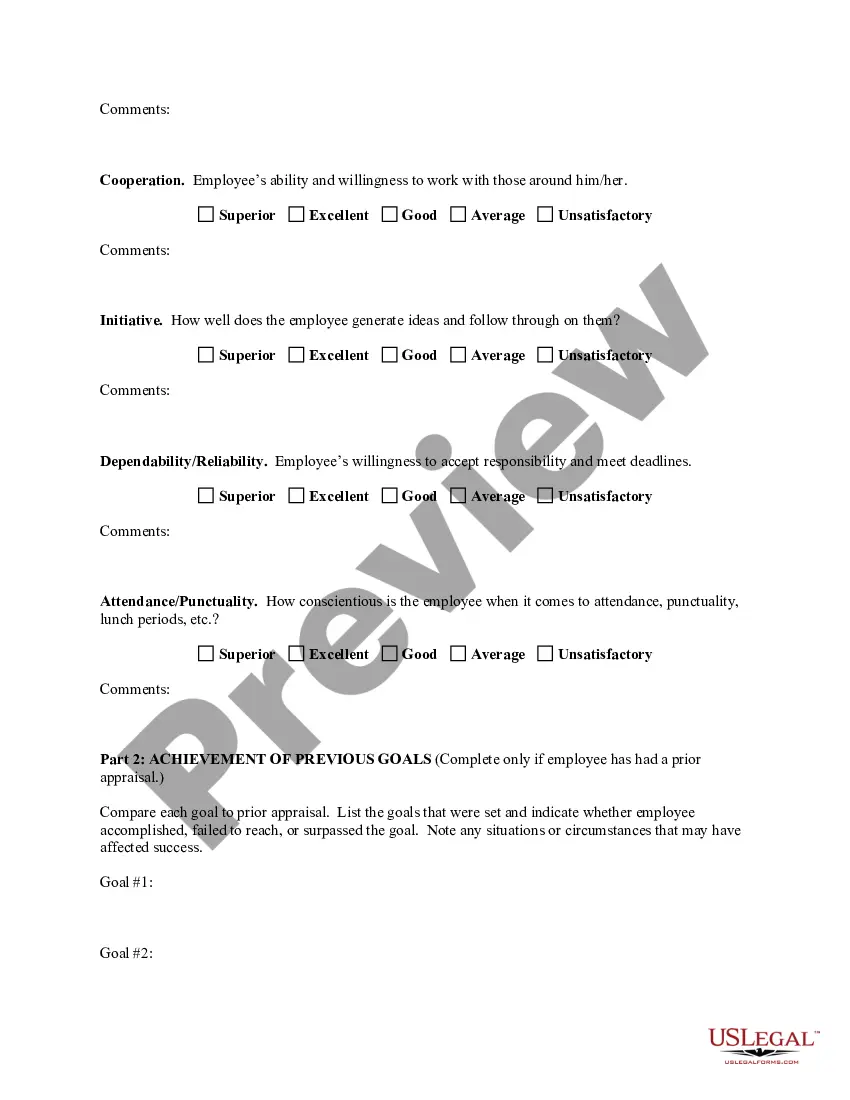

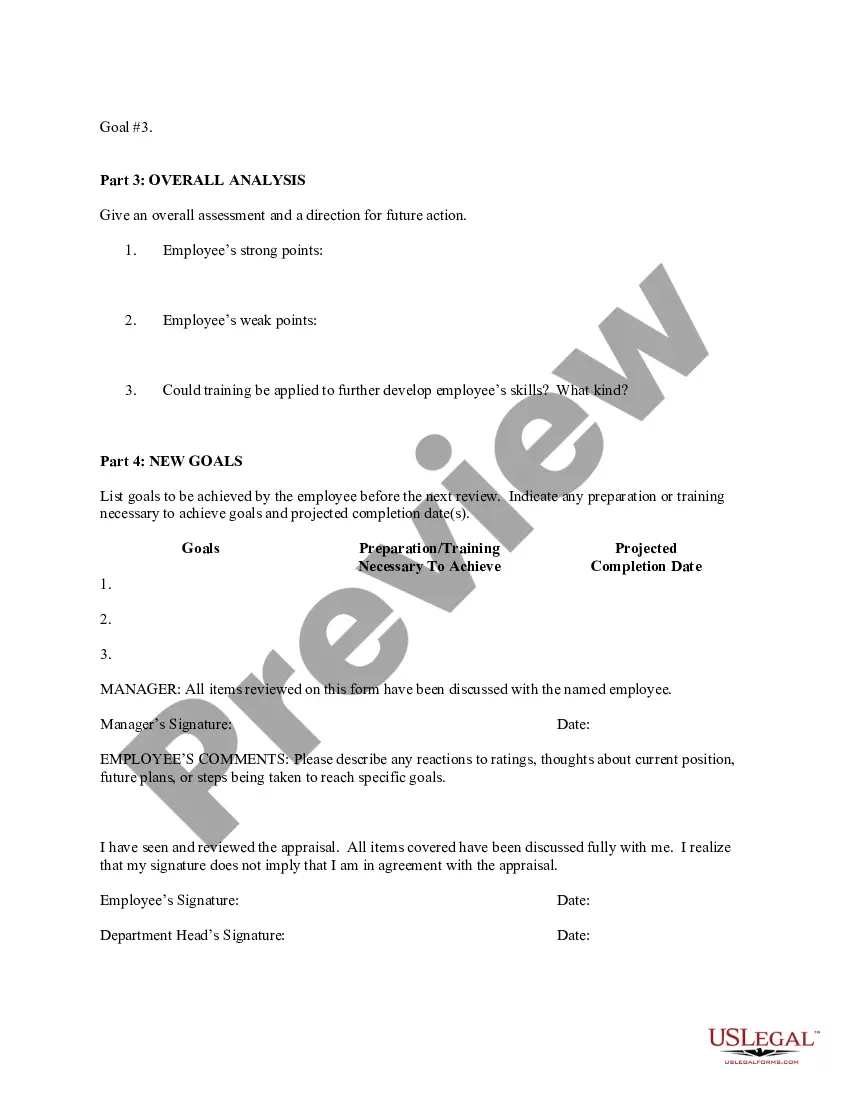

Travis Texas Employee Evaluation Form for Accountant is a comprehensive tool utilized by organizations to assess the performance and competency of their accounting professionals. This evaluation form is specifically designed for accountants working in Travis, Texas, ensuring that the assessment process aligns with local standards and requirements. By conducting regular evaluations, businesses can effectively monitor their accountants' progress, identify areas for improvement, and acknowledge exemplary performance. Key elements incorporated in the Travis Texas Employee Evaluation Form for Accountant may include: 1. Job-Specific Competencies: This section evaluates an accountant's knowledge and proficiency in key accounting principles, financial analysis, tax regulations, and software proficiency (such as QuickBooks or Excel). 2. Attention to Detail: This category assesses the accountant's accuracy and precision in handling financial data, maintaining records, and preparing reports. 3. Time Management: This area analyzes an accountant's ability to meet deadlines, prioritize tasks, and effectively manage their workload. 4. Communication Skills: This section evaluates oral and written communication abilities, including how well the accountant interacts with colleagues, clients, and superiors. 5. Analytical Thinking: This component measures an accountant's problem-solving skills, their capacity to identify financial discrepancies, and their ability to propose efficient solutions. 6. Teamwork and Collaboration: This category assesses an accountant's ability to work effectively within a team, contribute to group projects, and support colleagues when necessary. 