Maricopa Arizona Log of Records Retention Requirements is a set of specific guidelines established by the Maricopa County government to determine the length of time certain records should be retained by different departments and organizations within the county. These requirements are crucial for maintaining transparency, accountability, and legal compliance. The Maricopa County government has implemented various types of Log of Records Retention Requirements, each catering to the specific needs and characteristics of different departments. Some significant types include: 1. Administrative Records: These requirements pertain to documents related to administrative functions, such as personnel records, budgets, contracts, and internal policies. They outline the duration for which these records must be retained to ensure efficient management and access to vital information. 2. Financial Records: This category encompasses records concerning financial transactions, accounting information, budgets, audits, and tax-related documents. The Log of Records Retention Requirements for financial records ensures adherence to fiscal regulations, facilitates audits, and supports financial decision-making processes. 3. Legal Records: This segment focuses on preserving records that are crucial for legal proceedings and compliance purposes. Legal records encompass court proceedings, case files, litigation records, and other legal correspondence. The requirements specify the retention periods to uphold legal obligations and facilitate legal research and investigations. 4. Human Resources Records: These requirements are designed to govern the retention of employee-related documents, such as applications, resumes, payroll, performance evaluations, benefits, and disciplinary records. Compliance with these requirements ensures fair employment practices, smooth HR processes, and protection of employee rights. 5. Economic Development Records: This category addresses the records related to economic development activities, including business licenses, permits, economic impact studies, and economic development plans. The requirements outline the retention periods to support economic planning, attract investments, and monitor development initiatives. To comply with these Log of Records Retention Requirements, departments and organizations must carefully review and implement the guidelines. Regular audits and documentation are essential to ensure adherence to the specified retention periods and facilitate efficient record management practices. By adhering to the Maricopa Arizona Log of Records Retention Requirements, government entities and organizations operating within Maricopa County effectively preserve historical records, protect important information, facilitate organizational processes, and promote transparency and accountability.

Maricopa Arizona Log of Records Retention Requirements

Description

How to fill out Maricopa Arizona Log Of Records Retention Requirements?

