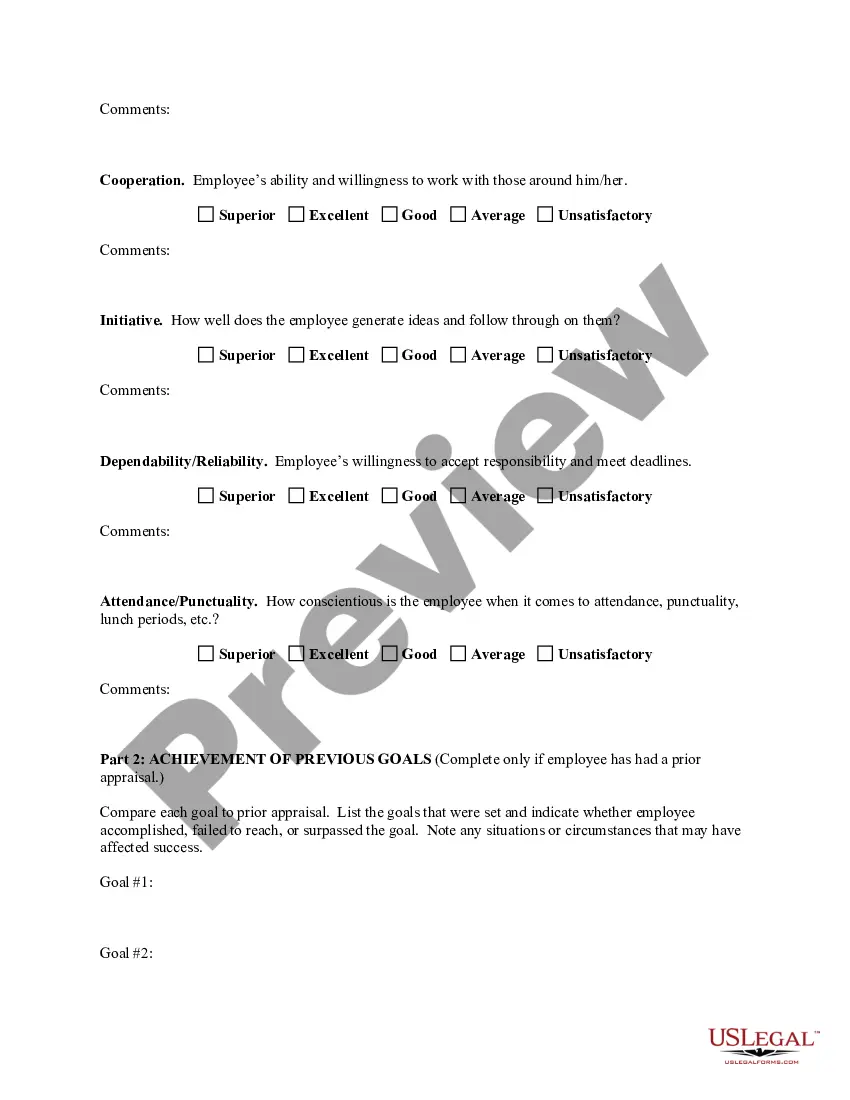

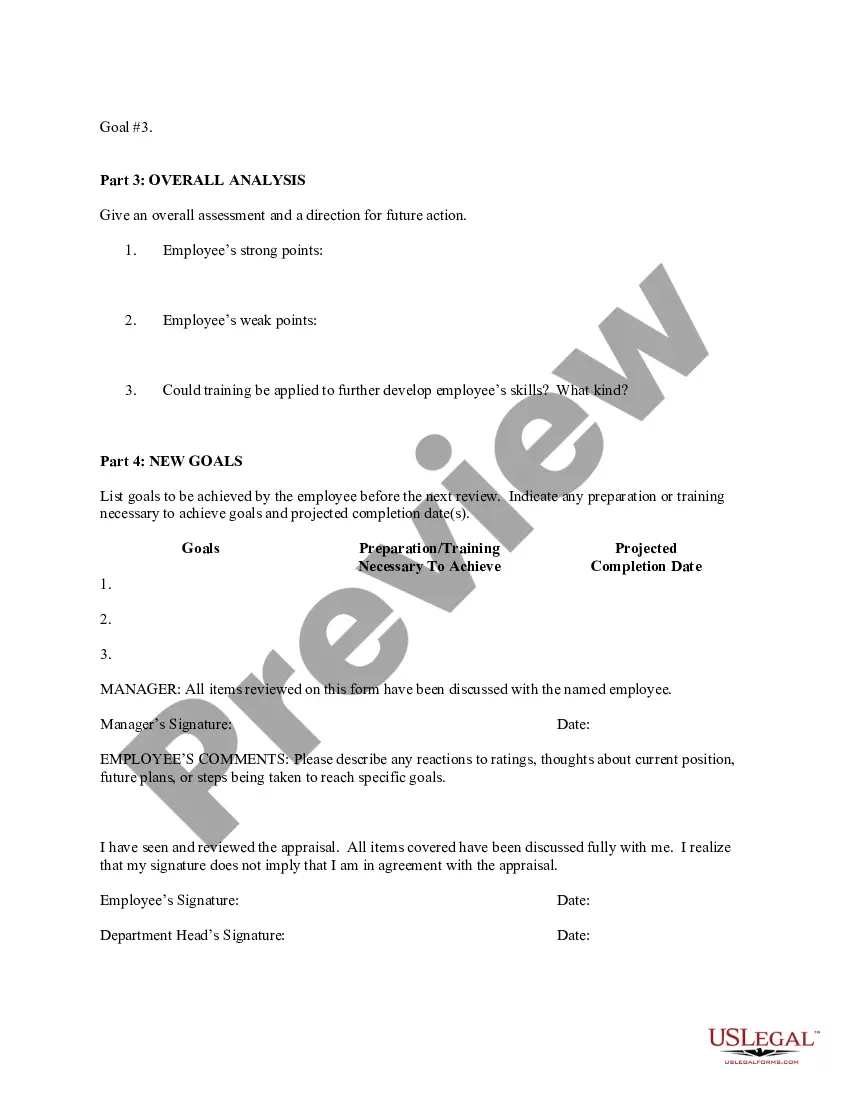

Miami-Dade County, located in Florida, utilizes an Employee Evaluation Form specifically designed for accountants. This comprehensive evaluation form aims to assess the performance and competence of accountants employed by the county government. By using this form, the county can effectively measure an accountant's ability to fulfill their duties and responsibilities. The Miami-Dade Florida Employee Evaluation Form for Accountant consists of various sections that encompass different key areas related to an accountant's performance. These sections include: 1. Job Knowledge: This section gauges the accountant's understanding and familiarity with accounting principles, procedures, and practices. It assesses their knowledge of financial regulations, tax laws, and software applications relevant to their role. 2. Work Quality: This section focuses on the accountant's ability to produce accurate and error-free work. It evaluates their attention to detail, data analysis skills, and the overall reliability of their financial reports and statements. 3. Time Management: This section examines the accountant's proficiency in managing their time and meeting deadlines. It evaluates their ability to prioritize tasks, handle competing assignments, and complete assignments in a timely manner. 4. Communication Skills: This section assesses the accountant's effectiveness in conveying financial information to relevant stakeholders. It evaluates their written and oral communication skills, as well as their ability to work collaboratively within a team or department. 5. Problem-solving and Analytical Skills: This section measures the accountant's aptitude for identifying and resolving complex financial problems. It evaluates their ability to analyze financial data, interpret trends, and provide accurate recommendations to improve financial processes. 6. Professionalism: This section focuses on the accountant's conduct and work ethic. It assesses their punctuality, willingness to learn and improve, ability to adapt to changes, and their adherence to ethical standards and confidentiality requirements. 7. Overall Performance: This final section provides an opportunity for the evaluator to provide an overall rating and comments on the accountant's performance. It allows for feedback on strengths, weaknesses, and areas requiring improvement. While there may not be different types of Miami-Dade Florida Employee Evaluation Forms for Accountants, the evaluation criteria and weightage of each section may vary based on the specific requirements of the accountant's role within the county government. The form is typically completed by the immediate supervisor or manager of the accountant and serves as a valuable tool for performance assessment and professional development.

Miami-Dade Florida Employee Evaluation Form for Accountant

State:

Multi-State

County:

Miami-Dade

Control #:

US-AHI-234-7

