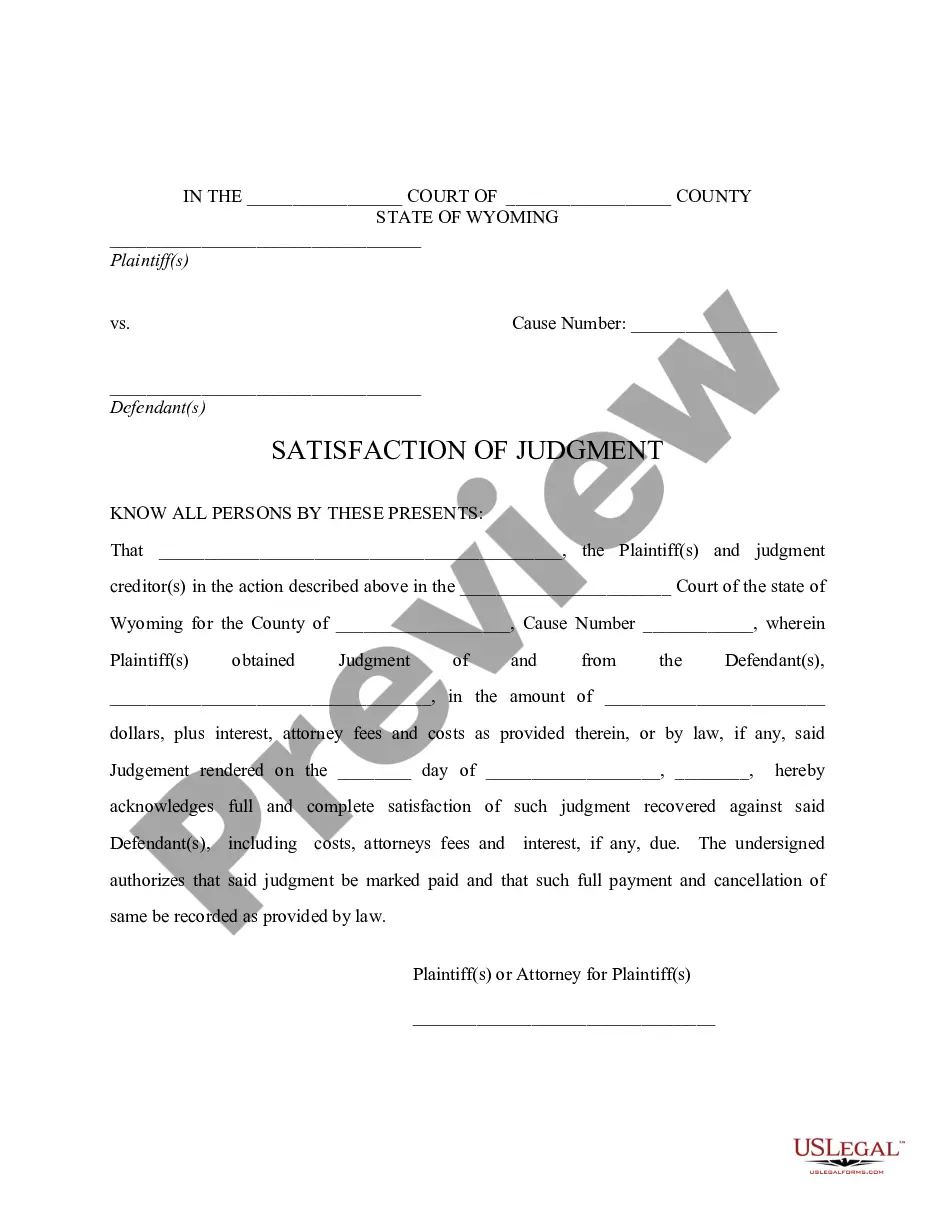

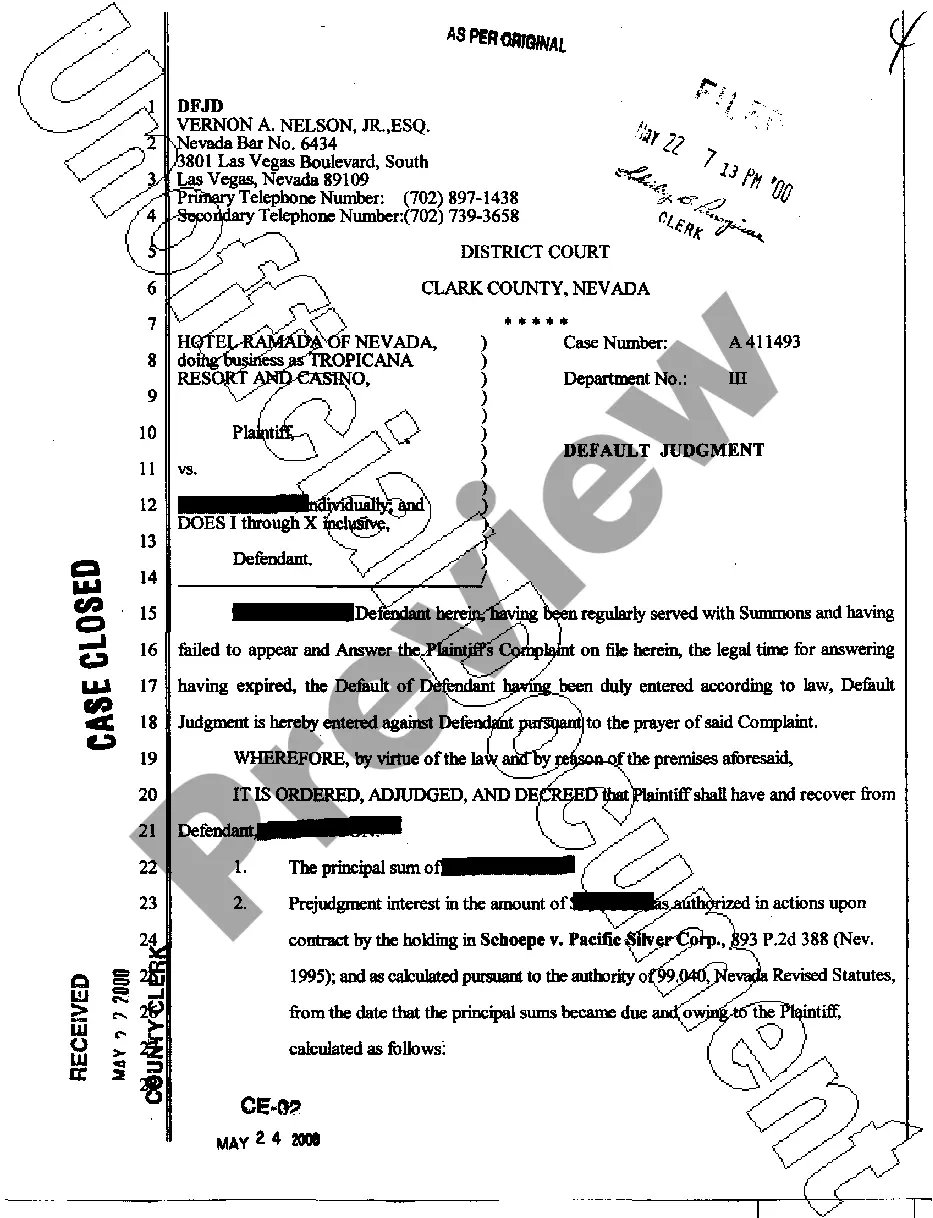

Wake North Carolina Log of Record Retention Requirements: Wake North Carolina, known for its vibrant community and booming economy, has established specific record retention requirements to maintain accurate and up-to-date documentation across various sectors. These requirements are vital for ensuring compliance, protecting sensitive information, and facilitating efficient record management. 1. Wake North Carolina Government Log of Records Retention Requirements: — Government agencies in Wake North Carolina are required to adhere to specific guidelines for record retention and disposal. These guidelines serve to maintain transparency, accountability, and efficient governance. Records related to financial transactions, personnel files, contracts, and public communications are some of the key documents that need to be retained for specific periods as per the guidelines. 2. Wake North Carolina Business Log of Records Retention Requirements: — Businesses operating in Wake North Carolina must also adhere to record retention requirements to ensure compliance with state laws and regulations. Various documents, such as financial statements, tax records, employee records, contracts, and licenses, must be retained for specific periods to meet legal obligations and facilitate smooth business operations. 3. Wake North Carolina Healthcare Log of Records Retention Requirements: — Healthcare providers in Wake North Carolina, including hospitals, clinics, and medical practitioners, are subject to specific record retention requirements to ensure the security and privacy of patients' medical information. These requirements encompass medical records, billing records, laboratory reports, and other related documentation, which are essential for continuity of care, reimbursement, and legal purposes. 4. Wake North Carolina Educational Log of Records Retention Requirements: — Educational institutions in Wake North Carolina, including public and private schools, colleges, and universities, maintain their own log of records retention requirements. These requirements involve student records, such as grades, transcripts, enrollment information, disciplinary records, and other pertinent documents, which are vital for educational administration, accreditation, and student services. 