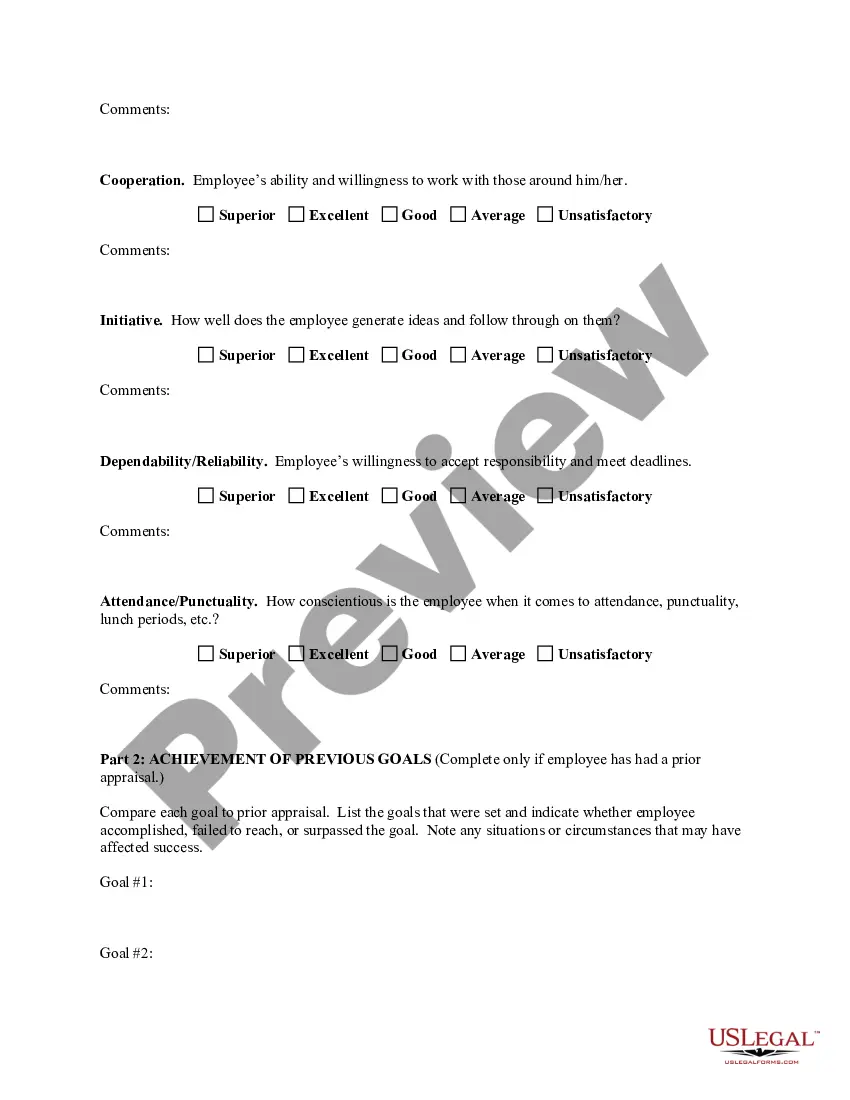

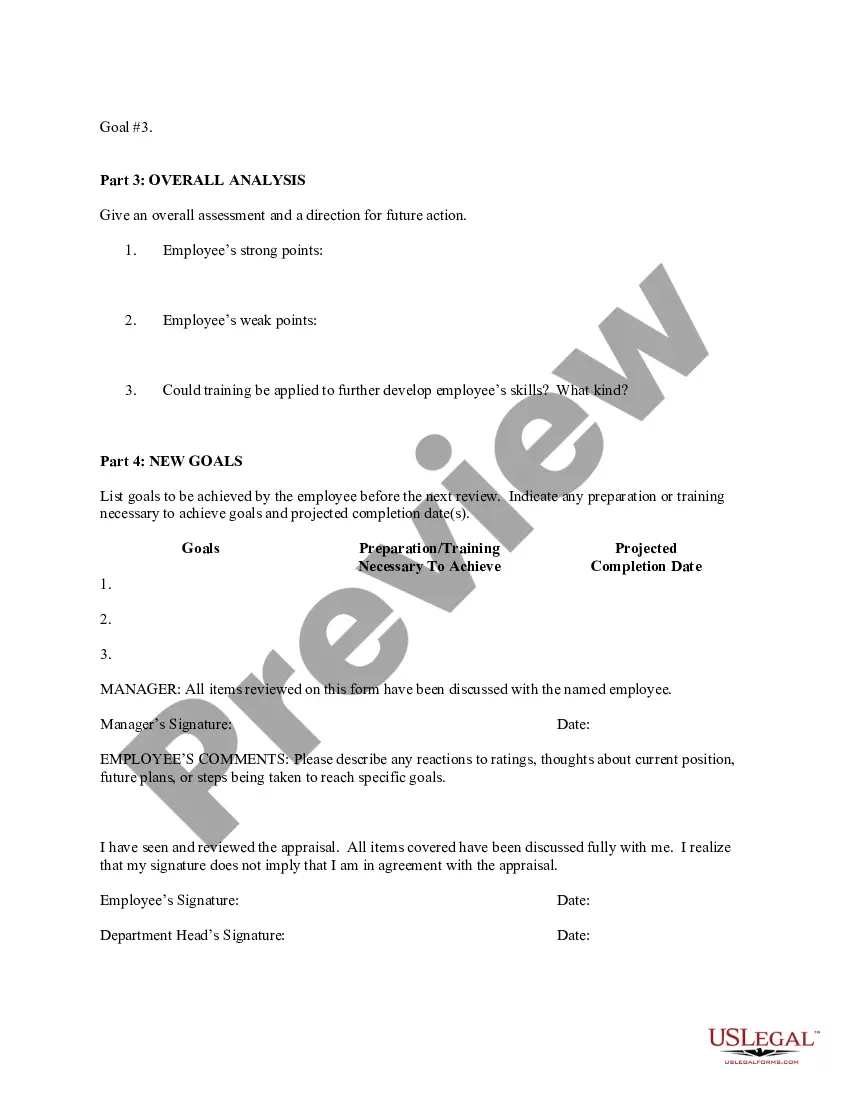

Wayne Michigan Employee Evaluation Form for Accountant is a comprehensive and standardized tool used by organizations in Wayne, Michigan to assess the performance, skills, and job-related competencies of accountants employed within their company. This evaluation form plays a crucial role in supporting the growth and development of accountants, as well as aiding in making decisions related to promotions, bonuses, or future career advancements. The primary purpose of the Wayne Michigan Employee Evaluation Form for Accountant is to provide a structured framework for evaluating an accountant's job performance over a specific period. This evaluation usually covers various crucial areas such as technical knowledge, attention to detail, problem-solving abilities, financial reporting, adherence to accounting standards, and teamwork. By assessing these areas, employers can gain an in-depth understanding of an accountant's strengths, weaknesses, and potential areas for improvement. The Wayne Michigan Employee Evaluation Form for Accountant typically consists of various sections allowing employers to rate an accountant's performance using a standardized rating system such as scales, rankings, or a combination of both. Moreover, the form often provides space for additional comments and feedback from the evaluator to support the ratings given for each section. This allows employers to offer constructive feedback, suggestions for improvement, or recognition of exemplary performance. Some examples of different types of Wayne Michigan Employee Evaluation Forms for Accountants may include: 1. Annual Performance Review Form: This form is generally conducted once a year and focuses on providing a comprehensive assessment of an accountant's overall performance during the past year. It covers a wide array of competencies and may include goal-setting discussions for the upcoming year. 2. Probationary Evaluation Form: Employers often use this type of evaluation form when accountants are on probation or recently hired. It assesses an accountant's performance during the probationary period to determine whether they meet the organization's standards. 3. Project Evaluation Form: In cases where accountants are involved in specific projects or assignments, this evaluation form assesses their performance, teamwork, and ability to meet project objectives within the allocated time and budget. 4. Skills Assessment Form: This evaluation form focuses on assessing an accountant's technical skills, including their knowledge of accounting principles, software proficiency, and their ability to adapt to evolving accounting practices and technologies. It is important to note that while the Wayne Michigan Employee Evaluation Form for Accountant may vary slightly across organizations, the overall objective remains the same — to provide a fair and systematic evaluation of an accountant's performance and contribute to their professional growth and development.

Wayne Michigan Employee Evaluation Form for Accountant

Description

How to fill out Wayne Michigan Employee Evaluation Form For Accountant?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business purpose utilized in your region, including the Wayne Employee Evaluation Form for Accountant.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Wayne Employee Evaluation Form for Accountant will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Wayne Employee Evaluation Form for Accountant:

- Ensure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Wayne Employee Evaluation Form for Accountant on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!