Format:

Word;

Rich Text

Instant download

Description

This AHI performance review is used to review the non-exempt employee based on how well the requirements of the job are filled.

Miami-Dade County, located in Florida, utilizes an Employee Evaluation Form specifically designed for accountants. This comprehensive evaluation form aims to assess the performance and competence of accountants employed by the county government. By using this form, the county can effectively measure an accountant's ability to fulfill their duties and responsibilities. The Miami-Dade Florida Employee Evaluation Form for Accountant consists of various sections that encompass different key areas related to an accountant's performance. These sections include: 1. Job Knowledge: This section gauges the accountant's understanding and familiarity with accounting principles, procedures, and practices. It assesses their knowledge of financial regulations, tax laws, and software applications relevant to their role. 2. Work Quality: This section focuses on the accountant's ability to produce accurate and error-free work. It evaluates their attention to detail, data analysis skills, and the overall reliability of their financial reports and statements. 3. Time Management: This section examines the accountant's proficiency in managing their time and meeting deadlines. It evaluates their ability to prioritize tasks, handle competing assignments, and complete assignments in a timely manner. 4. Communication Skills: This section assesses the accountant's effectiveness in conveying financial information to relevant stakeholders. It evaluates their written and oral communication skills, as well as their ability to work collaboratively within a team or department. 5. Problem-solving and Analytical Skills: This section measures the accountant's aptitude for identifying and resolving complex financial problems. It evaluates their ability to analyze financial data, interpret trends, and provide accurate recommendations to improve financial processes. 6. Professionalism: This section focuses on the accountant's conduct and work ethic. It assesses their punctuality, willingness to learn and improve, ability to adapt to changes, and their adherence to ethical standards and confidentiality requirements. 7. Overall Performance: This final section provides an opportunity for the evaluator to provide an overall rating and comments on the accountant's performance. It allows for feedback on strengths, weaknesses, and areas requiring improvement. While there may not be different types of Miami-Dade Florida Employee Evaluation Forms for Accountants, the evaluation criteria and weightage of each section may vary based on the specific requirements of the accountant's role within the county government. The form is typically completed by the immediate supervisor or manager of the accountant and serves as a valuable tool for performance assessment and professional development.

Free preview