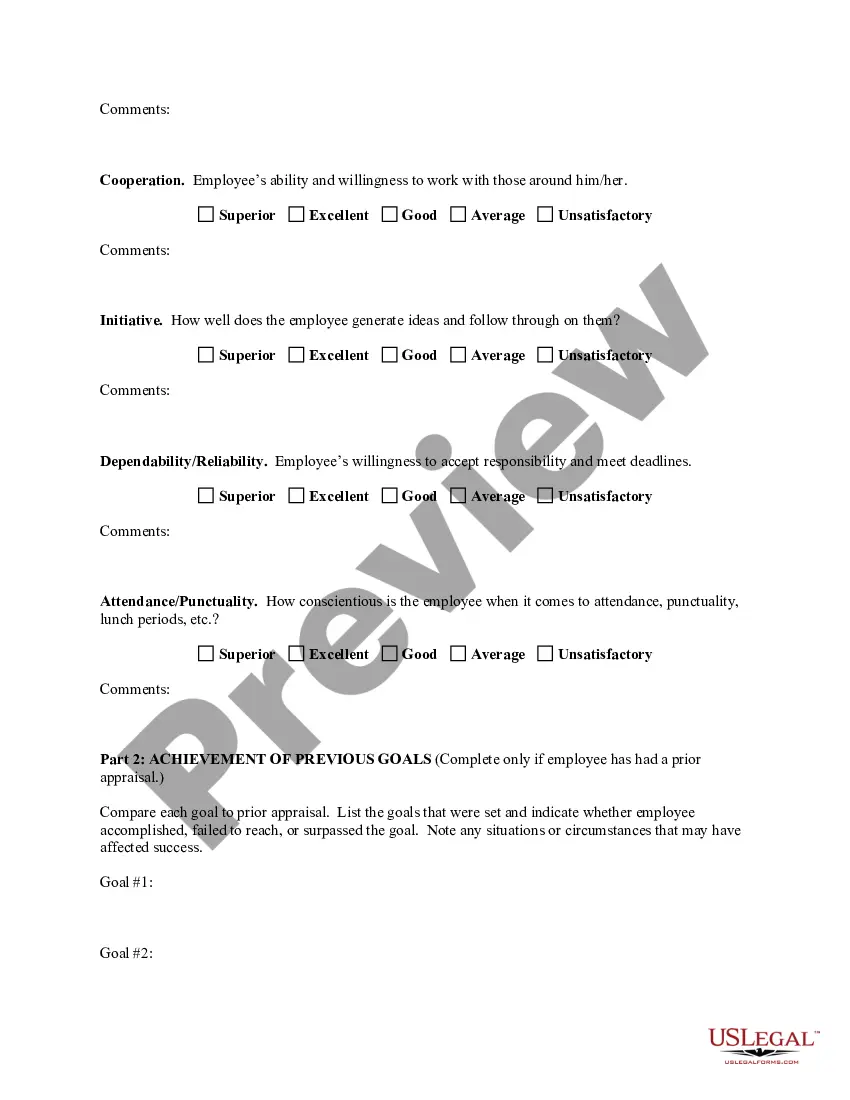

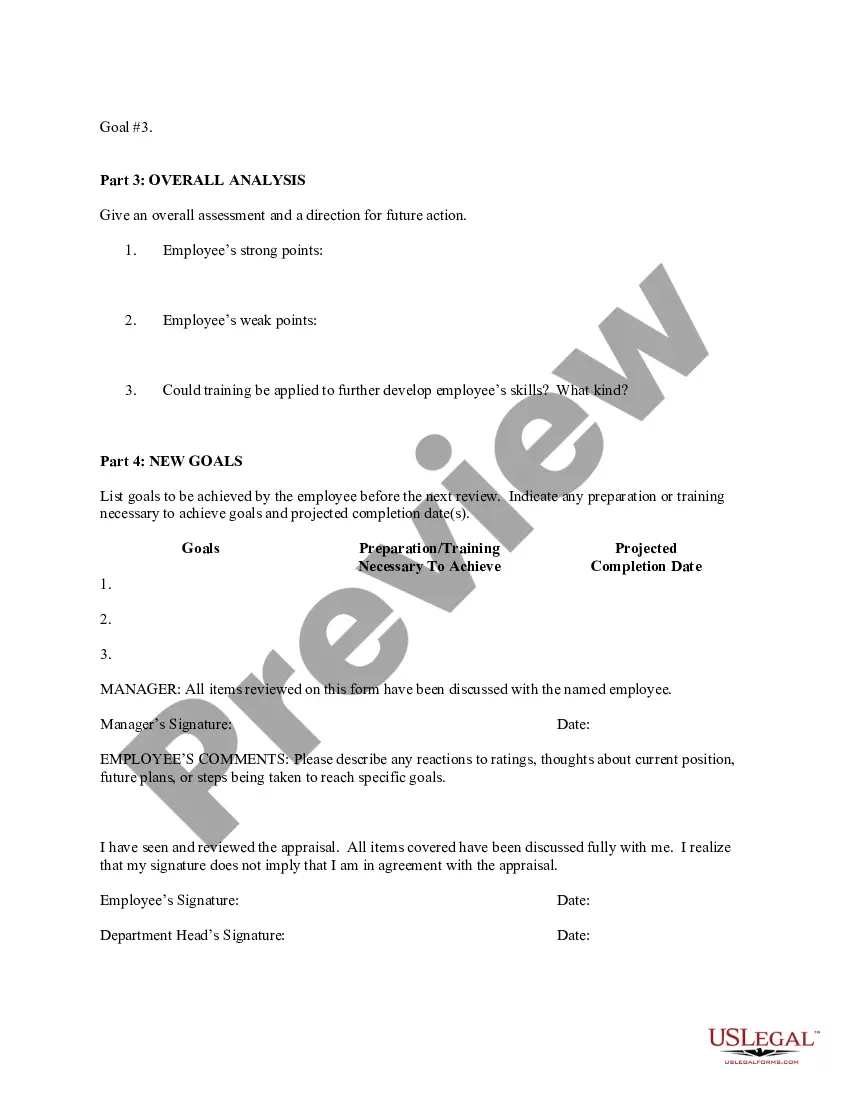

Houston Texas Employee Evaluation Form for Accountant is a structured tool used by employers to assess the performance and capabilities of their accountants working in the vibrant city of Houston, Texas. This evaluation form aims to provide a comprehensive overview of the accountant's job performance and overall contribution to the organization. The evaluation form typically consists of various sections that cover different aspects of the accountant's responsibilities and skills. Keywords that are relevant to Houston Texas Employee Evaluation Form for Accountant include: 1. Job Knowledge: This section evaluates the accountant's proficiency in technical accounting knowledge, including their understanding of accounting principles, relevant laws, and regulations applicable in Texas and Houston. It assesses their ability to apply this knowledge effectively in their day-to-day tasks. 2. Accuracy and Attention to Detail: Employers rely on their accountants to be meticulous and precise in their work. This section evaluates an accountant's ability to maintain accuracy in financial records, calculations, and reporting, emphasizing their attention to detail. 3. Timeliness and Efficiency: Accountants are expected to meet deadlines and complete tasks efficiently. The evaluation form assesses their ability to manage their time, prioritize work, and deliver projects within scheduled timelines. 4. Communication Skills: Effective communication is crucial for accountants, as they often collaborate with other departments and stakeholders. The evaluation form may evaluate an accountant's written and verbal communication skills, as well as their ability to listen actively and provide clear and concise explanations. 5. Analytical Skills: Accountants need to analyze financial data, identify trends, and interpret complex information. This section evaluates their ability to process and analyze financial information accurately, strategize based on data, and provide insights to support decision-making. 6. Problem-solving Skills: This section assesses an accountant's ability to identify and resolve accounting-related issues, suggesting proactive approaches to prevent future problems. It evaluates their critical thinking skills and innovative problem-solving techniques. 7. Teamwork and Collaboration: Accountants often work as part of a team, so their ability to collaborate effectively is essential. This section evaluates an accountant's interpersonal skills, willingness to help colleagues, and ability to work harmoniously within a team setting. Types of Houston Texas Employee Evaluation Forms for Accountant may differ based on the specific needs of the organization. They can include additional sections tailored to assess parameters such as leadership skills, client management, project management, or industry-specific knowledge. Overall, Houston Texas Employee Evaluation Form for Accountant serves as a valuable tool for employers to assess the performance and potential areas of improvement for their accountants. It helps companies identify top performers, address skill gaps, and support professional development initiatives in the dynamic and competitive accounting industry of Houston, Texas.

Houston Texas Employee Evaluation Form for Accountant

Description

How to fill out Houston Texas Employee Evaluation Form For Accountant?

Whether you intend to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Houston Employee Evaluation Form for Accountant is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Houston Employee Evaluation Form for Accountant. Follow the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the right one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Houston Employee Evaluation Form for Accountant in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!