5. Wake North Carolina Legal Log of Records Retention Requirements: — Legal professionals operating in Wake North Carolina, including attorneys, law firms, and legal departments, must adhere to specific record retention requirements to ensure the documentation integrity and meet legal obligations. These requirements cover client files, case files, court records, legal research material, and other relevant documents, which play a crucial role in legal proceedings, compliance, and client representation. Meeting these Wake North Carolina log of records retention requirements is crucial for individuals, organizations, and professionals to avoid penalties, protect sensitive information, ensure accountability, and enable efficient retrieval and management of records. By following these guidelines, Wake North Carolina stakeholders can contribute to a well-organized, legally compliant, and thriving community.

Wake North Carolina Log of Record Retention Requirements: Wake North Carolina, known for its vibrant community and booming economy, has established specific record retention requirements to maintain accurate and up-to-date documentation across various sectors. These requirements are vital for ensuring compliance, protecting sensitive information, and facilitating efficient record management. 1. Wake North Carolina Government Log of Records Retention Requirements: — Government agencies in Wake North Carolina are required to adhere to specific guidelines for record retention and disposal. These guidelines serve to maintain transparency, accountability, and efficient governance. Records related to financial transactions, personnel files, contracts, and public communications are some of the key documents that need to be retained for specific periods as per the guidelines. 