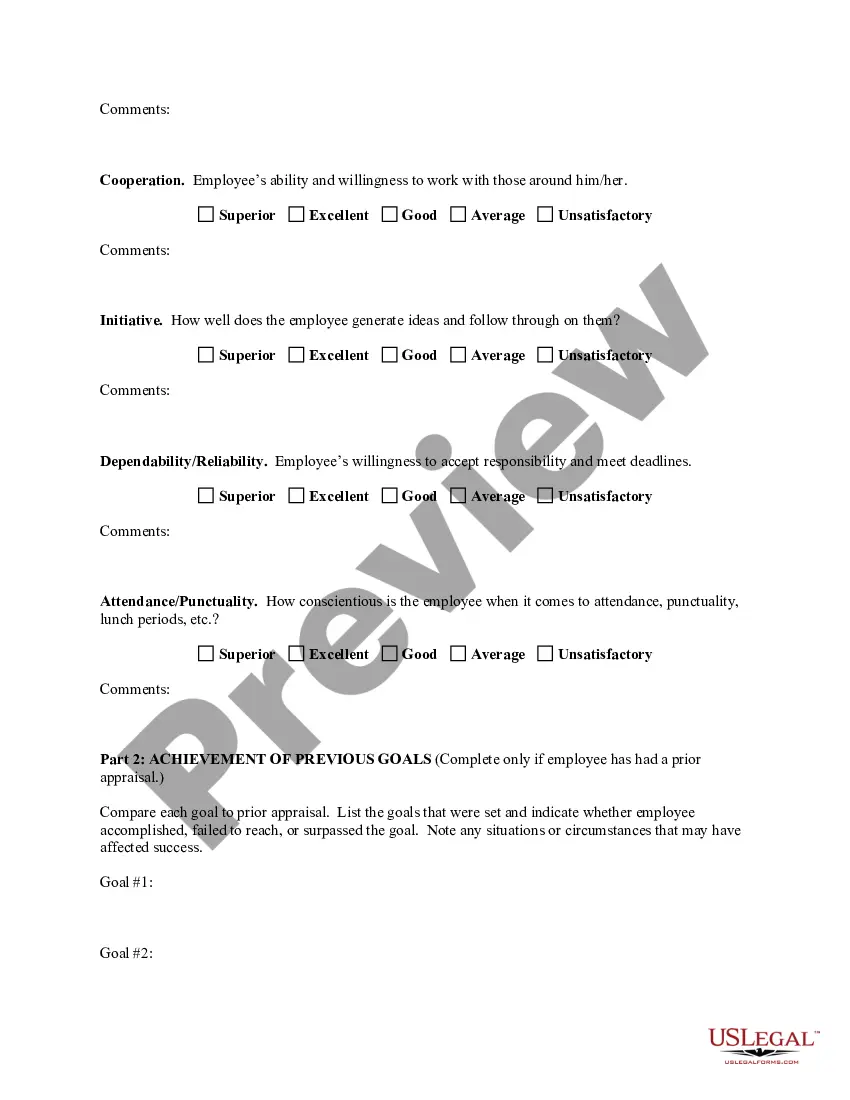

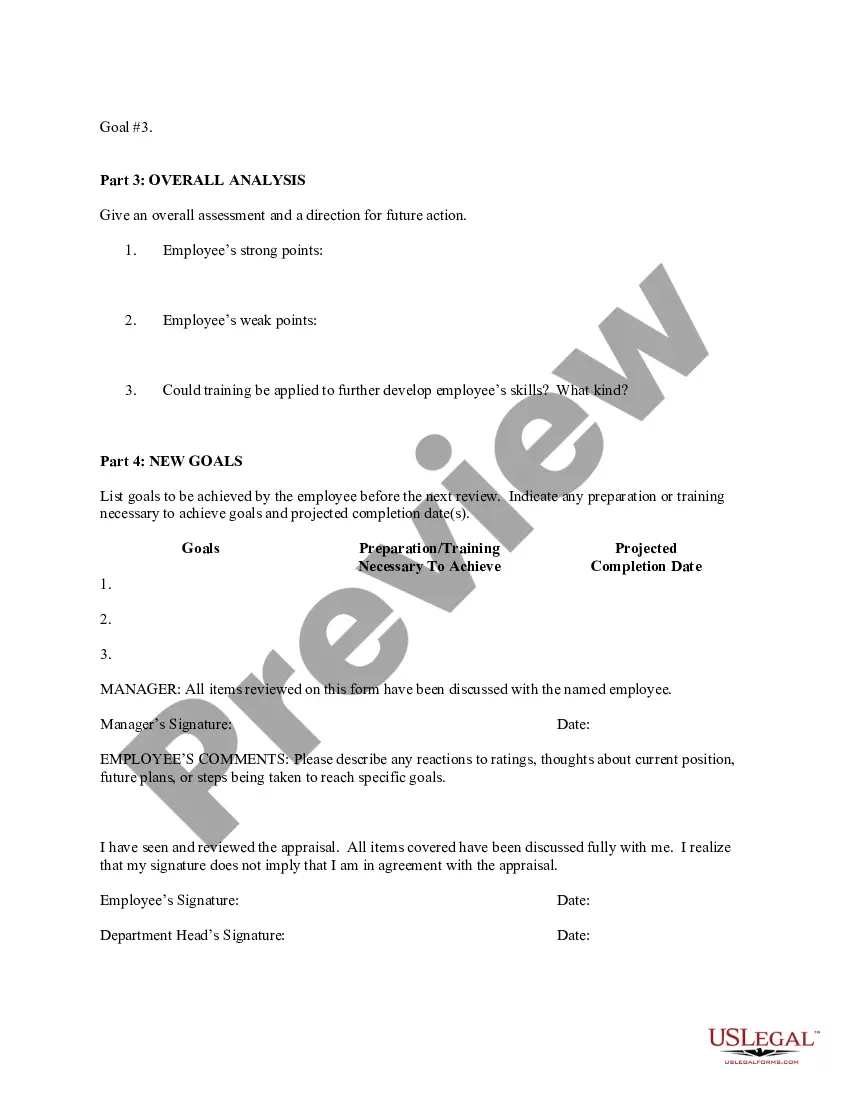

Phoenix Arizona Employee Evaluation Form for Accountant is a comprehensive document designed to assess the performance and capabilities of accountants working in various organizations in Phoenix, Arizona. This evaluation form plays a crucial role in providing objective feedback, identifying areas for improvement, and recognizing outstanding achievements of accountants in their respective job roles. The Phoenix Arizona Employee Evaluation Form for Accountant consists of multiple sections and specific criteria that address different aspects of an accountant's job responsibilities and competencies. These include: 1. General Information: This section captures basic details such as the accountant's name, job title, department, and the period for which the evaluation is conducted. 2. Job Performance: This section evaluates an accountant's overall performance, including their ability to meet deadlines, attention to detail, accuracy in financial reporting, and adherence to accounting regulations. 3. Technical Skills: This section focuses on assessing the accountant's proficiency in various technical aspects of their role, such as knowledge of accounting principles, software proficiency, financial analysis abilities, and familiarity with relevant laws and regulations. 4. Communication and Collaboration: This section evaluates the accountant's skills in communicating effectively with colleagues, clients, and supervisors. It also assesses their ability to work collaboratively in team settings, contribute to meetings, and share knowledge and expertise. 5. Problem-Solving and Decision-Making: This section assesses the accountant's ability to analyze complex financial data, identify problems or discrepancies, and propose appropriate solutions. It also evaluates their decision-making skills and ability to prioritize tasks effectively. 6. Professionalism and Leadership: This section evaluates the accountant's professionalism, integrity, and ethical conduct. It also assesses their leadership potential, including their ability to mentor and guide junior staff members. 