San Diego California Log of Records Retention Requirements refers to the guidelines and regulations set forth by the city of San Diego regarding the retention of various types of records. These requirements are crucial for businesses, organizations, and governmental entities operating within San Diego to ensure compliance with legal obligations and to maintain an organized record-keeping system. The log of records retention requirements outlines specific guidelines for different types of records, including but not limited to financial documents, human resources files, tax records, employee records, contracts, permits, licenses, correspondence, and other important documentation. There are various types of San Diego California Log of Records Retention Requirements based on the nature of the records. Some key categories may include: 1. Financial Records Retention Requirements: This category covers financial reports, ledgers, balance sheets, income statements, payroll records, bank statements, receipts, and other financial documentation. San Diego specifies the duration for which these records must be retained, typically ranging from 3 to 7 years, based on their significance and potential legal implications. 2. Employment Records Retention Requirements: This category encompasses personnel files, employment contracts, application forms, performance evaluations, disciplinary records, health and safety records, and other documentation related to employees. San Diego lays down rules for the retention of these records, ensuring compliance with state and federal regulations such as the Fair Labor Standards Act (FLEA) and the Equal Employment Opportunity Commission (EEOC) guidelines. 3. Licensing and Permit Records Retention Requirements: For businesses, San Diego mandates the retention of licenses, permits, certifications, and related documentation. These records validate compliance with local ordinances and regulations and are essential in case of audits or inspections. 4. Legal and Contractual Records Retention Requirements: This category covers contracts, agreements, leases, litigation files, insurance policies, and other legal documents. San Diego has set specific retention periods to ensure businesses and organizations stay prepared for potential legal disputes, comply with statute of limitations, and preserve records needed for reference. 5. Environmental Records Retention Requirements: For industries that impact the environment, San Diego sets guidelines for retaining records related to environmental impact assessments, permits, emissions data, waste disposal records, and other records required by environmental agencies. 6. Tax Records Retention Requirements: San Diego's log of records retention requirements also includes guidelines for retaining tax-related documents, such as tax returns, receipts, financial statements, and other records in compliance with the Internal Revenue Service (IRS) regulations. It is crucial for entities within San Diego to be aware of the specific log of records retention requirements applicable to their industry and to have effective record-keeping systems in place to avoid penalties, legal complications, and loss of important information. Consulting with legal professionals or relevant city departments can provide further clarification on specific San Diego California Log of Records Retention Requirements.

San Diego California Log of Records Retention Requirements

Description

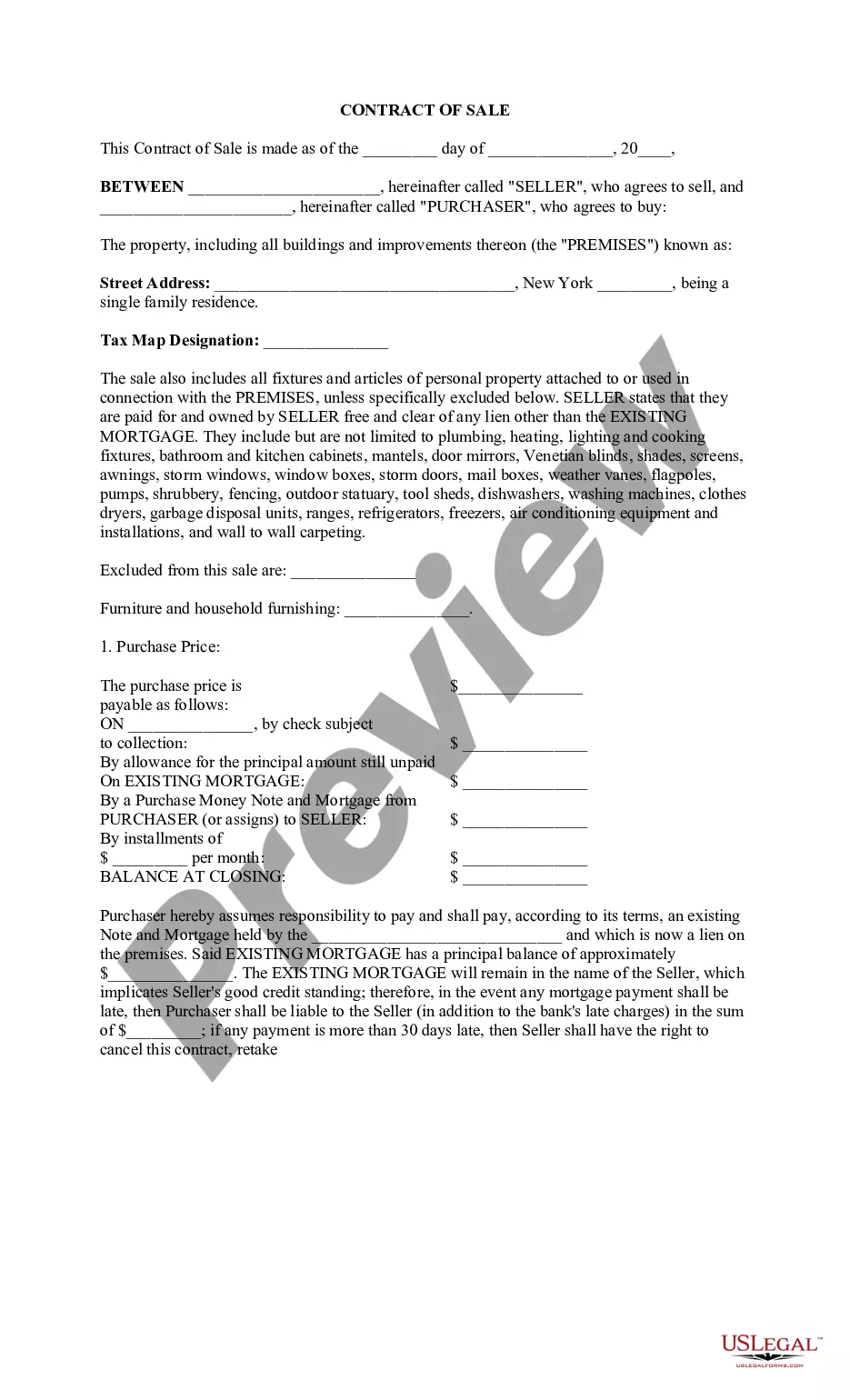

How to fill out San Diego California Log Of Records Retention Requirements?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Diego Log of Records Retention Requirements, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the latest version of the San Diego Log of Records Retention Requirements, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Log of Records Retention Requirements:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your San Diego Log of Records Retention Requirements and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!