Chicago Illinois Employment Status Form is a legally required document that employers in Chicago, Illinois must provide to their employees to gather essential information regarding their employment status. This form is crucial for ensuring compliance with labor laws and maintaining accurate employee records. The Chicago Illinois Employment Status Form typically includes fields to gather various details such as employee's full name, address, contact details, social security number, date of hire, job title, and department. It may also require employees to provide information on their work schedule, including regular hours, shift timing, and days of the week worked. To accommodate different employment types, there might be various versions of the Chicago Illinois Employment Status Form. Some examples may include: 1. Full-Time Employment Status Form: This form is for employees who work a standard 40-hour workweek and are considered full-time employees by their employer. 2. Part-Time Employment Status Form: Designed for employees who work fewer hours than full-time employees, typically less than 30 hours per week. 3. Temporary or Seasonal Employment Status Form: This form is for employees who are hired for a specific period or season and have a defined end date to their employment. 4. Independent Contractor Employment Status Form: This form is specific to individuals who are classified as independent contractors rather than traditional employees. It gathers information such as the contractor's business name, tax identification number, and details of the contracted services. 5. Internship or Trainee Employment Status Form: This form is used for individuals participating in an internship or trainee program, collecting information relevant to their educational institutions, program start and end dates, and any academic requirements. It is important for employers to accurately identify and provide the appropriate Chicago Illinois Employment Status Form to employees based on their employment arrangement. This ensures compliance with local labor regulations, helps determine eligibility for benefits like overtime pay or healthcare coverage, and maintains up-to-date employee records.

Chicago Illinois Employment Status Form

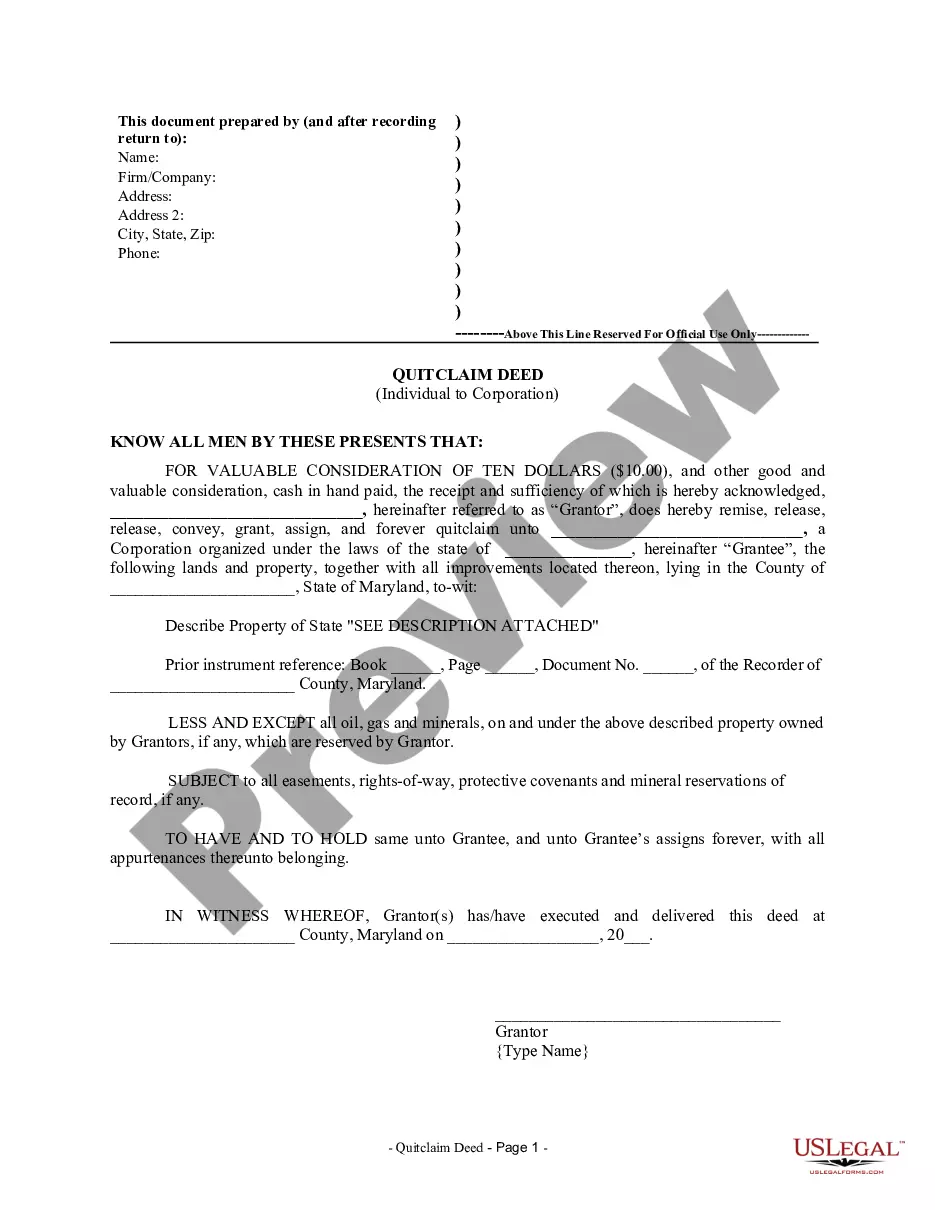

Description

How to fill out Chicago Illinois Employment Status Form?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Chicago Employment Status Form, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Chicago Employment Status Form from the My Forms tab.

For new users, it's necessary to make some more steps to get the Chicago Employment Status Form:

- Examine the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

If you become unemployed, you may file a claim online at IDES.Illinois.gov or at an IDES office. Office locations can be found online or by calling IDES Claimant Services. File your claim during the first week after you have become unemployed or as soon thereafter as possible.

Illinois State Unemployment is administered by the Illinois Department of Employment Security. Contact them at 1-800-247-4984 or visit their website at . You may file your UI-3/40 report and pay your Unemployment Insurance Tax via MyTax Illinois.

Most for-profit employers are required to pay contributions (taxes) as soon as they have: Paid $1,500 in wages in a single calendar quarter, or employed one or more persons for 20 weeks in a given calendar year; or. Paid $1,000 in cash wages in one calendar quarter for domestic work; or.

Guide to Uploading PUA Proof Of Employment - YouTube YouTube Start of suggested clip End of suggested clip You would log into re-employment. And select claimant login. Then you would select the provide puaMoreYou would log into re-employment. And select claimant login. Then you would select the provide pua proof of employment. Tab could start the upload.

Within 7-10 days of filing your claim, you will receive a UI Finding letter in the mail. The UI Finding letter will tell you whether you are monetarily eligible for benefits, meaning you have earned sufficient wages in your base period.

IL Form UI-3/40 - Employer's Contribution and Wage Report.

What is Illinois Unemployment Insurance? Unemployment insurance benefits provide temporary financial assistance to workers unemployed through no fault of their own that meet Illinois' eligibility requirements.

The best way to complete your certification is online from am - pm on your designated certification day, including holidays. Thursdays and Fridays are make-up days if you miss your certification day. You may also certify by Tele-Serve at (312) 338-4337 (am - pm, Monday - Friday).

Using MyTax Illinois monthly wage filing must be done via MyTax Illinois, the Department's online tax filing and wage reporting application. Employers that are already registered on MyTax Illinois can file using their existing MyTax Illinois account.

Employers must file wage reports (Form UI-3/40?) and pay contributions in the month after the close of each calendar quarter - that is, on or before April 30, July 31, October 31, and January 31.