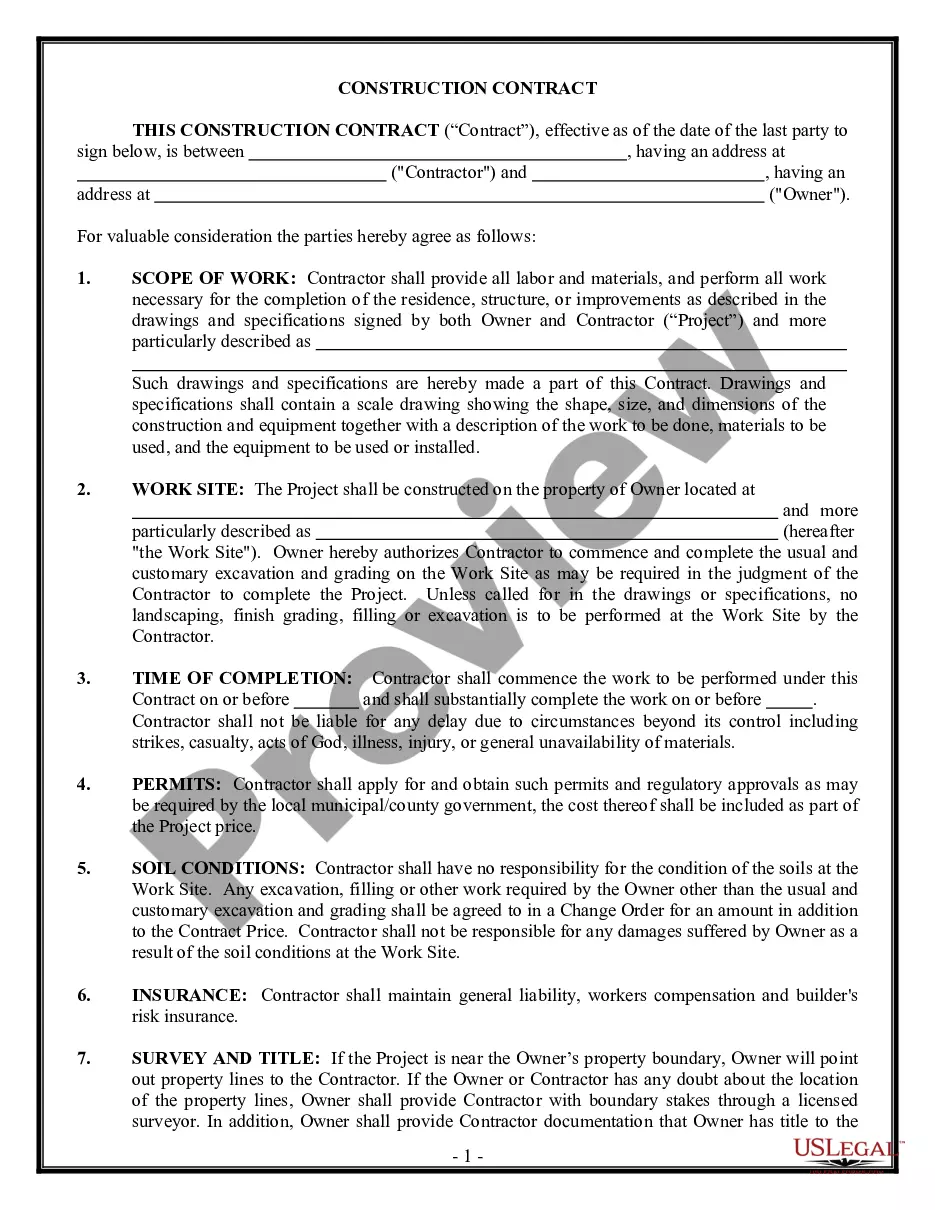

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Maricopa Log of Records Retention Requirements, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find detailed resources and tutorials on the website to make any activities associated with document execution straightforward.

Here's how you can locate and download Maricopa Log of Records Retention Requirements.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the related forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and purchase Maricopa Log of Records Retention Requirements.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Maricopa Log of Records Retention Requirements, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you need to deal with an extremely challenging case, we advise getting a lawyer to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

4 years after fiscal year of last attendance. If you have an Annual Enrollment for all students, then you can keep only the most recent Enrollment Record.

According to HIPAA, medical records must be kept for either: Six years from their creation; or. Six years from their last use.

These are to be retained for a minimum of seven years after the pupil has left school or until the pupil has reached the age of 25 years, whichever is later.

How long should school records be kept? File DescriptionData Protection IssueRetention PeriodStaff personnel filesYesTermination +25 yearsAccessibility plansYesCurrent year +6 yearsIncident ReportsYesCurrent year + 20 yearsSchool Brochure or prospectusNoCurrent year + 3 years12 more rows ?

HOW LONG DOES MY PROVIDER HAVE TO KEEP MY MEDICAL RECORD? Generally, Arizona law requires health care providers to keep the medical records of adult patients for at least 6 years after the last date the patient received medical care from that provider.

Different records are kept for different lengths of time. Most records are destroyed after a certain period of time. Generally most health and care records are kept for eight years after your last treatment.

Arizona Adult patients 6 years after the last date of services from the provider. 6 years after the last date of services from the provider, or until patient reaches the age of 21 whichever is longer.

In the USA the Health Insurance Portability and Accountability Act (HIPAA) requires healthcare providers and other Covered Entities to retain medical records for six years, measured from the time the record was created, or when it was last in effect, whichever is later.

Think of your student record as a short chronicle of your educational life. Schools keep records of your academic and personal progress, from kindergarten through graduation. And some schools keep student files for many years after the person has graduated or left.

When it comes to pupils, schools must keep records in order to monitor their progress and achievements, as well as to ensure that concerns about their safety and welfare are recorded.