2. Wake North Carolina Business Log of Records Retention Requirements: — Businesses operating in Wake North Carolina must also adhere to record retention requirements to ensure compliance with state laws and regulations. Various documents, such as financial statements, tax records, employee records, contracts, and licenses, must be retained for specific periods to meet legal obligations and facilitate smooth business operations. 3. Wake North Carolina Healthcare Log of Records Retention Requirements: — Healthcare providers in Wake North Carolina, including hospitals, clinics, and medical practitioners, are subject to specific record retention requirements to ensure the security and privacy of patients' medical information. These requirements encompass medical records, billing records, laboratory reports, and other related documentation, which are essential for continuity of care, reimbursement, and legal purposes. 4. Wake North Carolina Educational Log of Records Retention Requirements: — Educational institutions in Wake North Carolina, including public and private schools, colleges, and universities, maintain their own log of records retention requirements. These requirements involve student records, such as grades, transcripts, enrollment information, disciplinary records, and other pertinent documents, which are vital for educational administration, accreditation, and student services. 5. Wake North Carolina Legal Log of Records Retention Requirements: — Legal professionals operating in Wake North Carolina, including attorneys, law firms, and legal departments, must adhere to specific record retention requirements to ensure the documentation integrity and meet legal obligations. These requirements cover client files, case files, court records, legal research material, and other relevant documents, which play a crucial role in legal proceedings, compliance, and client representation. Meeting these Wake North Carolina log of records retention requirements is crucial for individuals, organizations, and professionals to avoid penalties, protect sensitive information, ensure accountability, and enable efficient retrieval and management of records. By following these guidelines, Wake North Carolina stakeholders can contribute to a well-organized, legally compliant, and thriving community.