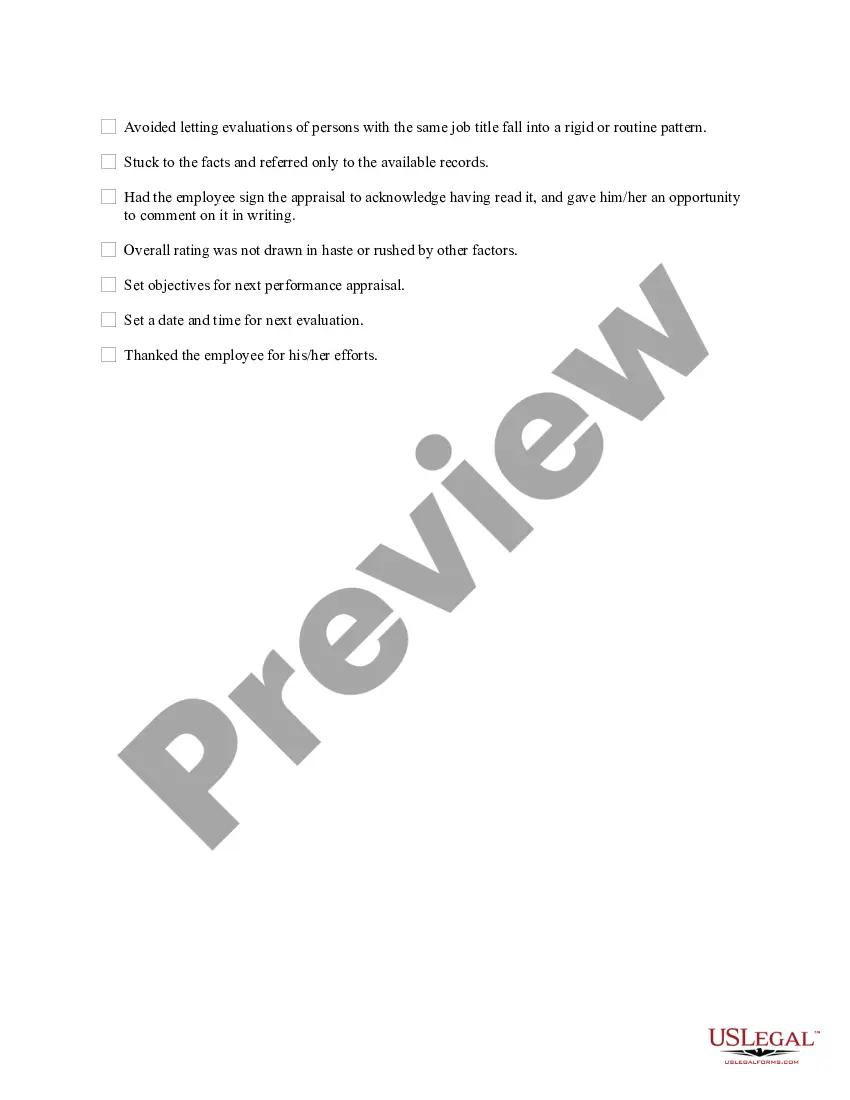

Hennepin County, Minnesota is the most populous county in the state, encompassing the city of Minneapolis and its surrounding suburbs. After an appraisal interview, it is important to have a checklist to ensure all necessary steps are taken to evaluate a property accurately. The Hennepin Minnesota Checklist — After the Appraisal Interview is designed to guide appraisers and property owners through the post-interview process, allowing for a comprehensive appraisal report. Keywords: Hennepin Minnesota, checklist, appraisal interview, property evaluation, accurate appraisal report, post-interview process. The Hennepin Minnesota Checklist — After the Appraisal Interview includes several crucial items that need to be reviewed and addressed. These may include: 1. Property Details: Verify that all necessary property information such as address, legal description, size, and unique features have been accurately documented. 2. Comparable Sales Analysis: Conduct a thorough analysis of recently sold properties in the area that are similar to the subject property. Compare features, condition, and location to determine market value. 3. Property Condition Evaluation: Assess the overall condition of the property, considering both the interior and exterior. Take note of any deferred maintenance, upgrades, or repairs required. 4. Neighborhood Influences: Consider the impact of the surrounding neighborhood on the property's value. Factors such as school districts, amenities, crime rate, and accessibility to transportation can influence market value. 5. Market Trends: Research and analyze current market trends in the Hennepin County area. Take note of any changes in supply and demand, property values, and economic factors that may affect the appraisal value. 6. Adjustments: Determine appropriate adjustments to be made when comparing the subject property with the comparable sales. Consider factors like square footage, number of bedrooms and bathrooms, and any unique features. 7. Final Value Calculation: Utilize all the gathered information to calculate the final appraisal value based on the sales comparison approach, cost approach, or income approach (if applicable). It is essential to understand that the Hennepin Minnesota Checklist — After the Appraisal Interview may vary depending on the specific requirements of the appraisal assignment, property type (residential, commercial, industrial), and intended use. Different property types may require specific checklists tailored to their unique characteristics. In conclusion, the Hennepin Minnesota Checklist — After the Appraisal Interview serves as a comprehensive guide to ensuring that all necessary steps are taken to evaluate a property accurately in Hennepin County, Minnesota. By following this checklist, appraisers and property owners can confidently prepare a detailed appraisal report that reflects the true market value of the subject property.

Hennepin Minnesota Checklist - After the Appraisal Interview

Description

How to fill out Hennepin Minnesota Checklist - After The Appraisal Interview?

Drafting paperwork for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Hennepin Checklist - After the Appraisal Interview without expert help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Hennepin Checklist - After the Appraisal Interview by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step guide below to get the Hennepin Checklist - After the Appraisal Interview:

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!