7. Professional Development: This section concentrates on an accountant's commitment to improving their skills, attending relevant trainings, obtaining certifications, and staying updated with industry best practices. 8. Compliance and Ethics: This area assesses an accountant's compliance with ethical standards, adherence to legal regulations, and commitment to maintaining confidentiality and data security. Different types of Travis Texas Employee Evaluation Forms for Accountants may include: 1. Performance Evaluation Form: This form provides a comprehensive assessment of an accountant's overall job performance, including a review of their strengths, areas for improvement, and goal setting for the future. 2. Annual/Quarterly Evaluation Form: These variations of the evaluation form are designed to be completed on a scheduled basis, providing a periodic assessment of an accountant's progress and development throughout the year. 3. Self-Evaluation Form: This form allows accountants to assess their own performance, providing insights from their perspective and encouraging self-reflection. 4. 360-Degree Evaluation Form: In this type of evaluation, feedback is collected from the accountant's peers, subordinates, and superiors, creating a more holistic assessment of their performance and interpersonal skills. Using the Travis Texas Employee Evaluation Form for Accountants grants organizations the means to ensure their accounting professionals are meeting industry standards, developing their skills, and contributing effectively to the financial health of the business.

Travis Texas Employee Evaluation Form for Accountant

Description

How to fill out Travis Texas Employee Evaluation Form For Accountant?

