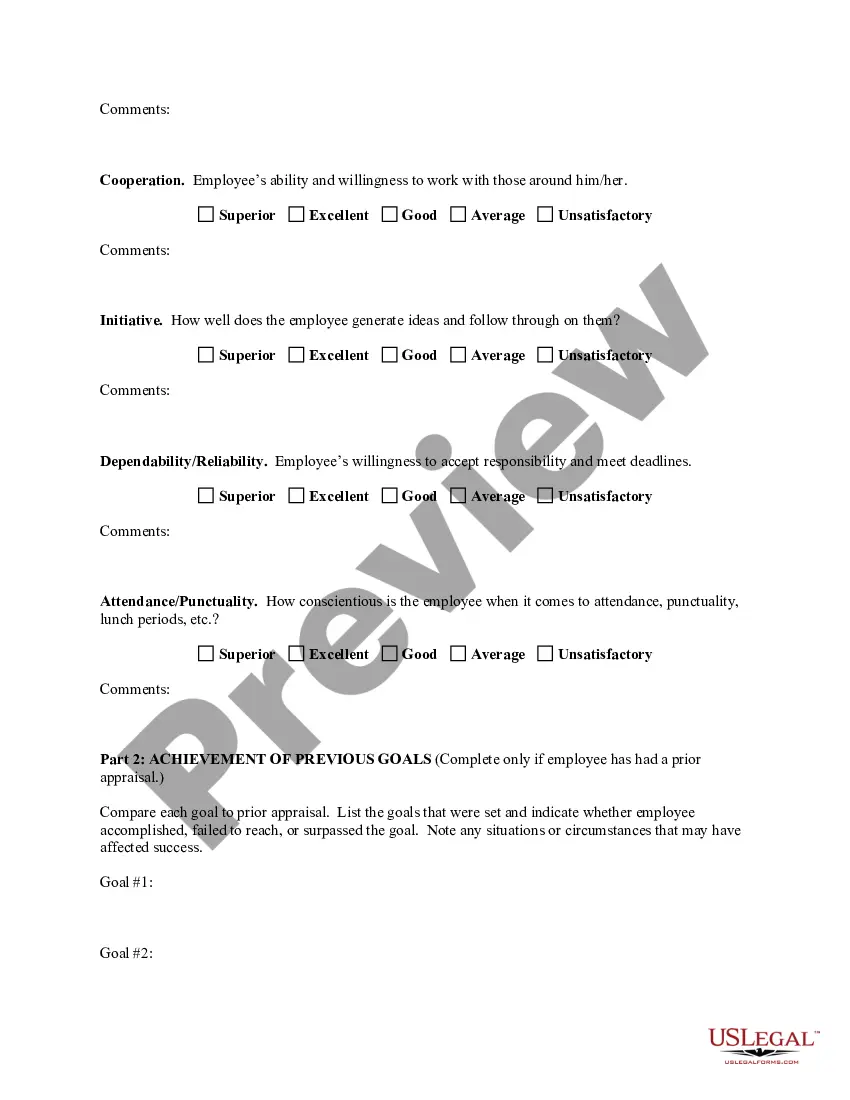

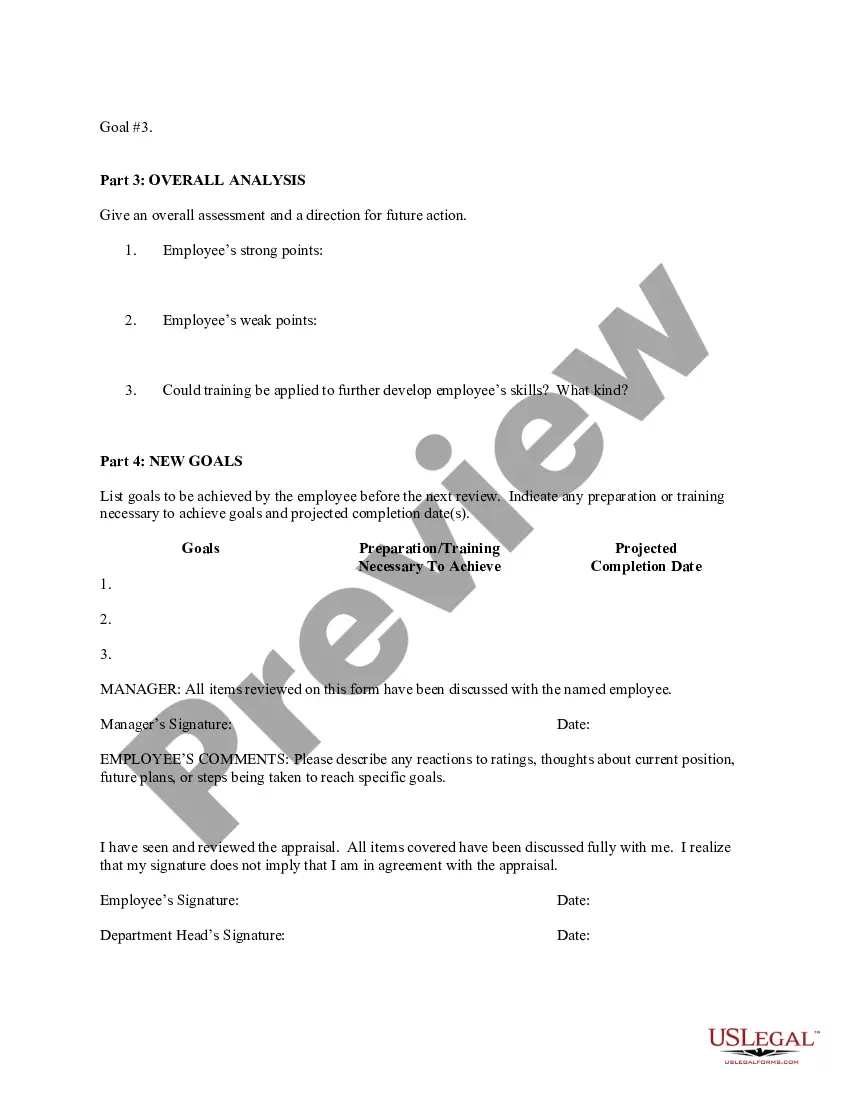

The Lima Arizona Employee Evaluation Form for Accountants is a comprehensive tool designed to assess and review the performance and competency of accountants working in various organizations within Lima, Arizona. It enables employers to objectively evaluate their accountants' skills, job knowledge, and overall contribution to the company's financial operations. The evaluation form consists of various sections that cover different aspects of an accountant's job performance. It typically includes areas such as: 1. Job knowledge and technical skills: This section assesses the accountant's proficiency in fundamental accounting principles, financial reporting standards, tax regulations, and knowledge of software tools used for financial analysis and reporting. 2. Accuracy and attention to detail: This section evaluates the accountant's ability to perform precise and accurate calculations, maintain error-free financial records, and spot discrepancies. 3. Time management and organizational skills: Accountants often work within deadlines and handle multiple tasks simultaneously. This section assesses their ability to prioritize assignments, meet deadlines, and manage their workload effectively. 4. Communication skills: Accountants need to effectively communicate financial information to colleagues, superiors, and external stakeholders. This section evaluates their skills in presenting complex financial data in a clear and understandable manner. 5. Problem-solving and analytical abilities: Accountants are required to analyze financial data, identify trends, and suggest improvements. This section assesses their critical thinking skills, problem-solving abilities, and their contributions in identifying cost-saving measures or areas of financial improvement. 6. Teamwork and collaboration: Many accountants work in teams or collaborate with colleagues from different departments. This section evaluates their ability to work cooperatively, contribute to group tasks, and maintain professional relationships with others. 7. Professional behavior and integrity: This section assesses the accountant's ethical conduct, adherence to the code of professional standards, and overall professionalism in handling sensitive financial information. There may be different types of Lima Arizona Employee Evaluation Forms for Accountants based on the specific job requirements or unique evaluation criteria set by different organizations. These could include forms tailored for entry-level accountants, senior-level accountants, managerial accountants, or specialized roles such as taxation accountants or auditing accountants. These evaluation forms are essential for employers to provide constructive feedback, track an accountant's progress, identify areas for improvement, and determine opportunities for career development within the organization. By utilizing these evaluation forms, employers can ensure that their accountants meet the required standards and contribute effectively to the financial success of the company.

Pima Arizona Employee Evaluation Form for Accountant

Description

How to fill out Pima Arizona Employee Evaluation Form For Accountant?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Pima Employee Evaluation Form for Accountant, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities associated with document completion straightforward.

Here's how to locate and download Pima Employee Evaluation Form for Accountant.

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the legality of some documents.

- Examine the related forms or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and buy Pima Employee Evaluation Form for Accountant.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Pima Employee Evaluation Form for Accountant, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you need to deal with an exceptionally challenging situation, we recommend getting an attorney to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!