7. Goal Setting and Professional Development: This section discusses the accountant's short and long-term goals, their plans for professional development, and their commitment to continuous learning and improvement. Some different types of Phoenix Arizona Employee Evaluation Forms for Accountants may include: 1. Quarterly Performance Evaluation Form: This form focuses on assessing an accountant's performance and progress over a specific three-month period. It provides a more frequent feedback mechanism and allows for timely adjustments and support. 2. Annual Performance Evaluation Form: This form evaluates an accountant's performance over a full year. It may include additional sections for setting goals and objectives for the upcoming year. 3. Self-Evaluation Form: This type of evaluation form allows accountants to assess their own performance and provide self-reflection on their strengths, weaknesses, and areas for improvement. It can be used alongside evaluations from supervisors to gain a well-rounded perspective. 4. Peer Evaluation Form: In some organizations, colleagues or team members may provide feedback on an accountant's performance using a peer evaluation form. This type of evaluation considers the accountant's ability to collaborate, communicate, and support their peers in achieving shared goals. The Phoenix Arizona Employee Evaluation Form for Accountant serves as a crucial tool in enhancing the performance, accountability, and professional development of accountants, ultimately contributing to the overall success of the organizations they serve.

Phoenix Arizona Employee Evaluation Form for Accountant

Description

How to fill out Phoenix Arizona Employee Evaluation Form For Accountant?

Creating forms, like Phoenix Employee Evaluation Form for Accountant, to manage your legal matters is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms intended for different scenarios and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Phoenix Employee Evaluation Form for Accountant form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Phoenix Employee Evaluation Form for Accountant:

- Ensure that your document is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Phoenix Employee Evaluation Form for Accountant isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our service and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!