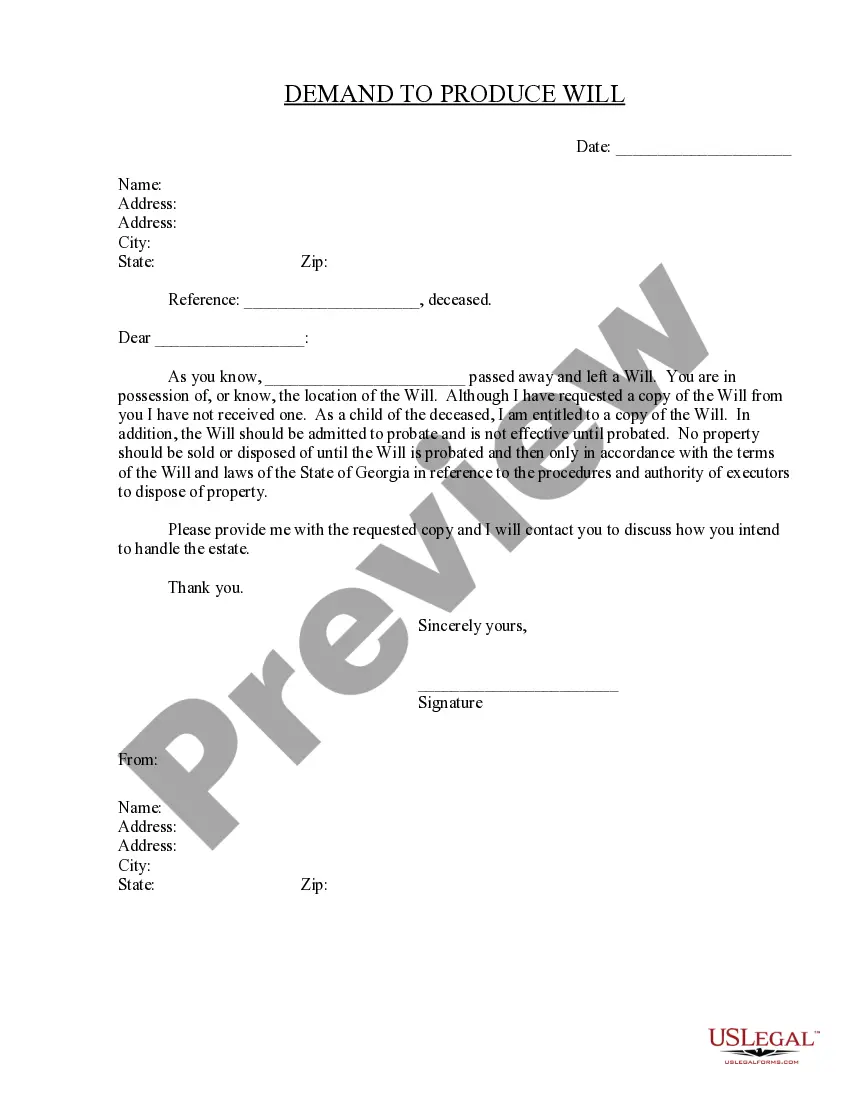

Creating paperwork, like Travis Employee Evaluation Form for Accountant, to take care of your legal matters is a challenging and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents crafted for a variety of scenarios and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Travis Employee Evaluation Form for Accountant template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before downloading Travis Employee Evaluation Form for Accountant:

- Ensure that your form is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Travis Employee Evaluation Form for Accountant isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our service and get the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Best practices for writing a self-assessment Be proud. One major goal of the self-evaluation is to highlight your accomplishments and recollect milestones in your professional development.Be honest and critical.Continuously strive for growth.Track your accomplishments.Be professional.

What to Include in an Employee Evaluation Form? Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.

For most staff positions, the job performance areas that should be included on a performance evaluation form are job knowledge and skills, quality of work, quantity of work, work habits and attitude.

How to get started writing your self-evaluation Reflect on feedback.Make a list of your top accomplishments and identify areas for improvements.Gather analytics to show impact.Make a commitment to improve.Set a SMART goal for yourself.Create a plan of action.Communication.Job Performance.

Here are a few examples: I always go out of my way to help co-workers. I make sure everyone on my team feels comfortable when exchanging ideas. I look for ways to keep my team on track and make sure important milestones are met. I brainstorm ways to motivate others and freely give praise when performance goals are met.

Here are the three steps of managing employee performance in a way that inspires and motivates workers to contribute their best efforts to your company. Focus on the overall business objectives by aligning goals.Regularly talk to your staff about work performance.Measure and adapt.

How to write an employee evaluation Gather employee information. Gather required information related to the employee to get the full picture of their value to the company.List employee responsibilities.Use objective language.Use action verbs.Compare performance ratings.Ask open-ended questions.Use a point system.

When you fill the form: Be honest and critical. Analyze your failures and mention the reasons for it.Keep the words minimal.Identify weaknesses.Mention your achievements.Link achievements to the job description and the organization's goals.Set the goals for the next review period.Resolve conflicts and grievances.

Dependability Has remained one of our most trustworthy team members Always very dependable in every situation Always ready to do whatever it takes to get the work done Well known for dependability and readiness to work hard Has been a faithful and trustworthy employee